👨🏫 Outline

Formulas for this lecture can be found in my paper formula sheets and online formula sheet.

The Fed’s Tools (in a Limited Reserves Regime)

- Open Market Operations

- Changing R: the Required Reserve Ratio

- Reserve Lending from the “Discount Window”

- Quantitative Easing (QE)

The fourth tool, QE was only introduced during the depths of the great financial crisis in 2008. Therefore, when people refer to “the three tools of monetary policy,” they often mean the first three tools, above. These three tools are referred to as “conventional monetary policy.”

1.) Open Market Operations (OMOs)

- These are the main tool of the Fed in a limited reserves regime.

- For exam: Make sure that you can do OMO calculations like those in the first two assignments. They are very similar to Deposit/Withdrawal calculations like from lecture 3. (Money multiplier etc.)

- How does the Fed pay for an Open Market Operation?

- The FOMC meets and chooses a target range for the Fed Funds rate (which is a rate that banks lend reserves to each other). The Fed Funds rate gets above that range, then the Fed does an OMO purchase to expand the money supply and lower the interest rate into the target. If the Fed Funds rate gets below that range, then the Fed does an OMO sale to contract the money supply and raise the interest rate into the target range.

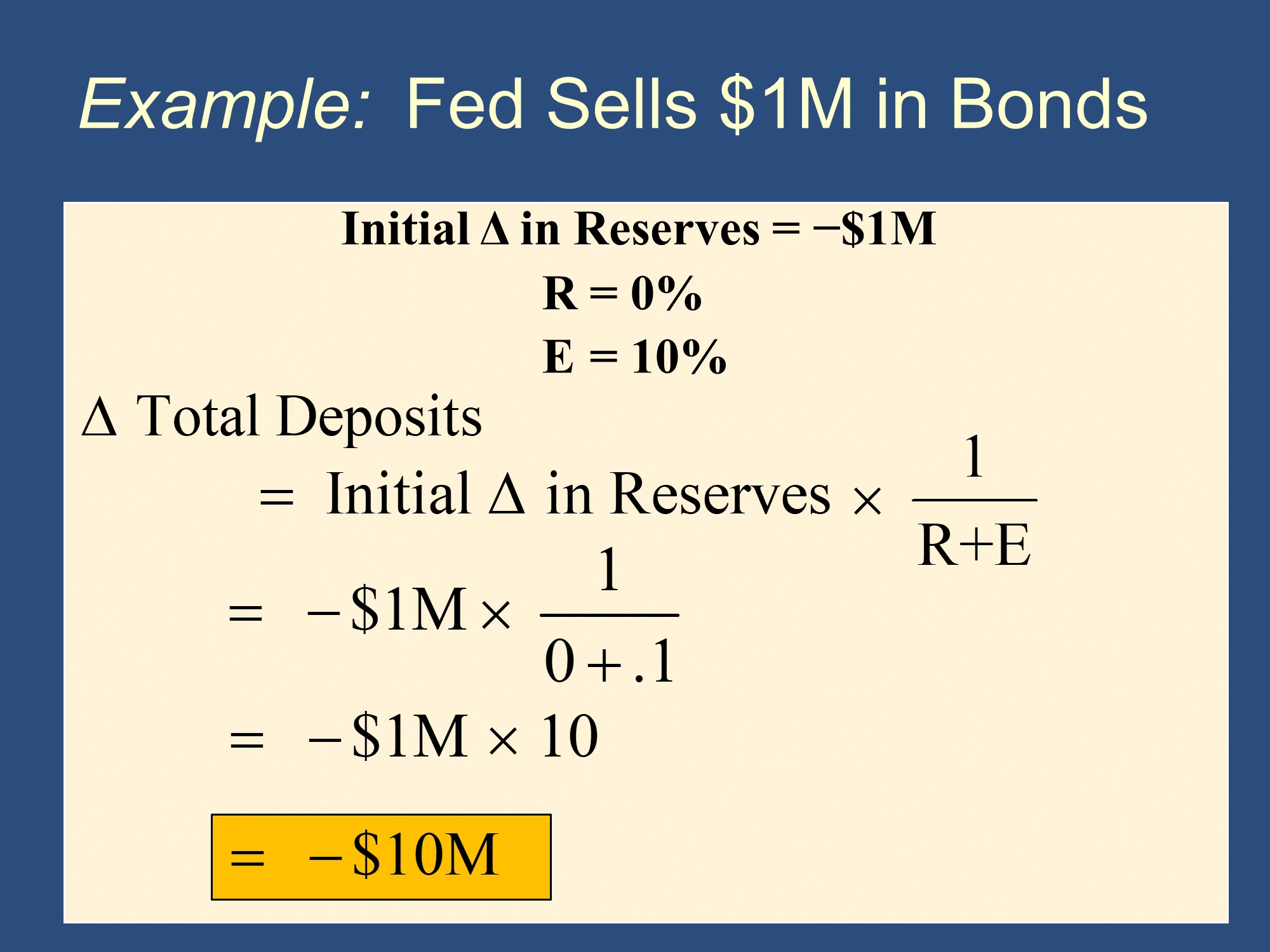

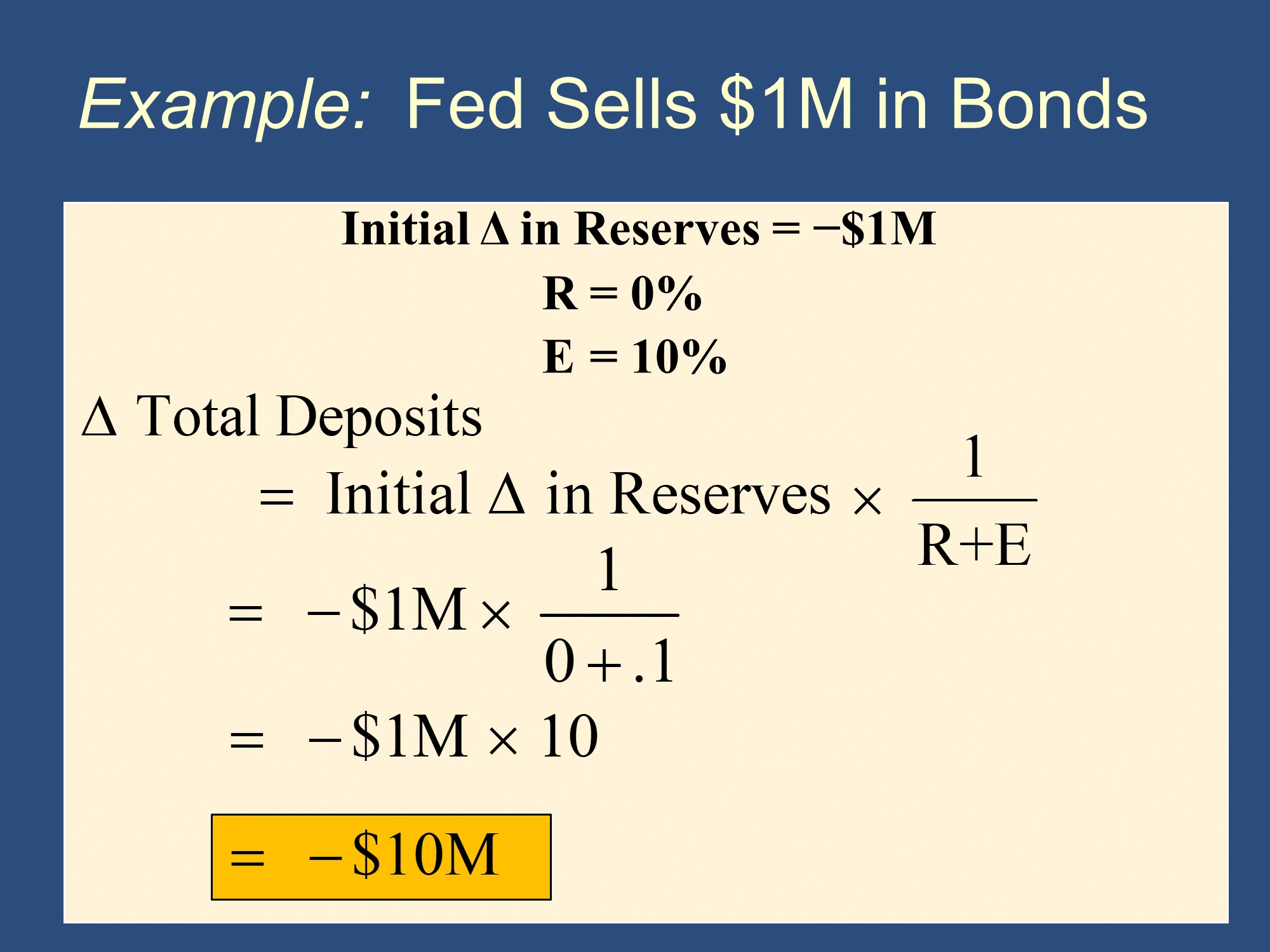

- Calculating an OMO is just like calculating a bank withdrawal or deposit (from the money multiplier lecture), except the for an OMO, whereas it is equal to the initial withdrawal or the negative of the initial deposit in a deposit or withdrawal.

- The Fed buys a $100,000 T-Bond from a bond dealer, and pays for it by electronic transfer of $100,000 to the bond dealer’s checking account. Consequently, the bond dealer’s bank’s balance sheet shows a $100,000 increase in reserves.

|  |

2.) Changing the Reserve Requirement (R)

While the Fed does have the power to change R, it typically doesn’t use this for monetary policy because changing R can be disruptive to the operations of the banks.

3.) The Discount Window

This discount window allows the fed to be a “Lender of Last Resort.” This means that it will lend to banks that no one else will lend to. Doing so can prevent the banks from collapsing.

- Primary Credit Program

- Very short-term loans (usually overnight) to depository institutions judged to be in generally sound financial condition

- Qualifying institutions pay the “Primary Credit” rate, ordinarily just called the “Discount Rate”

- Secondary Credit Program

- Loans to depository institutions not eligible for “primary credit” program

- Loans designed to meet short-term liquidity needs or to resolve “severe financial difficulties”

- Qualifying institutions pay the “Secondary Credit” rate

- Seasonal Credit Program

- Loans to smaller depository institutions with seasonal funding needs—e.g. banks in agricultural or resort communities

Quantitative Easing (QE)

Quantitative Easing is known as Unconventional Monetary Policy because it wasn’t used before the Great Financial Crisis in 2008.

- When short-term interest rates are already at or near zero, the central bank buys other financial assets from financial institutions in order to inject reserves into the system, lower interest rates on longer-term financial instruments, and stimulate the economy.

- In order to be effective, banks must be willing to lend their excess reserves.

Consequences of Fed Actions

https://prezi.com/view/AzqChnbTFeaAMICMVMWW/

Using OMOs and Discount Window lending to keep short term interest rates in line with a target is known as conventional monetary policy. Recently, a fourth tool has been added: Quantitative Easing (QE).

- Fed uses one of its policy tools

- ⇨ Which changes total deposits (via money multiplier green equation)

- ⇨ Which changes the money supply (via second green equation)

- ⇨ Which changes interest rates (via Money Market slide below)

- ⇨ Which changes aggregate demand, unemployment, and inflation (see lists further below)

