🔎 Margin account like a coffee cup

To buy or sell a future, you must have a “margin account” at your broker. I would like you to think of this as similar to a checking account in that it is your money in the account. However, it is like a good faith bond in that you must keep the money in the account. If you don’t honor your contractual obligations under the Futures contract, they can take money out of this account.

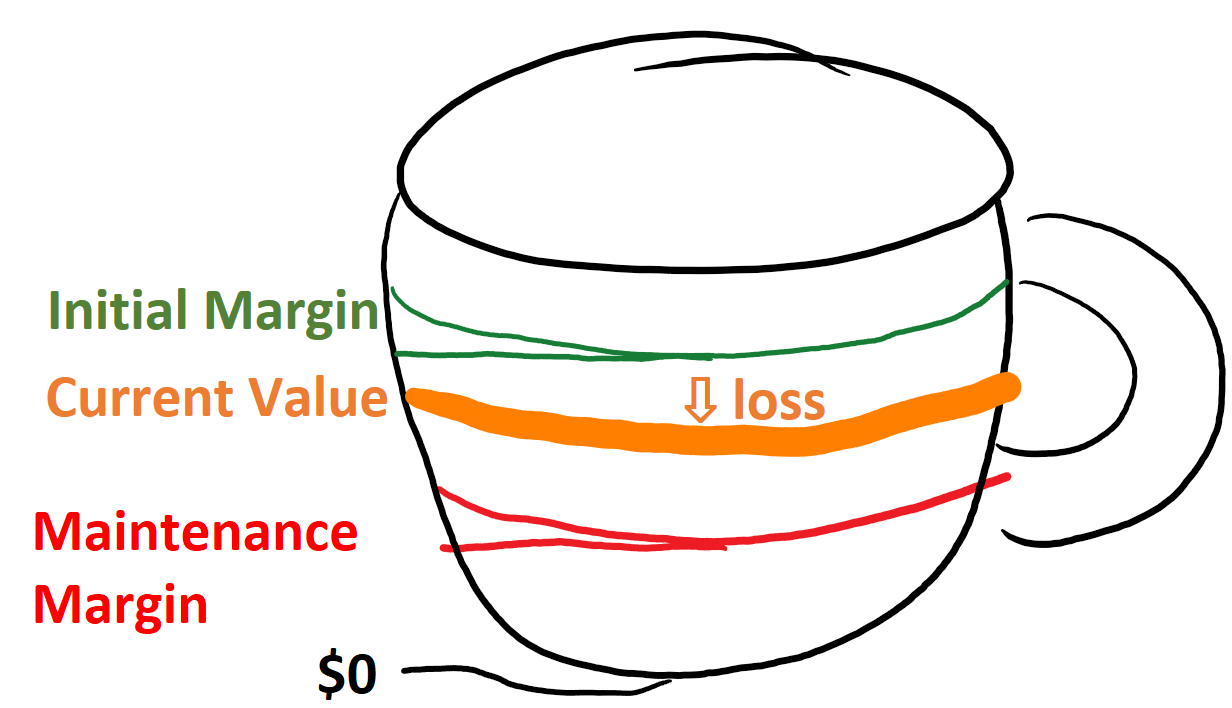

I like to think of it as a coffee cup.

When you first start your trade, you must deposit money into your margin account. This is the initial margin.

As time passes, your broker will take money out of this account whenever you lose money on your trade. They will add money whenever you make profit on your trade. Thus, the level of coffee can fluctuate.

Let’s suppose you lose money. Money will be removed from the coffee cup.

That’s fine… not a problem… until….

… until the orange line gets to the point of the red maintenance margin.

