🔎 Most important topics from this lecture

In all of Bruce’s classes, any idea presented during lecture is considered “fair game” on the exam. While that may sound like a lot of work, the good news is that you are only responsible for what he covers in lecture.

So, if all ideas are “fair game,” how can these topics be “Most important?”

They are especially important because they will be referred to heavily in the following two lectures. Studying them now ensures that everything goes smoothly when you watch those lectures.

The next two lectures will focus on how the Fed plays a massive role in the economy by changing the money supply. The main way that the Fed controls the money supply is by adjusting the amount of bank reserves in the economy.

We will see how it does this next lecture. For right now all you need to focus on is the definitions of the money supply and bank reserves. These two topics were defined this lecture and their definitions will be vital during the next two lectures. It is a very smart move to carefully study them today. Even memorizing them is a good idea.

Money Supply

Definition of the Money Supply

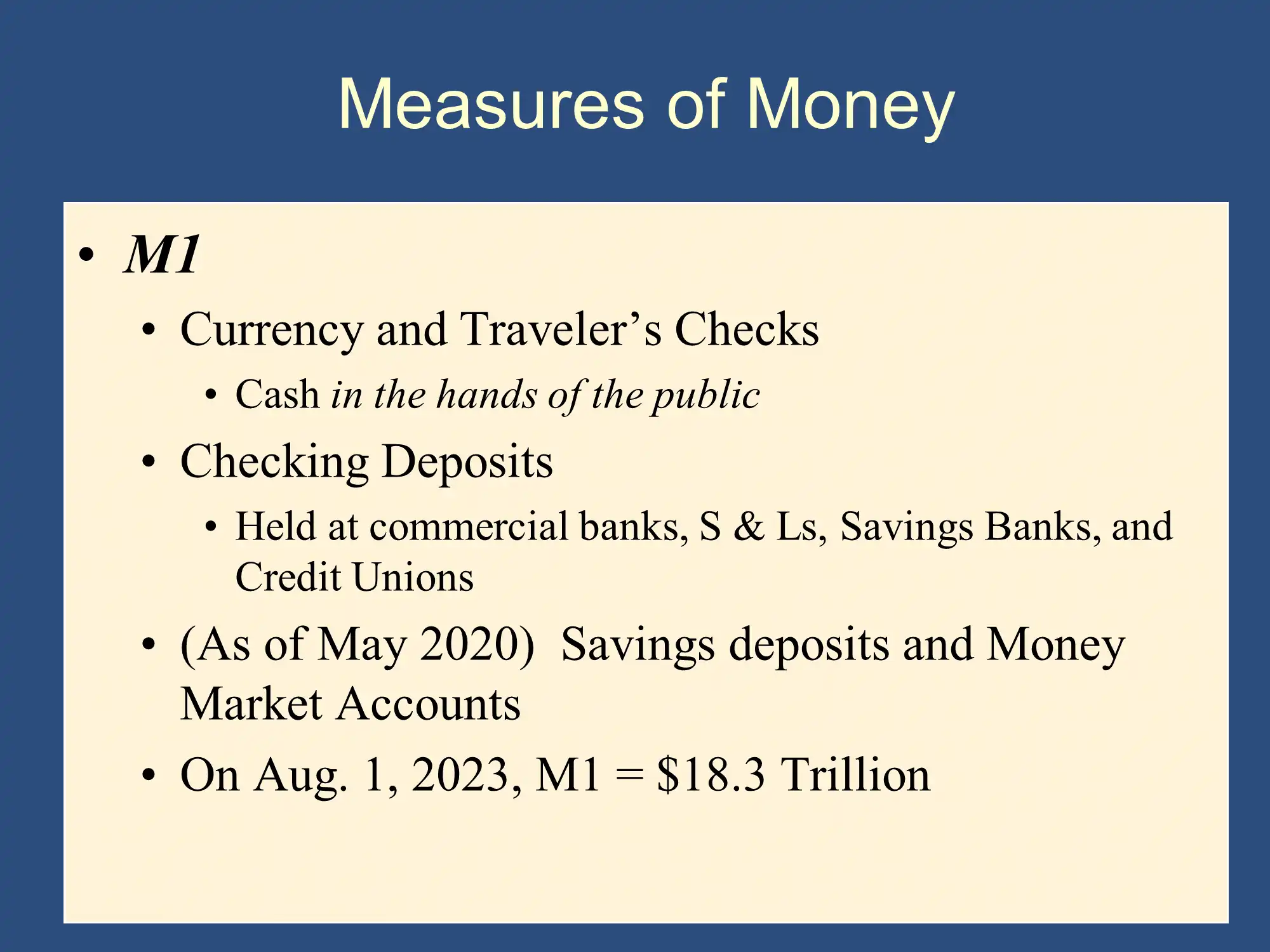

If Bruce asks you what the Money Supply is, refer to this slide:

The amount of money in the US is called the “Money Supply” or the “Money Stock.” There are two measures of the money supply published by the Federal Reserve System: M1 and M2. M1 is the number that we will focus on in this class.

This slide says that the M1 money supply is made up of two components:

- Cash in the Hands of the Public (ie Cash and Traveler’s Checks held by the public).

- Checking Deposits

We can summarize this with the following equation:

Money Supply = Cash in the Hands of the Public + Deposits

I typically abbreviate this with acronyms:

MS = CHP + Deposits

Changes in the Money Supply

If the Money Supply is just CHP + Deposits, then if the money supply changes, it must be because CHP and/or Deposits change. In fact, mathematically speaking the total change in the Money Supply must equal the change in CHP plus the change in Deposits.

As an equation:

Change in MS = Change in CHP + Change in Deposits

In equations, we abbreviate “Change in” using a capital Greek letter Delta: Δ. Therefore, the equation becomes:

