A downloadable Microsoft Word version of this formula sheet can be found at robmunger.com/2000share. Questions or comments? Please email rob.mgmte2000@gmail.com. Remember, your first reference is always the lectures and the homework.

Press Ctrl-D to bookmark this page. Feel free to download it, but please do not reupload.

L2 - Money and Banks

Bruce often refers to M1 as the “Money Stock” or the “Money Supply.”

M1=Total Deposits+Cash Held by Public

M2=M1+Time Deposits+Money Market Mutual Funds

Definition of Bank Capital:

Bank Capital=Assets−Liabilities

With algebra, this implies that the left and right of balance sheet are equal: ️⚖️

Assets=Liabilities+Bank Capital

Bruce’s 6 Bank Balance Sheet Event Examples are helpful.

References: 2 Feb 4.ppt and L2-Bank Balance Sheets

L3 - Bank Profitability and Leverage

Name

Equation

Example

= interest rate earned on assets - interest rate paid on liabilities

= 6% - 3% = 3%

Net Interest Income = (total interest received) - (total interest paid)

= $12M - $8M = $4M

=Total Interest Earning AssetsNet Interest Income

= $4M/$100M = 4%

=Total AssetsProfit After Taxes

= $1M / $100M = 1%

=Bank CapitalProfit After Taxes

= $1M / $10M = 10%

=CapitalAssets

= $100M / $10M = 10 to 1

=Bank CapitalBank Liabilities

= $90M / $10M = 9 to 1

ROE = ROA × Leverage Ratio

Checking the numbers:

10% = 1% × 10

Profit

= Δ Bank Capital

(Because profit increases your net worth)

L3 - Reserves

Name

Equation

Example

Required Reserves

= R × Checking Deposits

= 10% × $2B = $200M

Interpretation: The Fed decides how many dollars of reserves a bank is legally required to hold for every $100 of deposits.

TotalReserves

=Vault Cash + Deposits at Fed

= $50M + $250M = $300M

Interpretation: both Vault Cash and Deposits at the Fed count as reserves.

“Deposits at Fed” = "Deposits at the Central Bank"

ExcessReserves

= Total Reserves - Required Reserves

= $300M - $200M = $100M

Interpretation: Any reserves that are not required are excess reserves.

R + E

Total Reserves / Deposits

= $300M/$1B = 30% ⇨ If R + E = 30% and R=10%, then E must be 20%

Interpretation: R+E is the total percent of deposits kept as reserves.

L3 - Bonus Reserves Equations

Occasional questions may ask you to reason about excess and required reserves. With a tiny bit of algebra, these nine equations follow from what you’ve learned in class. I lay them out here systematically for reference. ($RequiredRes means “Dollars of Required Reserves,” etc.)

| Required Reserves Version | Excess Reserves Version | Required and Excess |

|---|

To find:

R or E | R=Deposits$RequiredRes | E=Deposits$ExcessRes | R+E=Deposits$TotalRes |

To find:

$Reserves | $RequiredRes=R×Deposits | $ExcessRes=E×Deposits | $TotalRes=(R+E)×Deposits |

To find:

Deposits | Deposits=$RequiredRes×R1 | Deposits=$ExcessRes×E1 | Deposits=$TotalRes×R+E1 |

L3 - Money Multiplier

MS=M1=Total Deposits+Cash Held by Public

Money Multiplier: R+E1=1/(R + E)

ΔTotal Deposits=Initial Deposit×R+E1

ΔMS=ΔDeposits+ΔCash Held by Public

References: 3 Feb 11.ppt and L3-Measures of Bank Profitability

L4/L5 - Monetary Policy

You can use the two green equations, above, for Deposits/Withdrawals and Open Market Operations. For an Open Market Operation, ΔCHP=0

References: 4 Feb 18.ppt and L4-Reserves

i=r+π and r=i−π

(r=real interest rate; i=nominal interest rate; π=inflation rate)

References: 5 Feb 25.ppt and L5-Outline

L6 - NPV and IRR

FV=PV×(1+i)N

PV=(1+i)NFV

Present Value of a stream of payments for T years:

PV=(1+i)1Pmt1+(1+i)2Pmt2+(1+i)3Pmt3+⋯+(1+i)TPmtT

To enter the above formula as plain text, write: PV = PMT1/(1+i)^1 + PMT2/(1+i)^2 PMT3/(1+i)^3 + ... + PMTT/(1+i)^T

PV of a Perpetuity=iYearly Pmt

NPV=PV of Cash Inflows−PV of Cash Outflows

To solve an IRR problem, write down NPV=0 or PVInflows = PVOutflows and solve for i.

NPV Rule: Undertake any project with a positive NPV. If two mutually exclusive projects have positive NPV, undertake the project with the higher NPV. (NPV is like the profit of the project.)

IRR Rule: Undertake any project for which the IRR is greater than the opportunity cost of capital.

References: 6 Mar 4.ppt and L6-Outline

Midterm

L7 - Bonds

F=Face value; T=Number of years until bond expires; i=discount rate/Interest rate; c=Coupon rate; Fc=F×c=a single coupon payment

PZCB =(1+i)TF

PConsol =iFc

PCouponBond =(1+i)1Fc+(1+i)2Fc+(1+i)3Fc+⋯+(1+i)TFc+(1+i)TF

For a 3 year coupon bond:

PCouponBond=(1+i)1Fc+(1+i)2Fc+(1+i)3Fc+F

Plain Text Formulas:

- 2 Year Coupon Bond:

PB = Fc/(1+i)^1 + (Fc+F)/(1+i)^2

- 3 Year Coupon Bond:

PB = Fc/(1+i)^1 + Fc/(1+i)^2 + (Fc+F)/(1+i)^3

- T Year Coupon Bond:

PB = Fc/(1+i)^1 + Fc/(1+i)^2 + Fc/(1+i)^3 + ... + (Fc+F)/(1+i)^T

- Zero Coupon Bond:

PB = F/(1+i)^T

Shortcut to calculate price of a 4 year coupon bond with F=1000,i=860)

PB = 60/1.08 + 60/1.08^2 + 60/1.08^3 + 1060/1.08^4

Equivalent Tax Free Rate: Taxable Rate×(1−Marginal Tax Rate)

To solve a Yield To Maturity (YTM) problem, write down the bond pricing formula and solve for i.

References: 7 Mar 25.ppt, L7-Outline, and L7-Notes

L8/L9 - Stocks & Investment Companies

Authorized Shares = Issued Shares + Unissued Shares

Issued Shares = Shares Outstanding + Treasury Stock

Shares Outstanding = Float + Restricted Shares

My “Classes of Shares” worksheet can you help solve problems using the above equations.

