✏️ Only 3 Core Types of IRR Problems…

Example IRR problems

You can solve any IRR problem by writing down the following formula and solving for i using basic algebra:

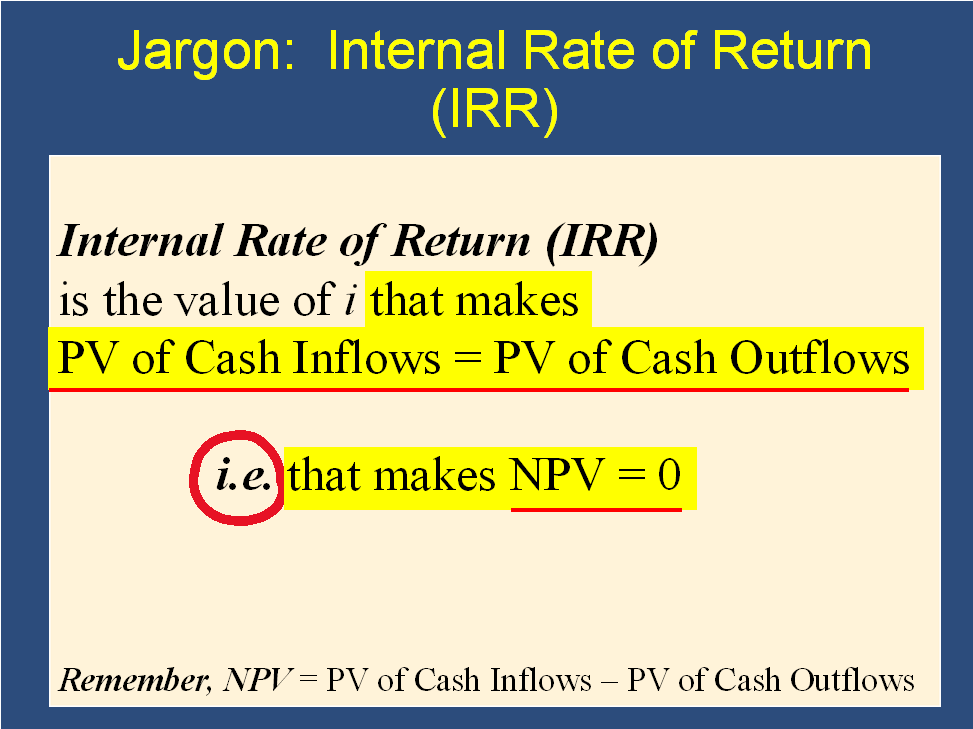

PV of Cash Inflows = PV of Cash OutflowsIRR is introduced on the following slide: (I’ve made some small edits for clarity)

The slide makes it clear the IRR is the value of i that makes either of red-underlined equations true. (If one equation is true, then the other equation is also true because of some simple algebra and the definition of NPV.) I suggest you use the first equation, not the second equation.

Note: some people will use the second equation (NPV=0) rather than the first (PV(Inflows)=PV(Outflows)). However, this tends to add a step to the algebra AND it will make it a bit harder when we learn bonds. Therefore, I always use the first equation and encourage you to do the same.

Note: I sometimes use abbreviations, writing “PV of Cash Inflows” as “PV(Inflows)” or “PV Inflows,” etc…

The three “core” types of problems

Perpetuity type

✏️ Suppose I am considering purchasing a business. I expect it to earn $120,000 per year, every year, forever. It will cost me $1.5M to purchase the business. What is the IRR of purchasing this business?

✔ Click here to view answer

We will be solving the following equation for i:

PV of Cash Inflows = PV of Cash Outflows

PV of Cash Inflows = ← using the perpetuity formula.

PV of Cash Outflows = $1,500,000

Setting these equal:

Algebra allows you to simply switch the ‘i’ and the $1,500,000. It’s actually two algebraic steps in 1. We call this the switcheroo.

✅

Let’s call questions like the previous one, “IRR problems with a perpetuity” problems. We can call the next type “IRR problems with cash flows in two consecutive years.”

1 period type

✏️ Suppose I borrow $358 today and pay back $487 in 1 year. What is the IRR for the person lending me the money?

✔ Click here to view answer

Write down formula from perspective of person lending me money:

← this is challenging because the i is in the denominator…

← switch the $358 and the “1+i” [switcheroo]

←subtract 1 from both sides.

