✏️ Strategy Example

✏️ Suppose you have purchased a TSLA bull spread with strike prices at $190 and $200. List the profit or loss at 5 differ ent stock prices. Make sure to include a price at which the P/L reaches its maximum, minimum, and break-even point.

| S= | 150 | 170 | 190 | 210 | 230 |

|---|---|---|---|---|---|

| Profit/Loss for the Straddle |

Suppose that you have previously determined that the premium for the $190 call is $14 and the premium for the $200 call is $8.

✔ Click here to view answer

We go to: L12 Notes → Bull Spread

We find the following information.

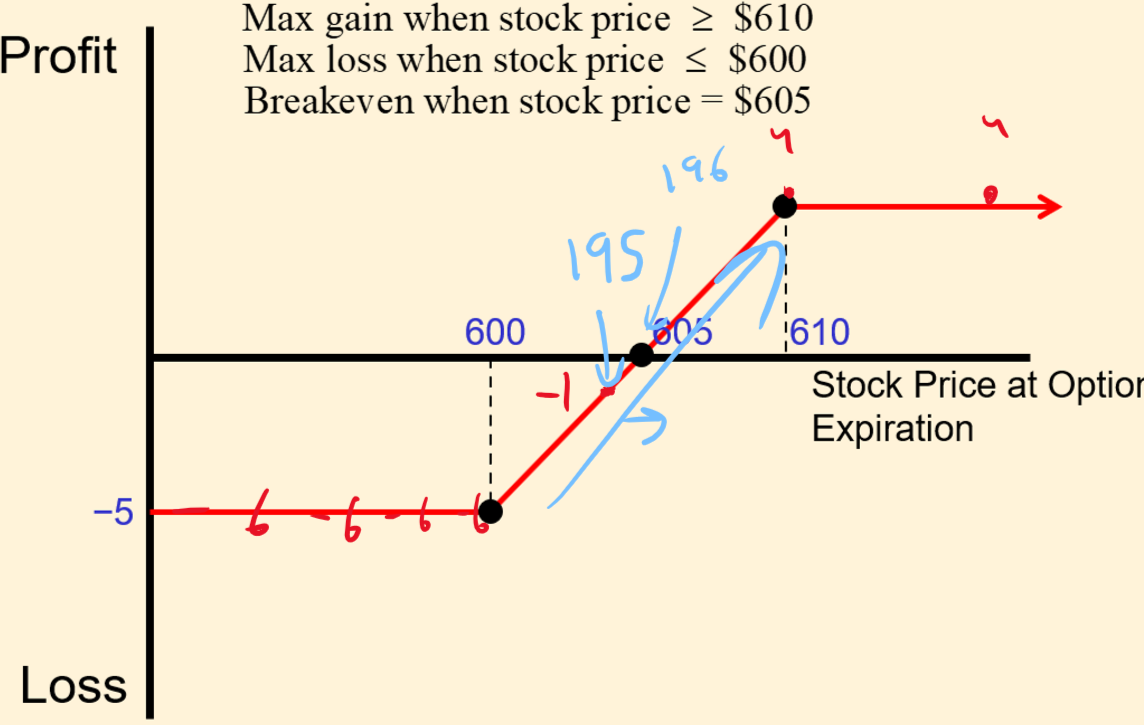

Bull Spread:

A cheap, low risk bet that S will be relatively high.

🖱️To purchase one, you buy and sell call options on the same stock but with different strike prices. For the following bull spread, you:

- Buy the $600 call The lower strike price is for the long call.

- Sell the $610 call

💵 With it:

- you make $5 if S is above $610, but

- you lose $5 if S is below $600.

- A bull spread is made of a long call and a short call with different strike prices. The strike prices match the two kinks in the diagram. The lower strike price is for the long call.

- Putting this together, we will buy the $190 call and sell/write the $200 call

| S= | 0 | 185 | 190 | 195 | 196 | 200 | 205 |

|---|---|---|---|---|---|---|---|

long/buy $190 call @$14 | -$14 | -$14 | -$14 | -$9 | -$8 | -$4 | $1 |

| short/writing $200 call @$8 | $8 | $8 | $8 | $8 | $8 | $8 | $8-$5=$3 |

| Profit/Loss for the Bull Spread | -$6 | -$6 | -$6 | -$1 | $0 | $4 | $4 |

- I chose to include S=$0 because it’s an interesting what happens if TSLA goes to $0.

- I chose 26 because it is below the lower strike price.

- I chose 28 because it is the lower strike price.

- -I chose 28.5 because it is between the strike prices and I’m hoping it will be the breakeven point.

- I chose 29 because it is the higher strike price

- I chose 30 because it is higher than the higher strike price.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.