Market Capitalization: Market “Cap” = Shares Outstanding × Price Per Share

Net Asset Value (NAV)=Shares OutstandingMarket Value of Assets−Liabilities

R=NAV0NAV1−NAV0+Income+Capital Gain

References: 8 Apr 1.ppt, L8-Outline, L8 Notes, 9 Apr 8.ppt, and L9 Notes

L10 - CAPM and EMH

CAPM: E(rS)=rF+β[E(rM)−rF]

CAPM Jargon:

E(rS) =E(ri)= Expected return on a portfolio or individual stock

E(rM) = Expected return on the market portfolio

rF = risk free rate = rate on return of assets considered to be risk-free = return on T-Bills

“Risk Premium” means you subtract off the risk free rate.

E(rM)−rF = Market risk premium = Expected risk premium of market

Expected Value (EV):

= Probability of Outcome 1 × Value of Outcome 1

+ Probability of Outcome 2 × Value of Outcome 2

+ Probability of Outcome 3 × Value of Outcome 3

+ …

+ Probability of Outcome N × Value of Outcome N

EMH stock price = PDV of EV of future price + PDV of dividend

Example: EVPrice=31($12)+31($18)+31($24)=$18

Stock price = PDV of EV+PDVof Dividend

Stock price = (1+12%)$18+(1+12%)$3

References: 10 Apr 15.ppt and L10 Notes

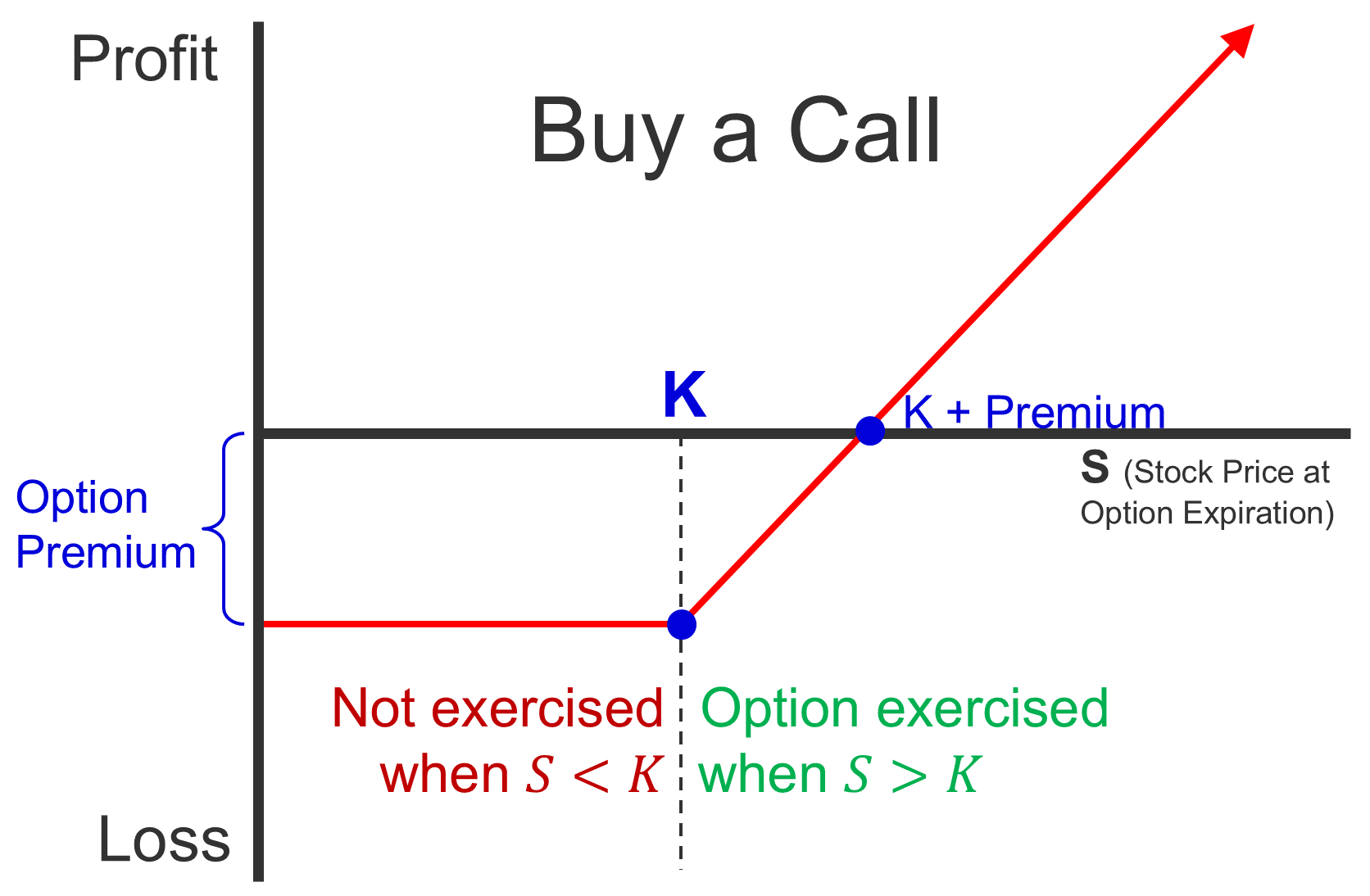

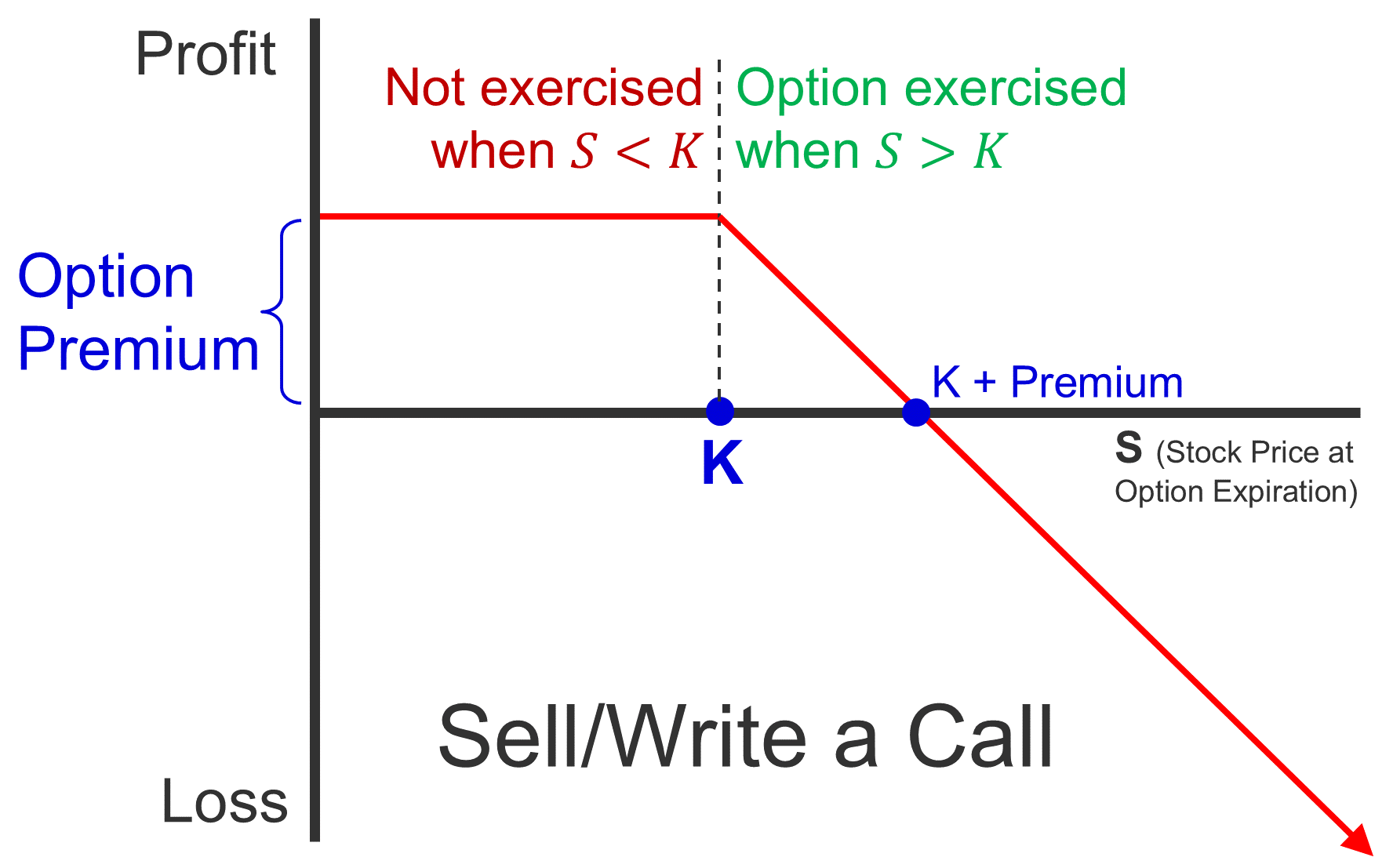

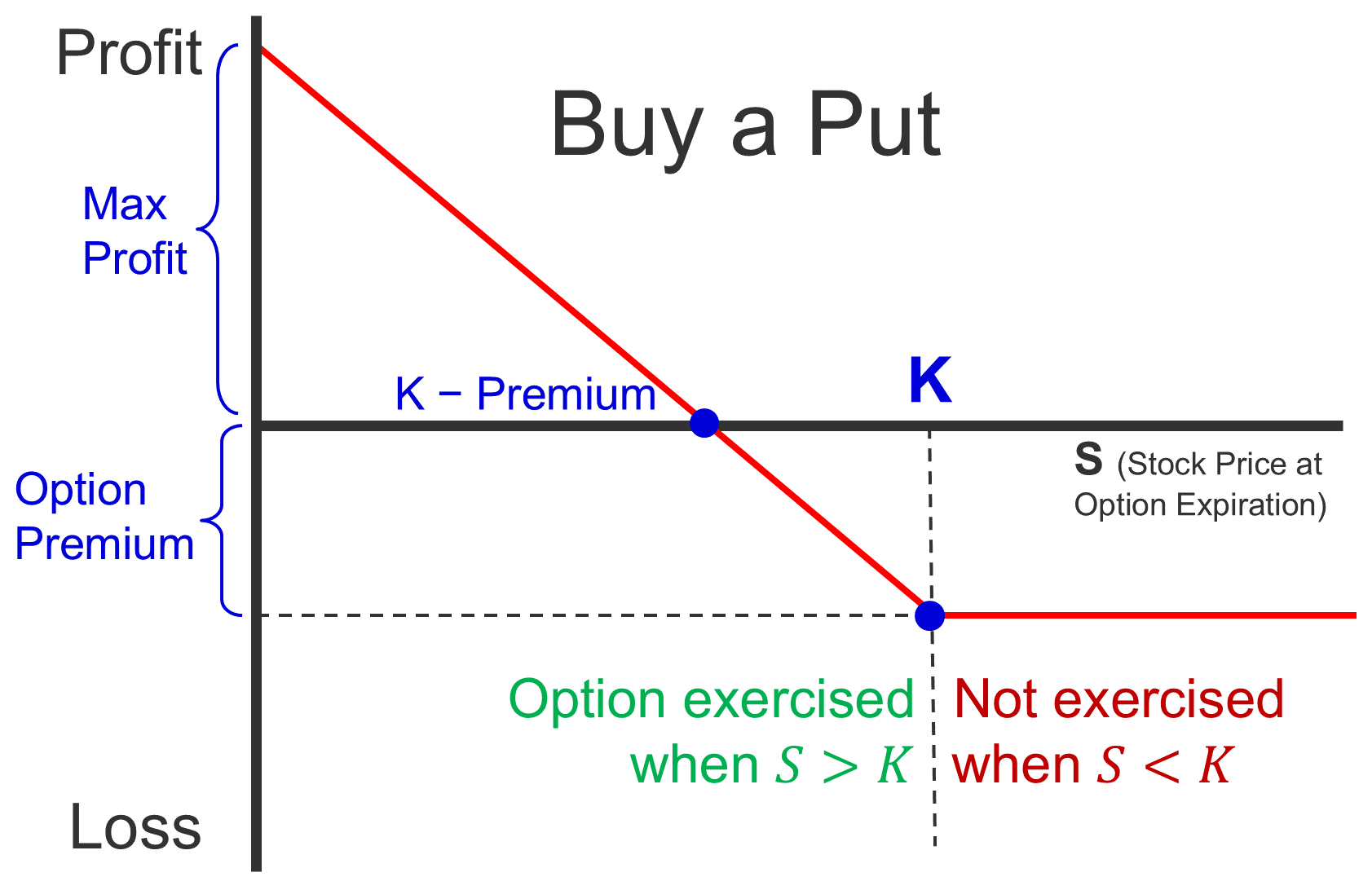

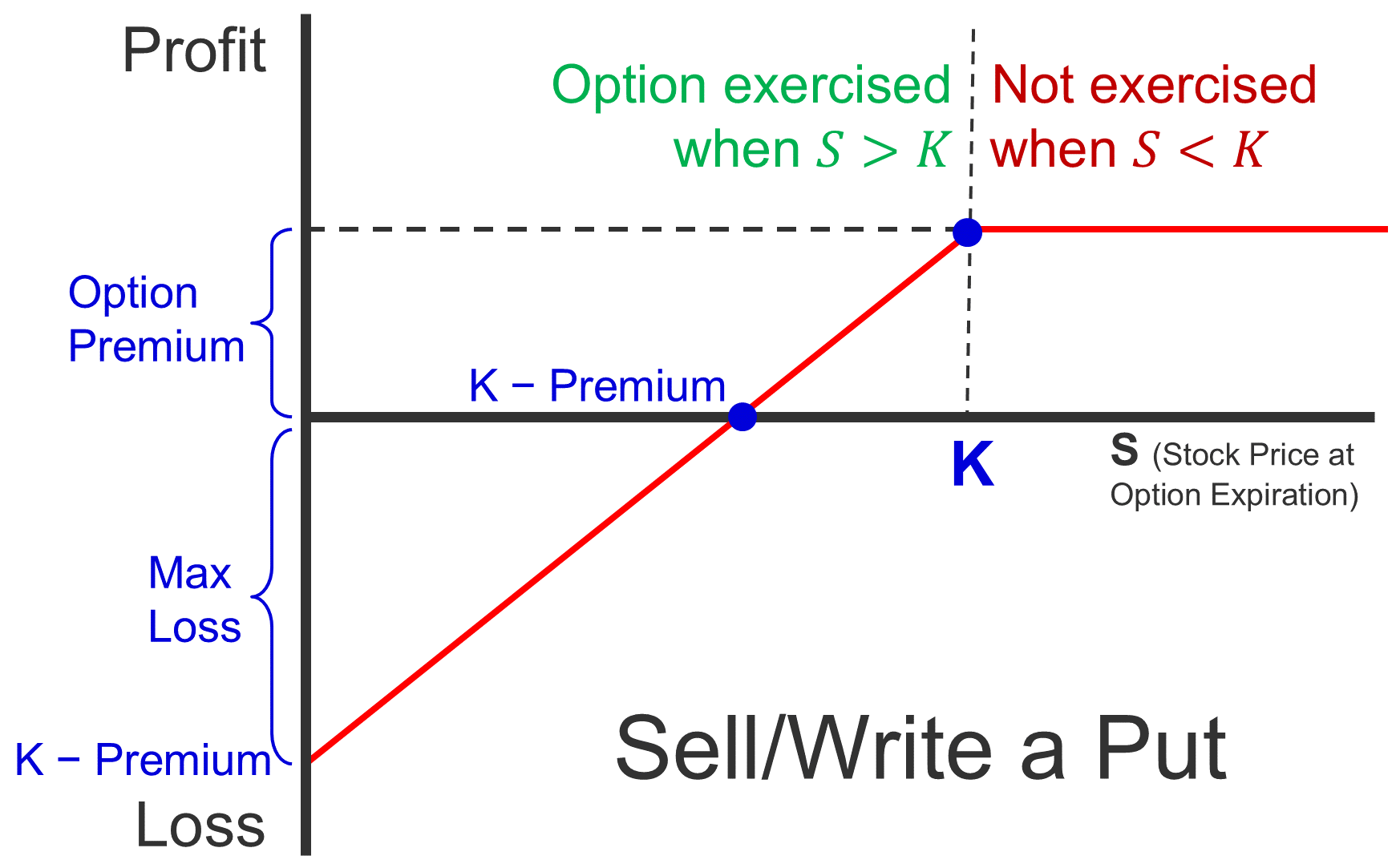

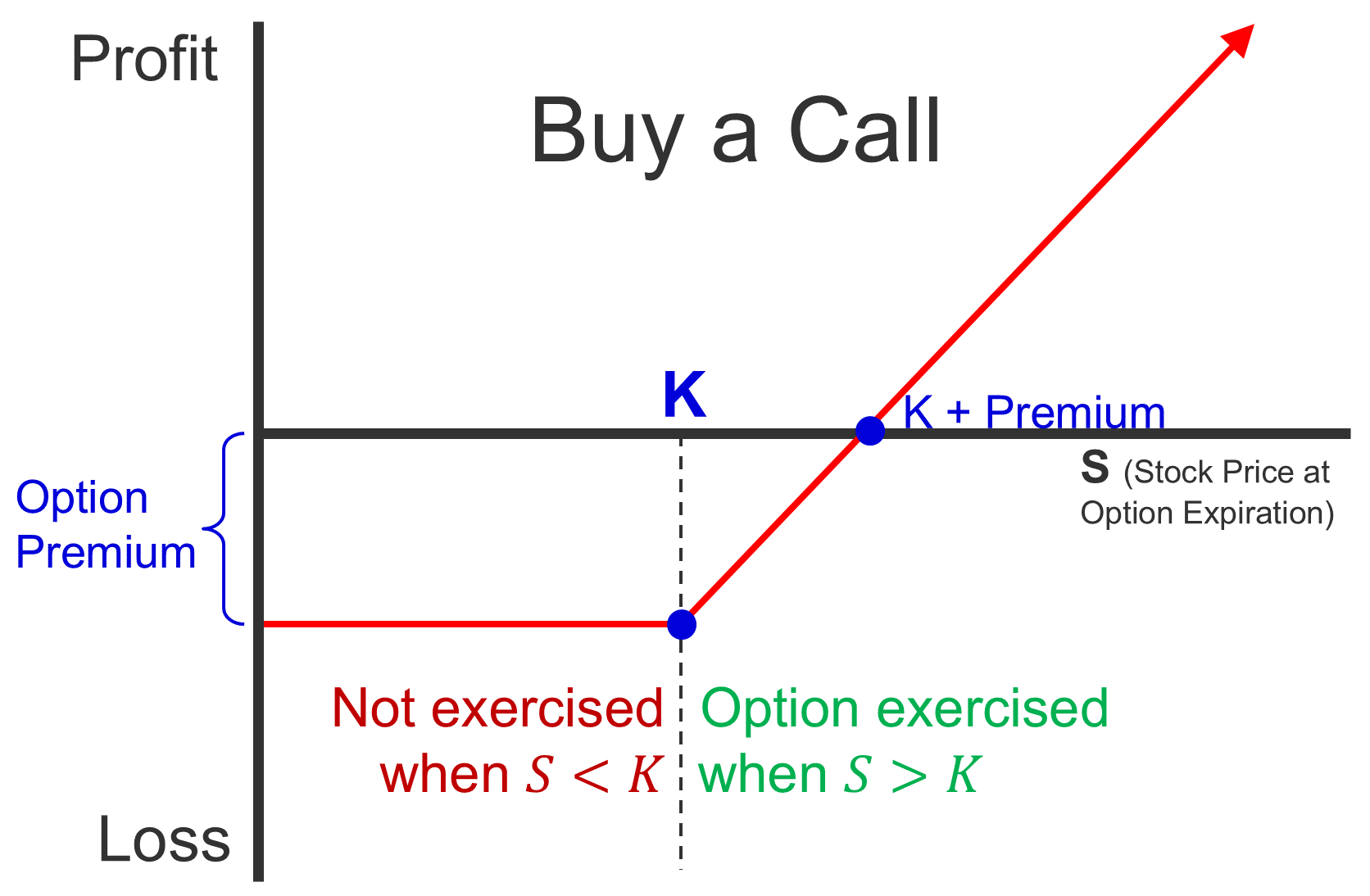

L11 Options

Call IV =Max(S−K,0)

Put IV =Max(K−S,0)

