👨🏫 Notes

This lecture will likely be very hard to apply if you haven’t mastered the previous lecture. Therefore, Bruce starts this lecture by reviewing the material from the previous lecture. You should definitely do the same!

In particular, before you attempt this problem set, you will need to know how to calculate gains and profits and losses for individual options. The sections where I covered individual options are now posted. I strongly urge you to watch those and to work on the flashcards I made before attempting this lecture. The flashcards and practice problems are specifically designed to help you with the tasks in this lecture and this problem set.

Premium of an Option or Strategy

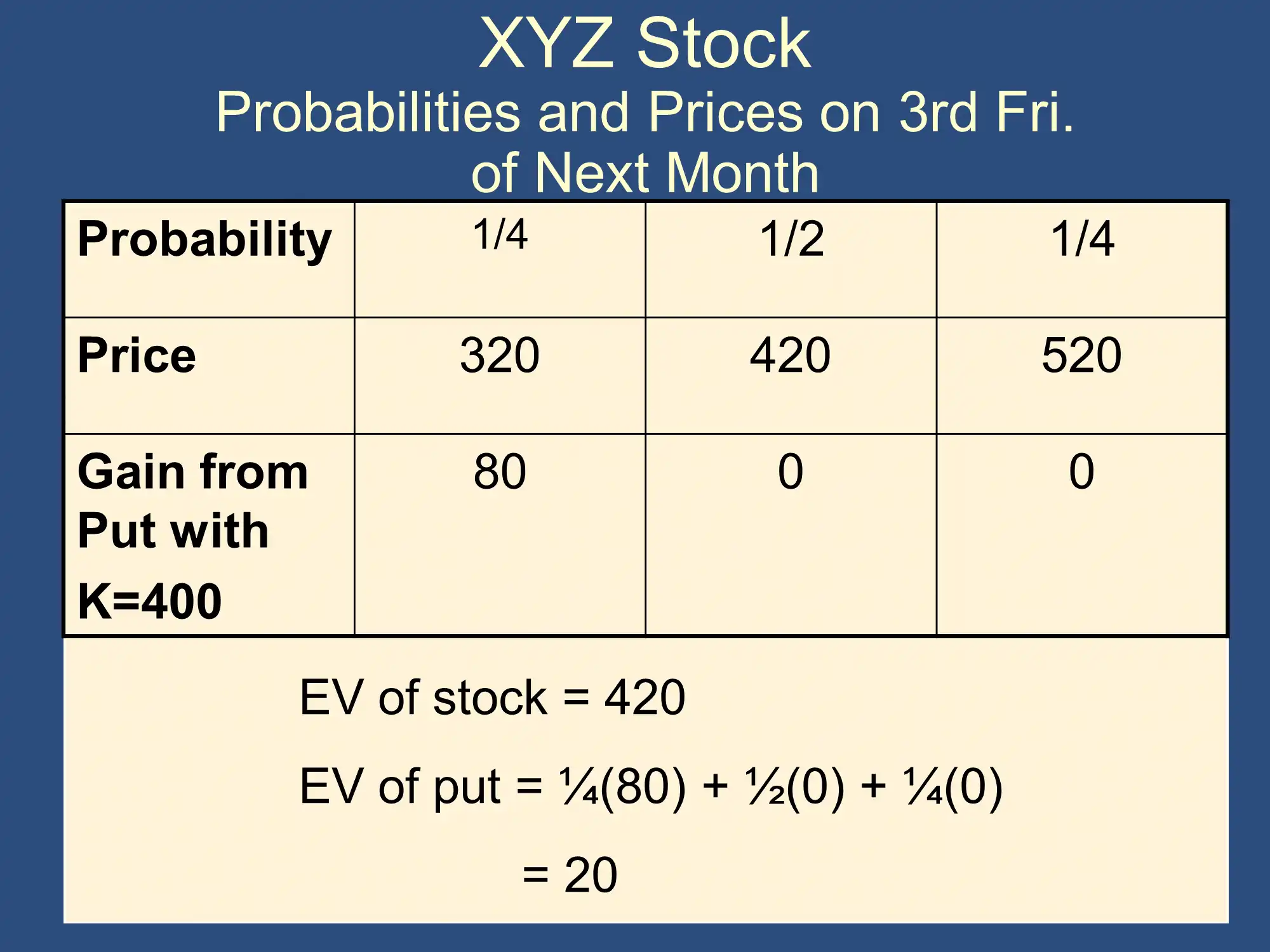

Calculating the premium of a call, put or strategy is a two-step process:

- Calculate the gain for each possible stock price

- The gain is the amount you could earn by exercising the option, ignoring how much you spent on the premium. In all of the P/L practice problems I’ve given you, I always calculate the gain first. You can calculate gain using the IV formula.

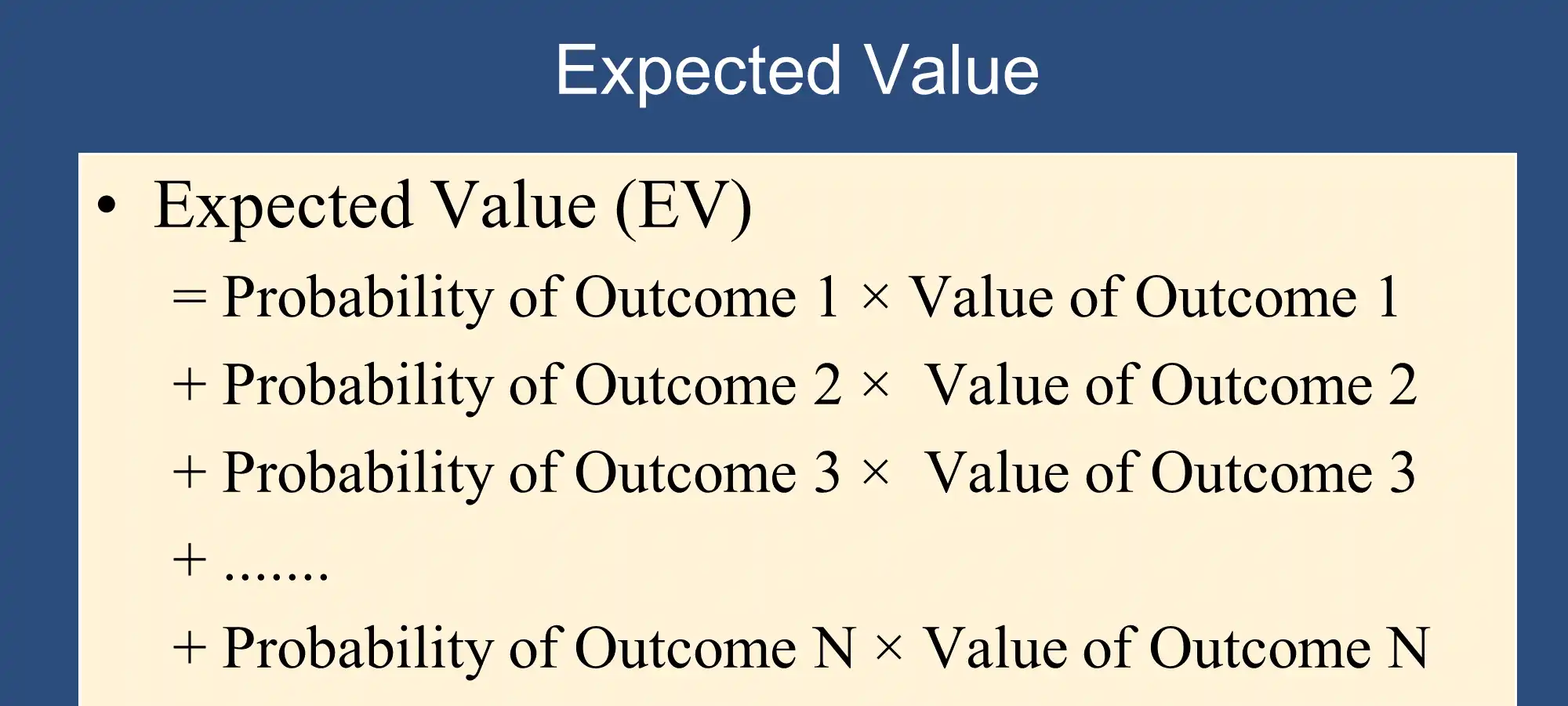

- The premium is the expected value of the gain using the formula from the EMH lecture:

