👨🏫 Notes

Formulas for this lecture can be found in my paper formula sheets and online formula sheet.

Formulas for this lecture can be found in the formula sheet.

Glossary for the Secondary Market

ECNs: Private computer networks that directly link buyers with sellers for automated/very fast order execution over multiple exchanges (connect investors).

Algorithmic Trading: The use of computer programs to make trading decisions (done by investors)

High-Frequency Trading: Special class of algorithmic with very short order execution time (done by investors)

Dark Pools: Trading venues that preserve anonymity, mainly relevant in block trading (connecting investors)

Pros of ECNs: (Additional background for context is given in grey. You don’t need to know beyond what Bruce said in lecture, but the grey text can provide context.)

- Transparent (unlike dark pools) because everyone can see unfilled orders (because everyone can see supply and demand for the shares, this helps with “price discovery” - finding the fair price for the shares).

- Pro: Cost reduction because with many buyers and sellers having direct access to the market, there is a smaller “spread” between the “bid” and “ask” price (the bid is how much it costs to sell the stock and the ask is how much it costs to buy it).

- Pro: faster execution

- Pro: after-hours trading (the main markets are open 9:30 AM ET to 4:00 PM ET, but ECNs have extended this).

Cons of ECNs:

- Con: Don’t work as well with thinly-traded stocks

- Con: Many ECNs are competing for volume, so the market becomes fragmented/complex.

The Jargon Slide

Selling Short means borrowing shares from your broker and then selling them. You hope that the share price will go down, so you can buy identical shares back at a lower price and return the new shares to your broker. (Note that because you borrowed shares, you must return shares at the end of the borrowing period.) If the stock price goes up, you will have to buy back the shares at a higher price, losing money. In summary, if the stock price goes up, you lose money, but if the stock price goes down, you profit. Therefore, selling short is a bet that the stock price will go down.

Profit for selling short = Psold - Pbuy back. For example, you borrow shares, sell them for $10 and hope the shares decline in price, so you can buy them back for $8, thereby making a $10-$8=$2 profit per share.

Buying on Margin means purchasing shares with money you’ve borrowed from your broker. To buy or sell stocks or other securities such as options, you must set up an account with a brokerage firm such as eTrade or Fidelity. When you create your account, you can set up a “margin” account that is a bit like a credit card that allows you to buy stocks using money borrowed from the brokerage.

An example may help. Suppose you have an eTrade account, and your only asset in it is shares of Microsoft worth $30,000. While you don’t have any cash in the account, you want to buy some shares of AMC. You may be able to borrow $20,000 from your broker to buy the shares of AMC “on margin.” If the shares of AMC decline in value and are only worth $10,000, then your broker can give you a “margin call.” This means that you must either deposit more money in your account or the broker will call in their loan, selling the $10,000 of AMC and an additional $10,000 of Microsoft so you can pay back the money you owe. Essentially, all of the other assets you have in the brokerage account can be used as collateral to secure the money that you borrowed to purchase AMC.

Needless to say, this is considered a very risky strategy, and most financial planners do not recommend it. We will talk much more about margin when we cover Futures.

Limit Orders

- A limit buy order is an order to buy a stock, but only at a price that is “low enough” - below some maximum limit price that you choose.

- A limit sell order is an order to sell the stock, but only at a price that is “high enough” - above some limit price.

You want the best price, after all! See also: 🔎 Limit orders and how modern markets actually work

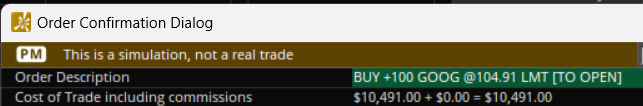

The following is a limit buy order: (I said I wasn’t willing to pay more than $104.91 per share for 100 shares)

If you don’t choose to set a limit, then it is known as a “Market Order,” because your broker will just try to find the best price they can on the Market.

Stop-Loss Orders are instruction to sell a stock if the price of the stock gets too low. More precisely, they are instructions to submit a market sell order when the price goes beyond a certain “trigger” level. This is explained at the bottom of the following page: 🔎 Limit orders and how modern markets actually work

Investment Companies

📰 My opinion: Conventional Mutual Funds and ETFs are likely the best way for most people to invest. By owning a low-expense index mutual fund or a “Target Date Fund,” you can get cheap access to a very well diversified portfolio of stocks and/or bonds (this is not investment advice→talk to a suitably licensed professional for any investment advice).

