🔎 The Textbook and Readings

Do I need to buy the textbook?

The textbook is a great reference work by an esteemed author and can help provide valuable background information on how the economic system works. With that said, of all of the courses that Bruce teaches, the match between what he covers and the textbook is the weakest in this class. Your time may be better spent going to sections and rewatching lectures. Going to sections and putting the time in to review the material in a proactive and structured manner will be more than enough.

With that said, some students find the textbook to be helpful. Finance is a language and the more you practice it, the more comfortable you get. Further, the first author of the textbook, Frederick Mishkin, is widely regarded as an expert in Monetary Policy and the Federal Reserve, having served as a member of the Federal Reserve’s Board of Governors. The question to ask is whether you feel you will use it. My perspective, as mentioned before, is that going to sections and putting the time in to review the material in a proactive and structured manner is what really matters.

Here is what Bruce has to say about the textbook in the syllabus:

Readings

Most of the readings listed in the Course Calendar below are from the textbook: Financial Markets and Institutions, 9th edition, by Frederic Mishkin and Stanley Eakins.

However - PLEASE NOTE: The book is not required!!

You will find that I don’t follow it closely at all. Many students have done perfectly well in the class without ever buying the book. Others find it useful to reinforce material we have covered, or to extend their knowledge of various subjects.

Some of the topics we cover do not appear in the book. Conversely, some of the reading listed below is for background, and will not be covered explicitly in class.

You should consider the textbook to be most useful as a reference, or as an additional source of review for material we have presented in class. You will not be responsible - on problem sets or exams - for material in the book that we have not covered in class. [This means that Bruce’s lectures and slides are the authoritative references for the class. —Rob]

If you have purchased the 8th edition, the international edition, or a used copy of an even earlier edition of Mishkin and Eakins, you should still find it useful. However, the page numbers given below refer to the latest, 9th, edition.

Relevant newspaper and magazine articles will also be placed on the “Readings” page of the course web site when relevant.

Can I purchase a different edition of the book?

You are welcome to get a different edition of the textbook to save money, but there are some caveats. Specifically, page numbers in the syllabus refer to the specific edition of the textbook that the syllabus mentions. If the syllabus gives chapter or chapter-and-section references, finding the corresponding section won’t be hard. I have also included some screenshots below that you can use to look up section names if Bruce only lists the page numbers in the syllabus. With that said, the current non-global edition will have more up-to-date statistics and examples.

Please note that the page numbers in the syllabus are for the standard version of the textbook, not the “Global Edition.” The global edition is designed to be sold in developing markets, but can sometimes be found on Amazon.

What about the non-textbook readings?

For some of the later lectures, Bruce has also listed several readings in the syllabus that are not included in the textbook. These readings can be downloaded from the “Suggested Readings” page of Canvas, found via the Modules page or the Home page.

When Bruce covers the Efficient Market Hypothesis after the midterm, he often makes a point of asking you to do specific readings on this topic. These readings often come up in the homework or the exams.

The extra readings for the first Options lecture are also exceptionally helpful because it takes a lot of practice to get comfortable thinking through options problems. They are important enough that the following page in this OneNote is devoted to them.

As we get closer to the times when we cover these topics, I will draw your attention to the corresponding readings.