For details and examples, see 🔎 Calculating the Premium of a Call, Put, or Strategy

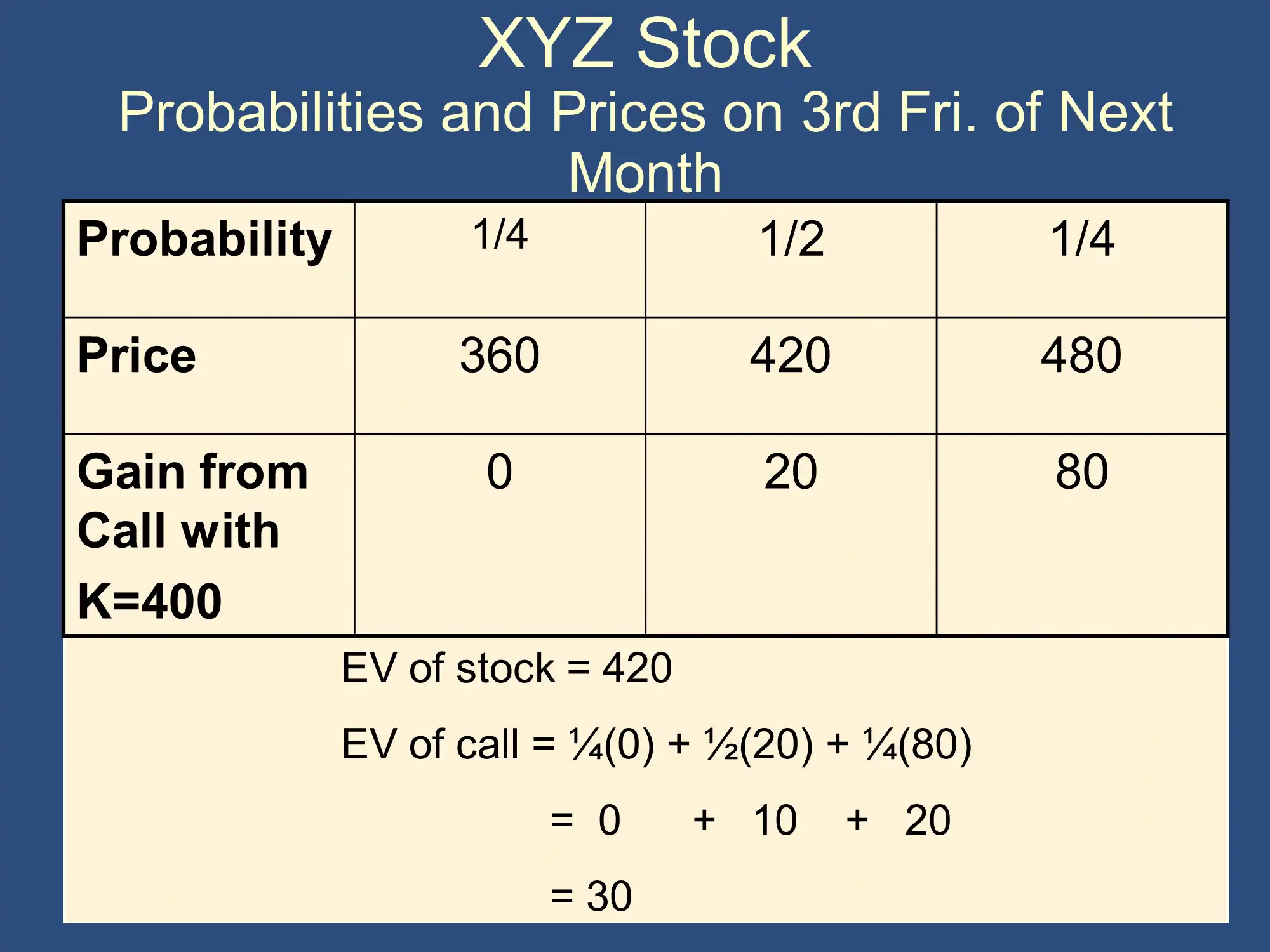

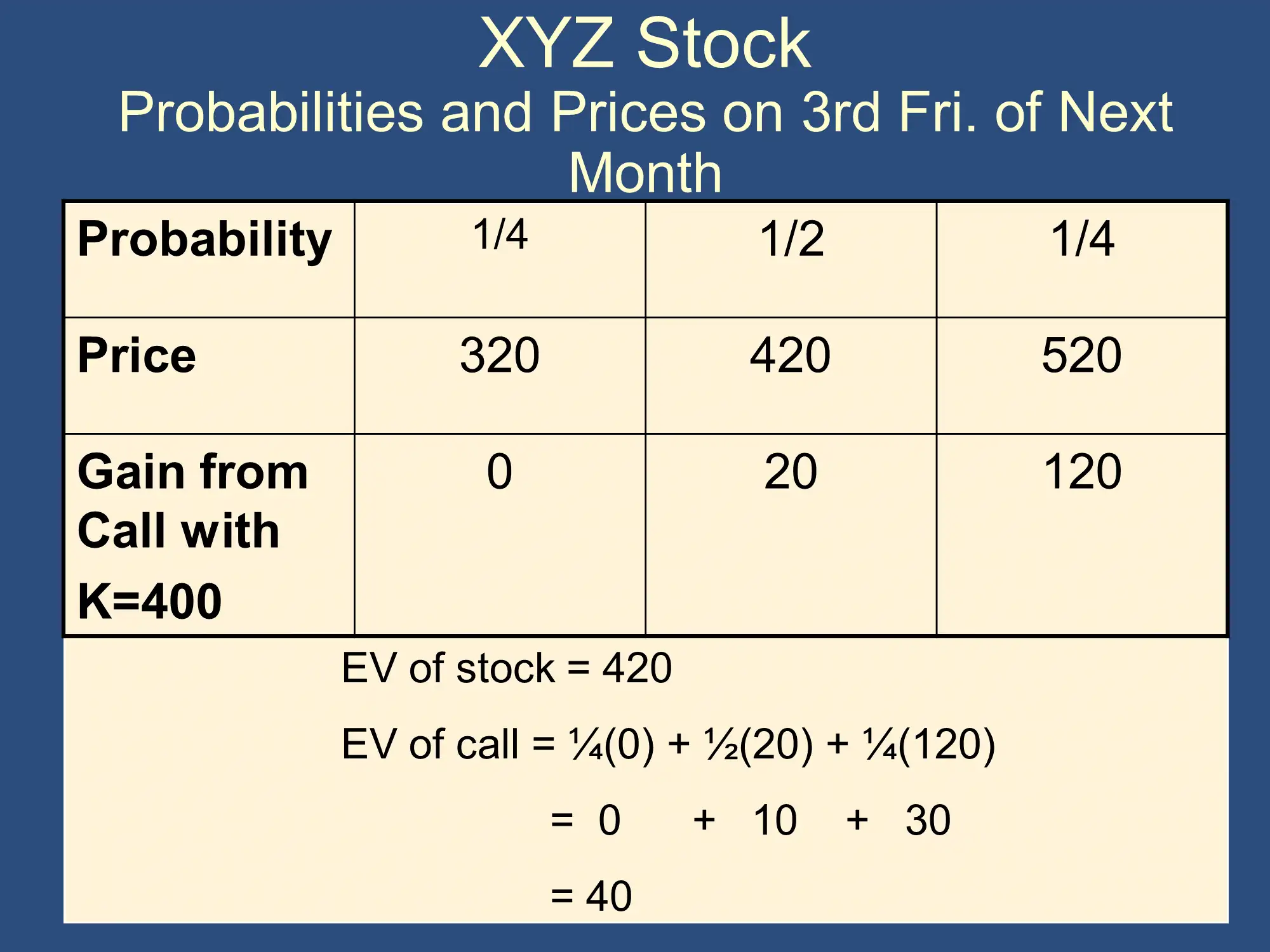

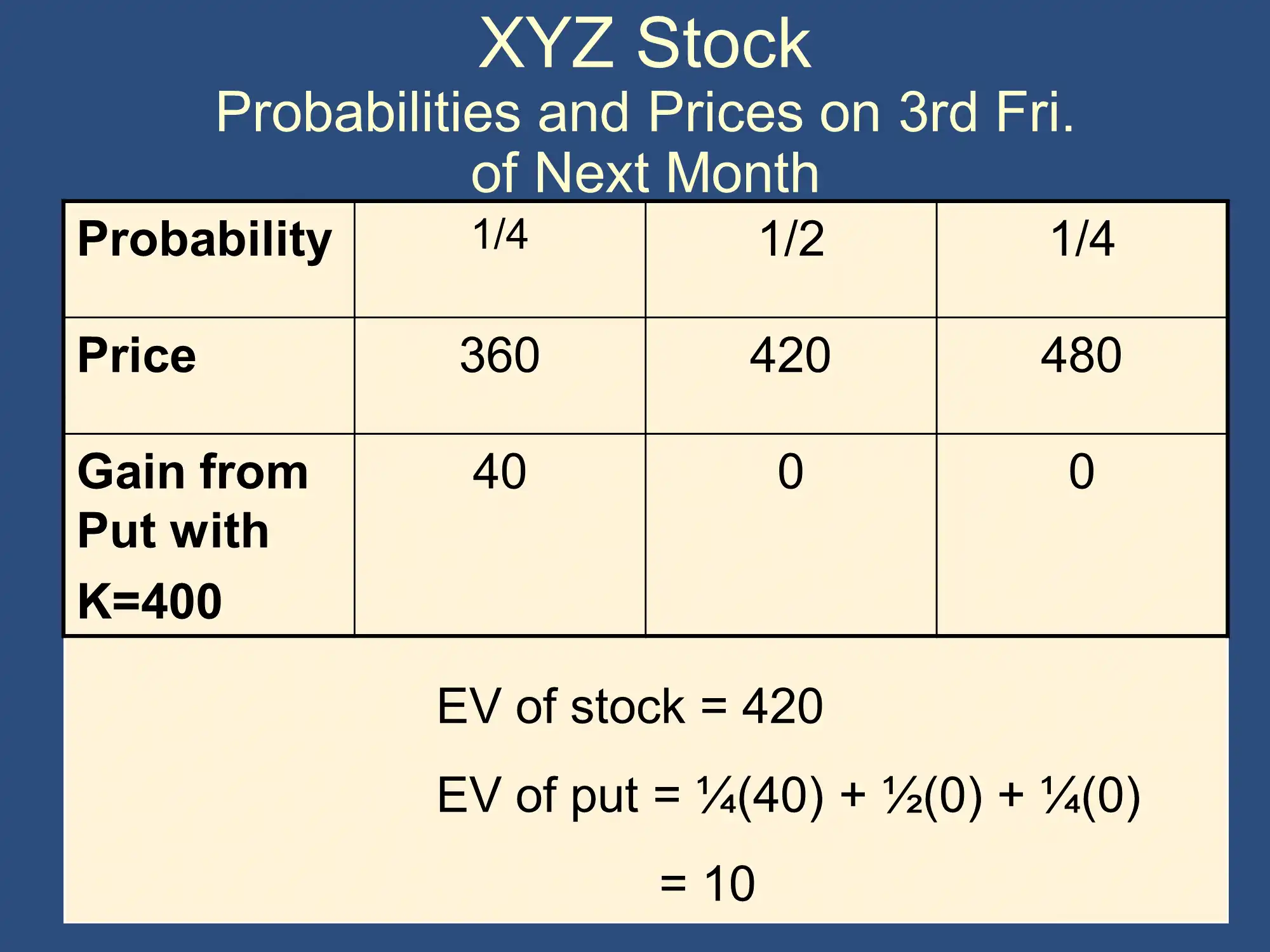

In the following slides, Bruce demonstrates that volatility is a main determinant of the premium of an option:

