🔎 Calculating the Price of a Call, Put, Stock, or Strategy

To calculate the price of an option, option strategy, or a stock, we use the techniques that Bruce introduced during the lecture on EMH. Specifically, we take expected values.

For an individual option, we take the expected value of the “Gain” we get by exercising the option. This is illustrated below.

How do I calculate the premium of a Call or a Put?

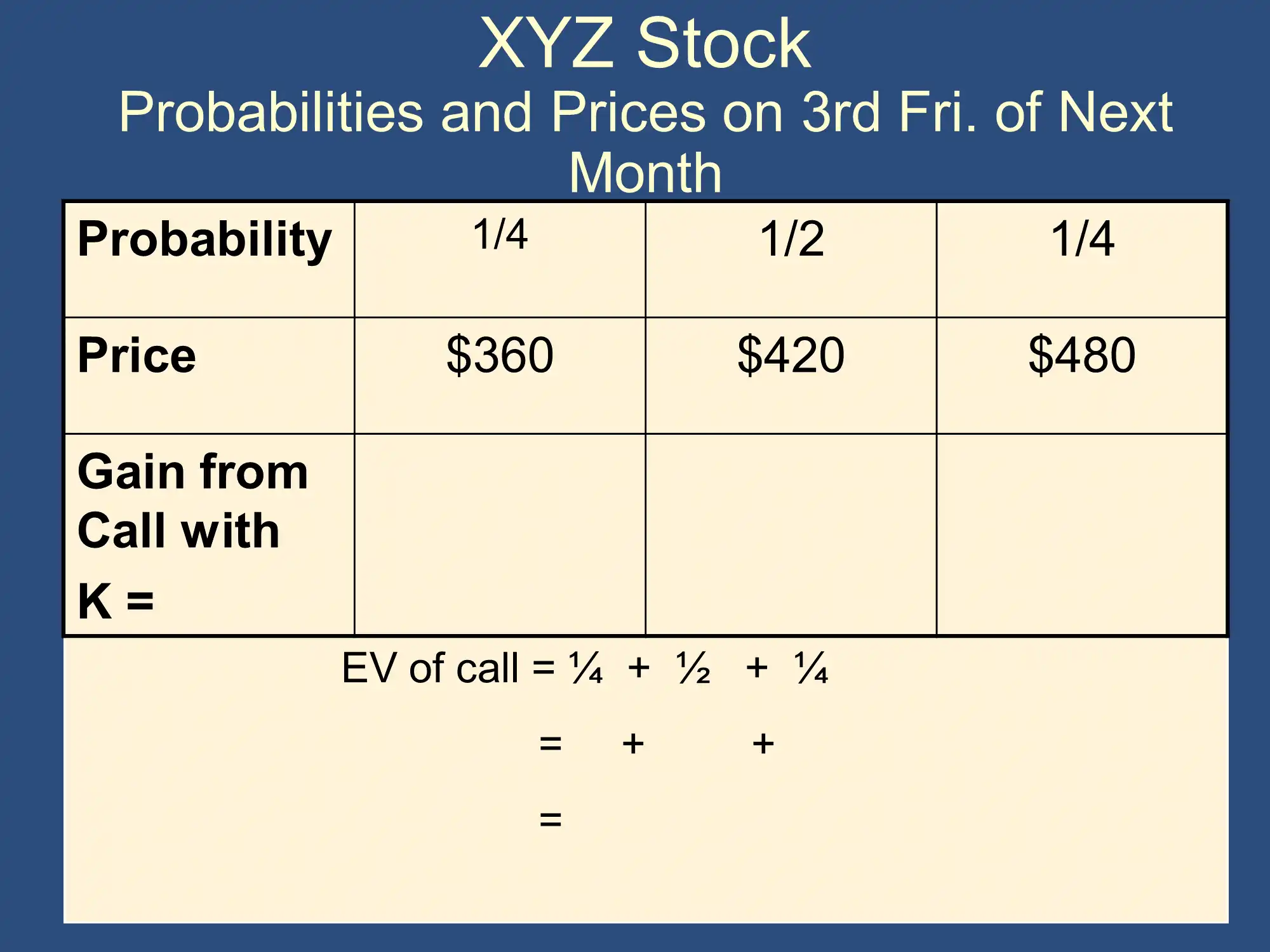

This will be easiest to explain if we have an example. Consider XYZ stock from the lecture:

Suppose you are considering purchasing the $410 XYZ call. As in class, there are only three possibilities for the stock price when your option expires. The probabilities of those stock prices are given in the slide above. For example, the probability of the stock price being $360 is 1/4.