P/L from Buying an Option =IV−Pr

P/L from Buying a Call =Max(S−K,0)−Pr

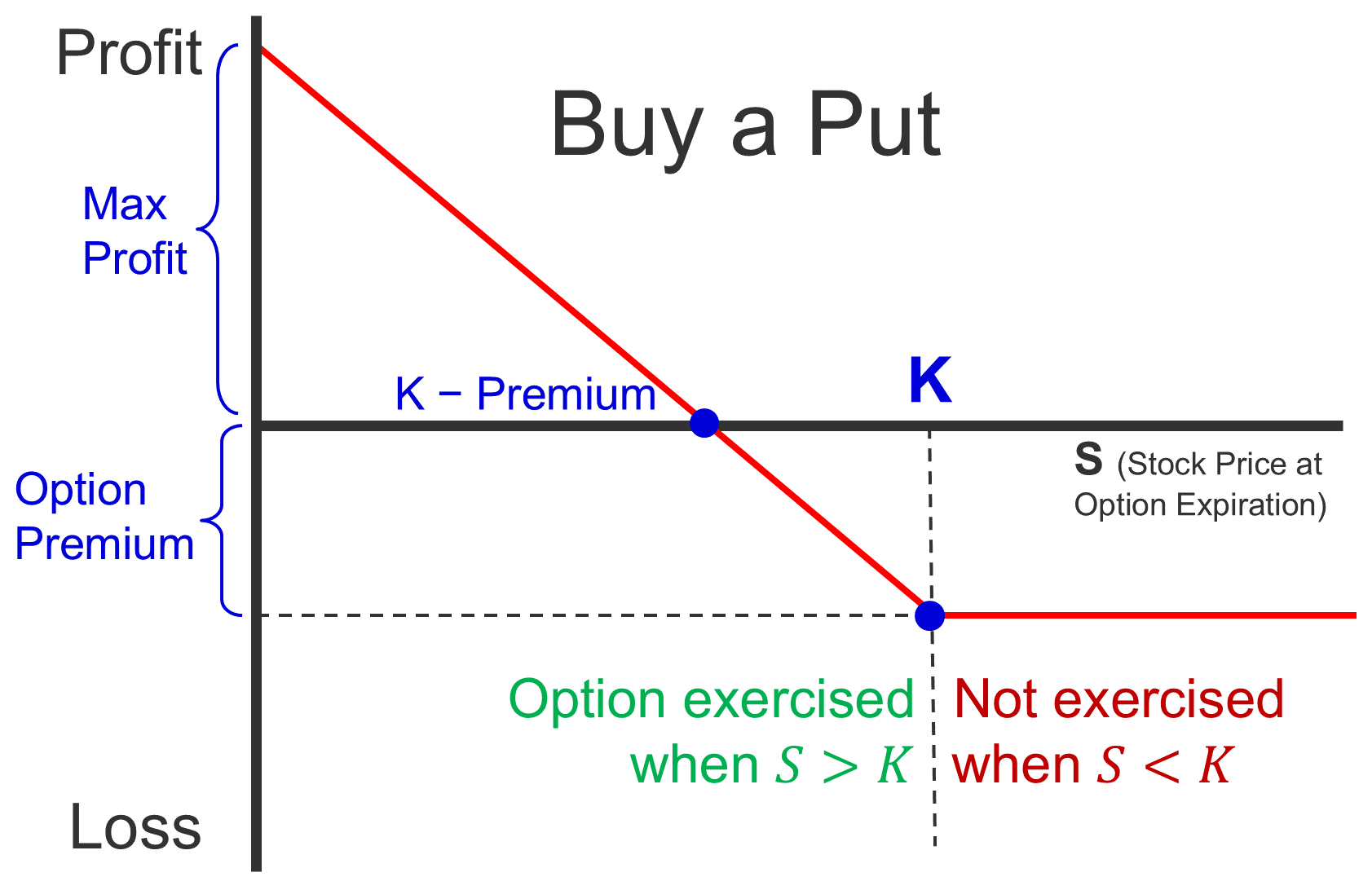

P/L from Buying a Put =Max(K−S,0)−Pr

P/L from Selling an Option =Pr−IV