The IRR is ✅

Only two cash flows

We can call the next type “IRR problems with cash flows on two nonconsecutive years”.

(AFTER THE MIDTERM: These exact same algebraic steps will be used to calculate the “YTM for a Zero Coupon Bond."")

✏️ Suppose you are a venture capitalist. You are looking at a company with very reliable, if modest, cash flows. You expect it will have earnings of $800,000 every year, in perpetuity. (Reassurance sentence: Your first cash flow would be received exactly 1 year after you purchased the business.) It costs $6,000,000 to acquire the company. Assuming your income projections are correct, what is the IRR of the project?

✔ Click here to view answer

✅

✏️ You lend $1000 to your brother in law. He promises to pay you back $1250 in one year. You trust him. What is your IRR if it works out as planned.

✔ Click here to view answer

If you invest $1000 and receive back $1250, your ROI is 25%, so we expect the IRR to be 25%. Let’s check.

You loan shark!!

✏️ It turns out the brother in law doesn’t pay you back for 3 years. He still only plays you $1250, though. You graciously don’t complain. What is your IRR?

✔ Click here to view answer

When you paste into the Google search bar (or the Chrome address bar), you get 1.07721

✏️ Suppose you are starting a business. The business will cost $600,000 to start up today and, starting in 1 year will pay you $80,000 every year, forever. Similar investments earn 5% per year.

- If someone invested the $600,000 and created the business, then wanted to sell it to Kevin O’Leary, what would the fair value be?

- What is the NPV of starting the business? What does the NPV rule advise?

- What is the IRR of starting the business. What does the IRR rule advise?

