✏️ Options Practice

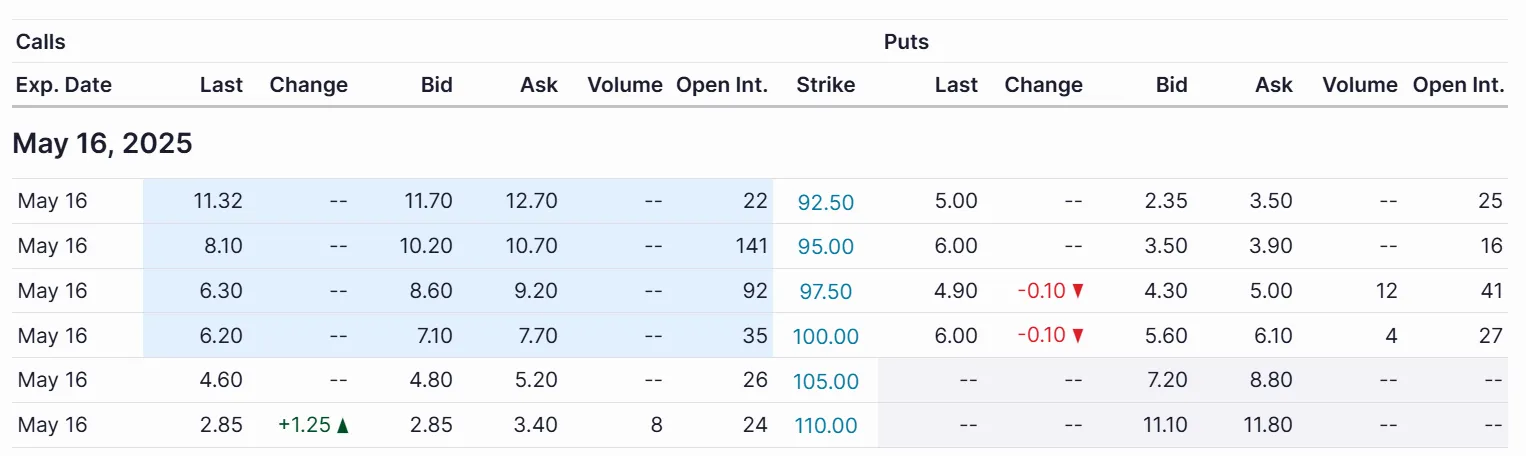

The next several questions use the option pricing data below for State Street Corporation (STT). Use the column labeled “last” to look up all option premiums.

| Calls | Puts | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Exp. Date | Last | Change | Bid | Ask | Strike | Last | Change | Bid | Ask |

| Jan 19 | 8.33 | -0.57 | 7.90 | 8.30 | 70.00 | 0.60 | 0.15 | 0.50 | 0.65 |

| Jan 19 | 5.80 | -0.97 | 5.80 | 6.10 | 72.50 | 1.01 | 0.21 | 0.95 | 1.10 |

| Jan 19 | 3.84 | -1.04 | 4.00 | 4.20 | 75.00 | 1.45 | — | 1.65 | 1.80 |

| Jan 19 | 2.65 | -0.48 | 2.55 | 2.75 | 77.50 | 2.90 | 0.50 | 2.65 | 2.85 |

| Jan 19 | 1.50 | -0.60 | 1.50 | 1.65 | 80.00 | 4.10 | 0.35 | 4.10 | 4.40 |

| Jan 19 | 1.20 | — | 0.80 | 1.00 | 82.50 | 15.10 | — | 5.90 | 6.20 |

| Jan 19 | 0.52 | 0.22 | 0.45 | 0.55 | 85.00 | 19.55 | — | 7.70 | 8.80 |

The last price that STT was traded at was $77.63 (AS OF DEC 15)

✏️ What are the Premium, IV, and TV for the Jan 19 82.50 Put? Is it in or out of the money? (A typical exam question would only ask one of these at a time, but I’m grouping them.)

✔ Click here to view answer

Premium = $15.10 per share

IV = Max(K-S,0) = Max($82.50 - $77.63= , $0) = $4.87

TV = $15.10-$4.87 = $10.23

✏️ Suppose you sold a $80 put today and that at expiration, the price of STT stock was $81. What would your profit or loss be? Would the contract be exercised?

