✏️ Classic OMO problem

Be able to do this:

According to 📰 The open market desk, on Jan 02, 2020, the Fed Purchased $53.8M of Treasuries from NatWest Markets:

| Trade date | Settlement date (T+1) | Transaction category | Face Value (in $M) | Issuer | Coupon & Maturity | CUSIP Security ID Number | Price per $100 of face value | Accrued interest (in $) | Par Amount *Price/100 + Accrued | Total amount (in $M) | Counterparty |

| Jan 02 2020 | Jan 03 2020 | Purchase | 50.0 | TSY | 02.875 | 912828Y79 | 106.28906250 | 609,375.00 | 53.75 | 53.8 | NatWest Markets Securities Inc. |

In an ample reserve regime like we have today, the Fed does OMOs as quantitive easing or just to ensure that reseves remain ample. Reserves had gotten tight in late 2019, so this open market operation was likely done simply to add more reserves into the market.

However, lets suppose that the Fed did a similar open market operation back in 2005, when reserves were limited.

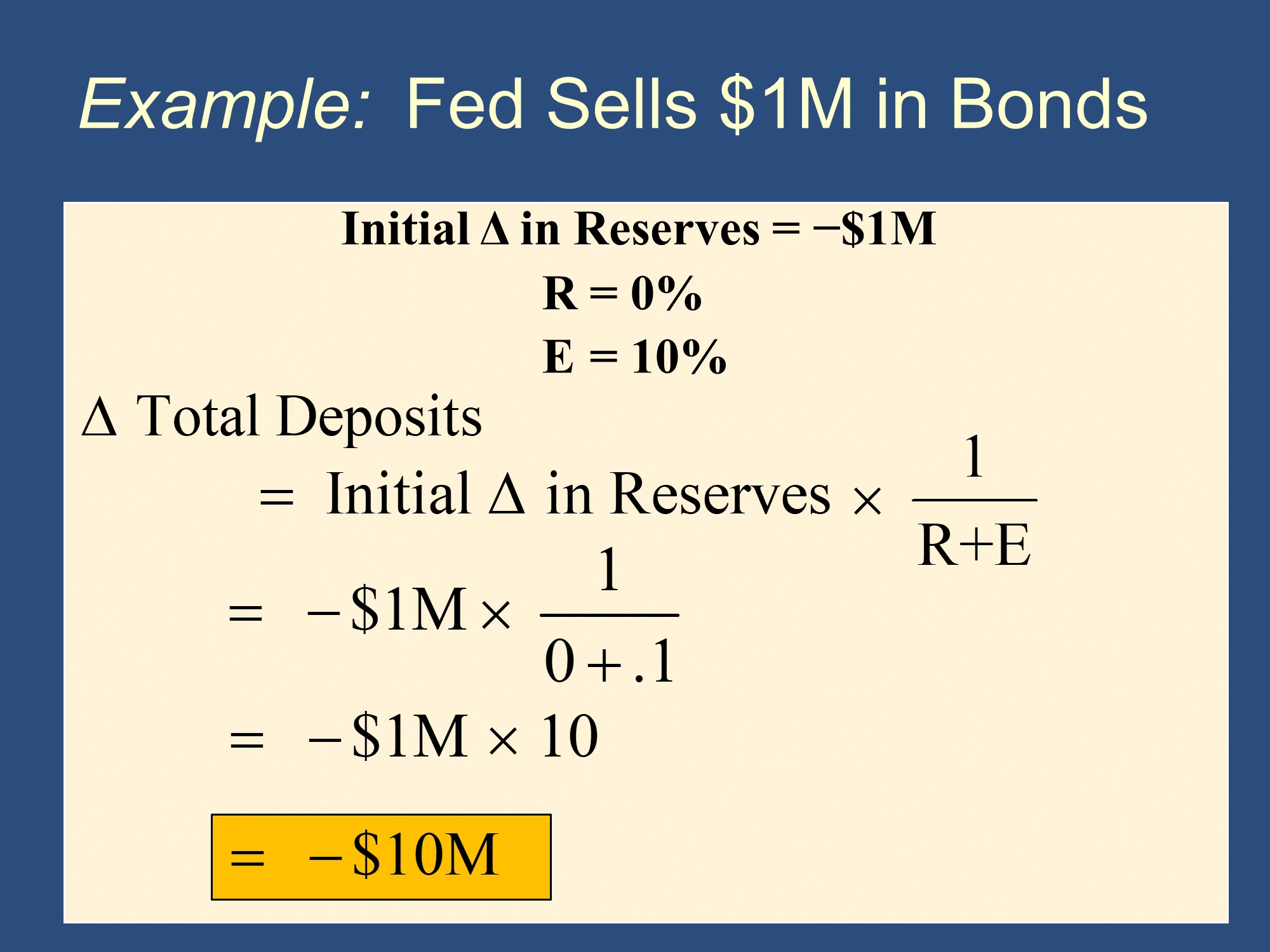

❔ Suppose that the Fed purchased $53.8 million of treasuries in 2005. Once the complete money multiplier process has played out, what will the change in the money supply be? Assume that R=10% and E=2.5%. Is this expansionary or contractionary monetary policy? What will happen to interest rates, unemployment, and the economy?