High volatility ⇨ high premium

Low volatility ⇨ low premium

Low Volatility Call (lower premium)  | High Volatility Call (higher premium)  |

Low Volatility Put (low premium)  | High Volatility Put (high premium)  |

Leverage and options

Photo credit: @Leon

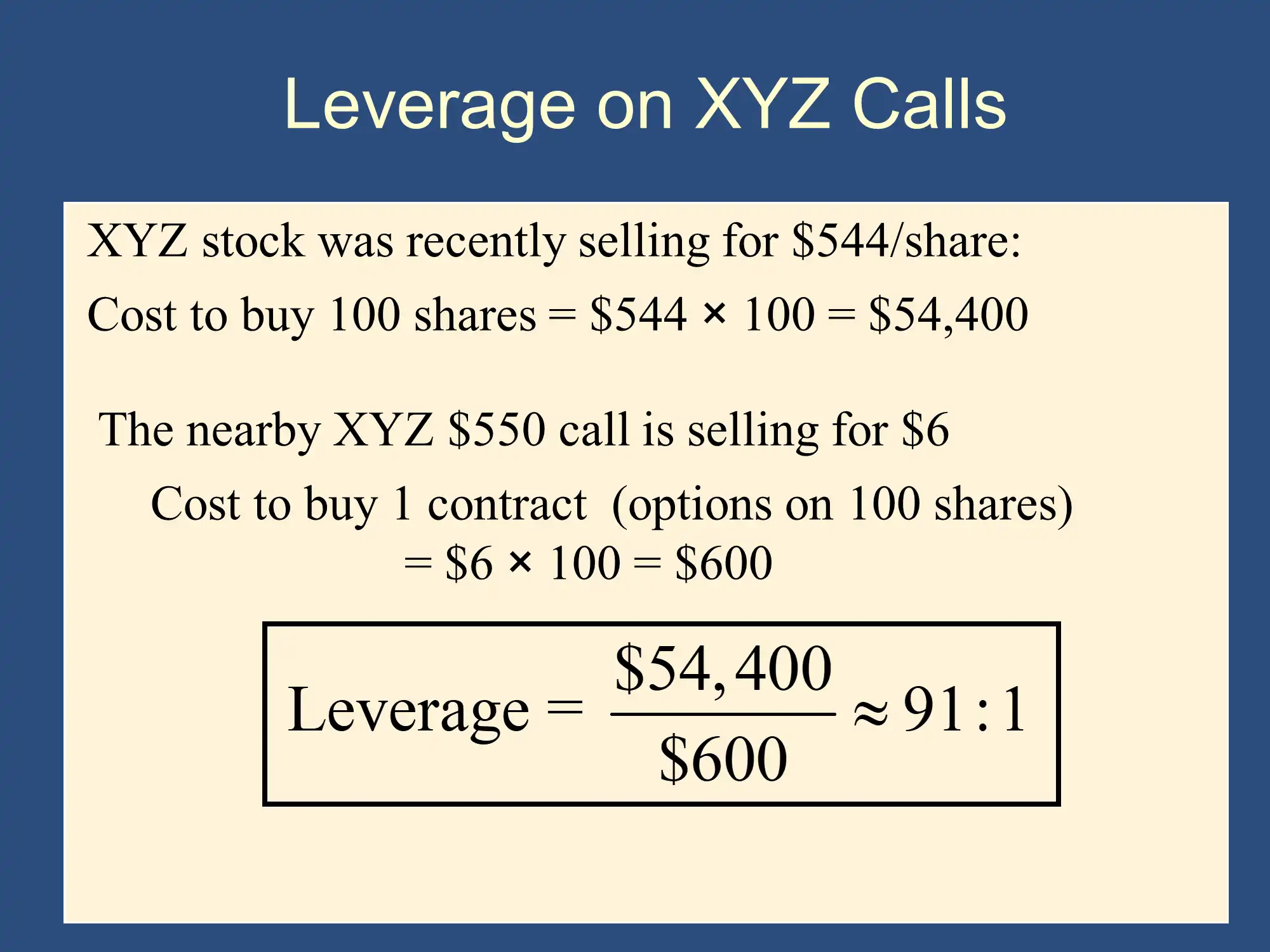

With an option, you can pay a small premium and gain exposure to shares of stock worth much more than the premium. This means that options have built-in leverage.

Here is the formula:

🙋 What is the intuition behind the formula?

✔ Intuitively leverage is the ratio between the size of the bet you make and the money that you actually must hand over. With large leverage, you can make a huge bet without handing much money over.

The “Size of the Bet You Make” is sometimes called the “notional value” of the total amount of stock you are betting on. In this case, you would purchase 100 shares at $544, so the notional value would be