The value of the option will be your best guess of the cash that you expect to be able to get from the option if you own it. To calculate this, we just calculate the cash that we can get from the option at expiration for each possible stock price (ie the gain for each stock price). We then find our “best guess” by calculating the expected value.

Note that this is exactly what we did to calculate the price of a stock in the EMH lecture. In this case, we don’t have to take the present value because we’ll assume that it won’t be very long before the option expires. For example, in the slide above, we are looking at the probabilities on the “3rd Fri. of Next Month.”

Main takeaway: if you want to find out the fair price, just take the expected value (and, if necessary, take the PDV of it and any other cash flows).

At the expiration date, the premium will equal the intrinsic value of the call because on the expiration date, there will be no time value.

✏️What is the premium of the $410 XYZ call?

✔

Step 1: Calculate the gains

The first step of calculating the premium for any option or option strategy is to calculate the gain or Intrinsic Value of the option. This is the cash flow the option owner can earn at expiration. At that point they decide whether to exercise the option.

| Probability | 25% | 50% | 25% |

|---|---|---|---|

| Stock Price | $360 | $420 | $480 |

| Gain from Call with K= $410 | $0 | $10 | $70 |

✏️ What is the gain when S=$360

✔ This Call allows you to buy shares of stock worth S=$360 for K=$410. Rather than getting a discount, you are overpaying for the option. Clearly, you won’t exercise the option, so there is no gain (Gain=$0). We say the option is “Out of The Money (OTM)” and has no intrinsic value (IV=$0).

✏️ What is the gain when S=$420

✔ This Call allows you to buy shares of stock worth S=$420 for K=$410. That is a discount of $10, so this option is “In The Money (ITM)” and you will exercise it. When you exercise it, you will gain $10. This $10 is the option’s intrinsic value.

(If you don’t want to buy more shares, you could easily exercise the option to buy them for K=$410 and then turn around and sell them on the market for S=$420, netting a $10 profit. You could even take out a short-term loan to do this.)

✏️ What is the gain when S=$480

✔ This Call allows you to buy shares of stock worth S=$480 for K=$410. That is a discount of $70, so this option is “In The Money (ITM)” and you will exercise it. When you exercise it, you will gain $70. This $70 is the option’s intrinsic value.

Another way to calculate the gains, though with far less intuition, is simply to use the intrinsic value formula.

When S=$360 ⇨ IV = Max(S-K, $0) = Max($360-$410, $0) = Max(-$50, $0) = $0

When S=$420 ⇨ IV = Max(S-K, $0) = Max($420-$410, $0) = Max($10, $0) = $10

When S=$480 ⇨ IV = Max(S-K, $0) = Max($480-$410, $0) = Max($70, $0) = $70

The reason why both approaches get the same answer is that they follow the same logic. S-K represents the discount mentioned above. If the discount is negative, you would be overpaying, so you don’t exercise the option and your gain is $0.

Step 2: Calculate expected value (of the gains)

Above, we calculated the gains to be:

| Probability | 25% | 50% | 25% |

|---|---|---|---|

| Stock Price | $360 | $420 | $480 |

Gain from Call with | $0 | $10 | $70 |

Now we calculate the expected value. The formula for EV was given in the EMH lecture. You just multiply probabilities times the gains and then add everything up:

EV of the gains = 25% * $0 + 50% * $10 + 25% *70 = $22.5

The premium of the $410 call is $22.50.

Here is another example:

✏️ What is the premium of the K=$425 XYZ call?

✔

Step 1: Calculate the gains for each stock price:

| Probability | 25% | 50% | 25% |

|---|---|---|---|

| Stock Price | $360 | $420 | $480 |

| Gain from Call with K= $425 | $0 | $0 | $55 |

Step 2: Calculate the Expected Value of the gains: Premium = EV of Gain = 25%*$0 + $50*$0 +25%*$55=$13.75

✏️What is the premium of the $425 XYZ Put?