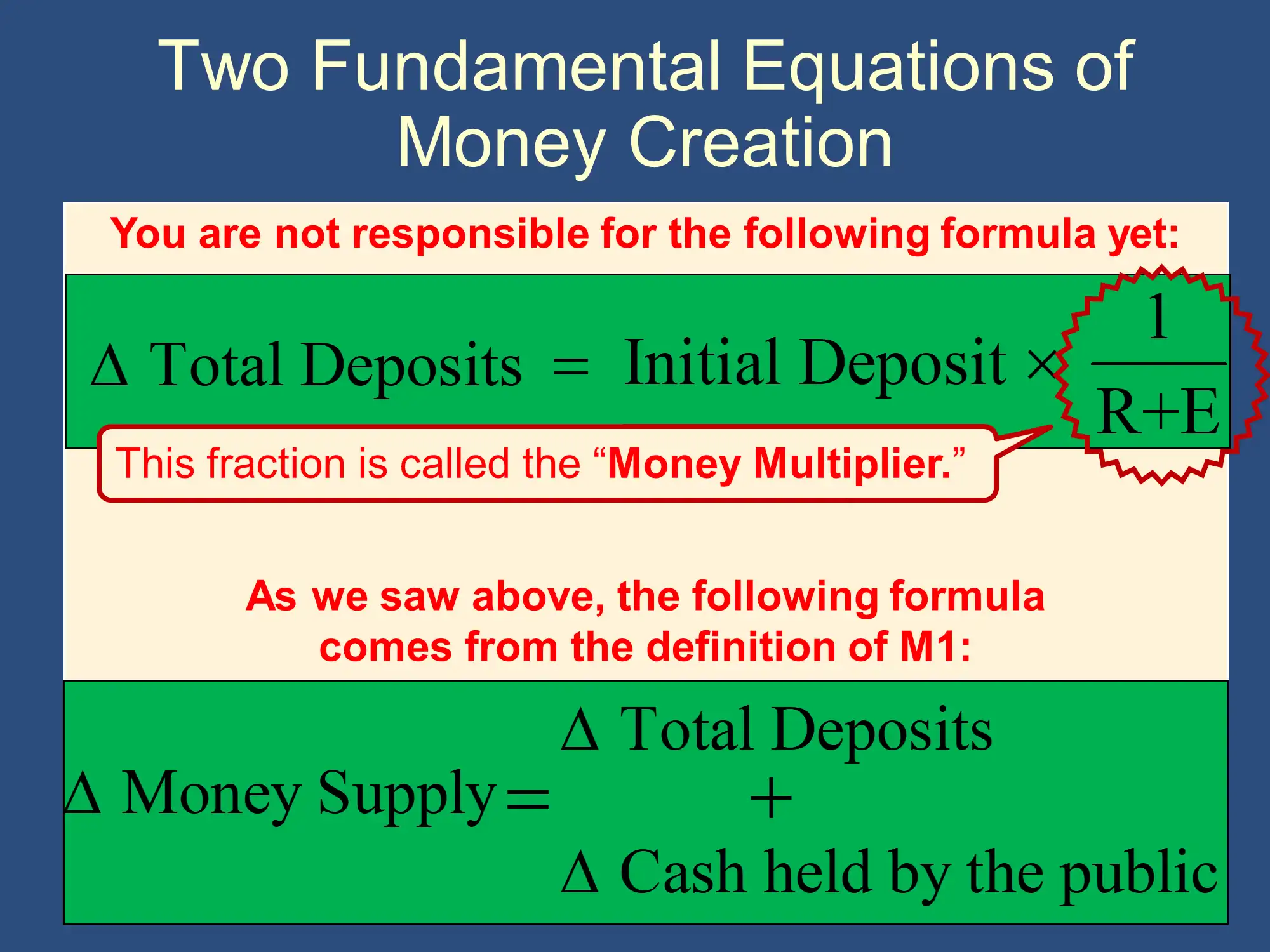

ΔMS = ΔCHP + ΔDepositsThe above formula will be very important in the following two lectures. Bruce refers to it as one of the “Two Fundamental Equations of Money Creation.” That name may sound intimidating, but as we can see, it is a simple consequence of the definition of the money supply!

The most important slide in the next lecture

While we are on the topic of the “Two Fundamental Equations of Money Creation,” including ΔMS = ΔCHP + ΔDeposits, the slide that introduces them is the most important slide in the next lecture, so it’s worth keeping an eye out for it. The slide encapsulates the “Money Multiplier,” which is the most important topic in the next two lectures.

NOTE: You are not responsible for this topic now. Bruce will introduce it during the next lecture. I’m just saying to keep an eye out for it.

Anyway, here’s the big slide to look out for:

I encourage you to pay special attention when he starts talking about the Money Multiplier.