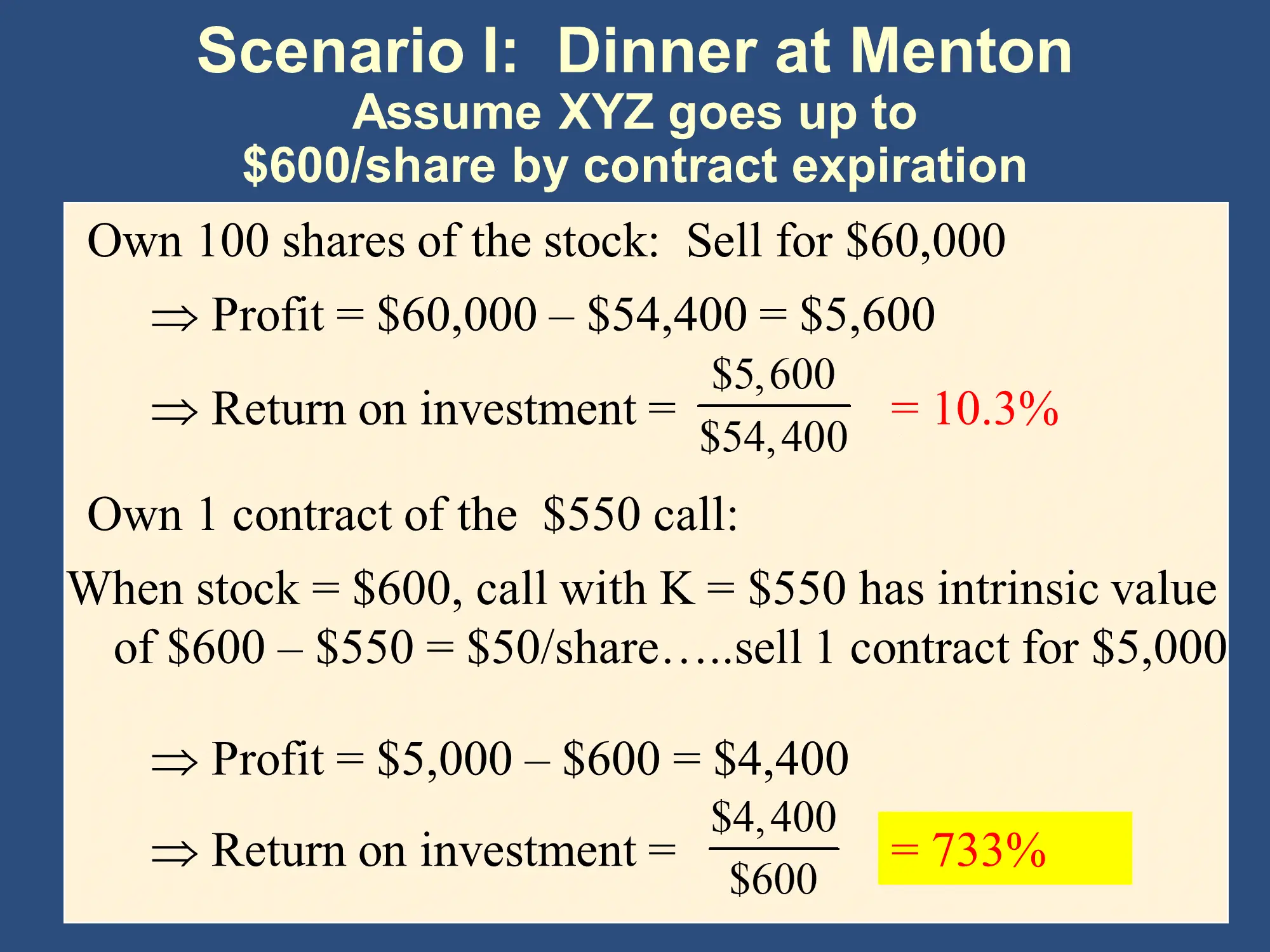

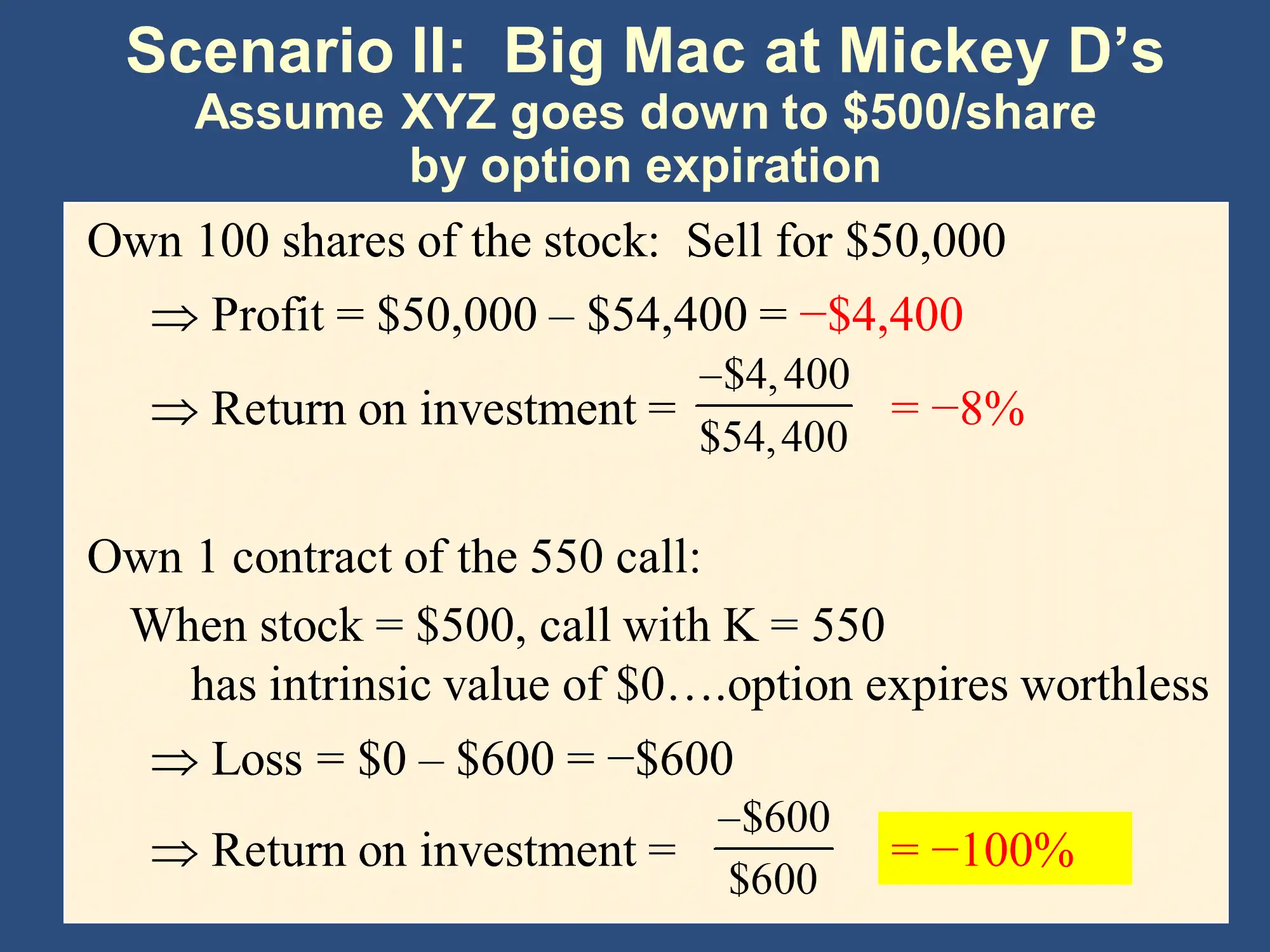

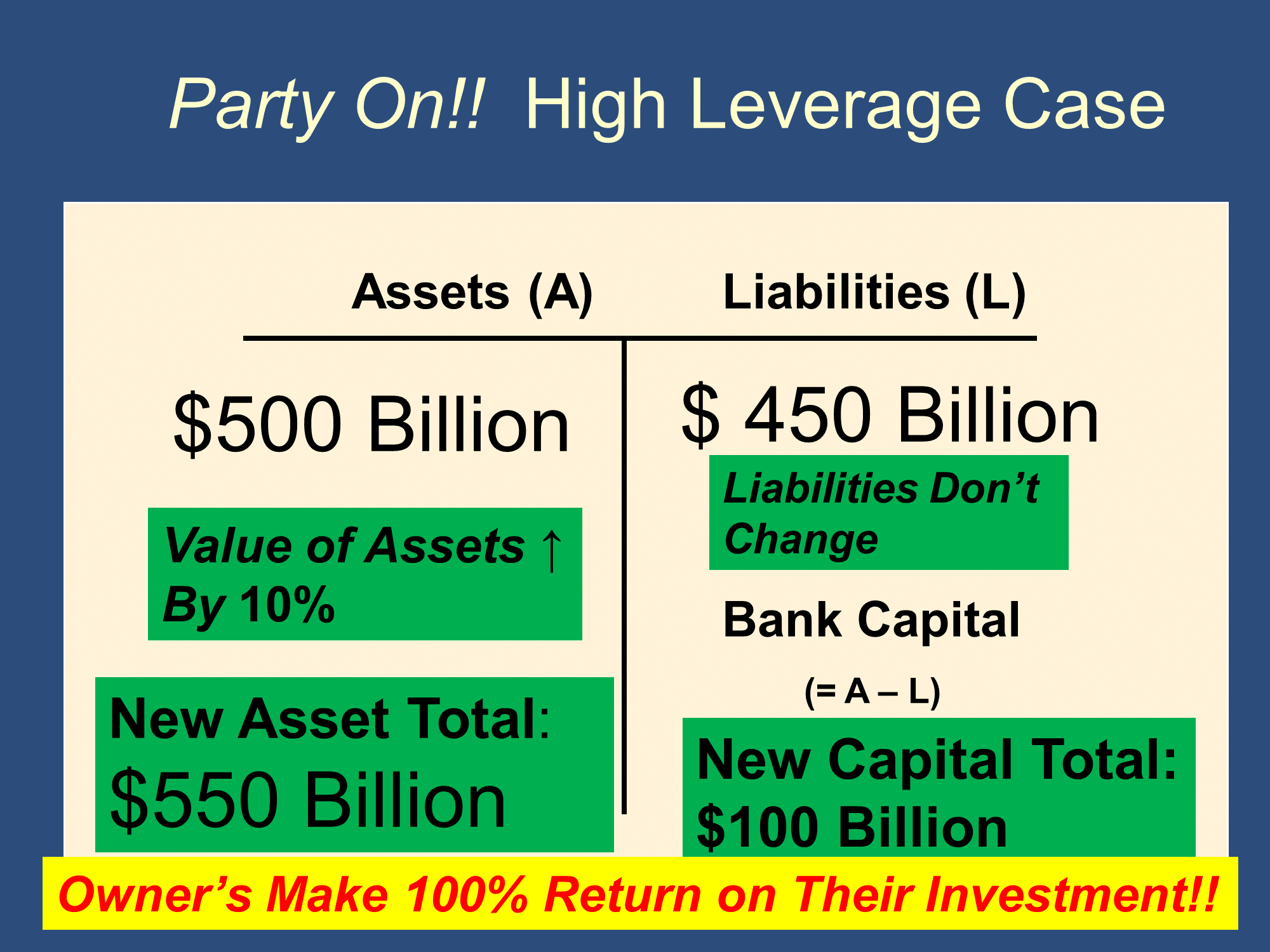

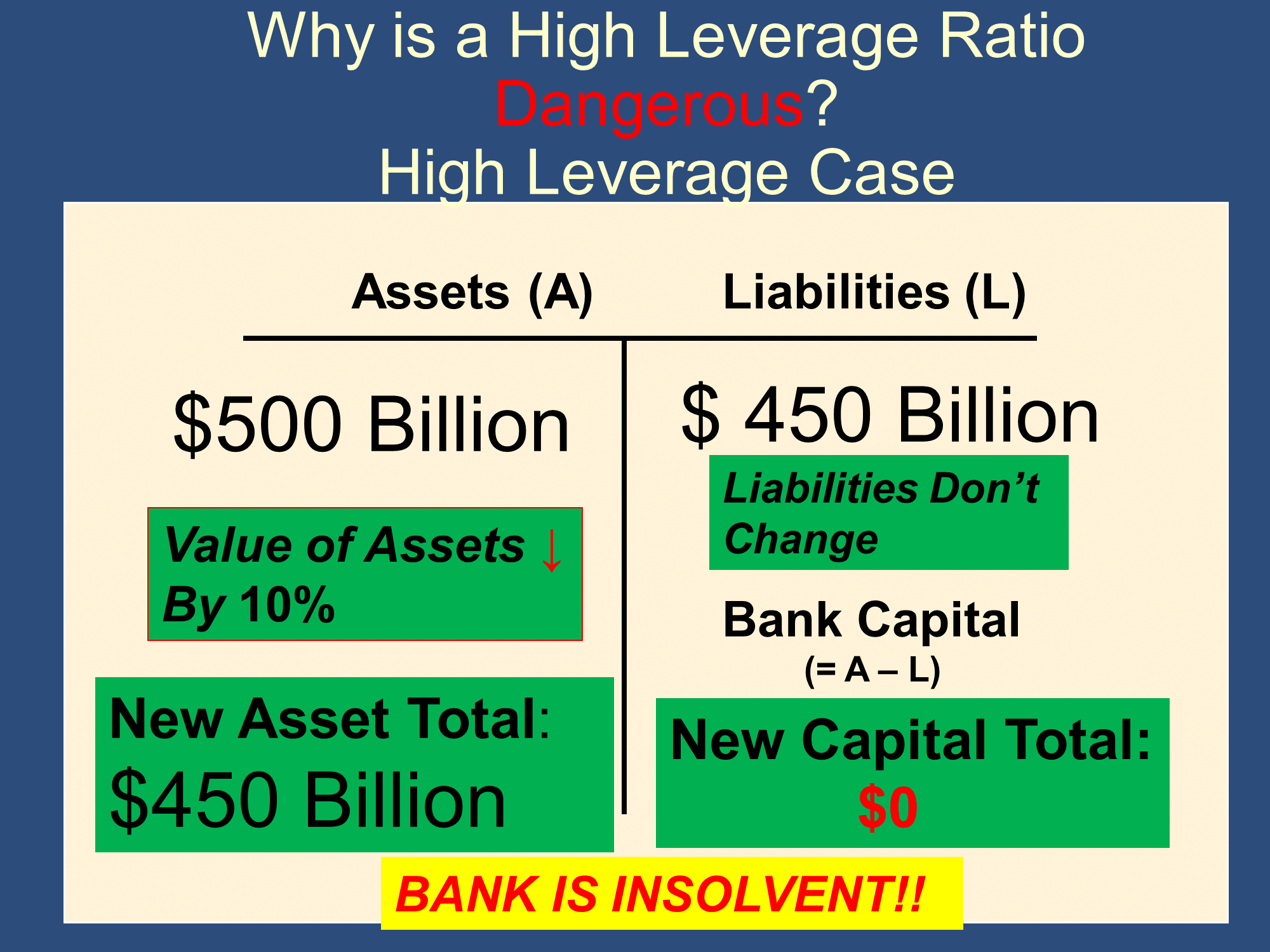

The leverage in options can amplify both gains and losses, as illustrated by the following slides:

