👨🏫 Notes

Formulas for this lecture can be found in my paper formula sheets and online formula sheet.

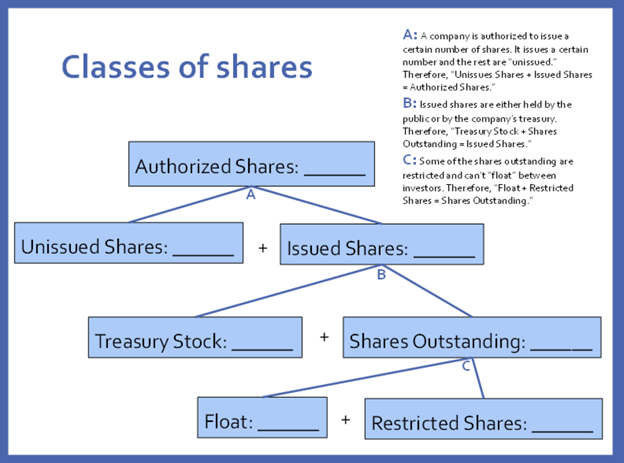

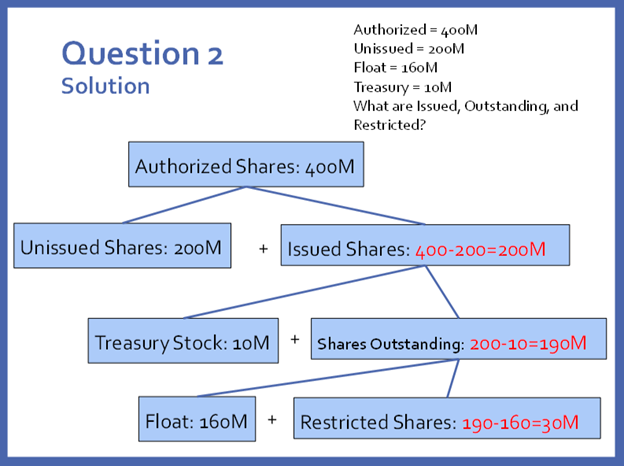

I’ve made a worksheet to help with “Classes of Shares problems.” You can download it here:

I think the worksheet is worth learning. Here is what it looks like:

