✏️ Examples for practice

Question Group 1: “Jennifer”

Jennifer walks into a bank and deposits $500. Banks are not required to hold any reserves, but they typically hold 20% of their deposits as reserves.

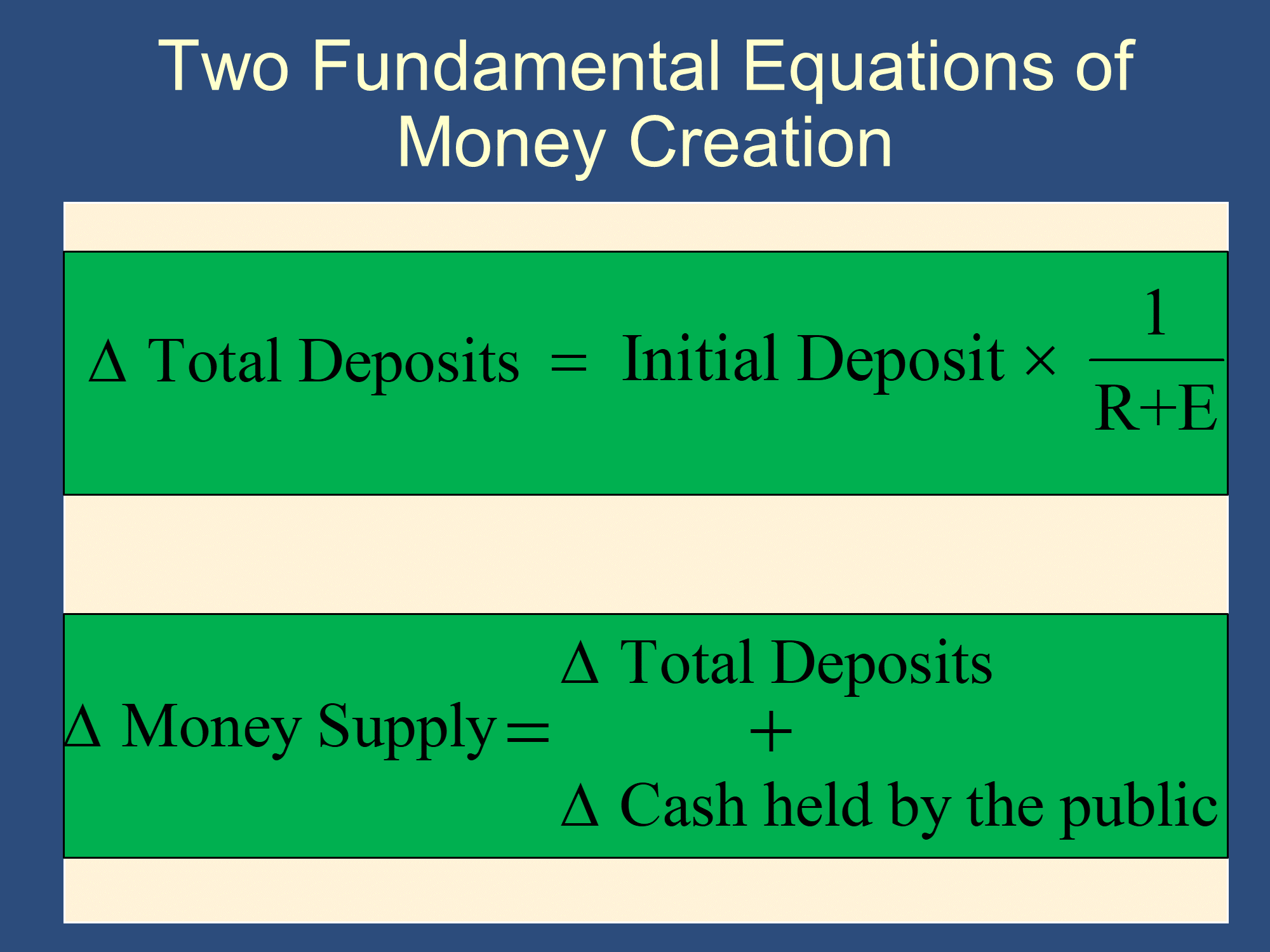

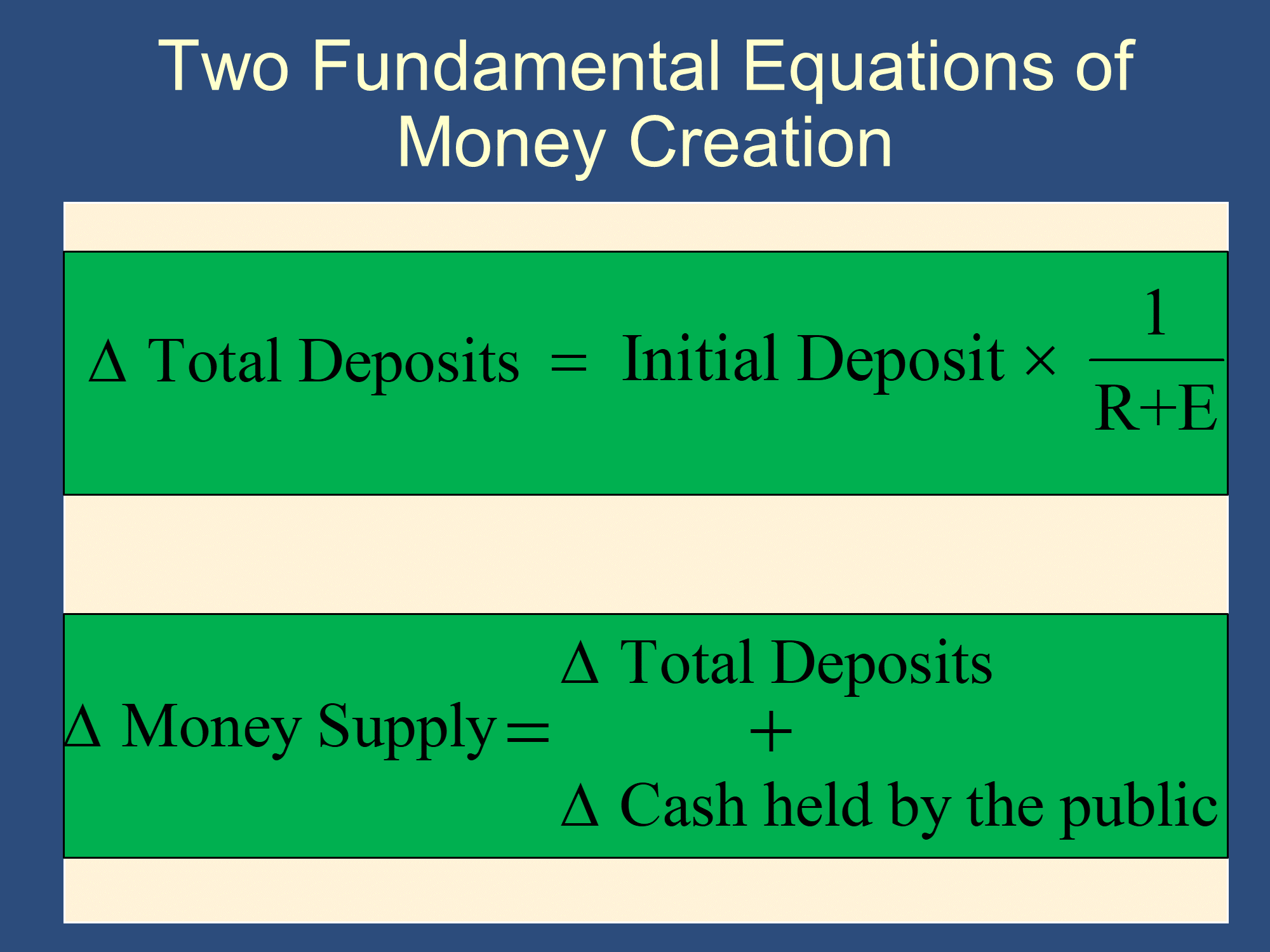

Note - In the following problem, you’ll need the Two Fundamental Equations of Money Creation:

✔ Click here to view answer

R=0%, E=20% , and

✔ Click here to view answer

✔ Click here to view answer

Therefore,

(We just calculated)

When Jennifer deposits the money in the bank, the $500 that she deposited still exists, but it is in the hands of a bank rather than being in the hands of a member of the public (banks aren’t members of the public). Therefore, cash held by the public declines by $500. Indeed, cash in the hands of the public will always change whenever someone deposits or withdraws money.

