🧠Personal Finance: the Index Card

While this course is not a personal finance course. We will cover a great deal of information that will be very relevant to personal finance.

Personal finance always involves judgment calls, but the following story contains a fun, simple and concise starting point.

A little while ago, NPR Morning Edition published the following in a personal finance story:

A couple of years ago, University of Chicago professor Harold Pollack did an online video chat with personal finance writer Helaine Olen. The topic was how regular people get steered into bad investments by financial advisers.

Pollack said that the best personal finance advice “can fit on a 3-by-5 index card, and is available for free in the library --- so if you’re paying someone for advice, almost by definition, you’re probably getting the wrong advice, because the correct advice is so straightforward.”

After they posted the video, the emails started pouring in --- people wanted to know, where could they get this index card? What was this fantastic yet simple advice for managing their money?

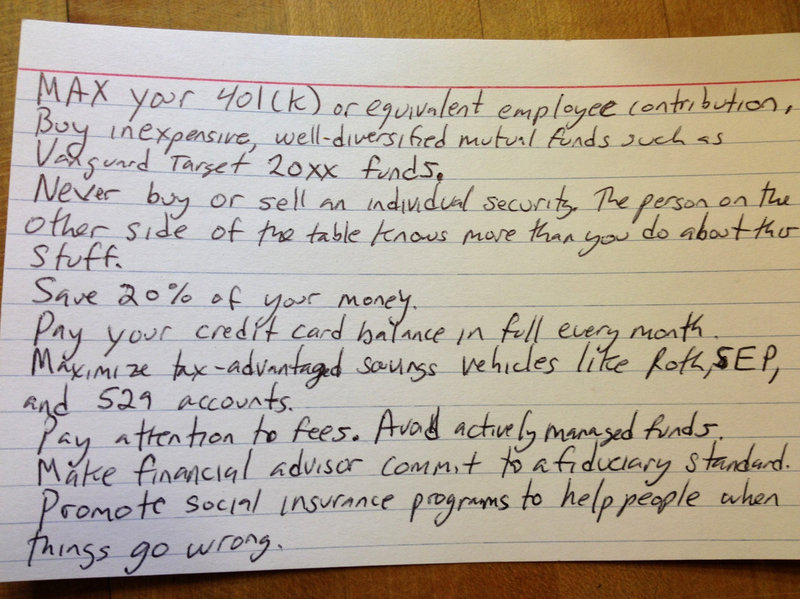

“Since I was speaking metaphorically, I was kind of stuck,” Pollack says. “But I just took one of my daughter’s index cards and I scribbled a bunch of principles, and I took a picture with my iPhone and I posted it on the Web.”

The index card got into Google’s news results. It got into big newspapers. Famous economists tweeted about it. Self-help sites like Lifehacker mentioned it.

In short, it went viral.

The original index card follows:

- Max your 401(k) or equivalent employee contribution.

- Buy inexpensive, well-diversified mutual funds such as Vanguard Target 20xx funds. We will cover mutual funds, their expenses, and the importance of diversification in the final lecture about stocks.

- Never buy or sell an individual security. The person on the other side of the table knows more than you do about this stuff. We will explain why this is true when we cover the efficient market hypothesis. Some students may disagree with this advice, and that is fine!

- Save 20% of your money.

- Pay your credit card balance in full every month.

- Maximize tax-advantaged savings vehicles like Roth, SEP and 529 accounts.

- Pay attention to fees. Avoid actively managed funds.

- Make financial advisors commit to the fiduciary standard.

- Promote social insurance programs to help people when things go wrong.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.