👨🏫 Outline

Formulas for this lecture can be found in my paper formula sheets and online formula sheet.

General Bond Information

Who Issues Bonds?

- Corporations

- Governments

- U.S. Government

- Treasury Bills, Notes, and Bonds

- Agency Securities

- State and Local Governments

- Foreign Governments

- U.S. Government

Investing in Bonds

- Bonds are the most popular alternative to stocks for long-term investing.

- Even though the bonds of a corporation are less risky than its equity, investors still have risk: credit risk and interest rate risk.

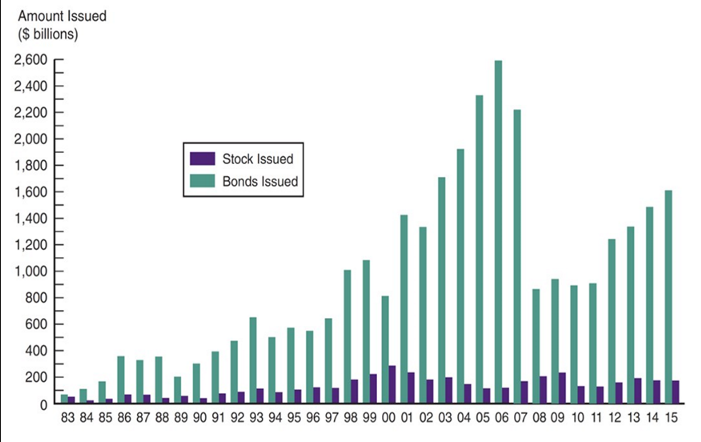

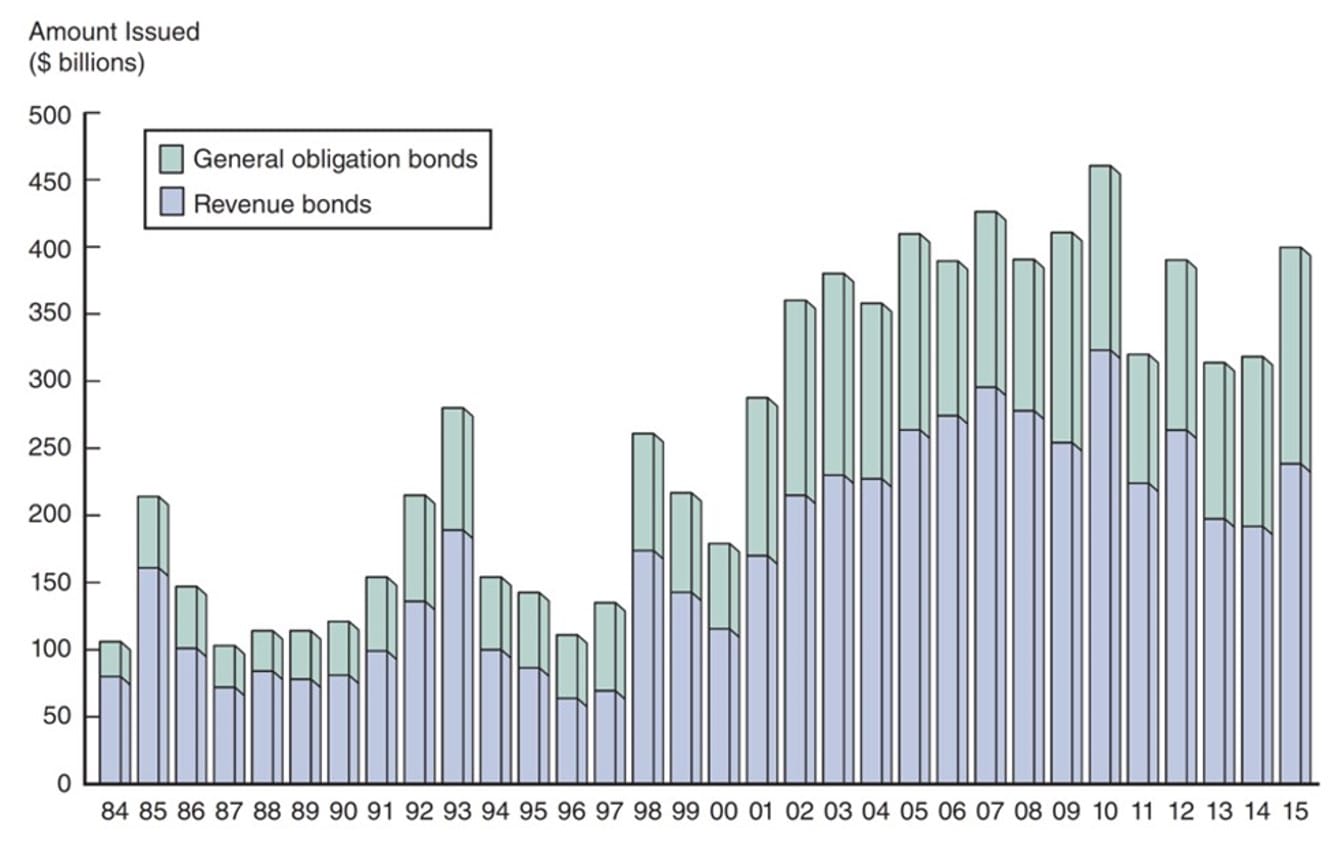

- The next slide shows the amount of bonds and stock issued from 1983 to 2015.

- Note how much larger the market for new debt is. Even in the late 1990s, which were boom years for new equity issuances, new debt issuances still outpaced equity by over 5:1.

Risks Relating to Bonds

- Credit Risk

- Interest Rate Risk

Bonds and Stocks Issued: 1983 - 2015:

Corporate Bonds:

- Typically have a face value of , although some have a face value of or

- Pay interest semi-annually

- Cannot be redeemed anytime the issuer wishes, unless a specific clause states this (call option).

- Degree of risk varies with each bond, even from the same issuer. As is always the case in finance, the required interest rate varies with level of risk.

Corporate Bonds

Corporate Bonds: Characteristics of Corporate Bonds

- Bearer Bonds

- Registered Bonds

- Replaced “bearer” bonds

- IRS can track interest income this way

- Restrictive Covenants

- Mitigates conflicts with shareholder interests

- May limit dividends, new debt, ratios, etc.

- Usually includes a cross-default clause

- Secured Bonds

- Mortgage bonds

- Equipment trust certificates

- Unsecured Bonds

- Debentures

- Subordinated debentures

- Variable-rate bonds

Credit Risk

“Big Three” Rating Agencies

- S&P Global Ratings

- Oldest and largest of the three formerly known as “Standard and Poor’s” -S&P for short

- Moody’s

- Formally - Moody’s Investor Service

- Subsidiary of Moody’s Corp.

- Fitch Ratings

- Smallest of the three

- Subsidiary of Hearst Corp.

Bond Rating Issues

- Up to the 1970s, the rating agencies’ work was paid for by investors

- Goal was to provide impartial financial information on bond issues

- Beginning in the 1970s, the agencies shifted to a business model which relied on payment from securities issuers themselves

