🔎 Bond Pricing

Why pricing is important

The main question in trading any security is, “what is the fair price?”

If you can buy it for less than the fair price and it rises to the fair price, then you will make money.

This is a simple introduction to why pricing is so important in the remainder of this class.

How do we calculate the fair price of a bond?

Calculate the Net Present Value of the payments you get from the bond (coupon payments and the face value).

The three cases

Simplest case is a Zero Coupon Bond. For this, the only payment you get is the Face value when the bond matures, years from now. The present value of this payment is

The next simplest case is a regular coupon bond. In addition to the Face Value, you get coupon payments, every year for the next years.

Finally for a consol, we don’t get paid the Face value. Instead, we get PEPETUAL stream of coupon payments FOREVER. We recall that whenever you receive payments forever, you can use the perpetuity formula: .

In all of these cases, for the discount rate, , you would use the Yield to Maturity of similar bonds. By similar bonds, we mean bonds with similar payment schedules (maturity, etc.) and risk levels.

In summary, here are the three bond pricing formulas:

What is the interest rate on a bond?

Since we’ve been calculating present values, we should immediately ask, “what does mean for a bond?”

will tell us the effective interest rate on our bond. This is known as “yield” or “Yield to Maturity” ().

Before we start, you may think that the coupon rate is the interest rate on a bond. BUT IT ISN’T. To see this, consider two bonds, both with a 1 year maturity and .

1.) ,

2.) ,

Suppose you have to invest. Which bond are you buying? They are equally risky. Let’s analyze it in terms of cash flows for a single bond.

1.) With the first bond, you pay at the start, and at the end you get . You are essentially getting an interest rate of on this investment, because you invest , and then in 1 year you get back. You get back the same money that you put in. This is an effective interest rate of .

2.) With the second investment, you pay right now and in 1 year you get no coupon payment, but you are paid . With this, turns into . This is a return of .

Takeaway from this is that the bond with had a return (aka Yield aka ) of . The zero coupon bond with has a return (/) of

IRR calculation:

will make this work, so the is .

Yield Calculation:

[The yield calculation always has EXACTLY the same equation as the IRR equation.]

Write down Bond Pricing formula:

↑PV Outflows ↑PV Inflows

recopying

will make this work, so the Yield to Maturity is .

How do you calculate YTM?

Just like you calculate IRR.

Yield/YTM of a 1 year coupon bond

✏️

What is the Yield to Maturity on this bond?

✔ Click here to view answer

For a yield to maturity question, always write down the bond pricing formula and plug numbers in, leaving as a variable.

Yield/YTM of a Zero Coupon Bond

✏️

What is the Yield to Maturity on this bond?

✔ Click here to view answer

For a yield to maturity question, always write down the bond pricing formula and plug numbers in, leaving as a variable.

Next, you solve for .

Start with the switcheroo:

“Take the power of both sides”

← the easiest thing is to paste it into Google: https://www.google.com/search?q=2.1739%5E(1%2F10)

Recopy

The coupon rate is , but this bond offers a return.

Yield/YTM of a consol

✏️

(ie it pays every year)

What is the ?

✔ Click here to view answer

For a yield to maturity question, always write down the bond pricing formula and plug numbers in, leaving as a variable.

Yield/YTM of a coupon bond

DON’T WORRY - he can only ask you to calculate the of a bond with algebra (unless he is much is much more clever than me). He has no interest in making you do fancy algebra beyond the algebra needed for the calculation above.

✏️

What is the YTM?

✔ Click here to view answer

This is very much like the 1 period coupon bond example we did above.

For a yield to maturity question, always write down the bond pricing formula and plug numbers in, leaving as a variable.