✔ Click here to view answer

Premium = $4.10

There are two ways to do this: use the equation or just think it through.

Use the equation: IV = Max (K-S, 0) = Max (80-81, 0) = Max (-1, 0) = $0

P/L when you sell an option = Prem - IV = $4.10 - $0 = $4.10

The contract would not be exercised because the IV=0.

Think it through: Whenever you want to analyze an option that you have written, you have to ask whether the option will be exercised. So let’s think about whether someone who purchased the option would exercise it. From their perspective, they can sell a share worth S=$81 for K=$80. Why would they do that?!?! Therefore, we wouldn’t expect this option to be exercised. We get to keep the premium, though. Our profit is $4.10.

✏️ Suppose you sold a $80 put today and that at expiration, the price of STT stock was $75. What would your profit or loss be? Would the contract be exercised?

✔ Click here to view answer

Use the equation: IV = Max (K-S, 0) = Max ($80-$75, $0) = $5

P/L when I sell the option = Prem - IV = $4.10 - $5 = -$0.90

The contract will be exercised because IV>$0

Think it through: Once again, we must ask whether the option would be exercised. From the perspective of someone who purchased this option, they can sell 100 shares of STT for $80 when the shares themselves are only worth $75. This is a great benefit! They will buy the shares on the market for $75 and sell them using their put option for $80, netting a $5 gain per share. This will come at your expense, so you will lose $5 per share. However, you get to keep the premium of $4.10, so you will only lose $5-$4.10 = $0.90

✏️ Suppose you sold a $80 call today and that at expiration, the price of STT stock was $75. What would your profit or loss be? Would the contract be exercised?

✔ Click here to view answer

Use the equation:

The option is out of the money, so it won’t be exercised.

You get to keep the premium: P/L = Prem - IV = $1.50 - $0 = $1.50

Think it through: Because you purchased the option you get to choose whether to exercise the option. In this case, you have the option to buy 100 shares that are worth $75 and pay $80 for them. Why would you want to overpay? There is no way to make money like this. Therefore, the option would expire worthless. You would get to keep the premium. Your P/L = $1.50

✏️ Suppose that STT stock closed at $101.14. (State Street Corp) Consider the following options:

Measure premiums using the “Last” column, which represents the last premium paid for an option of the given type.

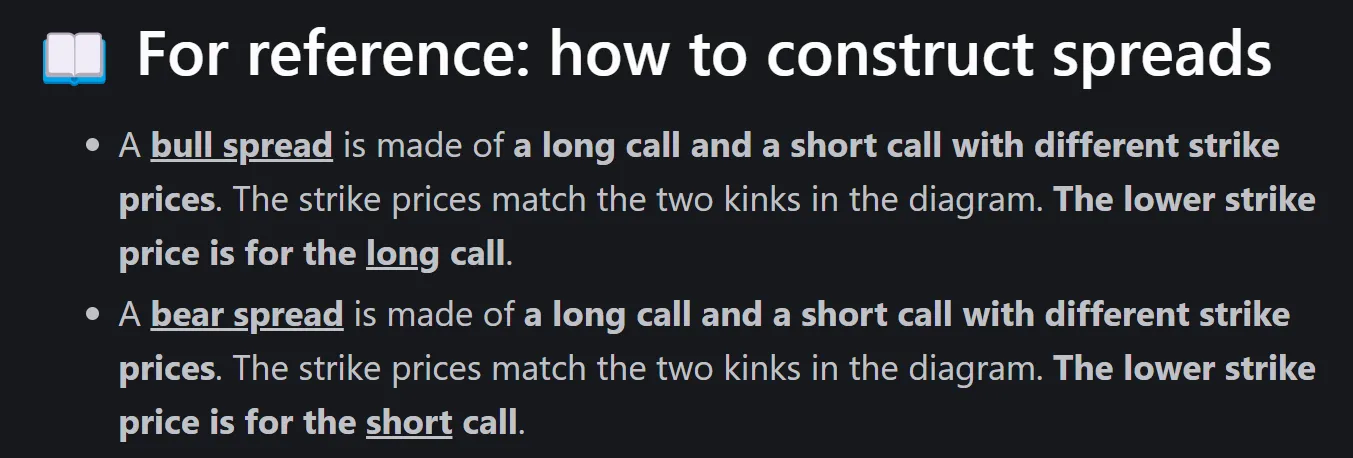

Construct a Bear spread, such that the P/L diagram has kinks at S=105. What options would you buy and sell to construct this Bear spread.

