✏️ Midterm Exam Practice

Tip: Working through these problems with a formula sheet handy is a great way to learn and get comfortable with the formula sheet. This will help you use the formula sheet quickly and confidently during the exam.

You can download my paper formula sheets at https://robmunger.com/2000share. If this is your first time using them, the “Basic” (not “Text”) sheet has all of the formulas and may be slightly more readable. There is also an online version on this website.

Before the Midterm

Bank Balance Sheets

Two bank balance sheet examples, inspired by Silicon Valley Bank:

✏️ Suppose that your bank has lent $13M to a fintech firm. Show the changes in your bank’s balance sheet if the fintech firm goes bankrupt.

✔ Click here to view answer

| Assets | Liabilities |

|---|---|

-$13M Loans | |

-$13M Bank Capital |

Suppose that you decide to withdraw your $5,000 of checking deposits from your bank. What is the impact on the bank’s balance sheet.

✔ Click here to view answer

| Assets | Liabilities |

|---|---|

-$5K Reserves | -$5K Checking deposits |

Bank Capital |

There are two types of Reserves: Cash Held by the Public and Deposits at the Fed. Whether the $5K of reserves was a decrease in CHP or DaF depends on how you withdrew the money:

- If you withdrew cash: Vault Cash will decrease.

- If you wrote a check and deposited it in another bank (or did another form of bank transfer): Deposits at the Fed will decrease.

✏️ Suppose that you want to renovate your kitchen. You borrow $32,000 from the bank and they put that money into a checking account. Show the immediate impact on the bank’s balance sheet before you withdraw or spend the money.