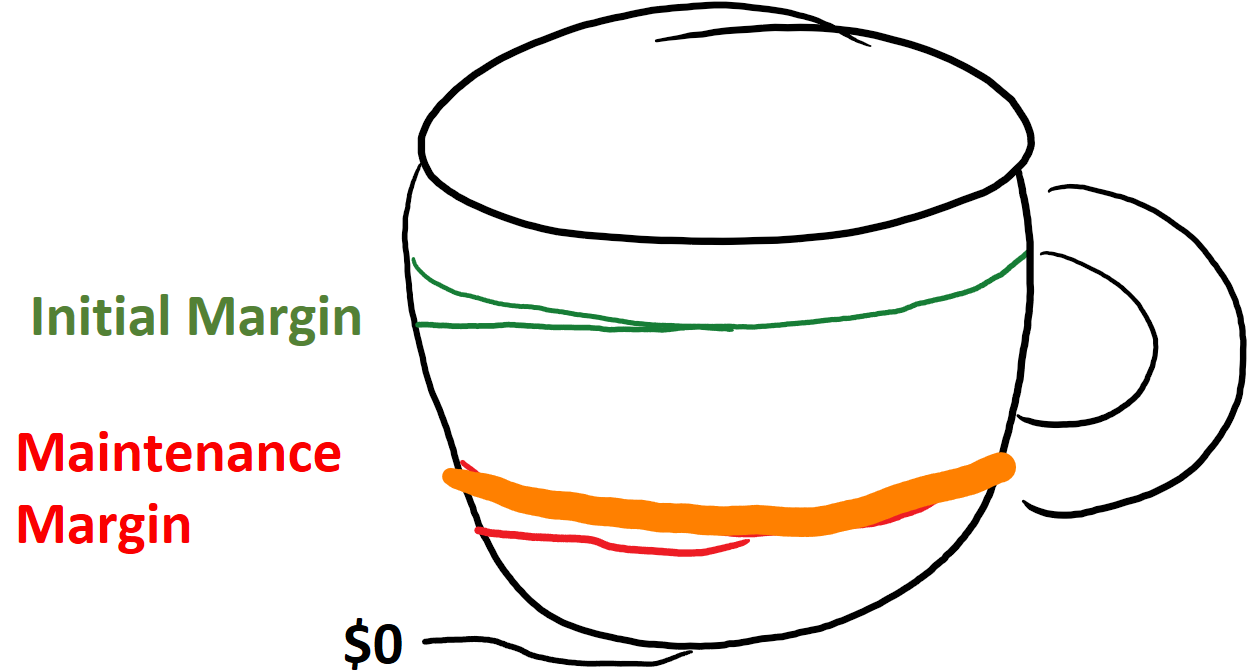

At that point, you get a margin call.

