✏️ Balance Sheet Reserve Ratio Questions

Note: rather than being core skills that you must be on top of, the examples on this page are relatively advanced. If you have limited time to study, you may want to skip this page.

Occasionally, Bruce will add questions on an exam or a problem set that require involve both a reserve ratio, such as R or E, and a balance sheet. There are generally two types of problems like this:

- In one type, you are given R, E, or R+E, and you need to draw conclusions about a balance sheet.

- In another type, you are given a balance sheet - likely with entries missing - and you need to draw conclusions about R or E.

This type of question can be very challenging, so this page gives you many examples, starting from the least challenging and building up toward more challenging questions.

Equations

We start with some equations, for reference.

Balance sheet equations

Definition of Bank Capital:

With algebra, this implies that the left and right of balance sheet are equal: (must balance ⚖)

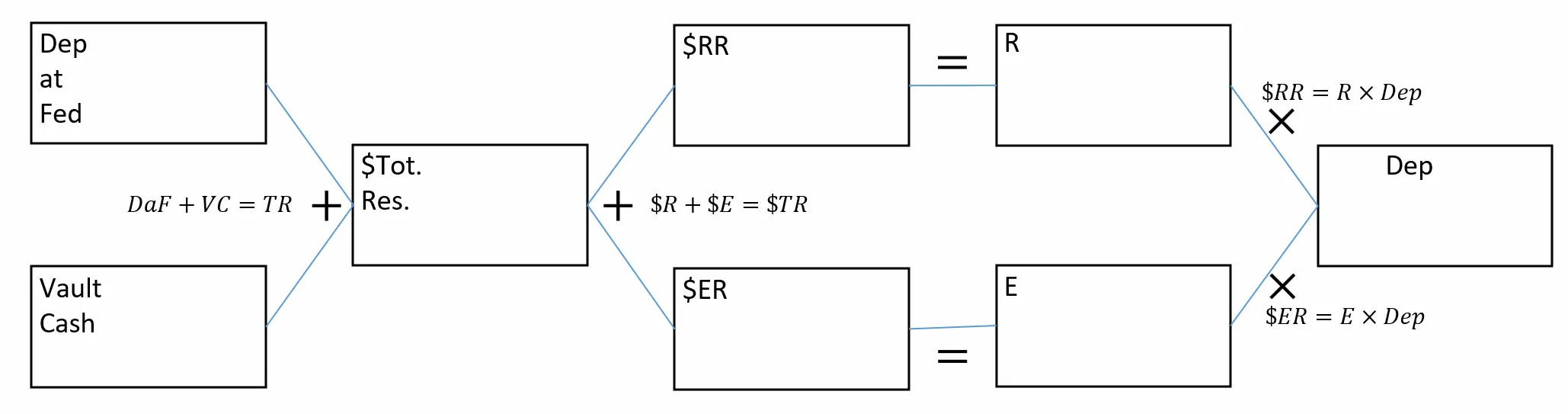

Reserves equations

Interpretation: Some reserves are required, but the total reserves may exceed that. The additional reserves are called excess reserves.

Both Vault Cash and cash deposited at the Fed count as legal reserves.

Main equations:

Related equations:

Analyzing balance sheets

✏️ Ie, “filling in the blanks”

⚖:

Question 1

Fill in the blanks in the following balance sheet.

| Assets | Liabilities |

|---|---|

____ Reserves | $5M Deposits |

| $0.5M |

Hint: calculate the total Assets, Total Liabilitie and Bank Capital. Then, use to fill in one of the blanks.

✔ Click here to view answer

| Assets (4.5M+Reserves) | Liabilities (L+BC=5.5M) |

|---|---|

$1M Reserves | $5M Deposits |

$0.5M |

Question 2

Fill in the blanks in the following balance sheet.

| Assets () | Liabilities () |

|---|---|

$___M Reserves | $5M Deposits |

| $___M |

✔ Click here to view answer

Both Vault Cash and cash deposited at the Fed count as legal reserves.

| Assets | Liabilities |

|---|---|

$1M Reserves | $5M Deposits |

| $0.5M |

Analyzing balance sheets when R and E are given

✏️ Q: Balance sheet with R and E…

The fed requires that banks hold 8% of their deposits as reserves and banks decide to hold excess reserves equal to 7% of their deposits.

Fill in the blank in the following balance sheet.

| Assets () | Liabilities () |

|---|---|

.6M Reserves | $4M Deposits |

| $___M |

✔ Click here to view answer

R=8% and E=7%, so R+E = 15%

You are holding 15% of your deposits as reserves.

Reserves = =

This bank is required to hold of required reserves.