Reserves

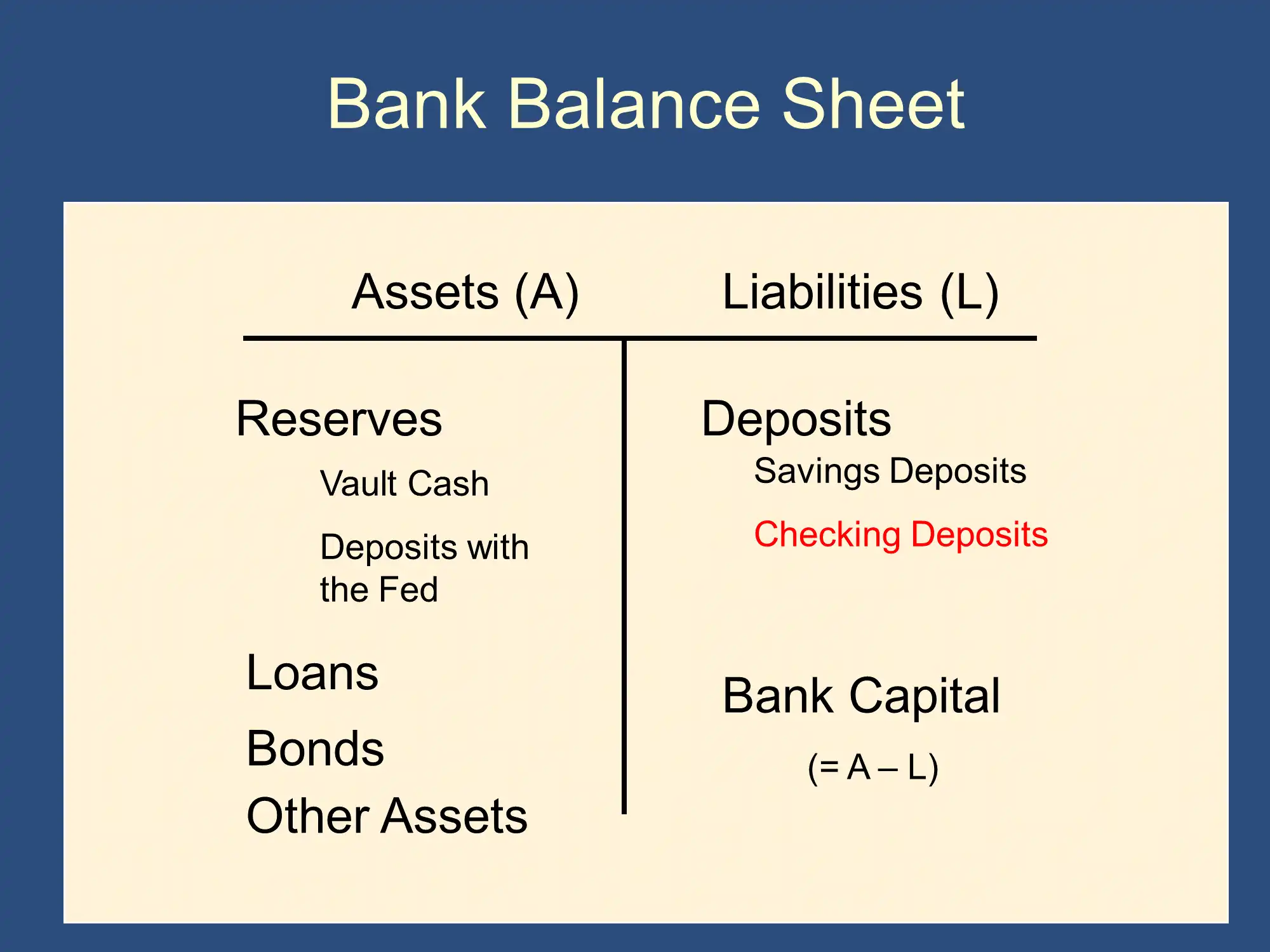

The bank’s most liquid assets are called its “reserves.” These are funds that the bank keeps on hand in case it needs money immediately.

Banks can keep the reserves in two forms: vault cash and deposits at the Central Bank. Vault cash is physical currency that the bank has in its vaults, ATM system, teller drawers, etc. The bulk of a bank’s reserves, however, are held as Deposits at the Central Bank. In the US, the central bank is called the Federal Reserve, so we will often call these Deposits at the Fed, as Bruce has done in the slide, above.

Just as you have a checking account at personal bank, your bank has a checking account at a government controlled bank called the “Central Bank.” The deposit account at the central bank functions just like your checking deposit account:

- If you have more cash on hand than you need, you can deposit it in your checking account at your bank for safe keeping.

- Similarly, if your bank has more currency on hand than it needs, it can pack that money into an armored car and deposit it at its central bank for safekeeping. This deposited money becomes Deposits at the Central Bank.

- If you have a quick need for cash, you can withdraw some money from your checking account via an ATM.

- Similarly, if your bank needs more currency than it has, it can withdraw some currency from its account at the Central Bank. The central bank will send it an armored car containing the currency.

- If you need to pay someone, you can write a check to them. A check is an order to your bank to transfer funds from your account to the other person’s account.

- Similarly, if your bank needs to pay another bank, it can instruct the central bank to transfer funds from its deposit account to the other bank’s deposit account. This means that the recipient bank can the withdraw the new funds from their account as currency, or it can use the funds to make payments to a third bank. Banks need to make payments to other banks all of the time (for example, when a check is cleared), so this is very valuable!

In summary, just as you keep funds that you might need to spend either as currency or as deposits in your checking account, banks keep funds that they need ready access to (reserves) either as vault cash or as deposits at the central bank.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.