✏️ P/L for a Straddle

✏️ Suppose you have purchased a TSLA straddle consisting of a long $190 put and a long $190 call. Calculate your profit or loss for each of the stock prices in the following table:

| S= | 150 | 170 | 190 | 210 | 230 |

|---|---|---|---|---|---|

| Profit/Loss for the Straddle |

Suppose that you have previously determined that the premium of both calls is $8 each per share.

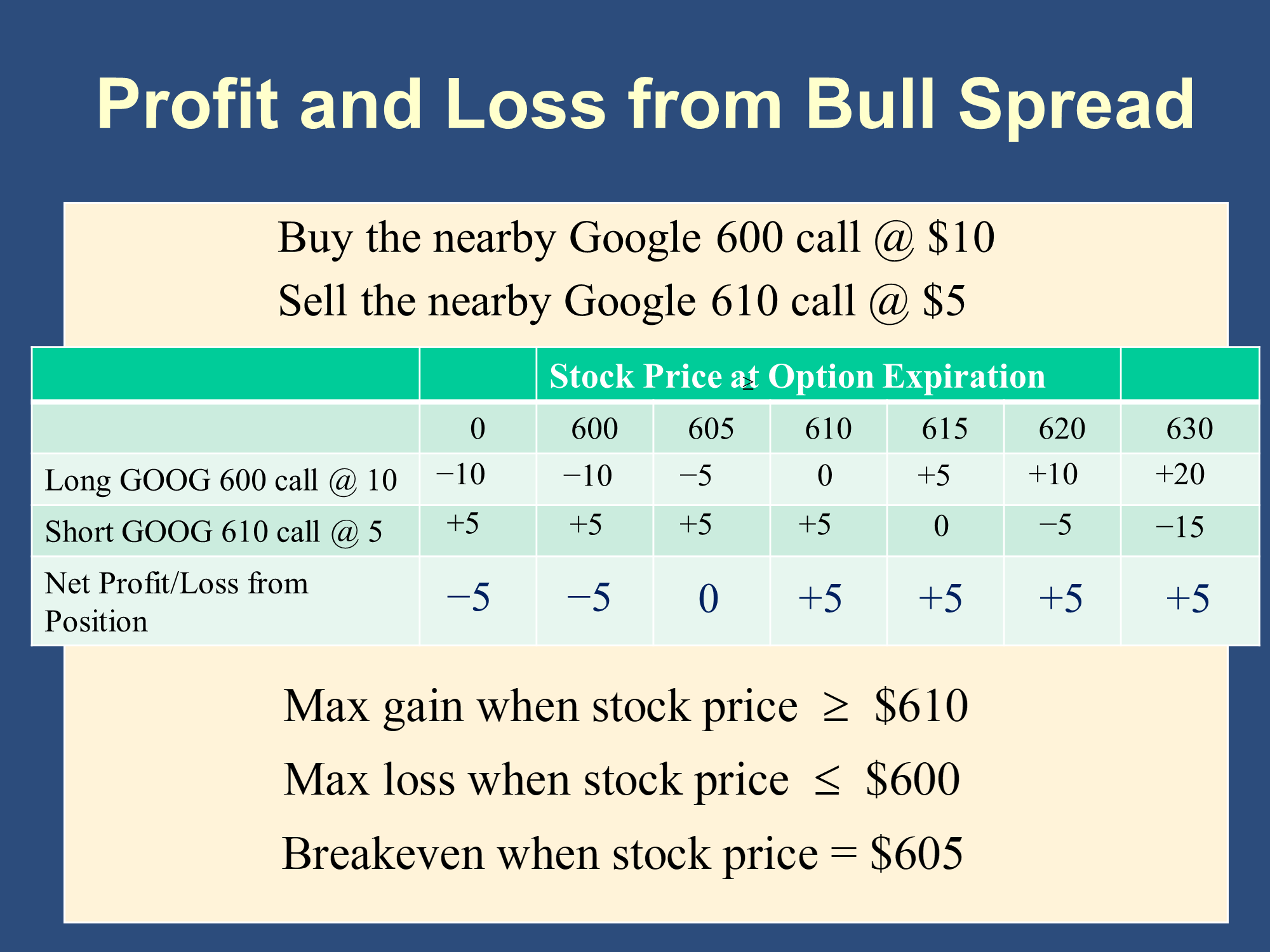

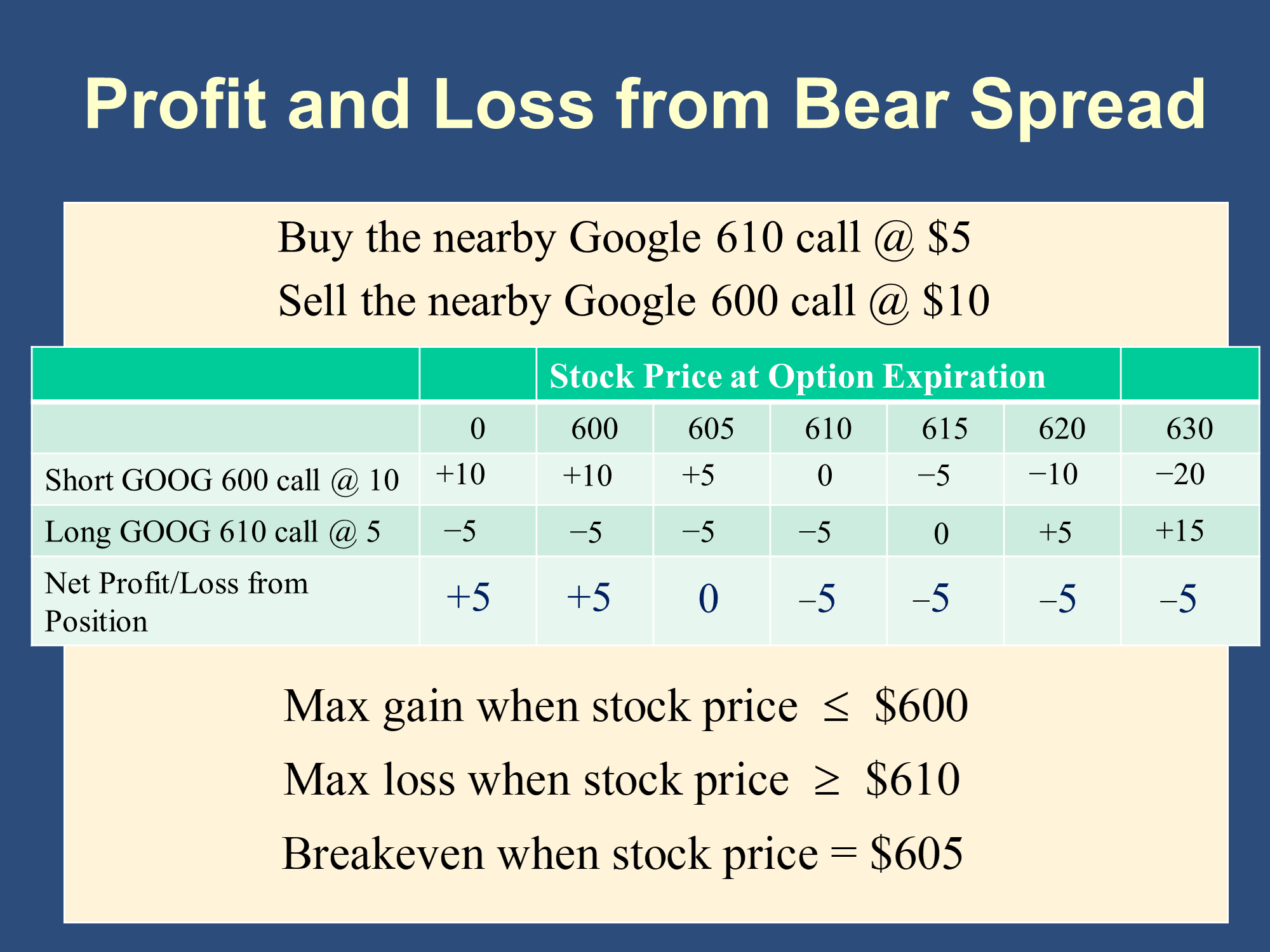

✔ In the slides, Bruce showed us how to calculate Profit and Loss Bull and Bear Spreads. We want to use the same technique to calculate Profit and Loss for a Straddle.

The option strategies we have covered are made of two options. To calculate the profit/loss for the full strategy, we just calculate the profit/loss from the two options and then add up both P/Ls to calculate the Net P/L for the entire option strategy:

|  |

|---|

Note that these are also the slides from the Options Self-Test that I provided, so we are familiar with them: ✏️ Options Self-Test

If you are unsure about how to calculate P/Ls for individual Long Calls, see either the call section of 🔎 Intro to Options or the ✏️ Long Calls P/L practice problems.

If you are unsure about how to calculate P/Ls for individual Long Puts, see either the put section of 🔎 Intro to Options or the ✏️ Long Puts P/L practice problems.