This bank has of excess reserves.

| Assets | Liabilities |

|---|---|

$.6M Reserves | $4M Deposits |

| $1.1M |

Bank capital is ALWAYS changing. Remember that Bank Capital is the Net Worth of a bank. Therefore, anything that is profitable increases bank capital. Anything that is unprofitable decreases bank capital.

How much bank capital?

Consider the following transactions occur. How will this affect the balance sheet?

Calculating R or E from a balance sheet

✏️ Suppose . What is E?

| Assets | Liabilities |

|---|---|

$1M Reserves | $5M Deposits |

| $.5M |

You want to figure out . Here is your equation from “Key Topics”

But , so is .

What is the money multiplier?

Side note:

Suppose you weren’t told that .

Is there a way to find the MM?

Recall that we know that

Of course!

Calculating R or E from a balance sheet

✏️ Banks elect to hold of their deposits as excess reserves.

Here is the balance sheet a First National Bank.

What is the required reserve ratio?

Fill in the blank in the following balance sheet.

| Assets () | Liabilities () |

|---|---|

___ Reserves | ___ Deposits |

| $5M |

✔ Click here to view answer

Start with the balance sheet:

| Assets | Liabilities |

|---|---|

$35M Reserves | $150M Deposits |

| $5M |

Now we use our favorite equation:

is given as in the question, so

Additional Practice Problems

✏️ Suppose that Metro Credit Union has the following balance sheet:

| Assets | Liabilities |

|---|---|

| DaF 2m VC ? Loans 40m Other 5m | Checking 40m Bank Capital 15m |

| Suppose that the required reserve ratio is 10%. What percentage of the banks deposits does it keep as excess reserves? |

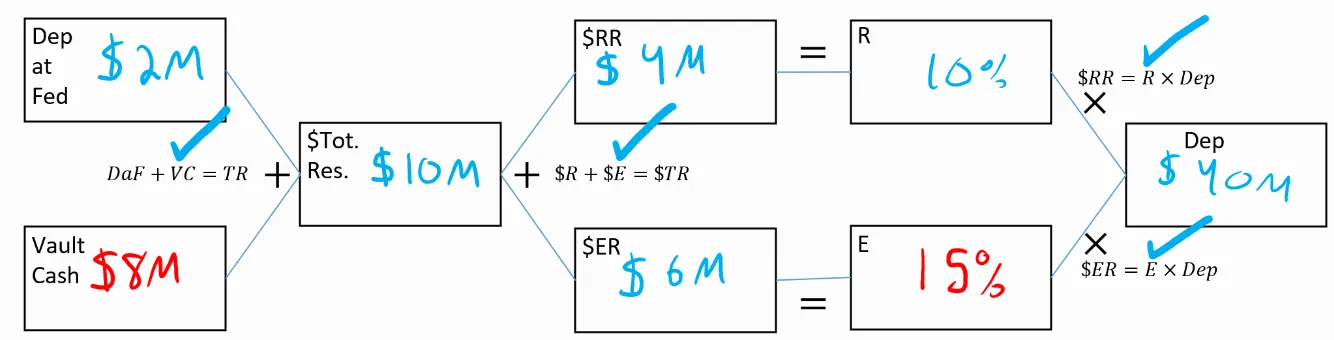

✔ First, we need to find out what quantity are we trying to find. The question asks for E. It also leaves Vault Cash blank, so we may need to figure that out along the way.

We know Assets = Liabilities + Bank Capital, so the left side of the balance sheet must be equally as large as the right. The right side adds up to 8m.

From this, we recall that VC+DaF=Total Reserves, so Total Reserves = 8m = $10m

This allows us to use the “total reserves as a % of deposits” equation: R+E=\frac{$TotalReserves}{Deposits}=\frac{$10M}{$40M}=25\% Because R+E is 25% and because R=10%, E must be 15%.

We can check our math using the “Fish Diagram:”

Another practice problem

✏️

| Assets | Liabilities |

|---|---|

| DaF ? VC 5m Loans 40m Other 5m | Checking 40m Other Liabilities? Bank Capital 3m |

| Suppose that R = 10% and E=20%. How many other assets does the bank hold? |

✔We are holding R+E=30% of our deposits as reserves. This is 12m of total reserves. (We used Deposits × (R+E) = $TotalReserves to find this.)

VC + DaF = TotalReserves, so $5m + DaF = $12m Therefore, DaF = $7m.

Assets = Liabilities + BankCapital Assets = 7m + 5m + 40m + 5m = 57m Therefore Liabilities = Assets - BC = 57m - 3m = 54m Other liabilities must therefore be $14m, because 40m + 14m = 54m = total liabilities.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.