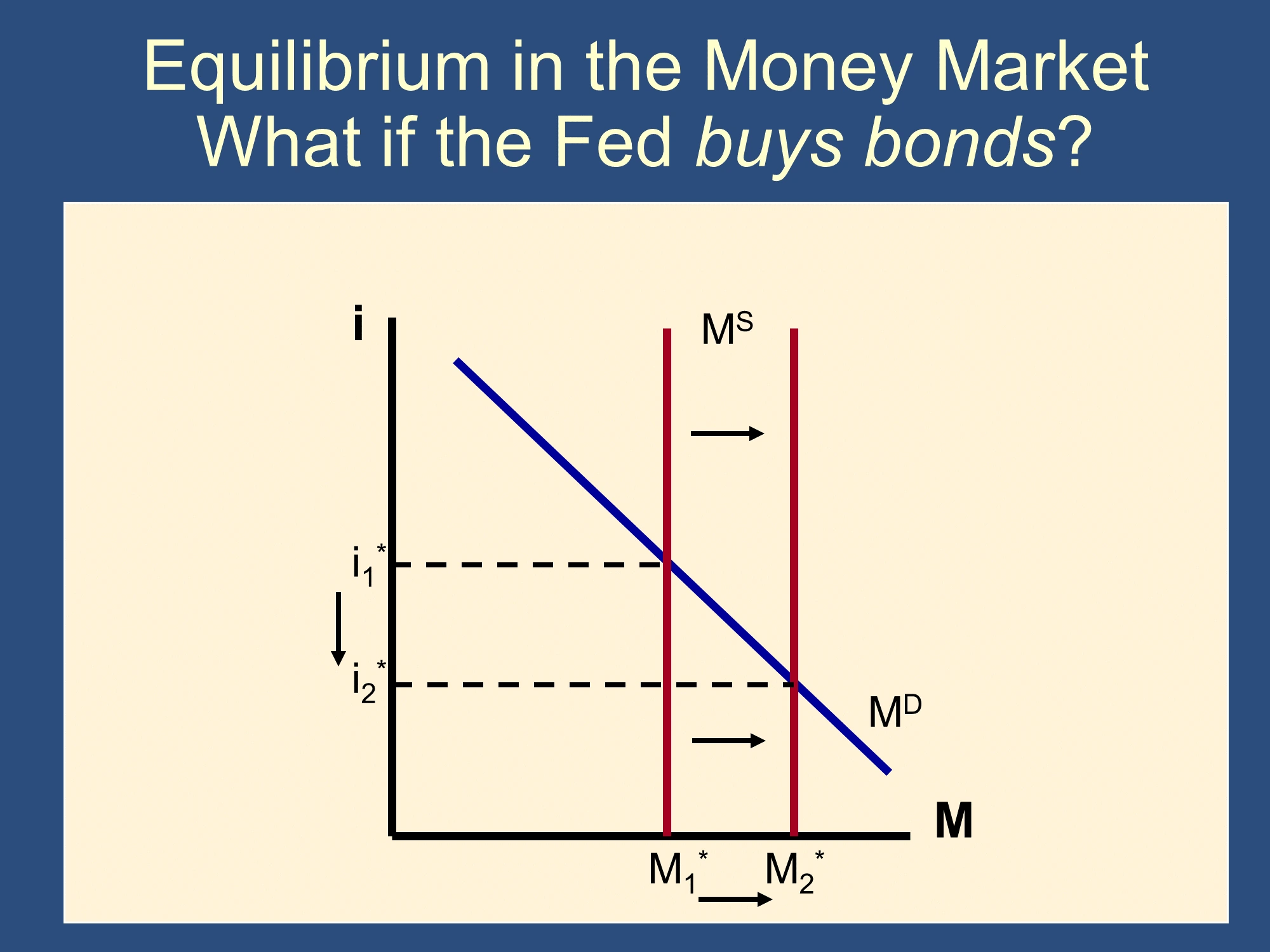

Expansionary Monetary Policy = actions which increase the money supply

- Expansionary Monetary Policy = Money Supply ↑

- ⇨ i ↓

- ⇨ Consumption ↑ Investment ↑ Net Exports ↑

- ⇨ Aggregate Demand ↑

- ⇨ National Income ↑

- ⇨ Inflation ↑ (sooner or later)