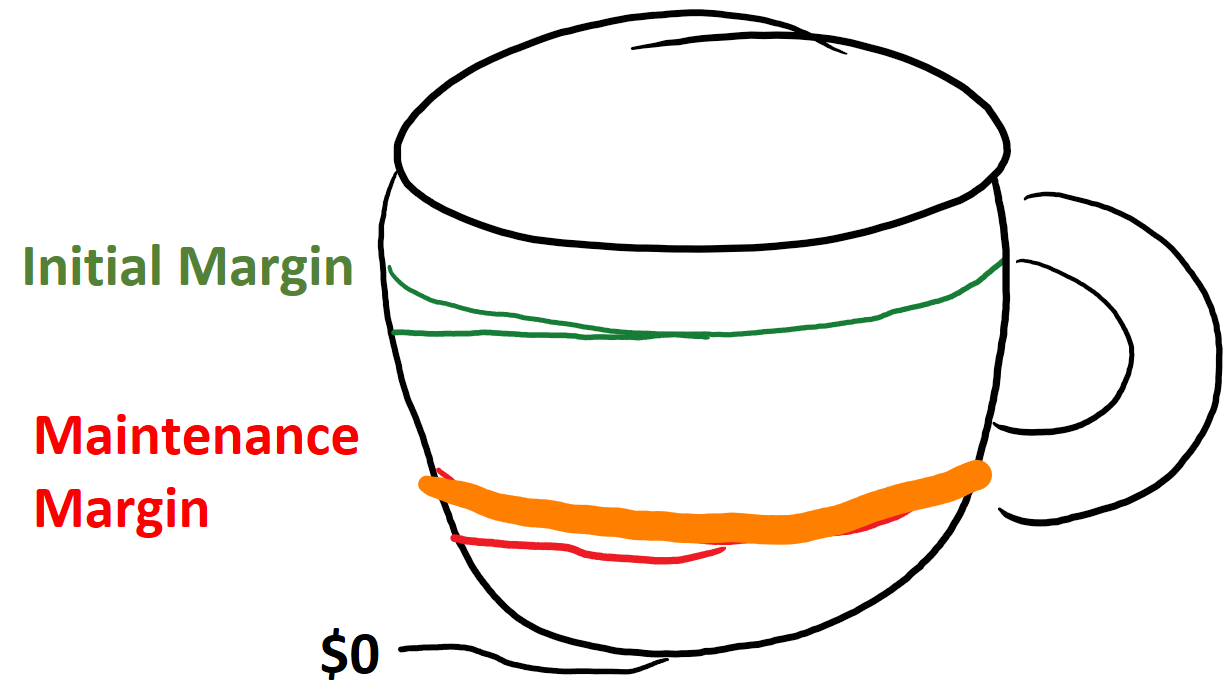

The margin call is just a request that you deposit more money into your margin account. You must add enough money to raise the orange line so it is back up to the initial margin.

You just wire them money. It’s just like pouring more money into the coffee cup.

Once you’ve done that, you are good to go.

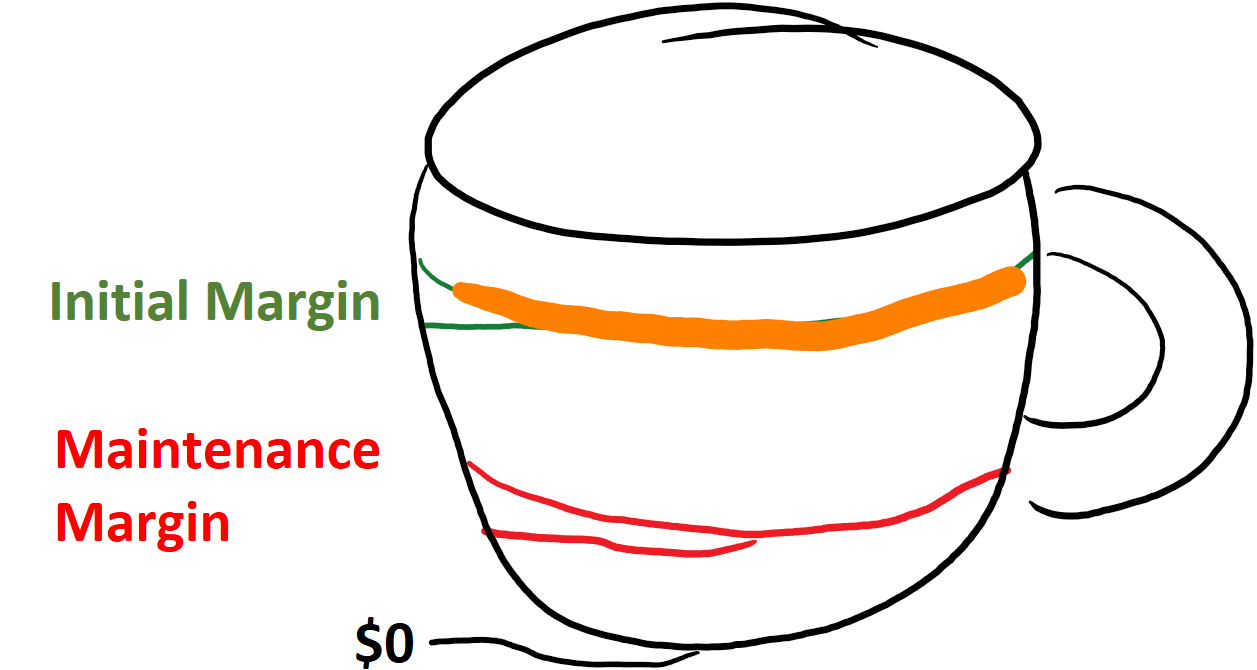

But what if you don’t?

If you don’t, the brokerage will close your contract and take all of the money in the margin account.

They have the legal right to take the money in the margin account.

But how do they “close out the contract?”

They essentially find someone else to take your place.

To explain this, let’s return to Bruce’s soybean example. contract on your behalf.

Soybeans (CBOT) Nearby contract

1 contract = 5,000 bu.