Question Group 2: “Amy”

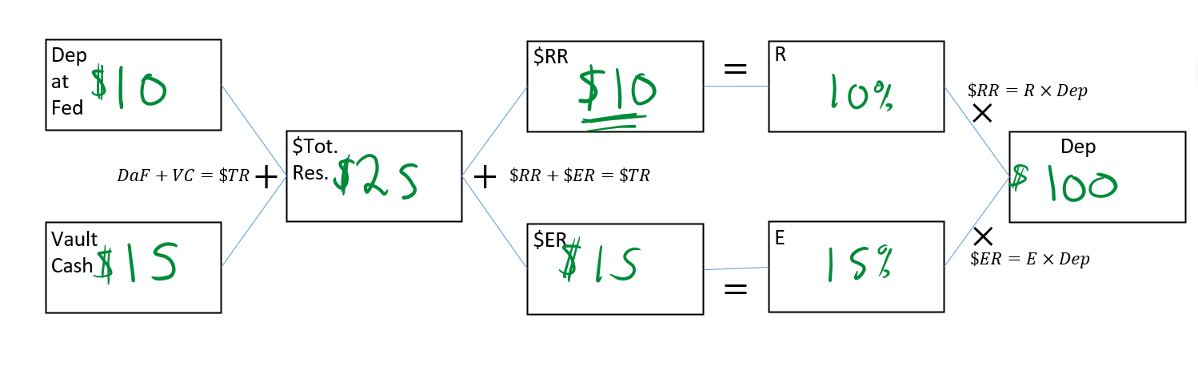

Suppose the Fed requires banks to hold 10% of their deposits as reserves. The following is one of many banks in the economy.

| Assets | Liabilities |

|---|---|

| $5 Vault Cash $20 Deposits at Fed $75 Loans ? Other assets | $100 Checking Deposits |

| $10 Bank Capital |

✔ Click here to view answer

✔ Click here to view answer

R=10% (because “the Fed requires banks to hold 10% of their deposits as reserves”)

✔ Click here to view answer

There are two ways to solve this.

Method 1:

This bank has $15 of Excess Reserves. To calculate E, you just divide this by the total amount of Deposits.

Method 2:

If we divide reserves/deposits, amount of reserves they hold as a fraction of the deposits they have:

They only needed to hold R=10% of their deposits as required reserves.

They are holding as excess reserves.

If R=10% and E=15%, then is the total amount of reserves that the bank holds as a fraction of deposits. As mentioned above, this is just . Therefore:

The above formula helps you solve many problem set and exam questions, so is worth jotting down!

Suppose that Amy withdraws $10 from her checking account as cash. What is the total impact on the money supply? R is always the same for all banks. You can assume that all banks hold the same amount of excess reserves as the bank above.

✔ Click here to view answer

Because Amy has withdrawn the money, she now holds $10 more cash.

Takeaway: if someone withdraws money, think of that as a negative initial deposit. This is known as the Reverse Money Multiplier.

🙋 Doesn’t the MS stay the same because deposits go down and cash held goes up.

It’s true that and that Amy’s deposits go down by -$10. While these things may cancel each other out, what isn’t canceled is that Amy’s bank has $10 less of reserves. That means that it can make fewer loans, which means that less money is spent and deposited in other banks. This means that the entire reverse money multiplier process will play out. It is all about the process of “lend-spend-deposit,” and that process will happen less because of Amy’s withdrawal. When you take money out of the banking system, it has big consequences.