✔ Click here to view answer

$430.4M of deposits will be created after the money multiplier process plays out.

The money multiplier process will play out, as the lent money is spent and deposited.

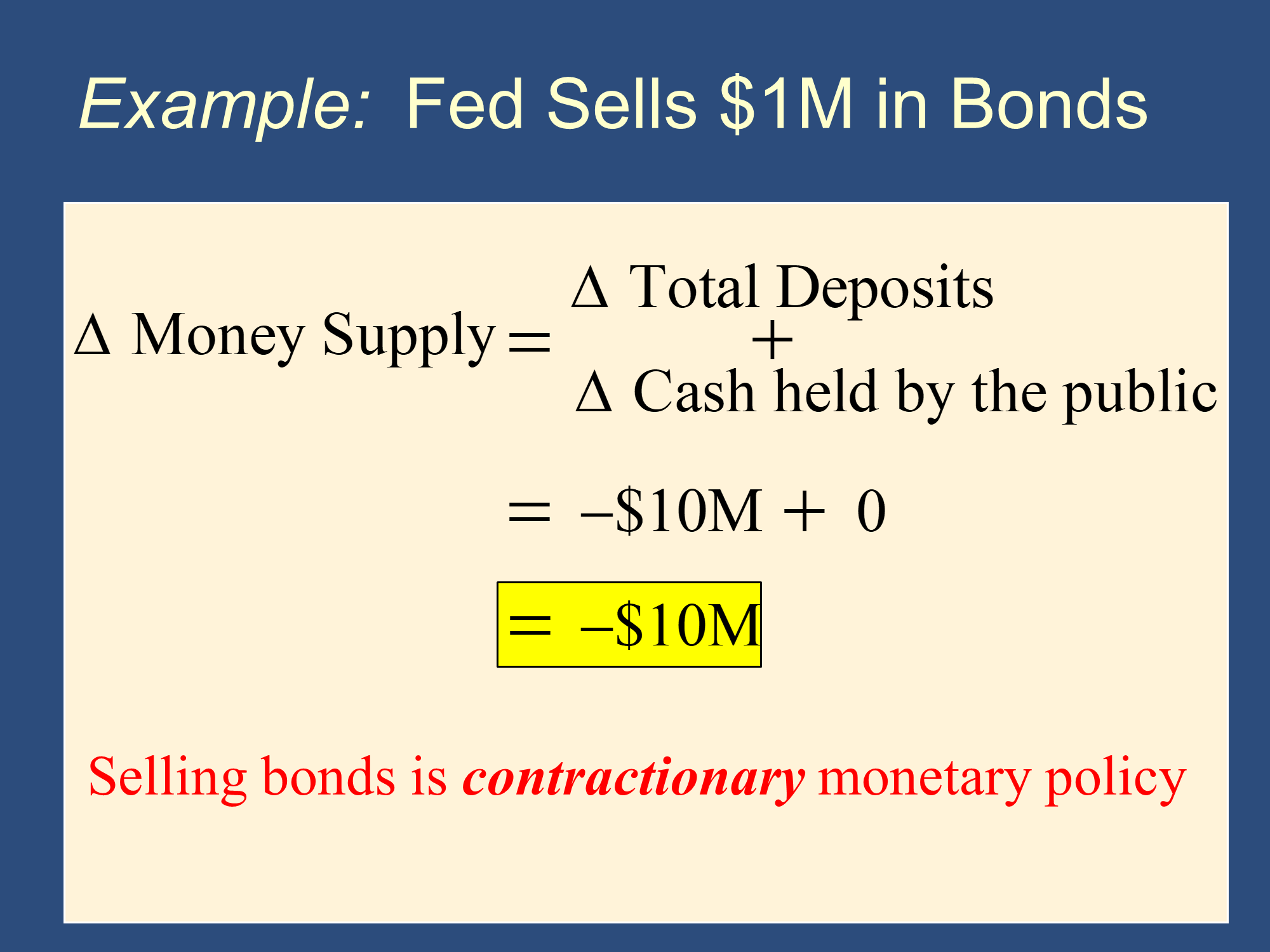

This is Expansionary monetary policy because the money supply increased. Interest rates will fall, causing the economy to expand and unemployment to fall. (On an exam, he would likely want you to explain this with a diagram, so read the question carefully.)

✏️ Redo the problem, but with the Fed had selling the bonds instead of purchased them.

[Hint: you’ll do the same math, but with ]

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.