✔ The kinks in a P/L diagram represent the two stock prices, so you will be buying or selling options with K=105.

We know from lecture that to construct a bear spread, you sell the call with the lower strike price and buy the call with the higher strike price.

Therefore, you buy the 95 call.

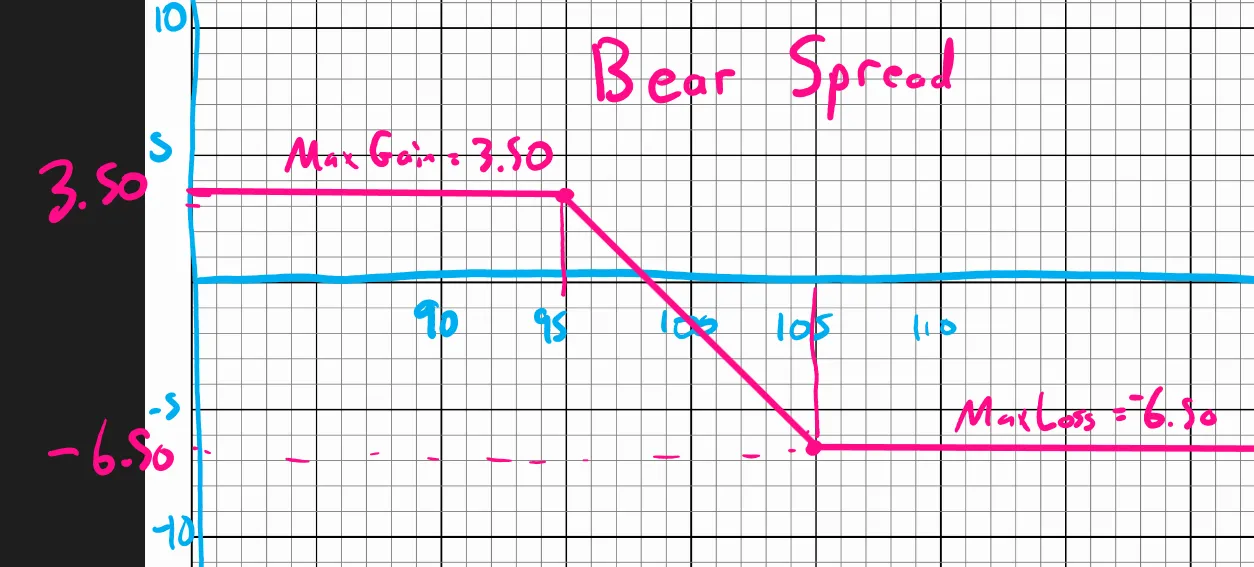

✏️ Calculate the P/L for each of the two options and for the resulting strategy at the prices of S=90, 100, 110

✔

| S=$0 | S=$90 | S=$95 | S=$100 | S=$105 | S=$110 | |

|---|---|---|---|---|---|---|

| Short 8.10 | $8.10 | $8.10 | $8.10 | 5 = $3.10 | 10 = -$1.90 | 15 = -$6.90 |

| Long 4.60 | -$4.60 | -$4.60 | -$4.60 | -$4.60 | -$4.60 | 4.60 =$0.40 |

| Bear Spread | $3.50 | $3.50 | $3.50 | -$1.50 | -$6.50 | -$6.50 |

| Moneyness | OTM/ OTM | OTM/ OTM | ATM/ OTM | ITM/ OTM | ITM/ ATM | ITM/ ITM |

| Moneyness: OTM = Out of The Money, ITM = In The Money, ATM = At The Money. (An At The Money option is also Out of The Money) |

✏️Graph the bear spread and label all important points on the diagram, except the break even point ✔

Graph paper

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.