🙋 Student Q&A (Lecture 13)

Click here to learn about timestamps and my process for answering questions. Section agendas can be found here. Email office hour questions to rob.mgmte2000@gmail.com . PS1Q2=“Question 2 of Problem Set 1”

📅 Questions covered Saturday, May 10

🕣

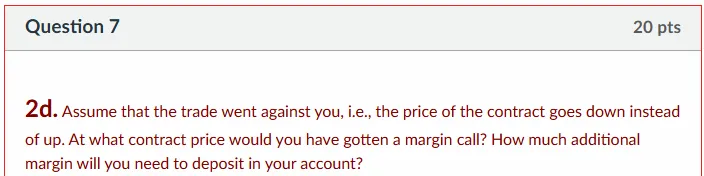

❔ PS7Q2d: to calculate the additional margin after the margin call “occurred”.

If the balance in the margin account is less than the required maintenance margin level, is the trader required to place additional fund to reach the initial margin or is it sufficient to reach the maintenance margin?

✔ Covered during video

📅 Questions covered Tuesday, May 13

🕣 12:24pm

❔ Algebra review and PS4Q5

✔ In recording

🕣 1:03pm

❔ On question 7 for problem set 7 do we assume that there is currently $0 in your account or that there is the current initial margin amount

✔

See the recorded full solutions for the problem set.

Assume that question 7 is best thought of as question 2d, as indicated in the screenshot below.

You should assume that everything described in question 2’s introduction and within questions 2a and 2b has happened prior to 2d. Part 2b requires you to put a certain amount of money in your margin account. You should assume that that money has been deposited, but that you only put in enough money to make the trade described in 2b. You can assume that 2c didn’t happen, because the wording of 2d says that “the trade went against you, i.e., the price of the contract goes down instead of up.”

If you don’t understand what I’ve written in the above paragraph, then I would encourage you to watch the section from Saturday, as it lays out the key skills that you need to interpret a question. Without a strong understanding of the material, it can be hard to interpret the question.

Does that help? It’s important that you don’t misunderstand the question, so please ask all necessary follow-up questions. The responsibility is always on you to ask questions when necessary.

🕣 1:03pm

❔ I had a question as I was going over my notes on bear spreads and bull spreads. Do I have this correct below for how to calculate the gains in both a bear and bull spread?

Bull spread- always buy the lower K and sell the call with the higher K long call gains (lower strike price): (Stock price -K price) - premium short call gains (higher strike price): (K price- Stock price) + premium

Bear Spread - buy higher strike price, sell lower strike price Long Call Gains (higher strike price)= (stock price- k price) - premium Short Call Gains (lower strike price)= (k price- stock price) + premium

✔

Just to follow up, I thought that you might find the following section of my formula sheet to be helpful:

https://2000.robmunger.com/formulas/#—l11-options

The password is Watson.

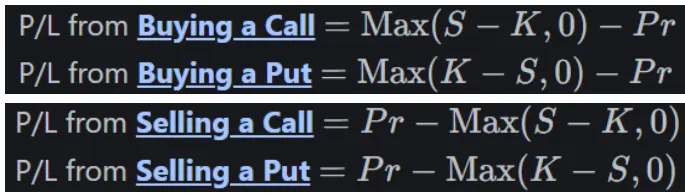

Basically, the method for calculating the P/L for any option is always the same. If you buy an option, the P/L is the IV minus the premium. If you sell an option, the P/L is the premium minus the IV.

The most simplified formulas that you can get out of this are as follows:

All four of the above formulas are in my formula sheet, as well as all of the other important formulas I could find from the course. If you haven’t had a chance to explore it yet, I think you might find it helpful:

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.