✔ Click here to view answer

| Assets | Liabilities |

|---|---|

+$32 K Loans | +32K of Checking Deposits |

Bank Capital |

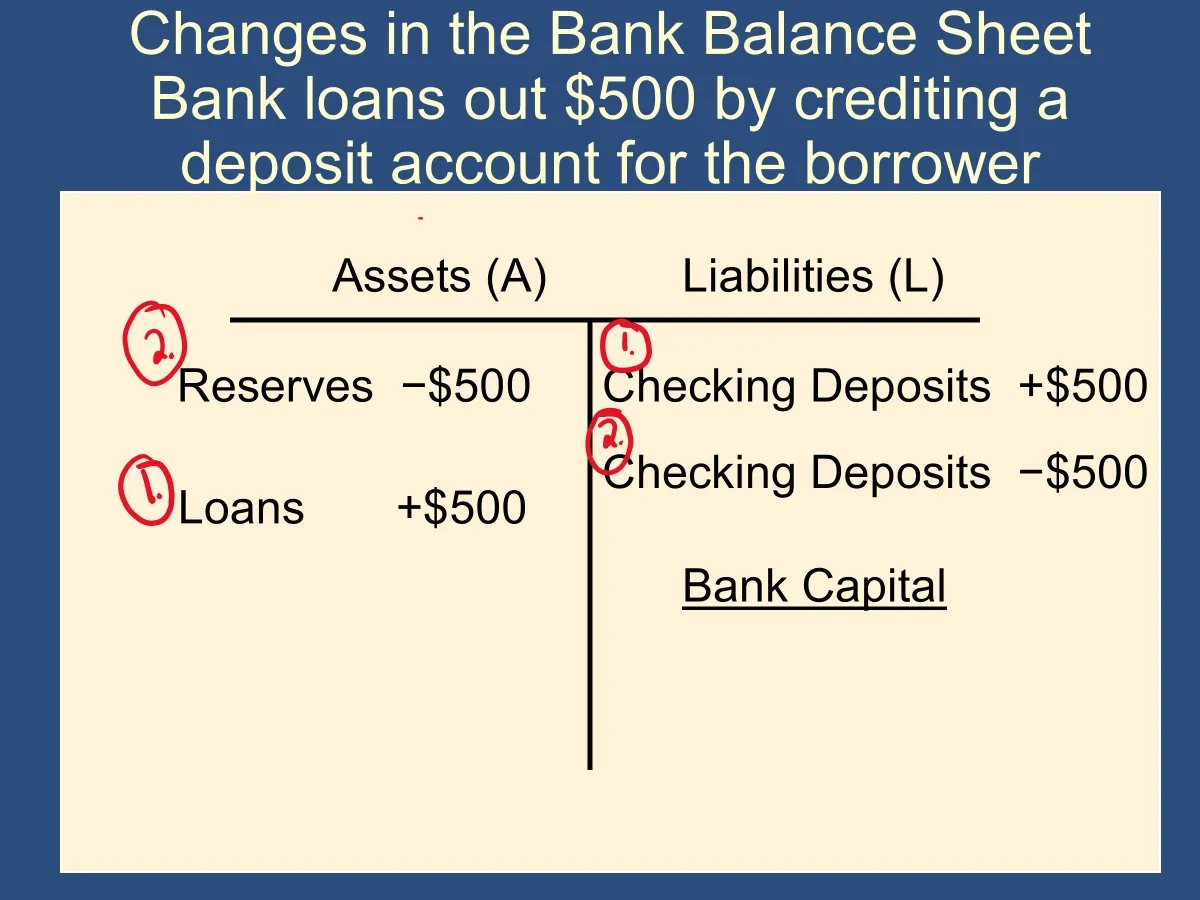

This is a reference back to one of the harder slides from lecture 2

At this stage, they have given you money because they have given you $500 of checking deposits. You are $500 richer. You might wonder where the money comes from, but it doesn’t really exist. They’ve got an awful lot of reserves in the bank and they’re confident that if you ever come over and ask for the money, they can give you $500. Therefore, they’ve just made a promise to give you $500 whenever you demand it (this is why checking accounts are often called “demand deposits”).

Now that we’ve studied monetary policy we know that if they don’t have enough reserves on site, they can always borrow more reserves from the Fed via the discount window or borrow it from other banks via the “Fed Funds” market. They would pay the discount rate or the Fed Funds rate, respectively.

At this stage, it looks like the following on the bank’s balance sheet:

| Assets | Liabilities |

|---|---|

| +500 Loans | +500 Checking Deposits |

| The above is what I refer to as “step 1.” It describes where we are when you walk out of the bank with a new loan. AT this piont, you and the bank have just traded IOUs (promises to pay the other according to a given schedule.) |

Step 2 is when you write a check to whoever is making the repairs on your home. This will empty out the checking account and the bank will have to transfer reserves to the repairperson’s bank. It lwill look like this in stage 2:

| Assets | Liabilities |

|---|---|

| -500 Reserves | -500 Checking Deposits |

In total, it looks like this:

| Assets | Liabilities |

|---|---|

| ① +500 Loans | ② +500 Checking Deposits |

| ② -500 Reserves | ② -500 Checking Deposits |

✏️ Building on the previous example, what happens to the bank’s balance sheet after you pay your contractor with the money you borrowed?

✔ Click here to view answer

| Assets | Liabilities |

|---|---|

-32K Reserves (Deposits at Fed) | -32K of Checking Deposits |

Bank Capital |

The combined effect of the loan and paying the contractor would have the following effect on the Bank’s balance sheet

✔ Click here to view answer

| Assets | Liabilities |

|---|---|

-32K Deposits at Fed | -32K of Checking Deposits |

Bank Capital |

Bank Profit

Suppose that the following bank has $50M of profit/net income (after taxes):

| Assets | Liabilities |

|---|---|

$5B total Assets | $4.5B Total Liabilities |

? Total Bank Capital |

What is:

- Bank Capital

- ROE

- ROA

- Leverage Ratio

- Debt/Equity Ratio

Use the following formula to check your math:

✔ Click here to view answer

Note that $50M is just $0.05B

We’ll use the following key equations from the formula sheet:

ROA = profit after taxes / assets

ROE=profit after taxes/capital

Leverage ratio = Assets/Capital

ROE = ROA * Leverage Ratio ← Helpful formula for checking work

Debt to Equity Ratio = Bank Liabilities / Bank Capital

Bank Capital = $5B - $4.5B = $0.5B

ROE = $0.05B / $.5B = 10%

ROA = $0.05B / $5B = 1%

Leverage Ratio = $5B / $.5B = 10 (or “ten to 1”)

Debt/Equity Ratio = $4.5B/$.5 = 9

There are two ways to check your math. First, it’s always true that ROE = ROA*Leverage:

ROE = ROA*Leverage

10% = 1% * 10

It’s also always true that the Debt/Equity ratio is one less than the leverage ratio:

Debt to Equity Ratio = Leverage Ratio - 1

9 = 10 - 1

Calculation of R

All banks in the economy have the same percentage of excess reserves. Consider the following balance sheet. Suppose R=0%. What is E? What is the Money Multiplier?

| Assets | Liabilities |

|---|---|

$30M Deposits at the Fed | $200M of Deposits (Checking Deposits) |

Bank Capital |

✔ Click here to view answer

We’ll use the following formulas from the formula sheet:

$TotalReserves = $VaultCash + $DepositsAtFed

R+E = $TotalReserves/$CheckingDeposits

$TotalReserves = $10M + $30M = $40M

R+E = $40M/$200M = 20%

R=0%, so E=20%

Money Multiplier = 1/(R+E) = 5

Money Multiplier

Deposit/Withdrawal

✏️ Suppose Bill Gate withdraws $10M and hides it under his very large pillow. What is the change in Total Deposits and the change in the Money Supply. Suppose that R=0% and E=20%.

✔ Click here to view answer

In a question like this, you often assume that the money multiplier process has played out.

Key equations from the formula sheet:

ΔTotal Deposits = Initial Deposit * 1/(R+E) (money multiplier equation)

ΔMS = ΔDeposits + ΔCash Held by Public

Once the money multiplier process has played out…

ΔTotal Deposits = Initial Deposit * 1/(R+E) = -$10M/(0%+20%) = -$50M

Total deposits in the economy declined by $50M.

ΔMS = ΔDeposits + ΔCash Held by Public = -$50M + $10M = -$40M

The money supply declined by $40M

Open Market Operation

✏️ Imagine we are in a limited reserves regime. Suppose that to raise interest rates and fight inflation, the Federal Reserve does an open market operation to sell $10M of bonds. As in the previous question, calculate the change in Total Deposits and the change in the Money Supply. As before, suppose that R=0% and E=20%.

✔ Click here to view answer

We use the same key equations, but we use them slightly differently. The only difference is that ΔCash Held by Public = $0.

Once the money multiplier process has played out…

ΔTotal Deposits = Initial Deposit × 1/(R+E) = -$10M/(0%+20%) = -$50M

ΔMS = ΔDeposits + ΔCash Held by Public = -$50M + $0 = -$50M

Open Market Operations are very similar to Deposit/Withdrawal questions. As these two problems illustrate, the only difference between them is whether Cash Held by the Public changes.

Future Value

Suppose that you want to have 2 million dollars when you retire at the age of 65. How much would you have to saved up by age 35 to ensure that that would happen? Assume that you expect a return of 10% on your portfolio between age 35 and 65.

Present Value tells us how much we must invest today to get a specific Future Value in the future, so this is a Present Value problem. Another way to look at it is that we know how muhc money we want to have in the future, and we want to figure out how much money we would like to have now in the present.

NPV

Your friend Otto needs to borrow $8.50. He will pay you back $11 in one year.

If you don’t give the money to Otto, you will keep it in a bank earning 10% interest.

Otto is very trustworthy. Assume you believe he will pay you back. What is the NPV of this transaction? Should you accept the offer?

You can also do it on one line:

IRR

Return to the example above. Assuming you believe that Otto will pay you back, what is the IRR? According to the IRR rule, should you accept the offer? Do the IRR and NPV rules agree?

(You could also set up NPV=0, but this is typically slightly easier.)

Switcheroo:

Therefore i=29%.

Intuitively, this means that we are giving Otto a loan with an interest rate of 29%.

Because our discount rate is 10%, the IRR rule says that w should accept any project with an IRR>10%. Therefore, we should accept this project. Note that this is thsame answer that was given to us by the NPV rule. The two rules generally agree.

Hard IRR

After Otto sees you doing this calculation, he finally realizes that he’s not getting a very good deal, so he says that he doesn’t want to pay you back for three years. What will the new IRR be? Should you accept the new deal?

(You could also set up NPV=0, but this is typically slightly easier.)

Switcheroo:

Take the 1/3 power of both sides and you get:

You can also write this as:

You enter this into a spreadsheet as 1.29^(1/3)= 1.0885 Therefore, 1+i = 1.0885 i=8.85%

We should reject this because the IRR is less than our discount rate of 10%. No dice, Otto!!

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.