Price = 1218 cents per bu. ($12.18 per bu.)

Value of 1 contract = 5,000 bu. × $12.18/bu.

= $60,900

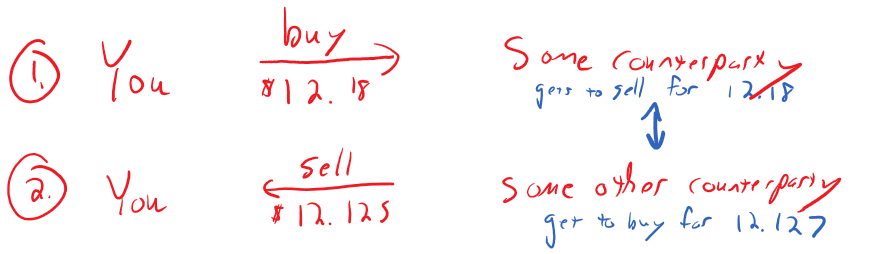

You have agreed to purchase 5,000 bu. of soybeans for $12.18 each. Some counterparty has a legal right to sell you these. This right must be honored even if you can’t make a margin call.

Suppose that the “futures price” drops to $12.127. That means that, at present, people are signing futures contracts to buy/sell soybeans in the future at a price of $12.127.

Over in the sidebar we calculate that if the futures price drops to $12.127, you will get a margin call. If you don’t honor the margin call and deposit more money, the following will happen:

The broker executes a trade on your behalf, to sell the futures contract at the prevailing futures price of $12.127.

The exchange needs someone to buy at $12.18 and to sell at $12.127. It matches your first counterparty up with your second counterparty. To make this work, it needs to add $12.180-$12.127=$0.053 into the mix.

In other words, the original counterparty will still be able to sell the soybeans for $12.18. The new counterparty will be able to buy for only $12.127. WHERE DOES THE MISSING $0.053 COME FROM? That’s a total of $0.053*5000=$265.0.

It comes out of your margin account.

Suppose you had $350 in your ma

2915-265=2650

If you don’t pay your margin call, your broker no longer trusts that you are reliable in the contract. They execute the trade on your behalf and take $265 out of your margin account so that it can match your two counterparties up. You originally deposited an initial margin of Initial margin = $2,915, which is more than enough to cover this.

The new counterparty will buy the soybeans for $12.127 and then the CME will add in the $0.053 taken from your account, so that the old counterparty gets the full $12.127+$0.053=$12.18 that they were promised.

The margin account is there so that they always have the $0.053 to close you out if they need to.

You will get a margin call if your margin account drops from Initial margin = $2,915 to Maintenance margin = $2,650. This is a loss of $2,915-$2,650=$265.00 for the total contract.

How much of a loss is it on a “per bushel” amount? $265/5000=$.05300 (5.3 cents)

You agreed to buy for $12.18. If the actual price is $5.3 cents lower, that means that the futures price has dropped to $12.180-$.053=$12.127

Who calculates the initial and maintenance margins?

Actuaries working at the CME.

These actuaries will assign higher initial and maintenance margins on more risky contracts (risky = more volatile and with a date farther in the future).

With high enough initial margins, all counterparties are safe and can trust that they will get paid according to their contracts.

Which side gets the margin call?

Suppose a dog food producer (Purina) is buys the futures contract for $12.18 and a farmer sells a futures contract for $12.18.

BOTH will need to put Initial Margin=$2915 in their margin accounts to open the trade.

Suppose that the “futures price” rises to $12.19. Who is making money on the futures contract.

Purina will be buying the soybeans for $12.18, but the current “futures market price” is higher than that. Purina gets to underpay based on their contract. 👍. The farmer is going to sell the soybeans for $12.18 because of their contract, but the future price is $.01 higher. The farmer loses out. 👎

Purina gets a $.01 discount on 5000 bushels

.01*5000=50.0

At the end of the day, $50 is added into Purina’s margin account.

The farmer is selling 5000 bushels of soybeans for a discount of $.01.

At the end of the day, $50 is removed from the Farmer’s margin account.