- “Shopping” for ratings by issuers

- Obvious conflict of interest

- Implicated in the sub-prime mortgage crisis

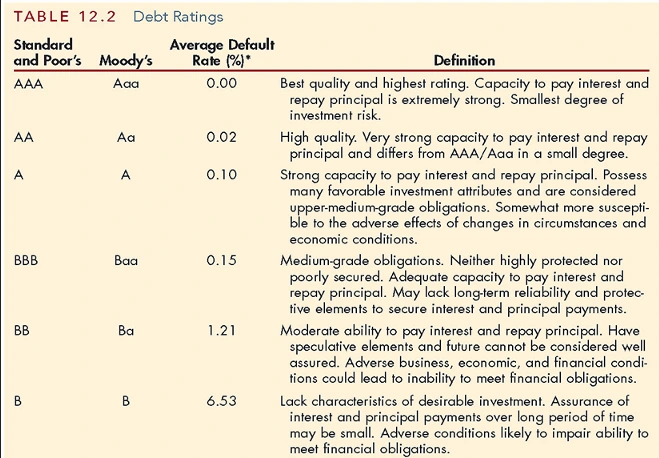

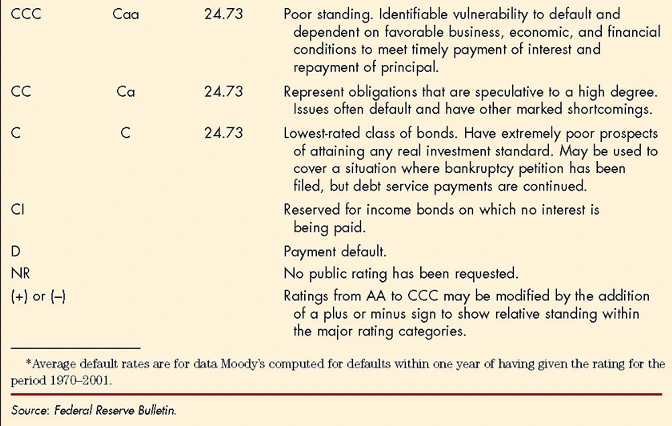

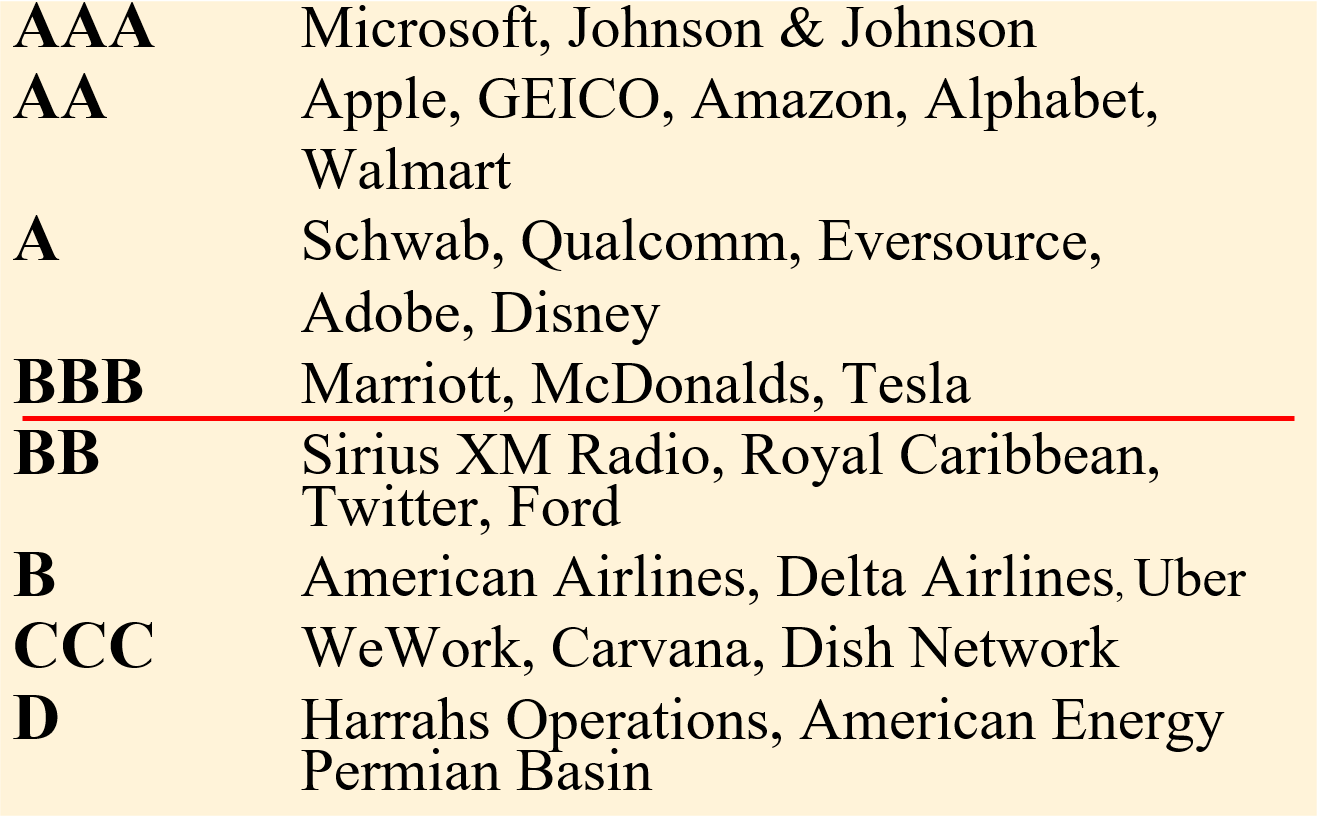

Corporate Bonds: Debt Ratings

Some Recent Bond Ratings

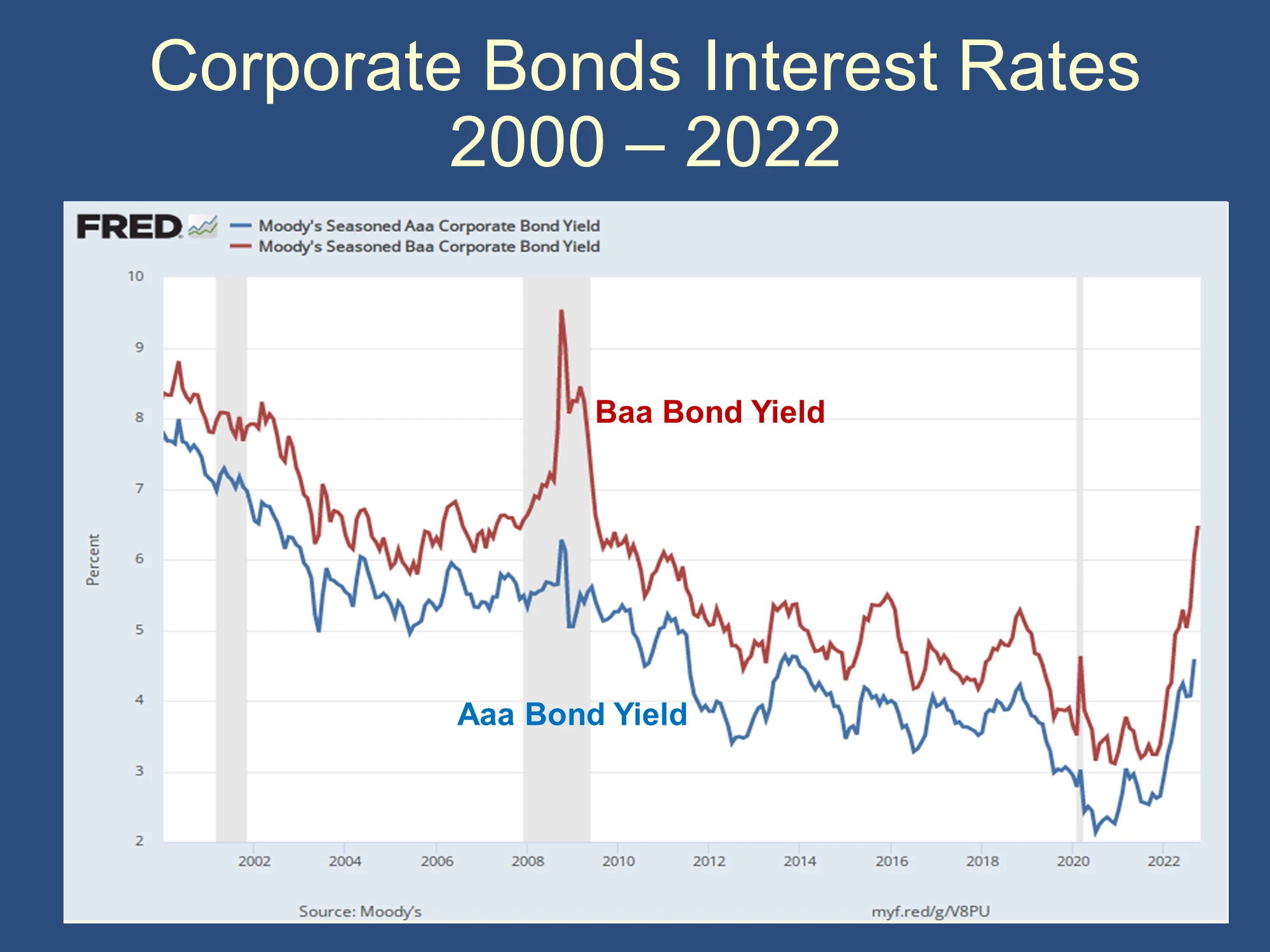

Corporate Bonds Interest Rates: 2000 - 2022:

High-Yield Corporate Bonds

- “Junk Bonds”

- Debt that is rated below BBB (S&P and comparable ratings for Moody’s and Fitch)

- Often, trusts and insurance companies are not permitted to invest in junk debt

- Michael Milken developed this market in the mid-1980s, although he was subsequently convicted of insider trading

Financial Guarantees for Bonds

- Some debt issuers purchase financial guarantees to lower the risk of their debt.

- The guarantee provides for timely payment of interest and principal, and are usually backed by large insurance companies.

- As it turns out, not all guarantees actually make sense!

- In 1995, JPMorgan created the credit default swap (CDS), a type of insurance on bonds.

- In 2000, Congress removed CDSs from any oversight.

- By 2008, the CDS market was over $62 trillion!

- 2008 losses on mortgages lead to huge payouts on this insurance.

US Treasuries

Treasury Notes and Bonds

- The U.S. Treasury issues notes and bonds to finance its operations.

- The following table summarizes the maturity differences among the various Treasury securities.