✔

Step 1: Calculate the gains for each stock price:

| Probability | 25% | 50% | 25% |

|---|---|---|---|

| Stock Price | $360 | $420 | $480 |

| Gain from Put with K= $425 | K-S = 425-360=$65 $65 | $5 | $0 |

Step 2: Calculate the Expected Value of the gains:

Premium = EV of Gain = 25%*$65 + 50%*$5 + 25%*$0 = $18.75

How do I calculate the cost of an option strategy?

The simplest way to calculate the cost of an option strategy is just to calculate the cost of the two options that make up the strategy. You then just add the cost of the two options to get the cost of the option strategy.

✏️ Consider a straddle consisting of a long $50 call and a long $50 put. Suppose you know that the only possibilities for the stock price at the expiration of your straddle are given below:

| Probability | 5% | 30% | 20% | 30% | 15% |

|---|---|---|---|---|---|

| Stock price at expiration: | S=$40 | S=$45 | S=$50 | S=$55 | S=$60 |

| How much does the straddle cost? (ie what is the price/premium) |

✔

This straddle is constructed from a call and a put. We know from above how to calculate the premiums of a call and a put, so we just calculate the two premiums and add them up.

Step 1: Calculate the gains: (don’t forget that you don’t need the premium to calculate the gain-gains ignore the premium)

| Probability | 5% | 30% | 20% | 30% | 15% |

|---|---|---|---|---|---|

| Stock price at expiration: S= | $40 | $45 | $50 | $55 | $60 |

| Gain from Long $50 Call | $0 | $0 | $0 | $5 | $10 |

| Gain from Long $50 Put | $10 | $5 | $0 | $0 | $0 |

Step 2: Calculate expected value (of the gains):

Premium of the call = 5%*$0 + 30%*$0 + 20%*$0 + 30%*$5 + 15%*$10 = $3.00

Premium of the put = 5%*$10 + 30%*$5 + 65%*$0 = $2.00

The straddle implies purchasing the call and the put, so

Premium of straddle = $3 + $2 = $5.00 ✅

Occasionally, I’ve seen problems where Bruce tells you the gain for a strategy at each stock price. For this type of problem, you just apply the same principles as above and calculate the expected value of the gains.

✏️ Suppose you know that the only possibilities for the stock price at the expiration of your straddle are given below. The gains for the straddle are also given below.

| Probability | 5% | 30% | 20% | 30% | 15% |

|---|---|---|---|---|---|

| Stock price at expiration: S= | $40 | $45 | $50 | $55 | $60 |

| Gain | $8 | $3 | $2 | $7 | $12 |

How much does the straddle cost? (ie what is the price/premium)

✔

Price of Straddle = EV of Gain = 5%*$8 + 30%*$3 + 20%*$2 + 30%*$7 +15%*$12 = $5.2

Is there a difference between “gain” and “IV?”

Basically, no. However, there are some fine distinctions.

First, the term “gain” is not precisely defined. Bruce usually uses it to indicate “the amount of money you can make (if any) by exercising an option for a given stock price at option expiration.”

In contrast, IV is precisely defined. It is “the amount of money you can make (if any) by exercising an option for a given stock price right now.”

They are slightly different. Your trading software will calculate the IV because knows the current stock price, so it can easily calculate the amount of money you could make by exercising the option right now. However, no one knows how much you could make by exercising the stock at option expiration, because no one knows what the stock price will be then.

That is why he uses two different words. You don’t need to worry about it, though.

How do you calculate the price of a stock?

In the lecture on EMH, we saw how to calculate the price of a stock if markets are efficient.

For these questions, you may assume that the stocks are fairly valued according to the EMH model. In other words, you may apply the above technique.

Further, if it doesn’t mention a dividend, you can assume there is no dividend. This essentially means you don’t have to do a dividend calculation if there is no dividend.

ALSO, if the stock is expiring just in the next month, you don’t need to do a PDV calculation either!!

In summary, all you have to do is to calculate the Expected Value of the stock price.

✏️ Suppose that you believe that GE stock will either be $90, $100, $110, or $120 next month with the following probabilities:

| Price | 90 | 100 | 110 | $120 |

|---|---|---|---|---|

| Probability | 10% | 30% | 40% | 20% |

✔First, we calculate the expected value of the future stock price.

EV = 10%*$90 + 30%*$100 + 40%*$110 + 20%*$120 = $107.00

The expected future value of the stock is $107. Because there are no dividends and because there is only a month left, the EMH suggests the stock price today should be $107.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.