You buy or sell an open-ended Mutual fund at their end-of-day Net Asset Value (NAV)

Net Asset Value = (Market Value of Assets - Liabilities)/Shares Outstanding

You can calculate your % return on a mutual fund using the following formula:

The above formula is just a shortcut for calculating the IRR of purchasing a share for and then selling it for after receiving distributions of and at the end of the year. As we saw with Bonds, most formulas to calculate the returns of various investments are just the IRR dressed up with a different name.

✏️ Suppose you purchase a mutual fund at a NAV of $40 per share. Over the course of a year, it’s NAV rises to $45. Along the way, it distributes $1 of Income and $2 of Capital Gains to its shareholders. What is your total return?

✔ Click here to view answer

Open-End vs. Closed-End Funds

In a closed-end fund , a fixed number of nonredeemable shares are sold at an initial offering and are then traded in the over-the-counter market like common stock. The market price of these shares is determined by supply and demand. The main determinant of the price is the value of the assets held by the funds. The market value of the shares may be above or below the value of the assets held by the fund, depending on the market’s assessment of how likely managers are to pick stocks that will increase fund value.

The problem with closed-end funds is that once shares have been sold, the fund cannot take in any more investment dollars. Thus, to grow the fund managers must start a whole new fund. The advantage of closed-end funds to managers is that investors cannot make withdrawals. Therefore, managers don’t have to worry about having to redeem investors’ money. Unfortunately, this means that the only way investors have of getting money out of their investment in the fund is to sell shares.

Today, the closed-end fund has been largely replaced with the open-end fund . Investors can buy shares from the fund at any time. They simply transfer money to the fund and the fund uses that money to enlarge its portfolio and then creates new shares in the fund, giving those to the investor in return for the investor’s money. Likewise, investors can sell their mutual fund shares to the fund at any time. Each day the fund’s net asset value is computed based on the number of shares outstanding and the net assets of the fund. All shares bought and sold that day by the fund are traded at the same net asset value.

Open-end mutual funds have a several of advantages that have contributed their growth.

- Because the fund will buy or sell shares at any time, the investment is very liquid. As always, liquidity has great value to investors.

- The open-end structure allows mutual funds to grow unchecked. As long as investors want to put money into the fund, it can expand to accommodate them. For example, the Vanguard S&P 500 index fund has holdings of about $608 billion.

These advantages explain why 98% of all mutual fund dollars are invested in open-end funds.

Fee Structure

A mutual fund must always pay its own operating expenses from it’s available cash. In addition, there are fees that may affect your returns.

Originally, most shares of mutual funds were sold by brokers who received a commission for their efforts. These commissions are called loads . If a load is charged when you purchase the shares, it is a front-end load . If it is charged when you withdraw, it is a deferred load . Most loads are between 1% and 2%, but some exceed 6%. Funds that don’t charge a load are referred to as no-load funds . Typically, you purchase them directly from the mutual fund company (after all, they omit the sales commission). Many investors have realized that when the initial deposit is immediately reduced, it can take a long time to catch up to the returns offered by no-load funds. Currently about 55% of equity funds and 65% of bond funds are no load.

There are other fees as well. Notably 12b-1fees, are sometimes deducted from the fund’s assets to pay marketing and advertising expenses or, more commonly, to compensate sales professionals. By law, 12b-1 fees cannot exceed 1% of the fund’s average net assets per year.

Over the past 20 years, competition within the mutual fund industry has produced substantially lower costs. Between 1996 and 2020, the average total shareholder cost of equity and bond mutual funds decreased by more than 50%. One factor undoubtedly contributing to this reduction is the requirement by the SEC that mutual funds clearly disclose all fees and costs that investors will incur.

Regardless of whether a fund is organized as a closed- or an open-end fund, it will have the same basic organizational structure. The investors in the fund are the shareholders. In the same way that shareholders of corporations receive the residual income of a company, the shareholders of a mutual fund receive the earnings, after expenses, of the mutual fund.

The board of directors oversees the fund’s activities and sets policy. They are also responsible for appointing the investment adviser, usually a separate company, to manage the portfolio of investments and a principal underwriter, who sells the fund shares. SEC regulation requires that a majority of the directors be independent of the mutual fund.

The investment advisers manage the fund in accordance with the fund’s stated objectives and policies. The investment advisers actually pick the securities that will be held by the fund and make both buy and sell decisions. It is their expertise that determines the success of the fund.

In addition to the investment advisers, the fund will contract with other firms to provide additional services. These will include underwriters, transfer agents, and custodians. Contracts will also be arranged with an independent public accountant. Large funds may arrange for some of these functions to be done in-house, whereas other funds will use all outside companies. Figure 20.30 shows the organizational structure of a mutual fund.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.