Leverage Amplifies Gains  ROI with stock: 10.3% (no leverage) | Leverage Amplifies Losses  ROI with stock: -8% (no leverage) |

We saw the same thing with banks’ leverage ratio, where banks use borrowed money to buy assets. This borrowed money amplifies their gains and losses:

|  |

With options, when you pay a $600 of premium and gain access to $54,400 of stocks, it is as if you are buying $54,400 of stock with borrowed money. That’s why we call this leverage.

Option Strategies

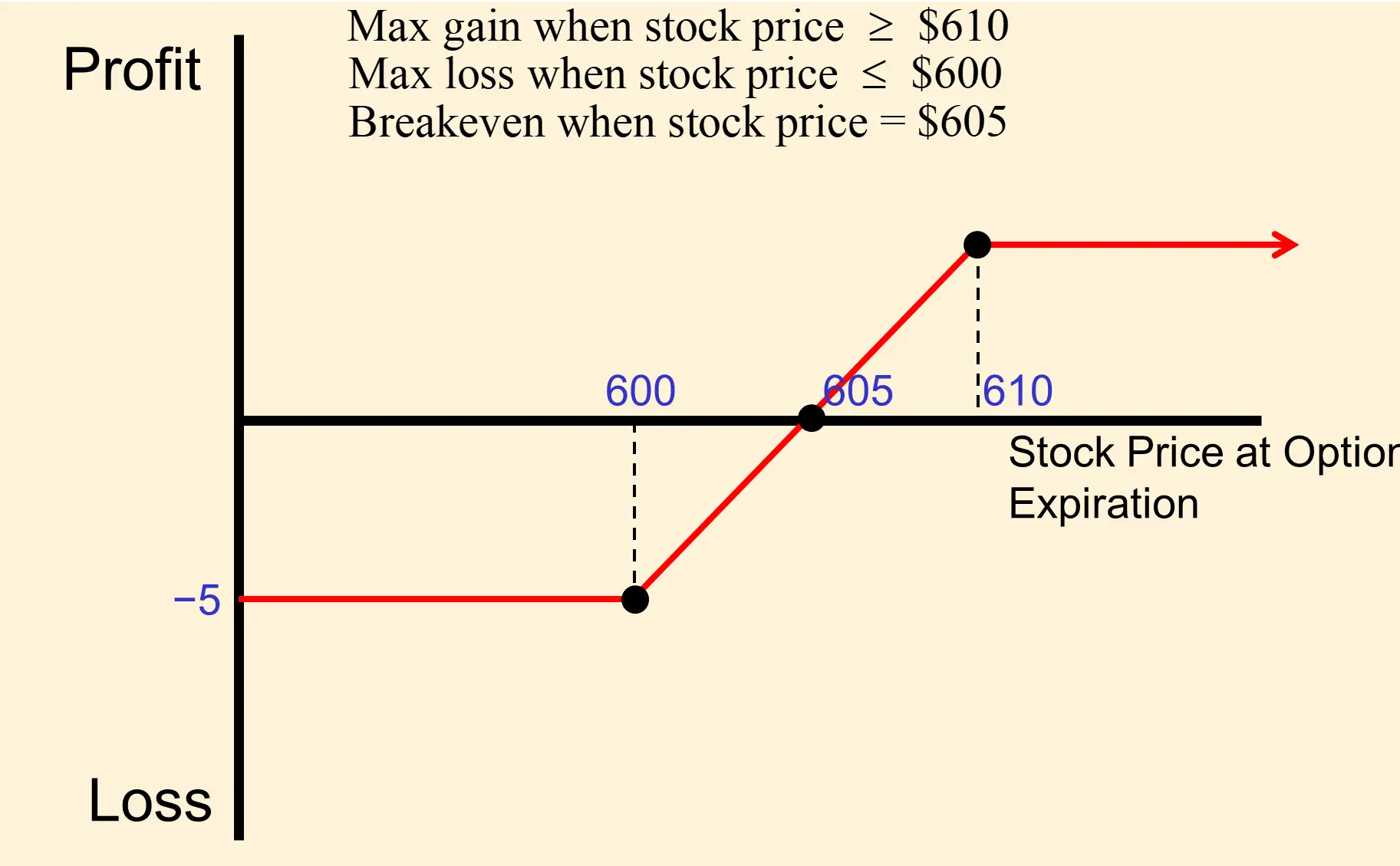

Bull Spread:

A cheap, low risk bet that S will be relatively high.