At the end of the day, the farmer is $50 closer to getting a margin call. They had $2,915 in their margin account, but now they only have $2,915-$50=$2,865 in their coffee cup. Closer to the red line! (maintenance margin)

Conversely, Purina is $50 farther from getting a margin call because they have $50 more in their account.

This is known as “daily settlement,” but you aren’t responsible for it.

After making these adjustments, the contracts are updated so to the new futures price of $12.19.

When the price moves .01 to Purina’s benefit, $50 is added to their margin account and the contract is changed from $12.18 to $12.19.

They can then sell the contract for $12.19, because that is the prevailing price. That’s very efficient, because the prevailing price matches their contract price.

They can just close their position by selling the contract. They keep the $50 they earned. They can also remove all of the money from their margin account

A contract to buy at $12.19 and $50 free cash is equivalent to a contract to buy at $12.18 without the free cash.

with the first, you pay $12.19*5000=$60950.00 and you apply your $50 cash for a total payment of $60950-$50=$60900

With the second, you pay $12.18*5000=$60900

It’s the same amount!

Here’s what a question will look like:

✏️ Suppose the farmer selling the contract at $12.18 and the Purina buys it at $12.18. What is the total contract value?

✔ Click here to view answer

Contract value = $12.18*5000=$60900

✏️ Suppose that in 10 days, the futures price is $11.98. What is the profit or loss for the farmer and Purina.

✔ Click here to view answer

Purina locked in a price of $12.18. The newer price is $11.98. They are overpaying by $12.18-$11.98=$0.20. Per contract, they have lost $.20*5000=$1000.00

The farmer locked in a price of $12.18 to sell. They are being overpaid by $.20. Their total profit from the contract is $.20*5000=$1000.

As usual, derivatives are a “zero sum” game. However, in this case, it is clearly a social good because both Purina and the farmer are able to manage their risk. This is an example of how derivatives can be used for hedging rather than speculation.

✏️Suppose that both parties put down an initial margin of $2915 and have a maintenance margin of $2650. At what price will the farmer get a margin call? At what price will Purina get a margin call?

As we saw above (in the sidenote), you get a margin call when your margin account drops from 2915 to 2650. Ie, when you have lost 2915-2650=$265.

On a per-share basis, that is $265/5000=$0.053.

The price must move against you by 5.3 cents.

Purina will get the margin call when they are overpaying by 5.3 cents, ie when the price has dropped by 5.3 cents and they are locked into their contract price. $12.18-.053=$12.127.

To be confident, let’s verify that this logic is correct. If the price drops by .053, they are overpaying by .053*5000=265. Mathematically,

When that is removed from their $2915 margin account, they have 2915-265=2650, which is the maintenance margin.

We could also think of this on a “per contract” basis. Purina has agreed to pay $12.18*5000=$60,900. But the soybean futures price is only $12.127*5000=$60635. They are getting soybeans worth less than they paid! The difference is $60,900-$60635=$265.00

↑ You can do the calculation either way!! You’ll get the same number.

I mention this because the example he does for an index future is on a “per contract” basis. We’ll explain this below.

The farmer will get the margin call when they are being underpaid by 5.3 cents, ie when the price has risen by 5.3 cents and they are locked into their contract price. $12.18+.053=$12.233.

Index futures

Suppose the S&P index is at 1218 (it’s much higher now, but it was down around there in around 2011 or so).

Suppose Purina S&P traders incorporated buys the contract for 1218.

Suppose the S&P drops from 1218 to 1212.7.

Purina has obligated themselves to pay 1218*$250=$304,500 at contact expiration.

⇨ The S&P contract is always $250 per point, unless otherwise specified. This is known as the “big contract.” (There is also an e-mini S&P 500 contract at $50 per point. Now, there is even a “micro-e-mini” S&P 500 contract. However, for simplicity, Bruce has always focused on the “big contract,” so, when in doubt, assume he is referring to the $250 per point version. )

In return, they get the value of the index *$250:

Purina traders gets = 1212.7*$250=$303175

Their net loss is $304,500-$303175=$1325

You could also calculate their loss as follows:

Purina bet the S&P would go up. It went down by 1218-1212.7=5.3 points.

To convert that to dollars, you multiply by $250:

They lost 5.3*$250=$1,325

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.