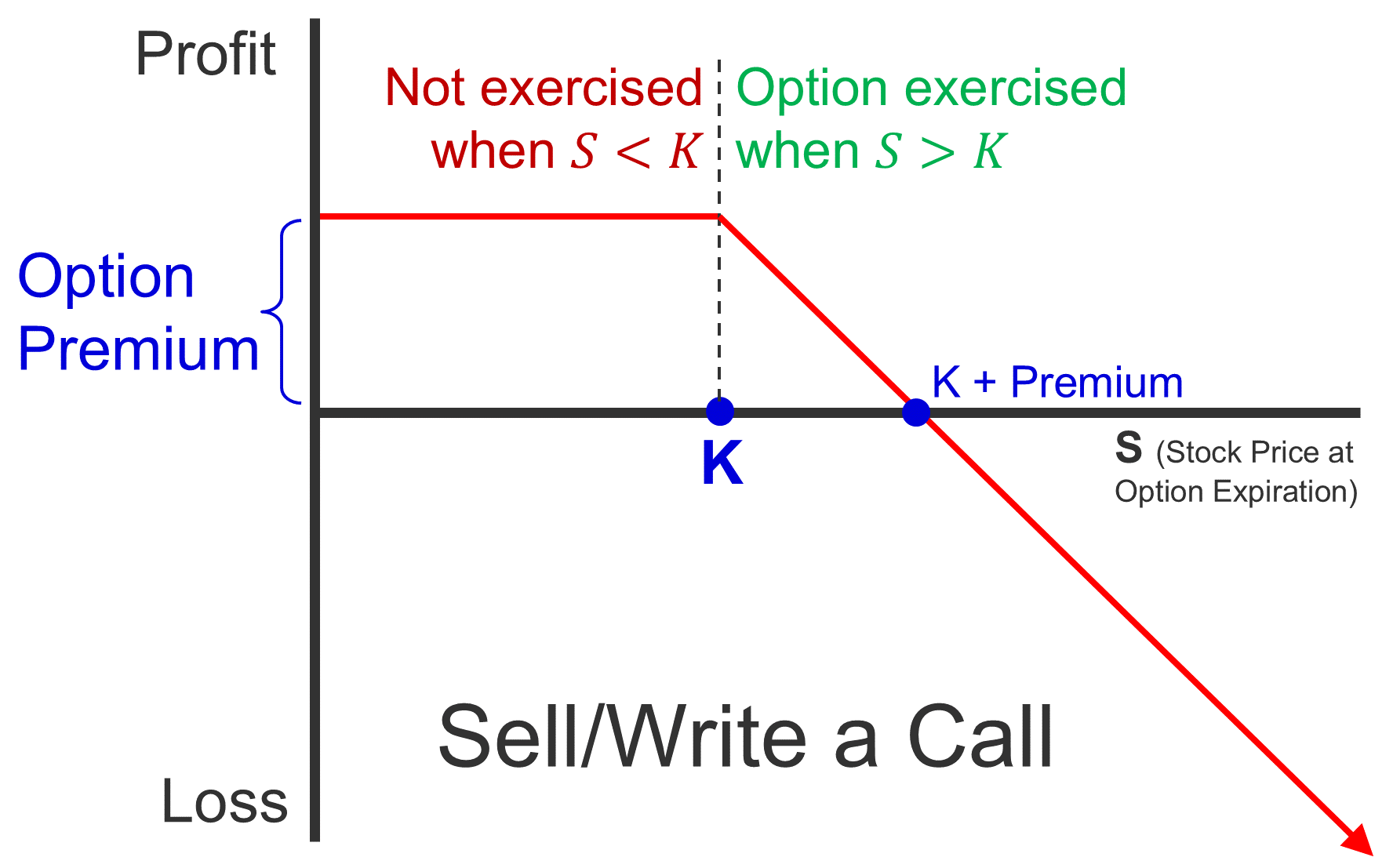

P/L from Selling a Call =Pr−Max(S−K,0)

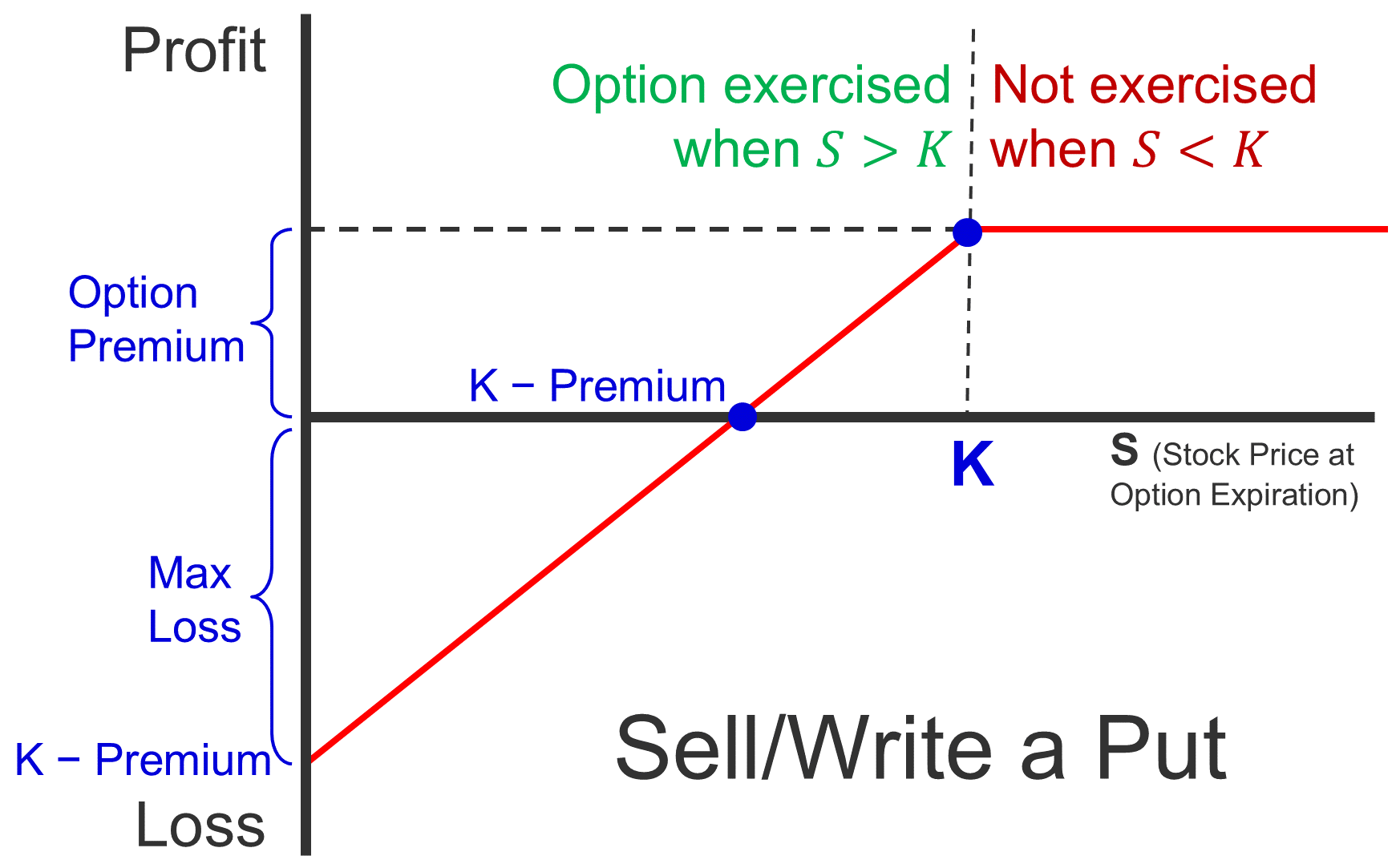

P/L from Selling a Put =Pr−Max(K−S,0)