🖱️ To purchase one, you buy and sell call options on the same stock but with different strike prices. For the following bull spread, you:

- Buy the $600 call

- Sell the $610 call

💵 With it:

- you make $5 if S is above $610, but

- you lose $5 if S is below $600.

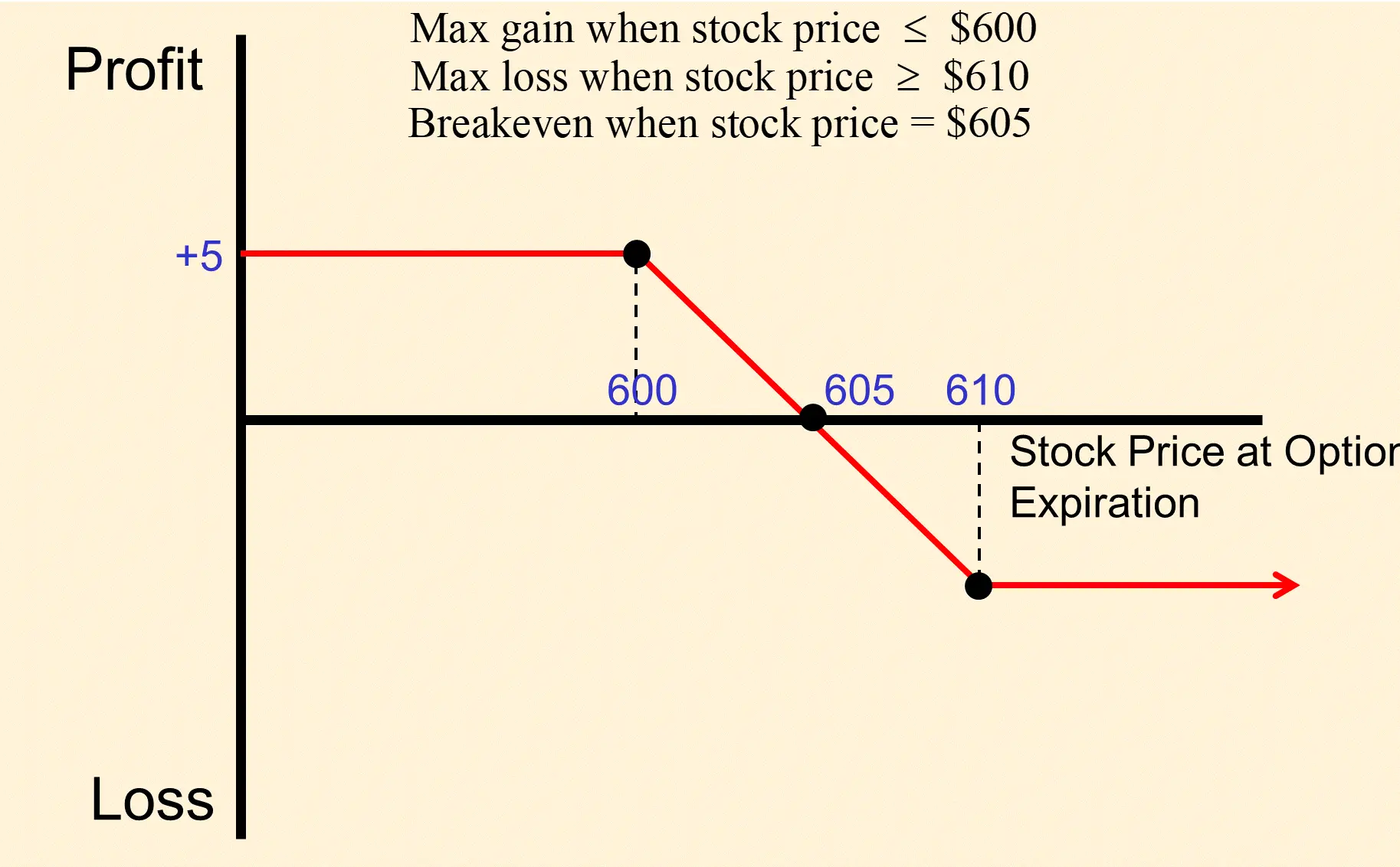

Bear Spread:

A cheap, low risk bet that S will be relatively low. 🖱️ To purchase one, you buy and sell call options on the same stock but with different strike prices. For the following bull spread, you:

- Sell the $600 Call

- Buy the $610 Call

💵 With it:

- you make $5 if S is below $600, but

- you lose $5 if S is above $610.