Here are the answers:

| S= | $150 | $170 | $190 | $210 | $230 |

|---|---|---|---|---|---|

| P/L from long $190 put @$8 | $40-$8 = $32 | $20-$8 = $12 | -$8 | -$8 | -$8 |

| P/L from long $190 call @$8 | -$8 | -$8 | -$8 | $20-$8 = $12 | $40-$8 = $32 |

| Net Profit/Loss for the Straddle | $32-$8 = $24 | $12-$8 = $4 | -$8-$8 = -$16 | -$8+$12 = $4 | -$8+$32 = $24 |

🙋 If we had already calculated the gains, could we use those to calculate out the P/Ls?

Yes. When you buy an option, the P/L is just the Gain - Premium. If there were any short options, it would be a bit more complex because you’d have to subtract off your counterparty’s gain, though (your counterparty’s gain would be your loss)

| S= | $150 | $170 | $190 | $210 | $230 |

|---|---|---|---|---|---|

| Gain from long $190 put | $40 | $20 | $0 | $0 | $0 |

| P/L from long $190 put @$8 | $40-$8 = $32 | $20-$8 = $12 | $0-$8 | $0-$8 | $0-$8 |

| Gain from long $190 call | $0 | $0 | $0 | $20 | $40 |

| P/L from long $190 call @$8 | $0-$8 | $0-$8 | $0-$8 | $20-$8 = $12 | $40-$8 = $32 |

| Net Profit/Loss for the Straddle | $32-$8 = $24 | $12-$8 = $4 | -$8-$8 = -$16 | -$8+$12 = $4 | -$8+$32 = $24 |

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.