Page # to Section # correspondence

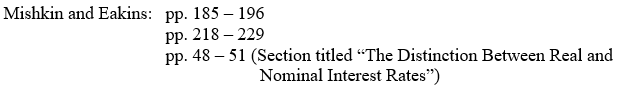

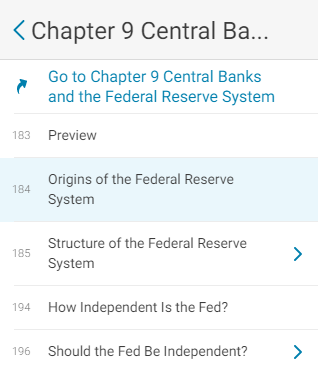

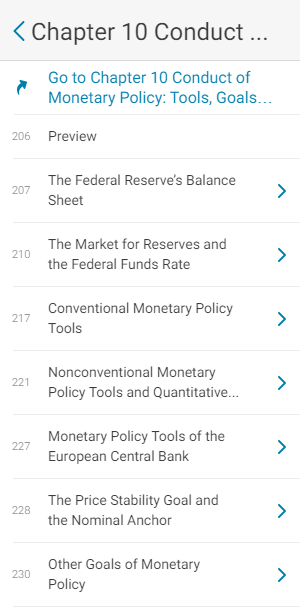

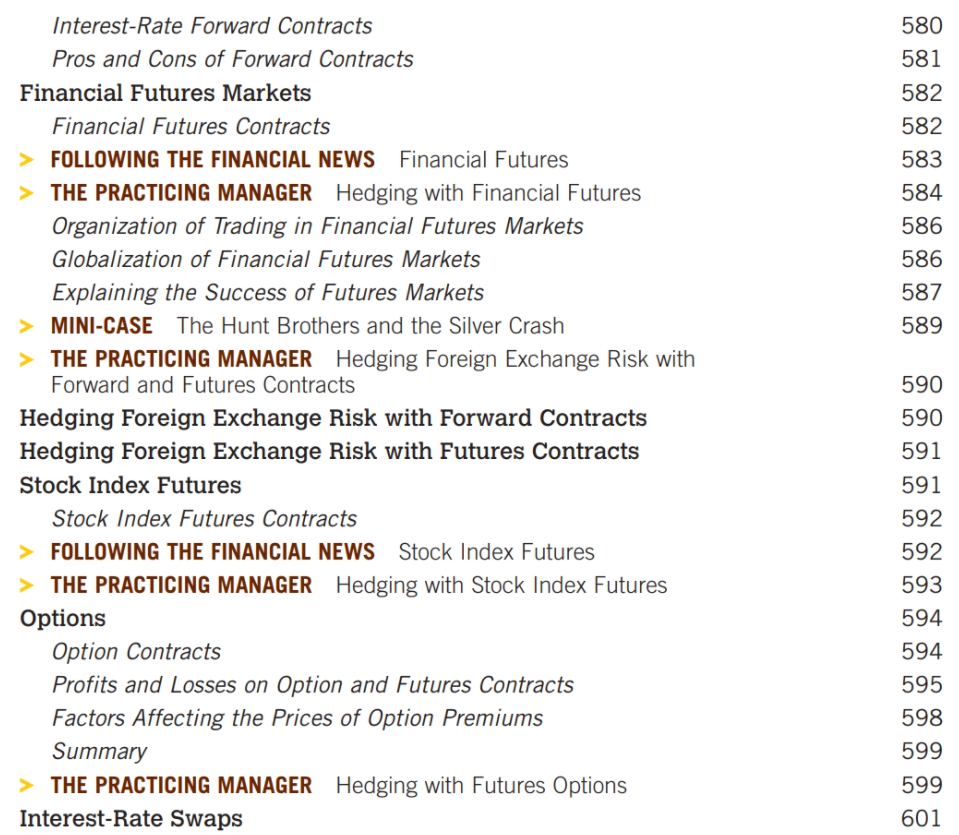

Prof. Watson occasionally includes page numbers in the syllabus rather than section numbers. If you have a different edition of the book, sometimes having the section numbers can help. The following screenshots may help.

From the lecture on the Federal Reserve System

Mishkin and Eakins: pp. 185 - 196, pp. 218 - 229

|  |

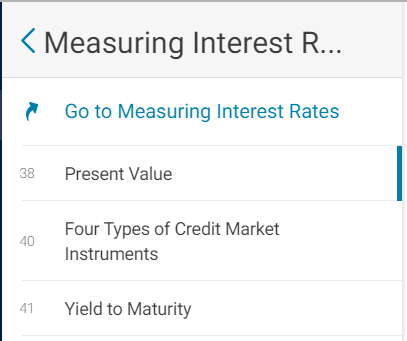

From the Lecture on Net Present Value and IRR

Mishkin and Eakins: pp. 38 - 39 (Section titled “Present Value”)

|  |

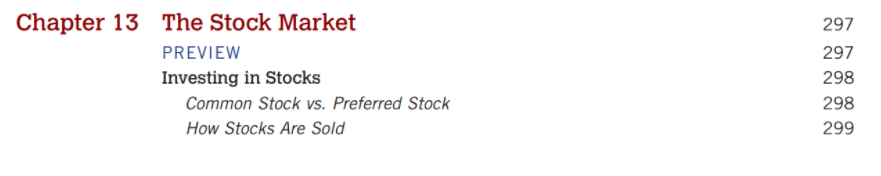

From the first lecture on the Stock Market

Mishkin and Eakins: pp. 534 - 540

Mishkin and Eakins: pp. 297 - 302

From the lecture on Mutual Funds and ETFs

The ETF section is part of the “How Stocks Are Sold” subsection.

Options: pp. 594 - 599 and Futures: pp. 582 - 593

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.