✏️ Tax exempt bond examples

To keep things simple, I’ll use some abbreviations on this page.

- For the return on a corporate bond or any other taxable bond, I’ll write .

- For the return on a tax-free municipal bond, I’ll write .

- For your Marginal Tax Rate, I’ll write .

To calculate your after-tax return, you multiply your return by (). For example, if and a corporate bond has a return of , then it’s after tax rate is .

A municipal bond with a return of will incur no tax liability, so it will have exactly the same after-tax return. We say it has an equivalent yield.

The calculations to verify this are illustrated in the following slide:

Three Types of “Tax-Equivalent” Problems

There are basically three types of “Tax-Equivalent Calculation Problems” that can be asked.

We basically have one equation for tax equivalent bonds:

Or, more concisely:

There are three variables in this equation, so there are basically three different types of questions that he can ask with this using algebra. Generally, he will tell you the values of the two of the variables and then ask you the third.

If you can do these three problems and understand the material in the slides, then I think you have the key ideas you need for this topic.

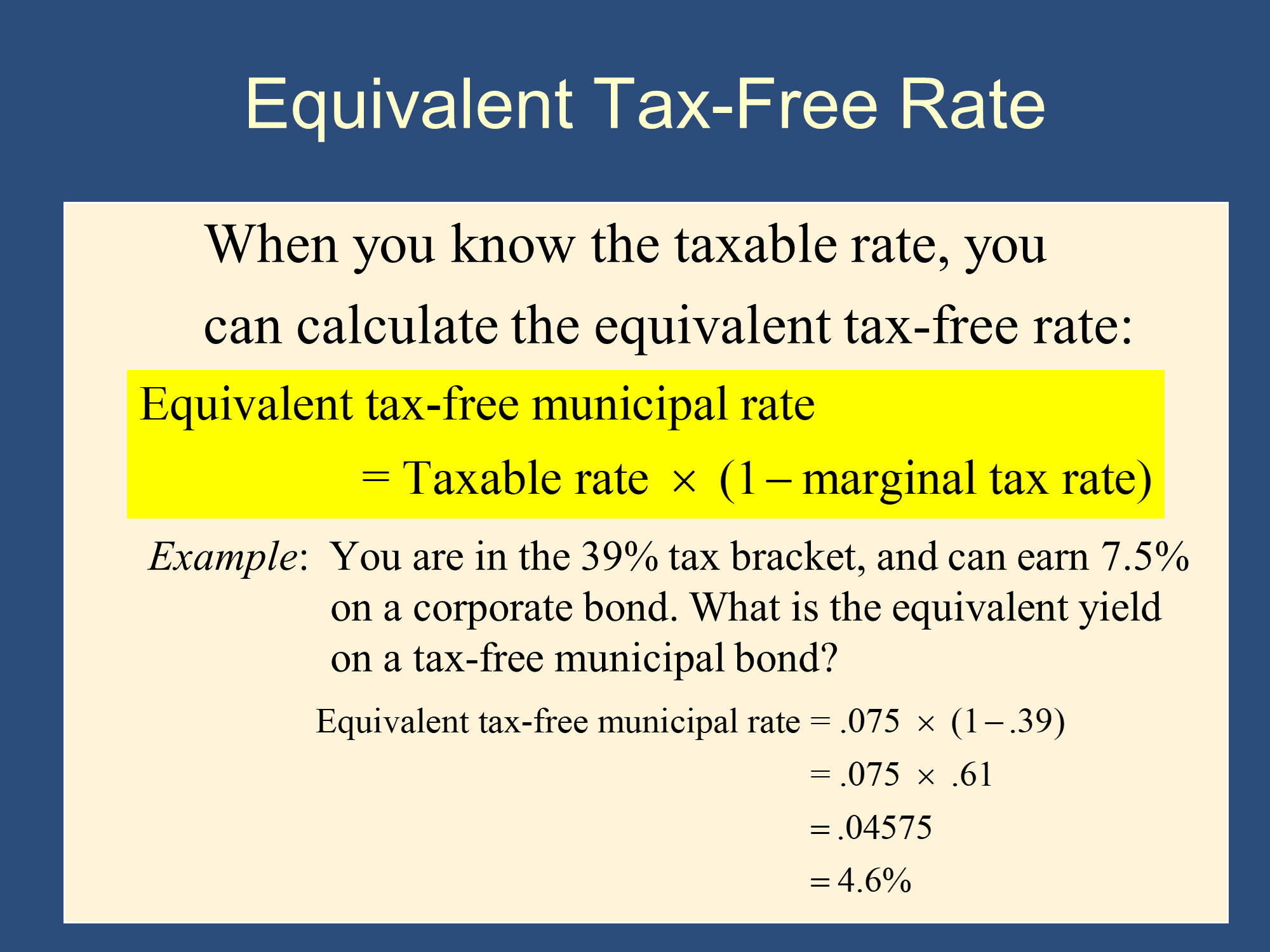

Type I: Given , find the equivalent muni rate.

This is the “vanilla” type of problem, where you just put the numbers in the equation and the answer pops out.

✏️ You are considering switching some of your portfolio from taxable bonds to munis. (“Muni” is common jargon for “municipal bond.“) You are currently invested in a taxable bond fund with an return of . You have a tax rate of . What is the minimum return () you should be looking for in muni funds? If you find a muni you think will earn , should you make the switch?

✔ Click here to view answer

Just plug it in:

Any muni or mutual fund of munis with a return higher than will give you a better after-tax return than your current taxable bond fund.

You should consider making the switch to the muni because it will have a higher after tax return. You should also consider other factors such as the relative riskiness of the muni (ie credit rating, etc.) and whether you could sell it quickly for a good price if you needed to (ie the liquidity of the muni).

Type II: Given , find the equivalent taxable rate

This type and the next type involve a little algebra. I call this type of algebra “Plug and Chug.”

✏️ You are selling muni bonds and you want to find an equivalent corporate interest rate that your muni is equivalent to. The muni offers a return of and you are targeting people with an effective tax rate of . What corporate rate would your bond be equivalent to.

✔ Click here to view answer

In this case, we’ll need to do a tiny bit of algebra. I call it “plug and chug:”

Plug and chug: (help)

- Equation:

- Plug:🔌

- Solve: 🚂

- Reflect: 🧠

If someone is receiving less than on a corporate or other taxable bond, you can claim that your bond is better.

In the previous question, we solved for to find the equivalent taxable rate. We can do the same algebra on the general formula to get a shortcut formula on this type of problem:

Type III: Find MTR to make and equivalent

✏️ You are selling munis with a return of and similar taxable bonds are returning . What do people’s tax rates need to be to make the munis more attractive. In other words, what would make these equivalent?

✔ Click here to view answer

In this case, we need to find the tax rate that make the corporate and muni bonds equivalent. For anyone in a higher tax bracket, they will prefer the muni. For anyone in a lower tax bracket, they will prefer the corporate.

Once again, we plug and chug:

Plug and chug: (help)

- Equation:

- Plug:🔌

- Solve: 🚂

(divide both sides by )

- Reflect: 🧠

The cutoff is . Anyone below that tax rate will prefer the corporate. Anyone above that tax rate will prefer the muni.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.