|  |

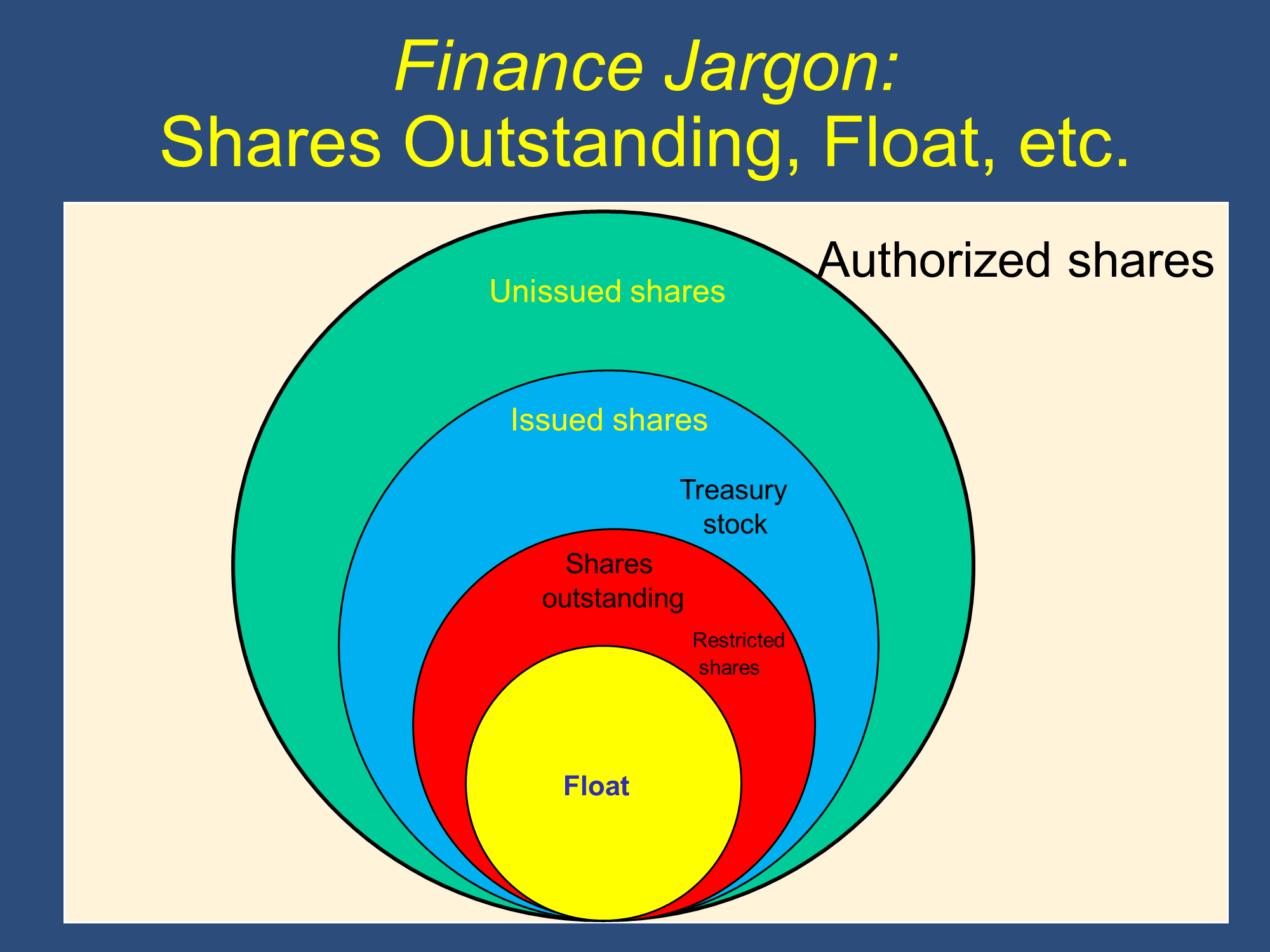

The above worksheet and the following diagram convey the same idea, but the worksheet is optimized for writing on while you solve problems.

Market Cap Categories

| Mega Cap |

|

| Large Cap |

|

| Mid Cap |

|

| Small Cap |

|

| Micro Cap |

|

Initial Public Offerings (IPOs)

An IPO is the first offering of stock to public.

Benefits:

- Increased access to capital markets (can sell stock to raise money)

- Founders can “cash out”

Costs:

- Loss of control (Example: Jobs and Wozniak at Apple)

- Exposure of sensitive information (SOX)

- Investor relations efforts

🙋 If an IPO makes a company public, what is a private company? How does this relate to Private Equity, Venture Capitalists, Angel Investors, and Leveraged Buyouts?

See answer

You are not responsible for the following information, but the information is helpful.

As mentioned above, companies which do an IPO are required to provide regular disclosure of a great deal of information. They must also engage in investor relations efforts.

These required disclosures and investor relations efforts make the companies much safer for regular investors to invest in. Therefore, only “financially savvy” investors can invest in companies that don’t make these disclosures. These companies are know as “private companies” because their stocks can’t be held by the public and are offered only in private placements.

Companies which satisfying the disclosure and investor relations requirements are known as “Public Companies.” Stocks of public companies can be sold on public exchanges and can be purchased by anyone.

The vast majority of the largest companies are public because share prices are higher when more people can buy the shares. Investment funds that specialize in private companies are known as “Private Equity.” Because stock in private companies can’t be sold to the public, private equity investors tend to hold large stakes in those companies and they therefore get more involved in running the company than an investor in a public company would.

You may have heard of several specialist types of firms that do private equity investments:

- Investment funds that do private equity investments that specialize in relatively young companies that haven’t gone public yet are called “Venture Capital (VC)” companies. Some famous VC companies are based in Silicon Valley.

- Individual investors who purchase private equity in the smallest and youngest companies are called Angel Investors. You can watch some angel investors in action on the CNBC show “Shark Tank.”

- Other private equity funds take out large loans (leverage) and buy out entire public companies, taking them off the public exchange and makign them private again. Typically, they restructure the newly private companies and then do another IPO later to cash out. This is known as a “Leveraged Buyout (LBO).”

IPOs are managed by investment banks, often working together in a syndicate. You choose an underwriting bank or syndicate based on the details of the contract they offer, the spread (a markup that goes to the investment banks) and, most importantly, their reputation/credibility with investors (this allows them to market the shares - their primary job).

Steps in an IPO: The Lead underwriter values the company (determines the offering price of shares), “Builds the book” via road shows (sells/collects orders for shares), fills the necessary paperwork, and files the prospectus.

