🙋 Student Q&A (Lecture 3)

Click here to learn about timestamps and my process for answering questions. Section agendas can be found here. Email office hour questions to rob.mgmte2000@gmail.com . PS1Q2=“Question 2 of Problem Set 1”

📅 Questions covered Saturday, Feb 15

🕣 3:11pm

❔ Interpretation on Q6. Asks about excess reserves even thought it asked us to push it to 0%.

✔ We’ll do a full review of how to interpret that question.

🕣 3:11pm

❔How to ask a good question.

✔ I need clear questions to demonstrate all of the great work that you’ve done to solve the question independently.

🕣 4:16pm

❔ Reserves - where do loans come out of?

✔

📅 Questions covered Tuesday, Feb 18

🕣 7:30 pm until 8:31pm

❔ interpretation

✔

🕣 8:24

❔ 5a include deposit.

✔ Just ignore Karen when you do 5a. Do the calculation based on the existing balance sheet.

🕣 8:32pm

❔ Order for fill in the blank questions.

How do you kick it off?

New questions & Same question but with different inputs

✔ We covered how to do this closer to the start when we discussed plug and chug as well as how to use equations when you are stuck.

🕣

❔ How do we tell if a bank is profitable?

✔ Look in the formula sheet. We covered profit on there. Profit was the change in bank capital.

🕣

❔ I have a question about the lender-savers portion of the last slide in the lecture presentation: how would you factor ‘insurance reserves’ in this taxonomy?

For context — insurance companies invest assets backing insurance reserves in a variety of financial products, which should be in the order of 1-2 trillion USD just in the US. Although a great portion of these funds are allocated to govies (at least that is the case here in Brazil), companies especially in the US are allowed to invest in a variety of asset classes, including corporate bonds and stock.

So Insurance Companies are clearly lenders, but are these reserves savings? Companies are required to keep reserves to comply with liquidity and solvency requirements and regulation that vary by country, so I would not personally consider these funds to be surplus capital.

✔ The short answer is that insurance companies are very important savers in the financial system. As you mention, they have massive savings. From the perspective of the financial system, they play a role similar to other savers. They purchase assets and make more money available for the borrower-spenders.

He will talk specifically about insurance companies in the second lecture when he discusses contractual savings institutions.

🕣

❔ In the financial crisis how did assets drop? Was it default or decrease in home value?

✔

🕣 7:54pm

❔ Are required reserves the same amounts as fed deposits? Or can those numbers be different? (For example, can you have more money in fed deposits than the required reserved ratio?) Are excess reserves the same as vault cash? Does reserve ratio always equal the amount in the fed deposit or capital bank deposit? (can there be more money in the fed reserve than r x deposit?)