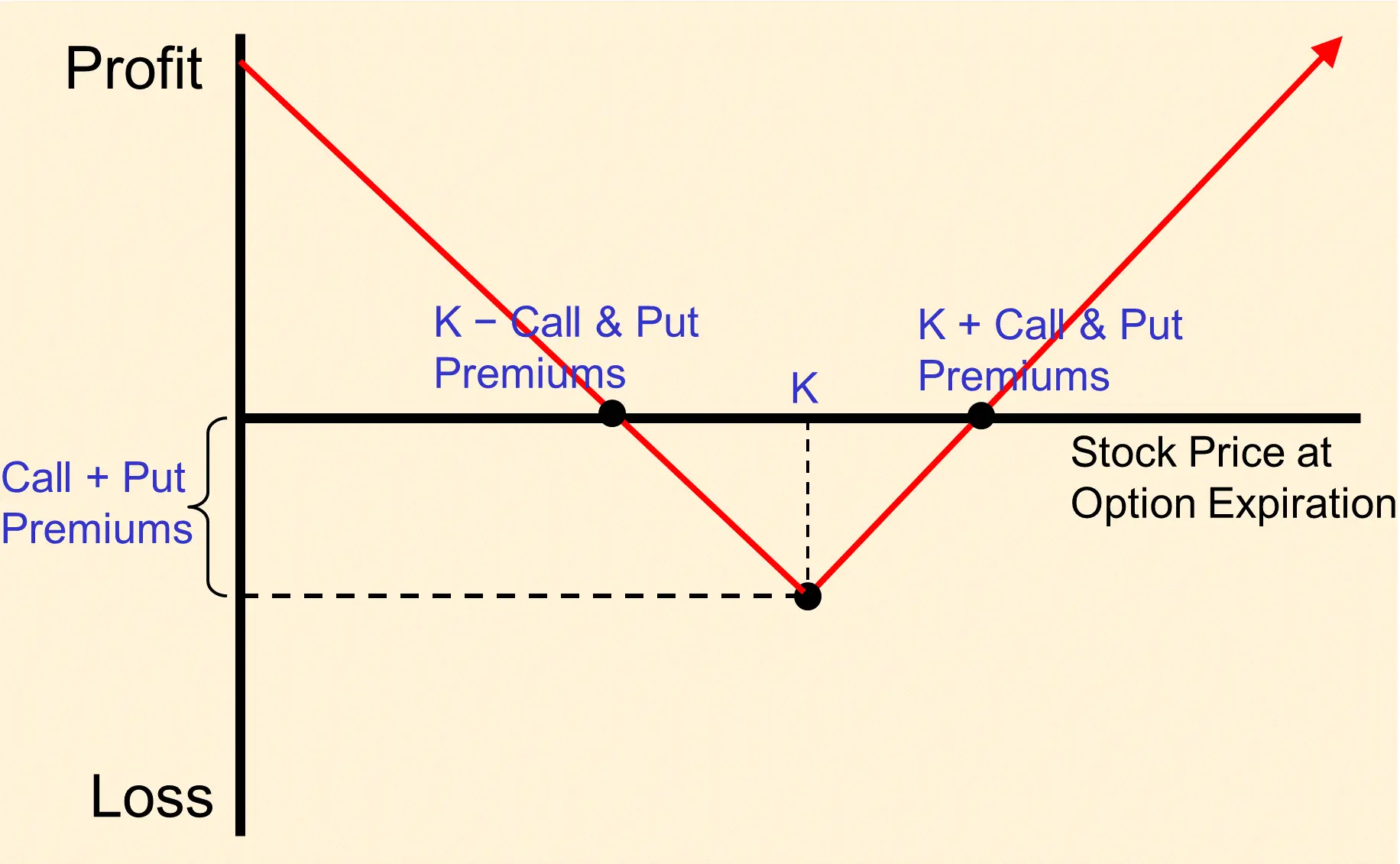

Long Straddle:

Good if: You expect price to go far from K, but don’t know whether up or down.

- You might buy a long straddle if you expect high volatility going forward. For example, you don’t know whether a stock will go up or down after a big news event, but you expect a lot of volatility.

🖱️ To purchase one you buy a call and put with the same strike price. For the following long straddle, you:

- Buy the $K call

- Buy the $K put

💵 With a long straddle:

- you are better off the farther S is from K

- you only make money if S is far enough away from K to reimburse you for the call & put premiums you paid.

You always choose a strategy based on the P/L diagram. You purchase the strategy that pays off in the outcomes that you feel are most likely. You have to be able to guess the probabilities better than the rest of the market to make money, though.

You always choose a strategy based on the P/L diagram. You purchase the strategy that pays off in the outcomes that you feel are most likely. You have to be able to guess the probabilities better than the rest of the market to make money, though.

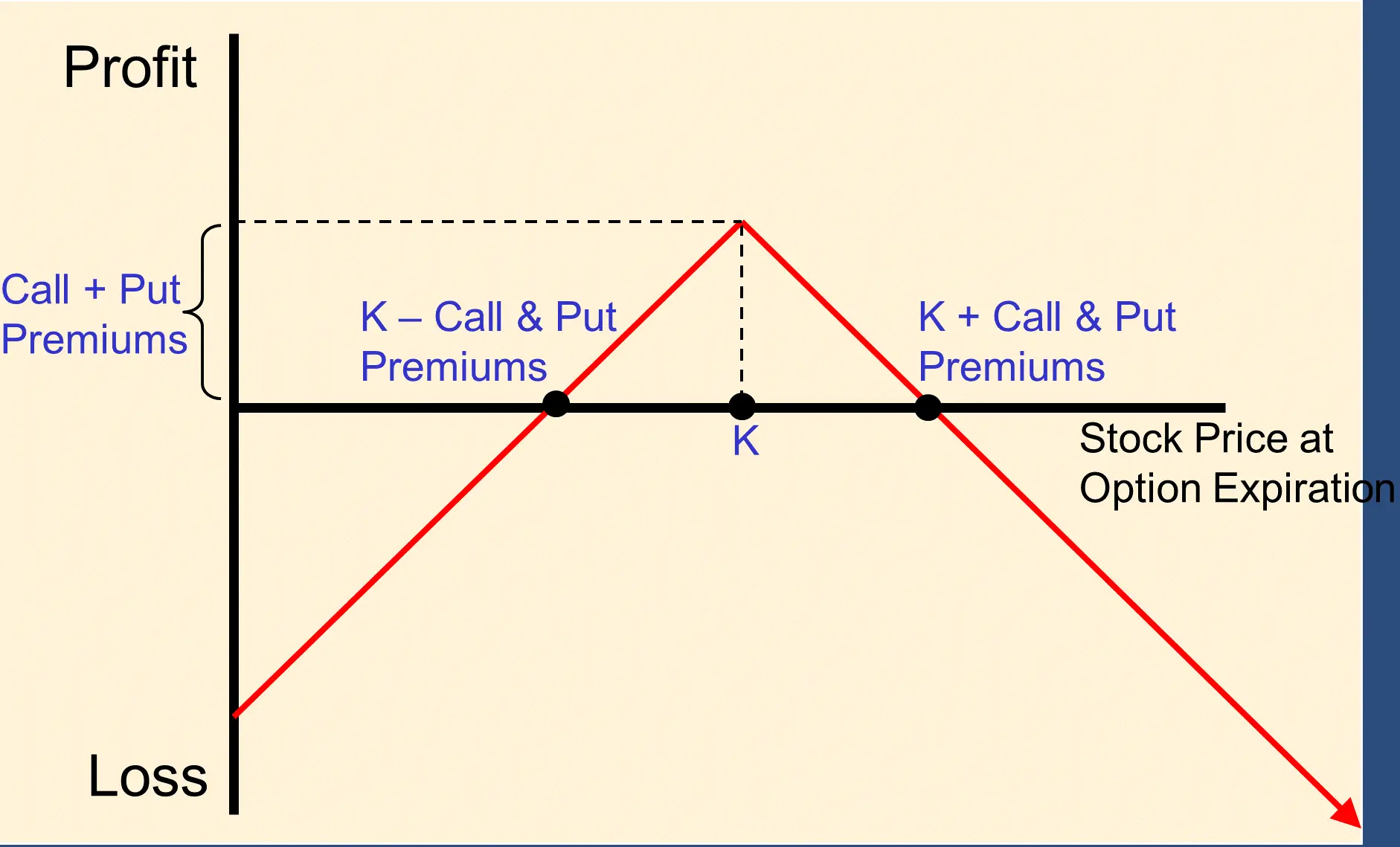

Short Straddle:

Good if: You don’t expect price to go far from K. (You expect low volatility)

- You might sell a long straddle if you think you can predict the future stock price with precision and you expect low volatility going forward. Professionals sell them by attempting to estimate volatility with computer models. They are bets on low volatility.

🖱️To sell one you sell a call and put with the same strike price. For the following short straddle, you:

- Sell the $K call

- Sell the $K put

💵 With a straddle:

- you are worse off the farther S is from K

- you only make money if S doesn’t get far enough away from K to wipe out the call & put premiums you receive.

📖 For reference: how to construct spreads

- A bull spread is made of a long call and a short call with different strike prices. The strike prices match the two kinks in the diagram. The lower strike price is for the long call.

- A bear spread is made of a long call and a short call with different strike prices. The strike prices match the two kinks in the diagram. The lower strike price is for the short call.

Additional Notes

- Spreads tend to be cheap because though you buy one call, you sell the other. Therefore, you pay one premium, but receive the other.

- Spreads are bets either that the stock price will be relatively high or relatively low. In this, we say that they are “directional” strategies. In contrast, straddles are bets on volatility.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.