- “Expansionary” stimulates the economy, so most arrows point up: ↑

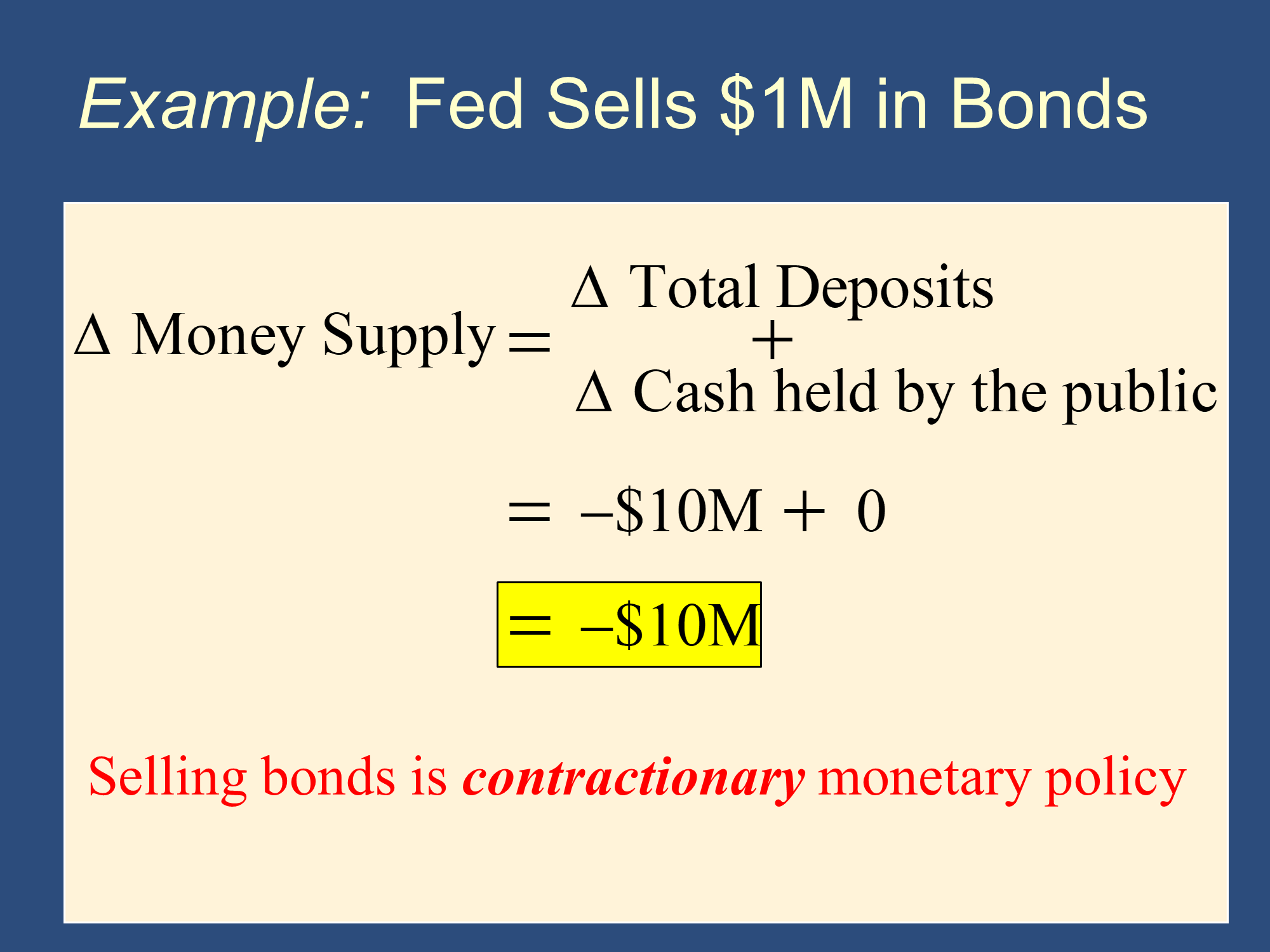

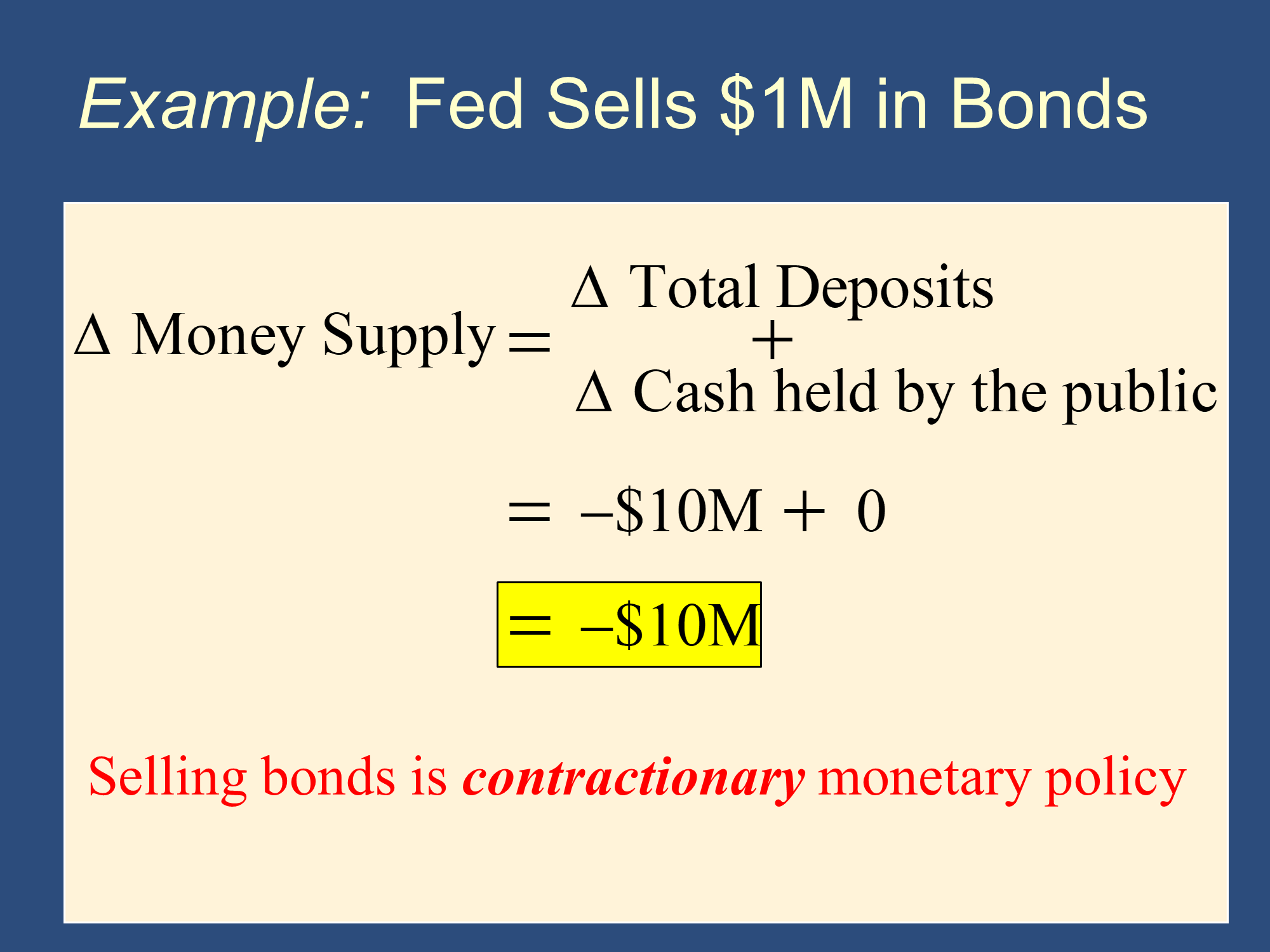

Contractionary Monetary Policy = actions which decrease the money supply

- Contractionary Monetary Policy

- ⇨ Money Supply ↓

- ⇨ i↑

- ⇨ Consumption ↓ Investment ↓ Net Exports ↓

- ⇨ Aggregate Demand ↓

- ⇨ National Income ↓

- ⇨ Inflation ↓ (sooner or later)

- “Contractionary” slows down/contracts the economy, so most arrows point down: ↓

Real vs. Nominal Interest Rates

-

-

(gaining 3% of purchasing power every year)

-

(The real interest rate is defined as nominal interest rate minus inflation)

(Break nom interest rate into real interest rate + inflation.)

You don’t know the inflation rate until afterward. If forecasting, use , expected inflation:

The Fed always faces a tradeoff between promoting good business conditions and fighting inflation:

- If it lowers interest rates, inflation may rise☹️, but the economy will thrive😀.

- If it raises interest rates, it can fight inflation😀, but the economy will weaken☹️.

This tradeoff is reflected in the “dual mandate” given to the Fed by Congress:

“Price Stability” means “low and steady inflation"

"Maximum Employment” means “an economy that is thriving”

During Covid, they emphasized making sure that the economy would thrive. (They lowered interest rates, and inflation rose☹️, but the economy thrived😀 compared to what it would have been.) Recently, inflation has begun to rise very significantly, so the Fed must take dramatic action. (They must raise interest rates, fighting inflation😀, but the economy will weaken☹️.)

You are not responsible for any material introduced in this box, but it is helpful for reading current news reports.

✏️ Suppose your mortgage rate is and inflation is . What is your real interest rate on your mortgage? (Hint: whenever you hear an interest rate, it is generally a nominal interest rate)

✔ Click here to view answer

✏️ Suppose that the Fed buys of bonds. and . What is the money multiplier and how much will the money supply change by?

✔ Click here to view answer

The money supply will increase because buying bonds is expansionary monetary policy.

Calculating an OMO is just like calculating a withdrawal or deposit from a bank, except the for an OMO, whereas it is equal to the initial withdrawal or the negative of the initial deposit in a deposit or withdrawal.

|  |

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.