Plug in:

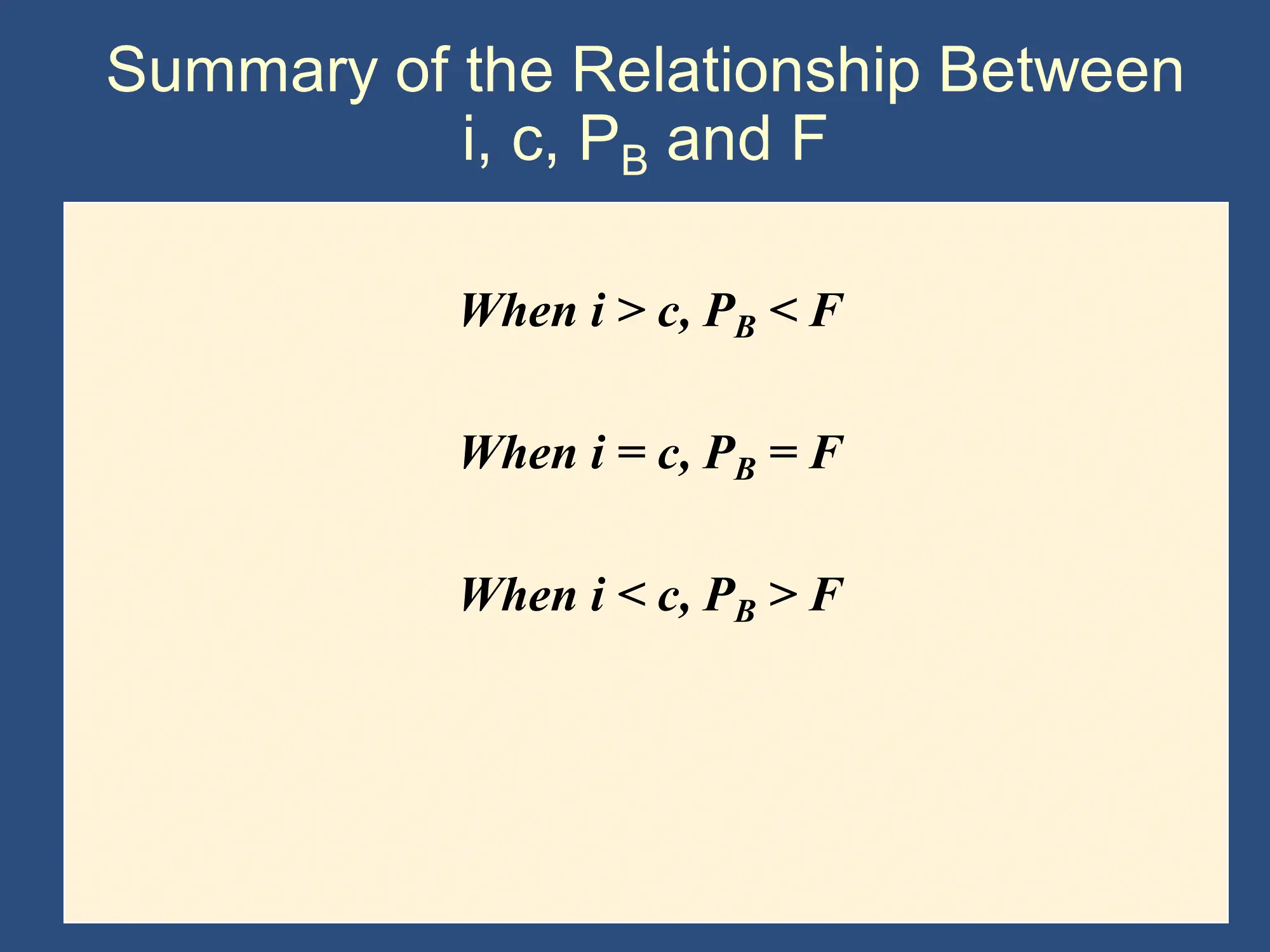

The coupon rate was a full , but the actual yield of the bond was only . Why? It’s because the is higher than the face value. This is what is known as a premium bond.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.