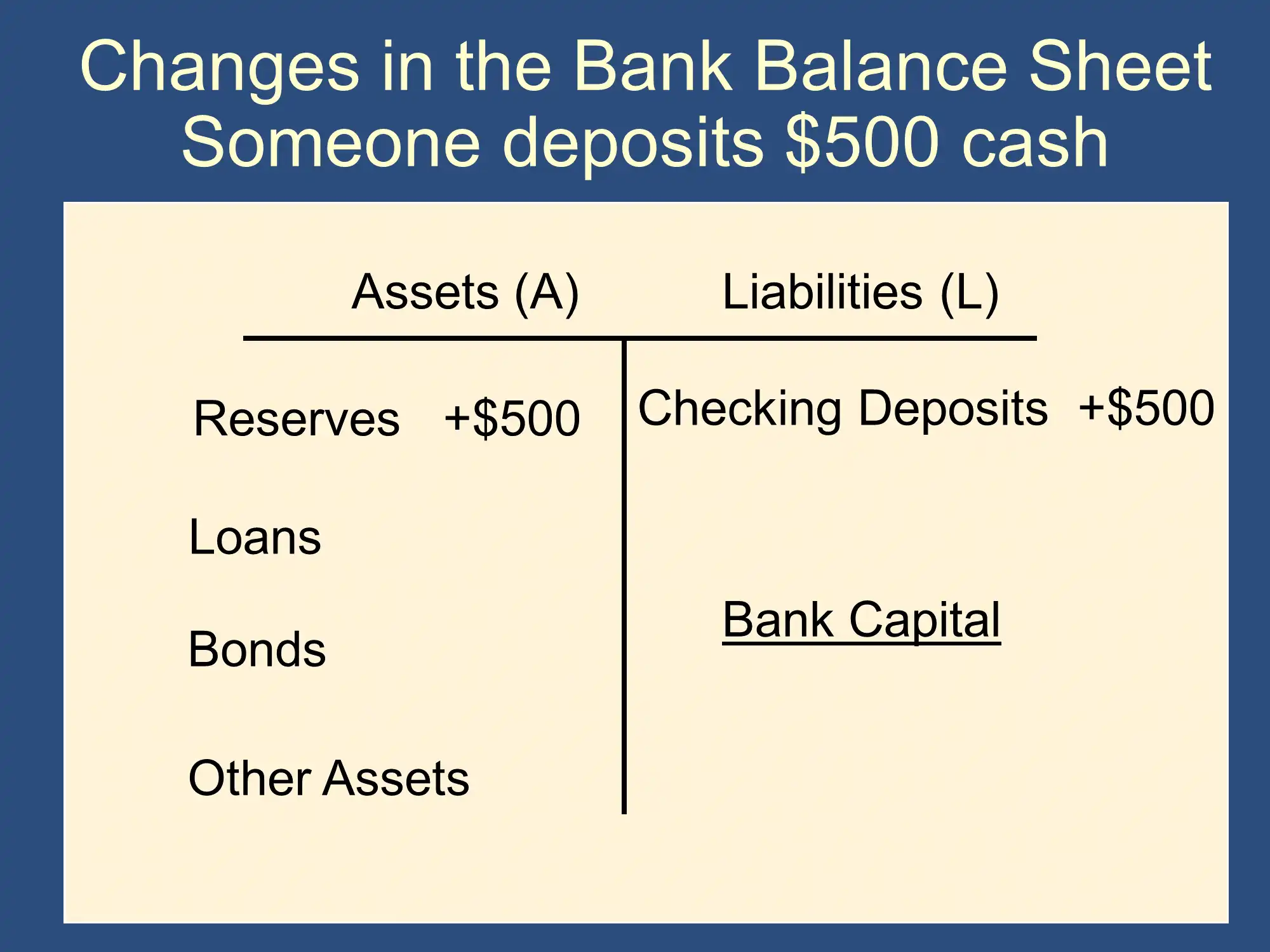

Assume that Amy withdrew the money as cash. What would the bank’s balance sheet look like after Amy’s withdrawal, but before the bank has done any other transactions? Also assume that Amy’s bank starts out with a balance sheet that looks like this:

| Assets | Liabilities |

|---|---|

$15 Vault Cash | $100 Checking Deposits |

$10 Bank Capital |

✔ Click here to view answer

We handle this similar to the following slide, but as a withdrawal rather than a deposit:

| Assets | Liabilities |

|---|---|

$15-$10 = $5 Vault Cash | $100-$10=$90 Checking Deposits |

$10 Bank Capital |

Previous to Amy’s withdrawal, the public held $500 and there was $2000 of deposits in the entire economy. Then Amy withdraws the $10 from her checking account described above. What are the old and new equilibrium money supplies? (FYI, “Money Stock” is a synonym for “Money Supply” that Bruce sometimes uses.)

As we saw in the previous lecture,

✔ Click here to view answer

At the start,

R=10%

| Assets | Liabilities |

|---|---|

| $6M Vault Cash $6M Deposits at Fed $75M Loans ? Other assets | $100M Checking Deposits |

| $10 Bank Capital |

This bank is fine!

They have $6M VC and $6M DaF, so they have $12M of Reserves in Total.

Therefore, they have $10M of required reserves AND $2M of Excess Reserves.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.