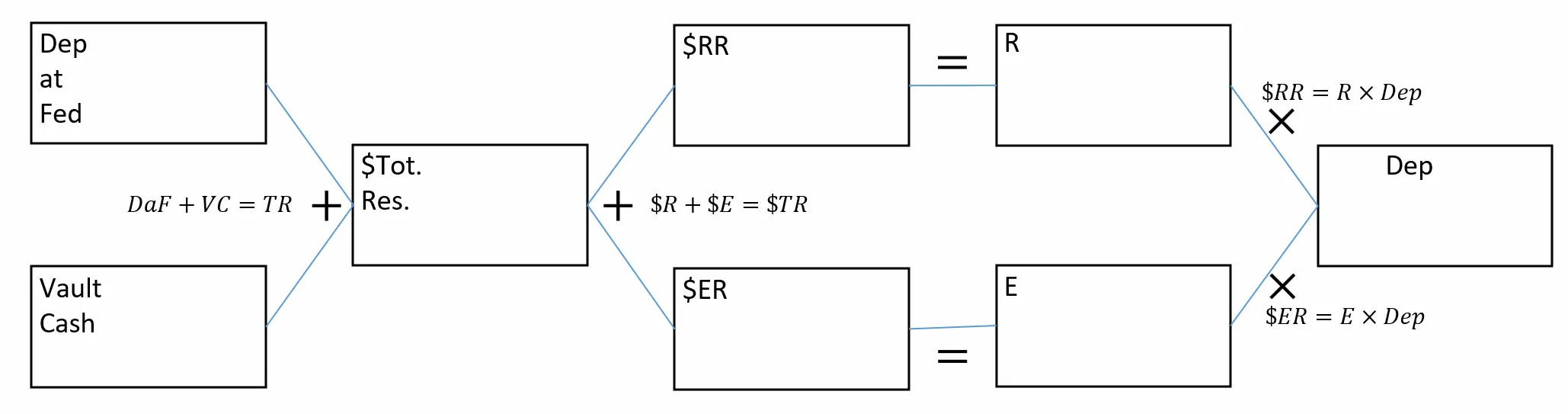

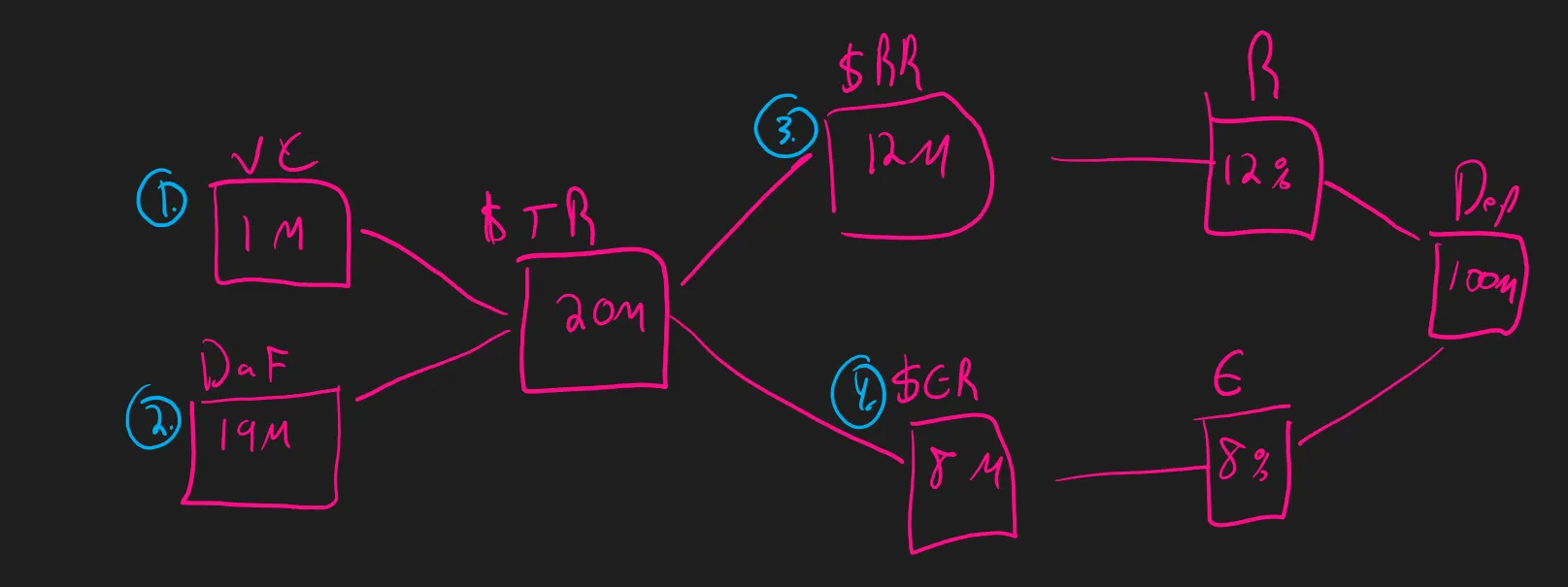

✔ The short answer is that required reserves are not the same as fed deposits and that excessive reserves are not the same as vault cash. Vault cash and deposits at the Fed (ie Deposits at the Central Bank) are just two equivalent ways that a bank can hold reserves. They are equivalent in that both VC and DaF legally count as reserves. They don’t have any direct connection to excess or required reserves.

✔

To be incompliance with the law,

Vault Cash + $Deposits at Fed = $Total Reserves ≥ $Required Reserves = R×Deposits

Finally, regarding reserve ratio and deposits at the fed, banks can have as much money as they want in their deposit accounts at the fed. The only legal limitation is that when you add up vault cash and deposits at the fed, the total must be more than the dollar amount of required reserves. In other words, as long as the following is true, the bank can do whatever it wants: vault cash + deposits at the fed ≥ deposits × R

You can use the following diagram to keep the numbers straight when solving for R and/or E

🕣 8:08

❔ Does question 3b imply that Deposits at the Fed or Reserves can’t change?

✔ No. The only thing that can’t change is VC.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.