Treasury Securities

| Type | Maturity |

| Treasury Bill | Less than 1 year |

| Treasury Note | 1 to 10 years |

| Treasury Bond | 10 to 30 years |

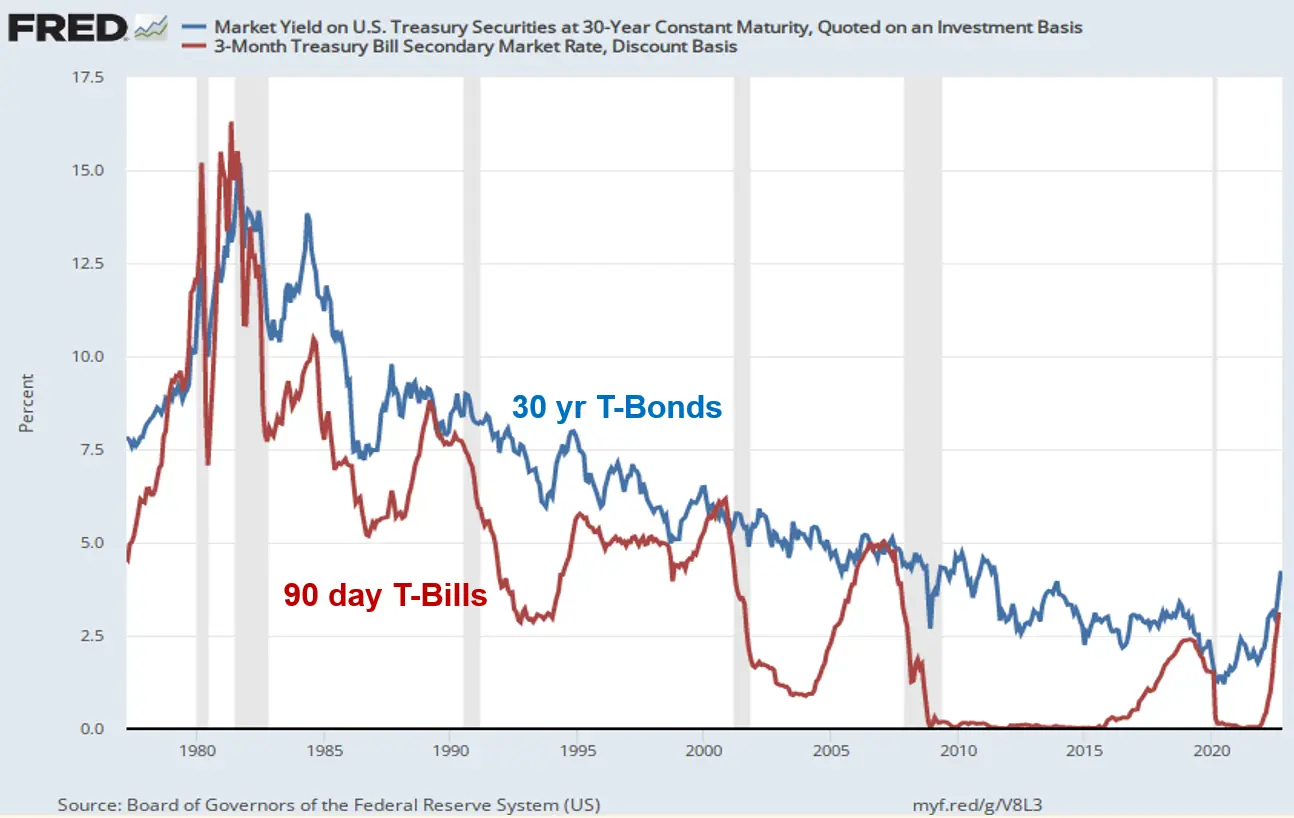

Treasury Bond Interest Rates

- No credit risk since the government can simply divert (or raise) taxes to pay off the debt

- The government can also simply increase the money supply (create money) to service the debt

- Treasury securities have very low interest rates

- Risks involved in Treasury securities:

- Credit risk: None

- Interest rate risk:

- T-Bills: None (or very little)

- T-Notes: Some

- T-Bonds: Substantial

Treasury Security Interest Rates: Bills vs. Bonds: 1977 - 2022:

Agency Debt

Treasury Bonds: Agency Debt

- Although not technically Treasury securities, agency bonds are issued by government-sponsored entities, such as GNMA, FNMA, and FHLMC.

- The debt has an “implicit” guarantee that the U.S. government will not let the debt default. This “guarantee” was clear during the 2008 bailout…

The 2007-2009 Financial Crisis: Bailout of Fannie and Freddie

- Both Fannie and Freddie managed their political situation effectively, allowing them to engage in risky activities, despite concerns raised.

- By 2008, the two had purchased or guaranteed over $5 trillion in mortgages or mortgage-backed securities.

- Part of this growth was driven by their Congressional mission to support affordable housing. They did this by purchasing subprime and Alt-A mortgages.

- As these mortgages defaulted, large losses mounted for both agencies. The final outcome remains unknown.

Municipal Bonds

Municipal Bonds

- Issued by local, county, and state governments

- Used to finance public interest projects

- Coupon payments are free of federal income tax

- Coupon payments may also be free of state income tax if the issuing municipal or state entity is in the state where the taxpayer has a state tax liability

Equivalent Tax-Free Rate

- When you know the taxable rate, you can calculate the equivalent tax-free rate:

Example: You are in the 39% tax bracket, and can earn 7.5% on a corporate bond. What is the equivalent yield on a tax-free municipal bond?

Municipal Bonds: Example

- ❔ Suppose the rate on a corporate bond is 9% and the rate on a municipal bond is 6.75%. Which should you choose? Your marginal tax rate is 28%.

- ✔ Answer: Find the equivalent tax-free rate:

- The . If the actual muni-rate is above this (it is), choose the muni.

- ❔ Suppose the rate on a corporate bond is 9% and the rate on a municipal bond is 6.75%. Which should you choose?

- ✔ Answer: Find the marginal tax rate:

- If you are in a marginal tax rate above 25%, the municipal bond offers a higher after-tax cash flow.

Municipal Bonds

- Two types

- General obligation bonds

- Revenue bonds

- NOT default-free (e.g., Orange County California)

- Defaults in 1990 amounted to $1.4 billion in this market

Municipal Bonds: Comparing Revenue and General Obligation Bonds 1984 - 2015

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.