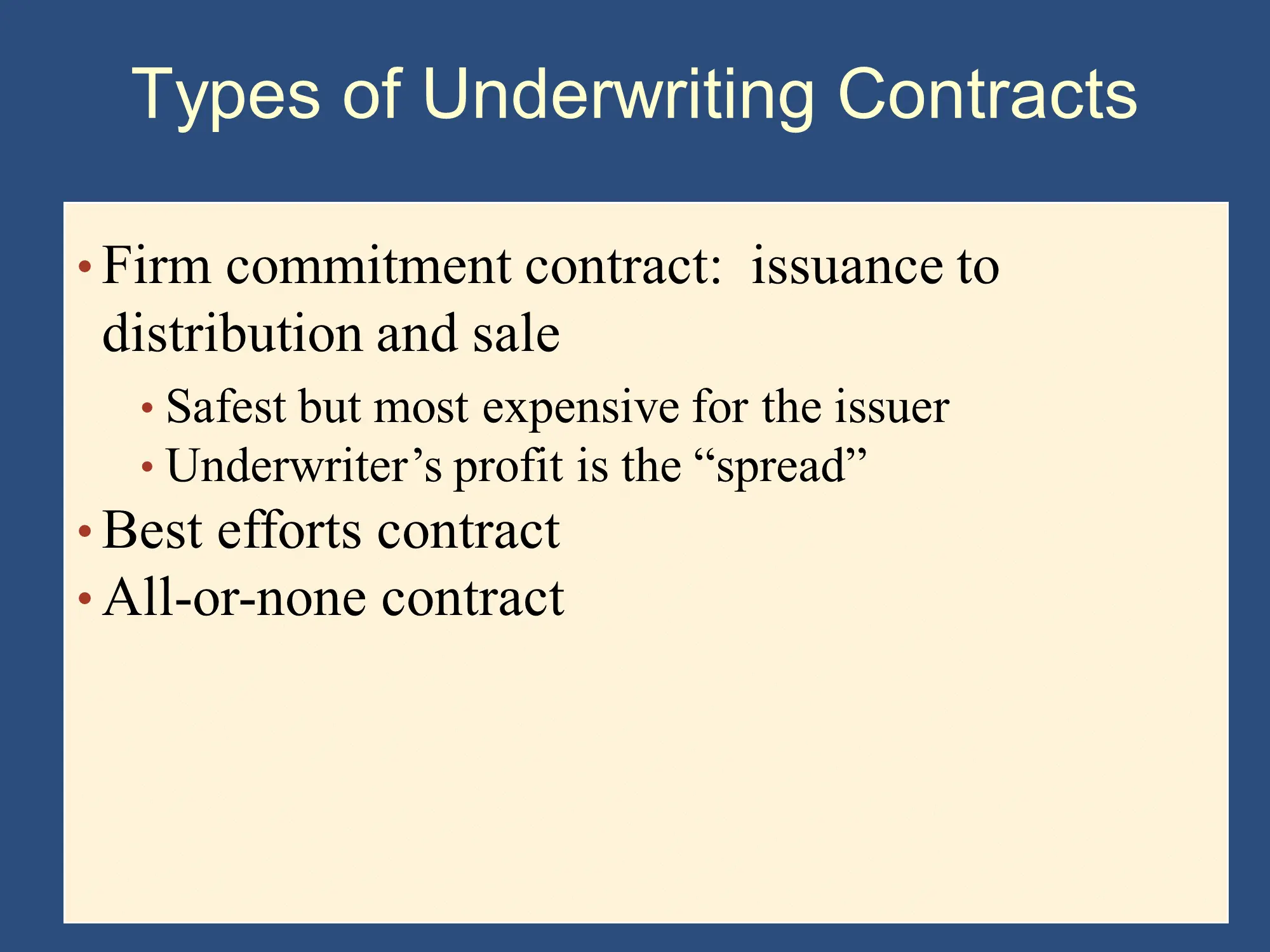

Types of underwriting contracts:

- Firm commitment (aka “issuance to distribution and sale”): Underwriter commits to buying shares at a discount from the firm and reselling them at the higher “public offering” price to investors. The difference between the two prices is the “spread” and is the underwriter’s profit. This is safest for the issuer because if investors decide they don’t want the shares at the public offering price, the underwriter has already bought them for a known price. The underwriter needs to be compensated for taking all of the risk and charges a substantial spread, so it is also the most expensive.

- Suppose TCKR company wants to go public. If the underwriting banks buy the shares from TCKR for and then sells the shares to the bank’s customers and other investors for , then the investment banks have a spread. If they sell shares, then they have a . Here, as a percentage, the spread is .

- Best efforts: the underwriter does not buy shares, they make their best effort to sell all the shares they can. That can be risky for the firm, but cheaper because there is no spread; they only pay underwriter fees for their service.

- All or None: Underwriter attempts to sell all of the issuing firm’s shares, or, if all cannot be sold, the IPO is cancelled.

NYSE & NASDAQ

Originally, NASDAQ was primarily a dealer market with a price quotation system.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.