Premium = Intrinsic Value + Time Value

Premium = EV of the gain from an option or strategy

Leverage = Share Price×100 / Premium×100

| Buy/Long | Write/Sell/Short |

|---|

| Call |  |  |

| Put |  |  |

References: 11 Apr 22.ppt and L11 Notes

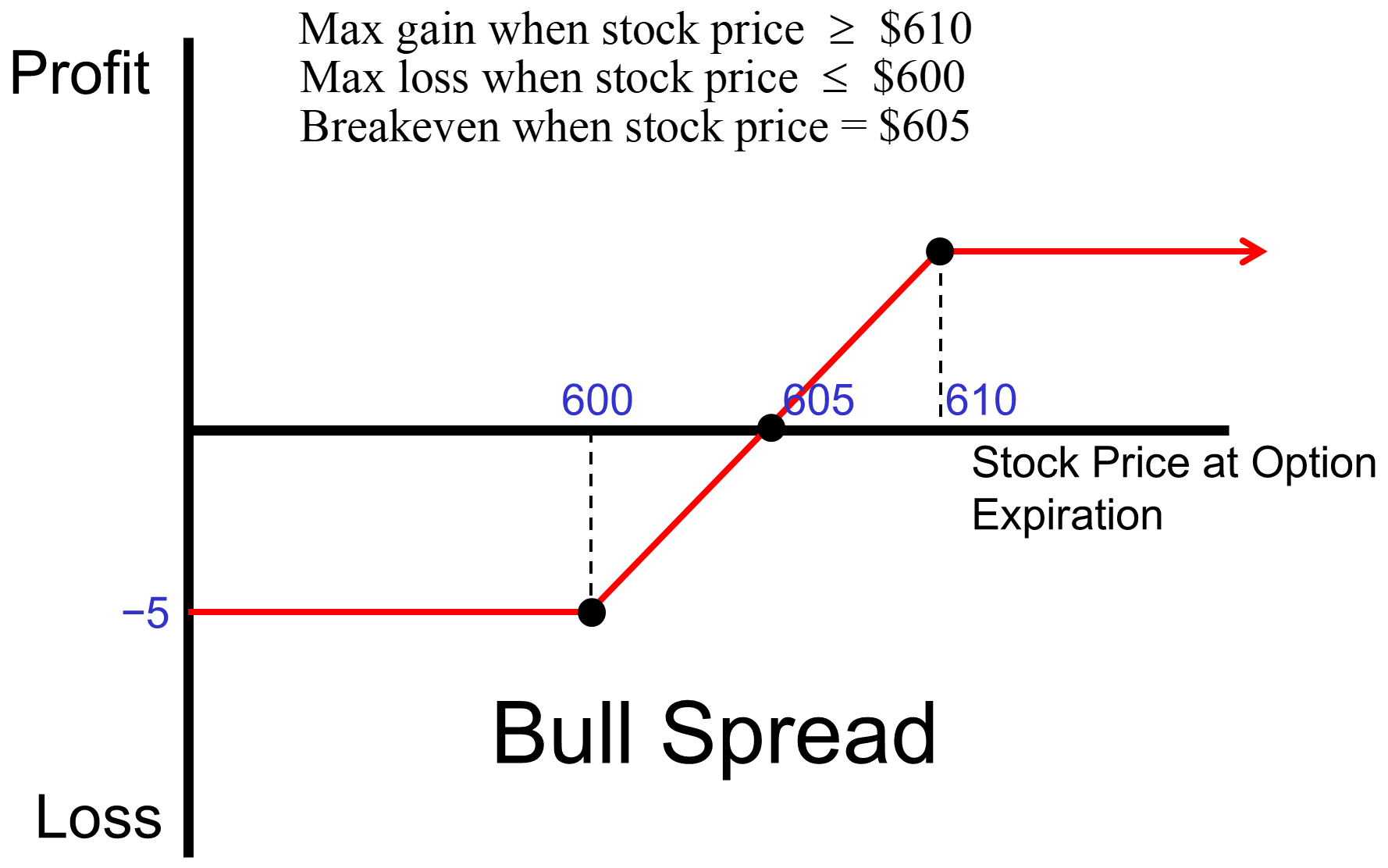

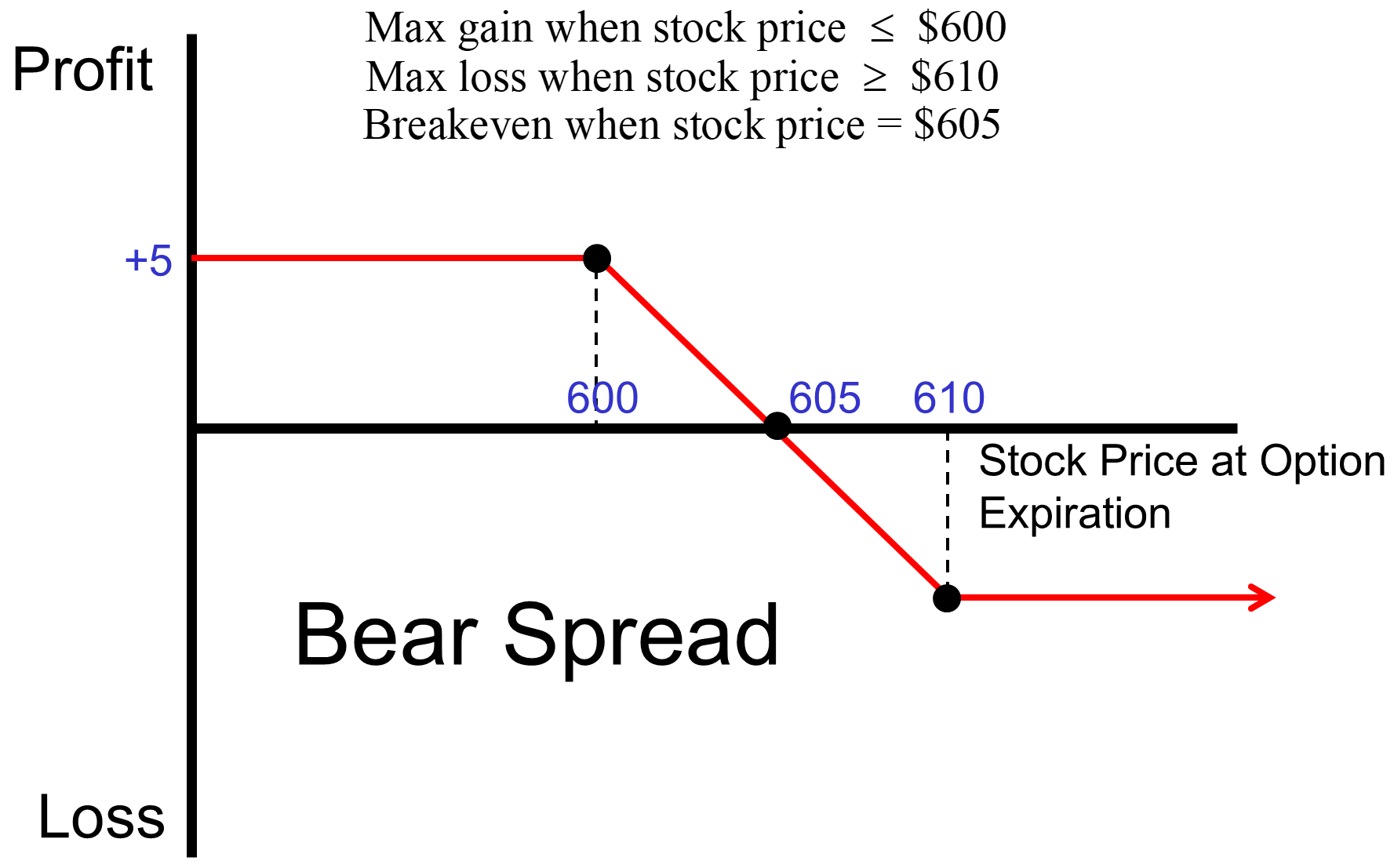

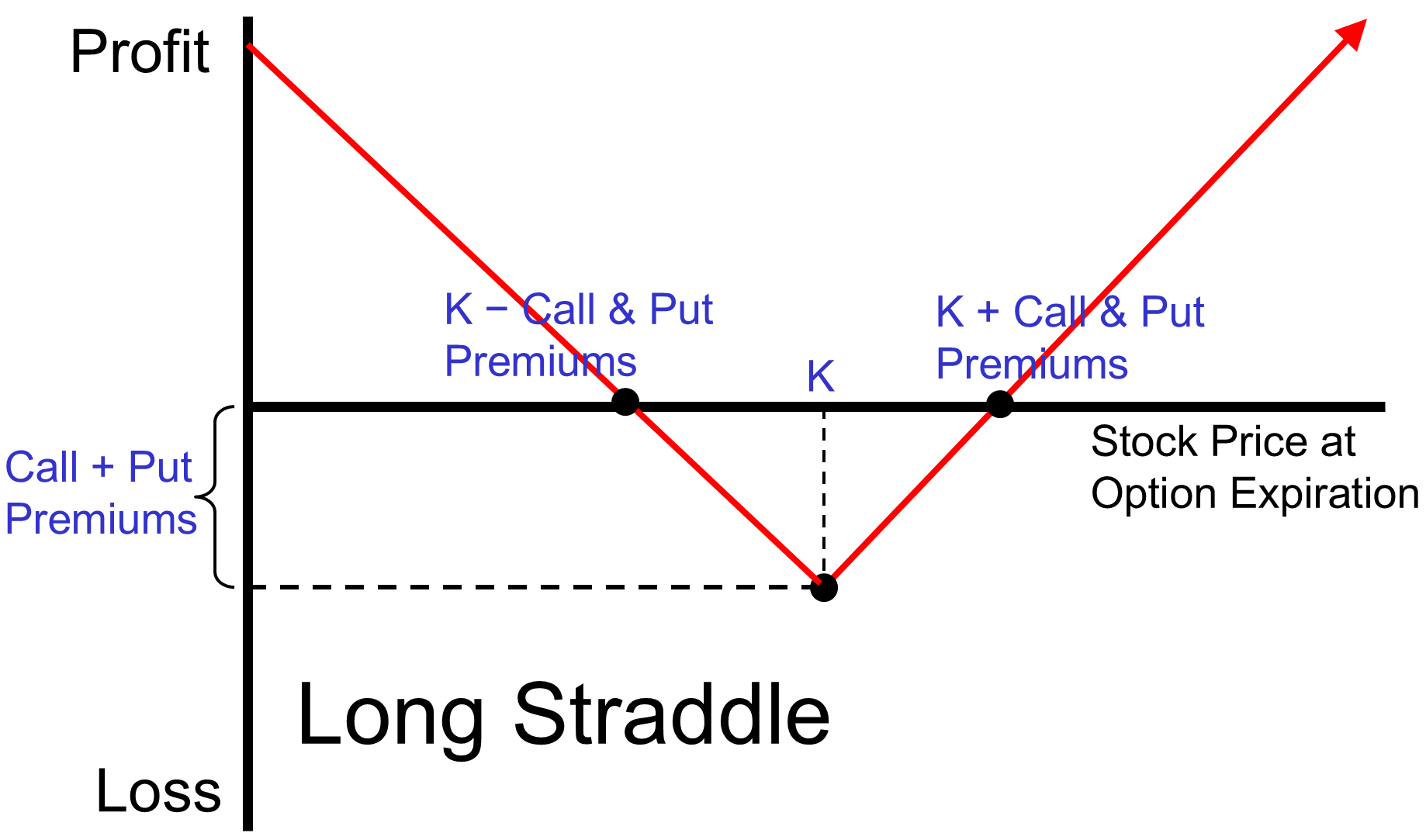

L12 Options Strategies

References: 12 Apr 29.ppt, and L12 Notes

Futures

ΔPrice=(NewPrice−OldPrice)

Buy the contract: P/L=∆Price×ContractSize

Sell the contract: P/L=−∆Price×ContractSize

ContractSize = 5000 bushels wheat (for example)

ContractSize = $50 per point of S&P 500 ($250 for ‘full-sized contract,’ $50 for e-mini, and $5 for micro e-mini)

Value of contract=ContractPrice×ContractSize

Leverage=Initial MarginValue of Contract

References: 13 May 6.ppt, L13 Notes

© 2025 Rob Munger