✔ Click here to view answer

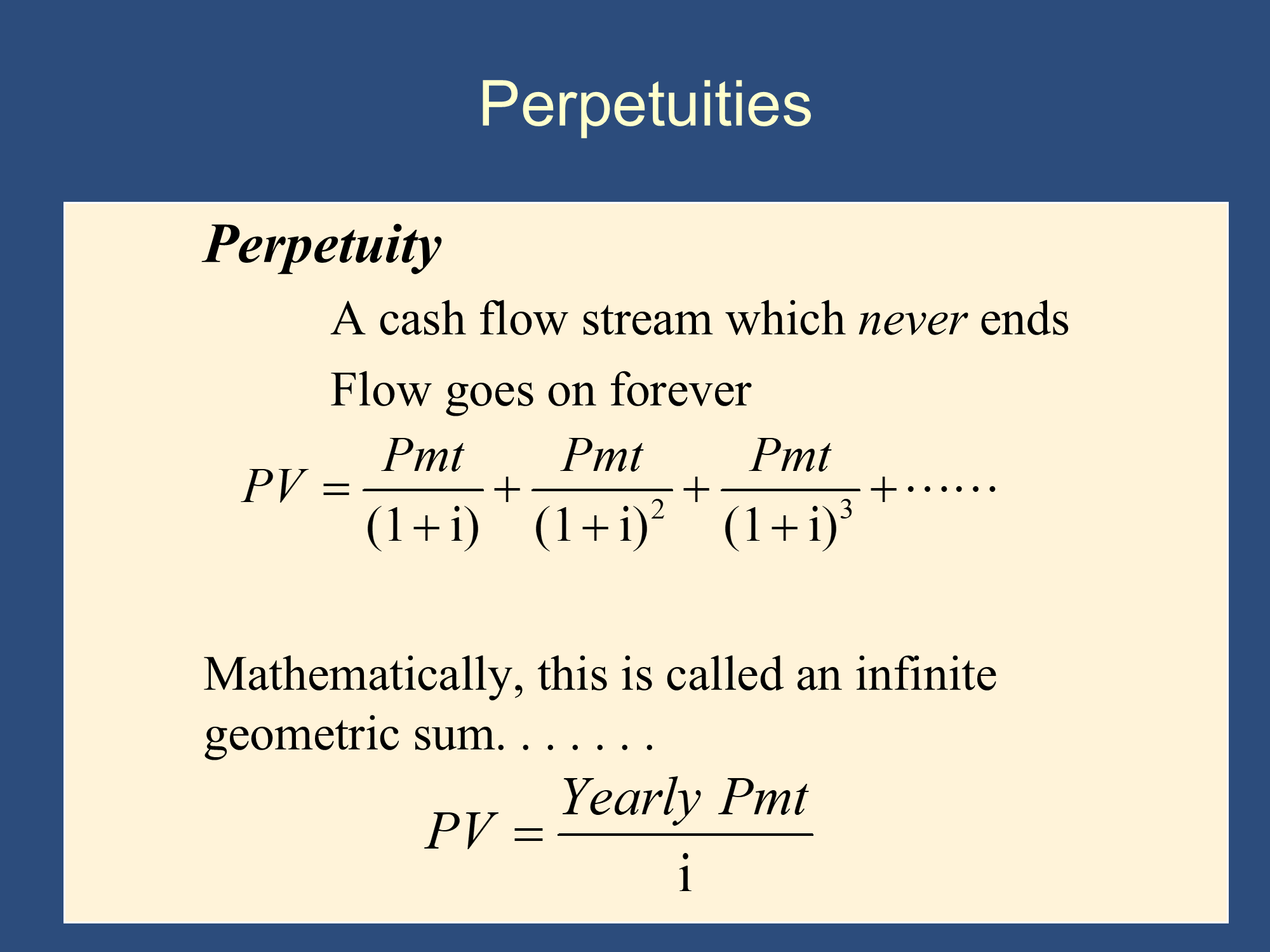

Whenever payments go on “forever” you will use the perpetuity formula:

Part 1.)

The fair value of the business is the PDV of the income you get from the business. We want to calculate the PDV of the $80,000 every year, forever.

← perpetuity formula

(Present Value and Present Discounted Value are essentially synonyms, so we use PV and PDV interchangeably here.)

Part 2.)

NPV rule: NPV>0, 👍 Take it!

Part 3.)

for any IRR problem, solve it by writing down a formula and then solving for i

As before, and ← perpetuity formula, leaving i as a variable.

Setting them equal:

Switcheroo:

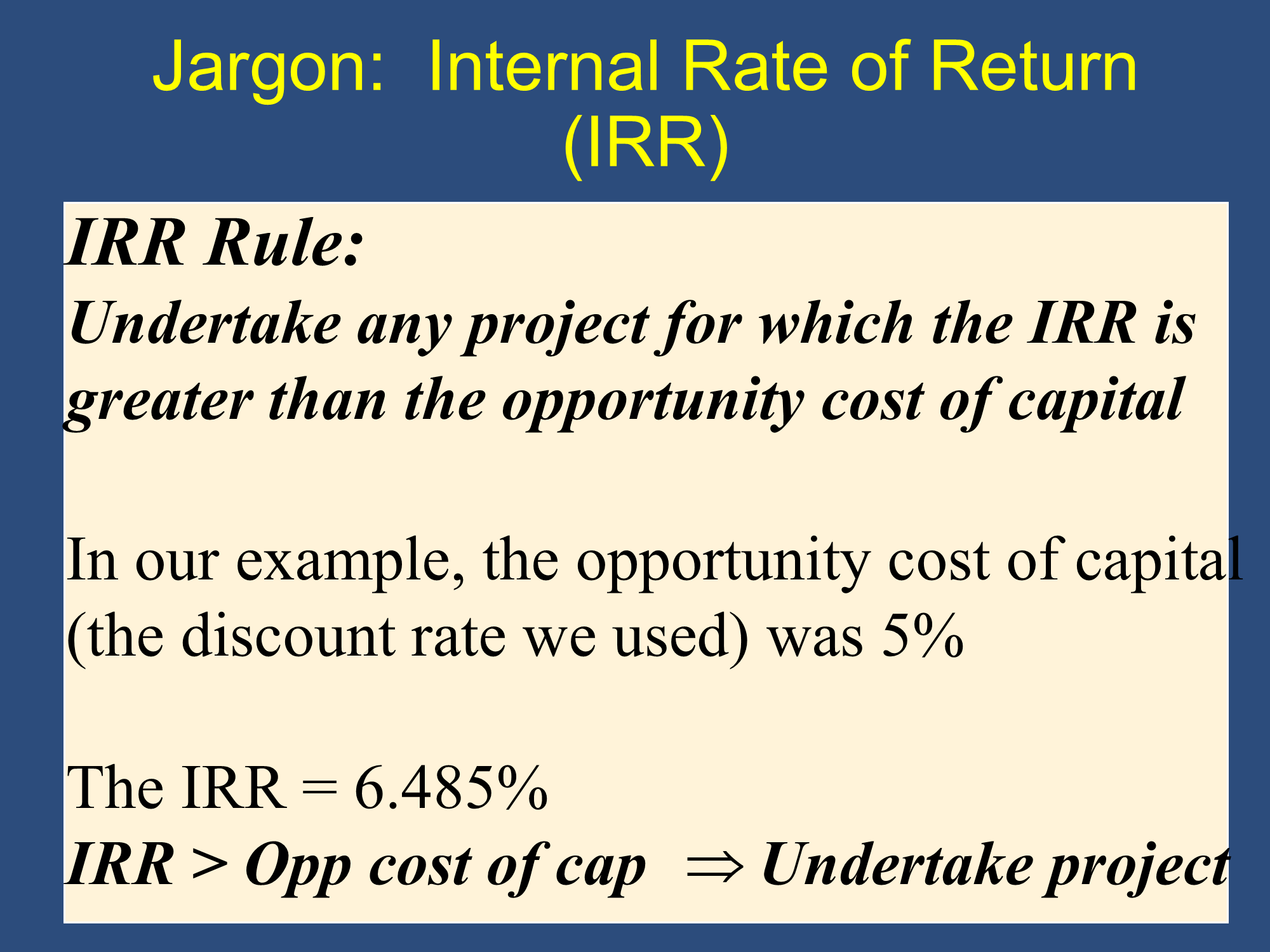

The return on this investment is essentially 13.33%. Similar investments earn 5% per year. Therefore, this investment is very attractive. This is an example of the IRR rule. Because IRR=13.33% opp cost of cap = 5%, undertake project.

As you can see, IRR calculations are simple for a perpetuity. When we calculate the IRR of purchasing a bond, it is called “Yield to Maturity.” If you are ever asked to calculate the “Yield to Maturity” for a bond that pays off forever (these are called consols), you can celebrate. Just use the algebra above!

✏️ You are considering an investment with the following cash flows. What is its IRR?

| T | Cash Flows |

|---|---|

| 0 | -$1000 |

| 1 | $60 |

| 2 | $60 |

| 3 | $1060 |

✔ Click here to view answer

We guess that IRR is 6%, because this looks like a bank account where you are earning 6% interest and withdrawing your interest at the end of each year.

Let’s verify using the equations from the slides:

IRR is the value of i that solves:

Plugging in , you get

Therefore, i=6% makes PV Inflows = PV Outflows, so the IRR is 6%. ✅

✏️ Suppose you are paid in advance for a contract. You will be paid $20,000 today, but must provide services in 2 years that will cost $25,000. What is the IRR?

✔ Click here to view answer

Switch: Next, take square root of both sides.

1.118

⇨ What if the total cash inflows are equal to the total cash outflows?

✏️ Suppose you can invest $60,000 today and then in each of the following 4 years, you will receive back $15,000

| t | [net] cf |

|---|---|

| 0 | -60,000 |

| 1 | 15,000 |

| 2 | 15,000 |

| 3 | 15,000 |

| 4 | 15,000 |

✔ Click here to view answer

Notice that the cash inflows are equal to the cash outflows. IRR is like the interest rate on a bank deposit. If you deposit $60,000 and then you withdraw $60,000 and you can’t withdraw any more money (ie the account is empty), what must your interest rate be? Clearly, you weren’t earning any interest, so i=0%. Let’s guess that the IRR=0% for this problem.

I call this methodology GUESS AND CHECK.

The IRR is the i that solves the :

Note that i=0% solves this equation. It’s the only number that does, so it is the IRR.

Intuitively, Notice that the cash inflows are equal to the cash outflows. IRR is like the interest rate on a bank deposit. If you deposit $60,000 and then you withdraw $60,000 and you can’t withdraw any more money (ie the account is empty), what must your interest rate be? Clearly, you weren’t earning any interest, so i=0%. Let’s guess that the IRR=0% for this problem.

Keyboard speed tip:

✏️ Write down the formula for the present value of an annuity where you get $100 each year for the next 15 years. i=5%

❔

If someone wanted to give you a 15 year annuity, which would pay you $100 per year for 15 years, and wanted to sell you that for $1100, you wouldn’t take it because the fair value is $1,037.97.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.