🔎 Introduction to Futures Margins

A futures contract is like a bet. With any bet, you want to be sure that your counterparty can pay you back. With futures, this is enforced by the exchange requiring you to put a certain amount of money up in a margin account.

The money in a margin account is your money, just like the money in a deposit account is your money. However, if the trade goes against you, they may require you to deposit more money into the account. This is known as a “Margin Call.”

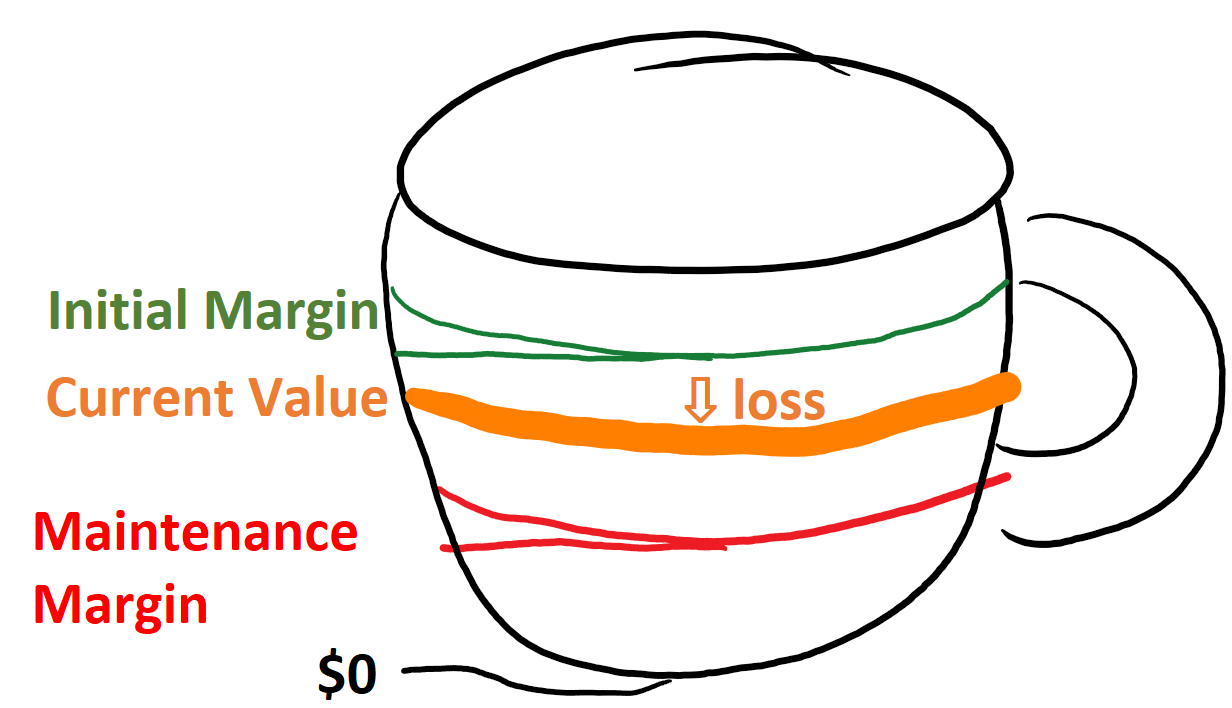

The two terms you need to know for your margin account are “Initial Margin” and “Maintenance Margin.” To understand these concepts, I think it’s helpful to think of your margin account like a coffee cup.

As you can see from the diagram below, initial margin is higher than the maintenance margin.

When you first start out a futures trade, the exchange will force you to fill up your margin account up to the green, “initial margin” level. This reassures them that you can and will pay if the trade goes against you.

As the trading days pass, every day that the trade goes against you, they will remove money from the margin account. This is known as “marking to market.”

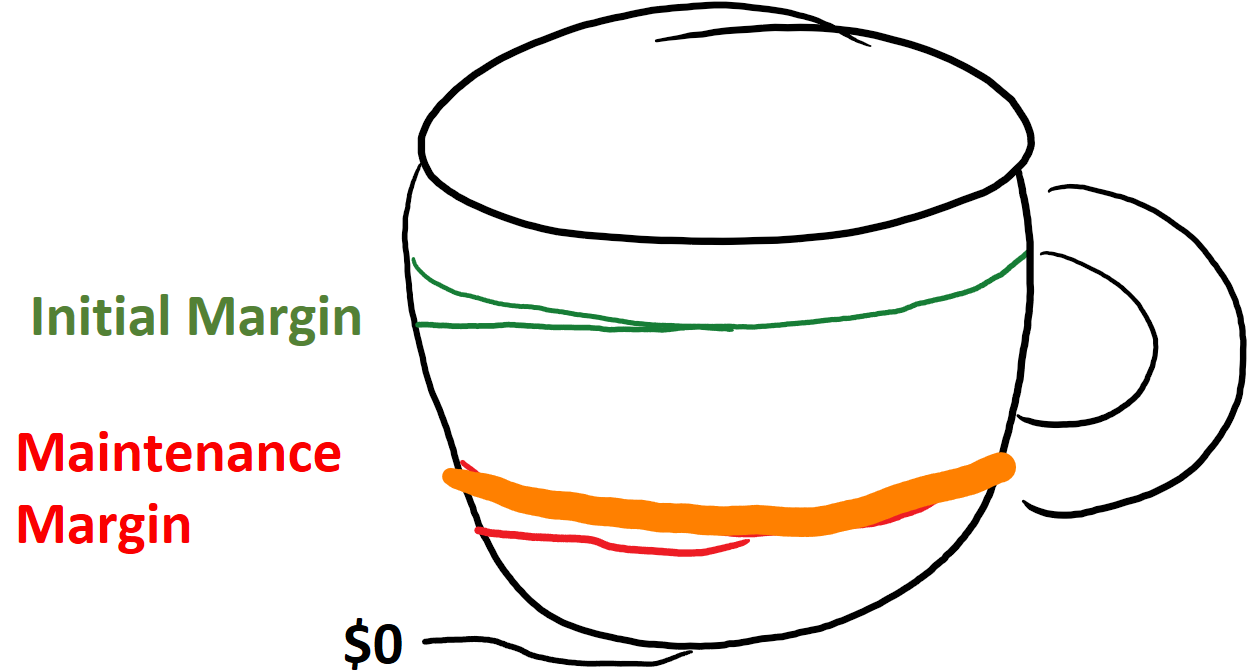

If they remove so much money from your margin account that the level of money in the account falls to the level of the maintenance margin ③→, then you you get a “margin call” because you don’t have enough money in your margin account.

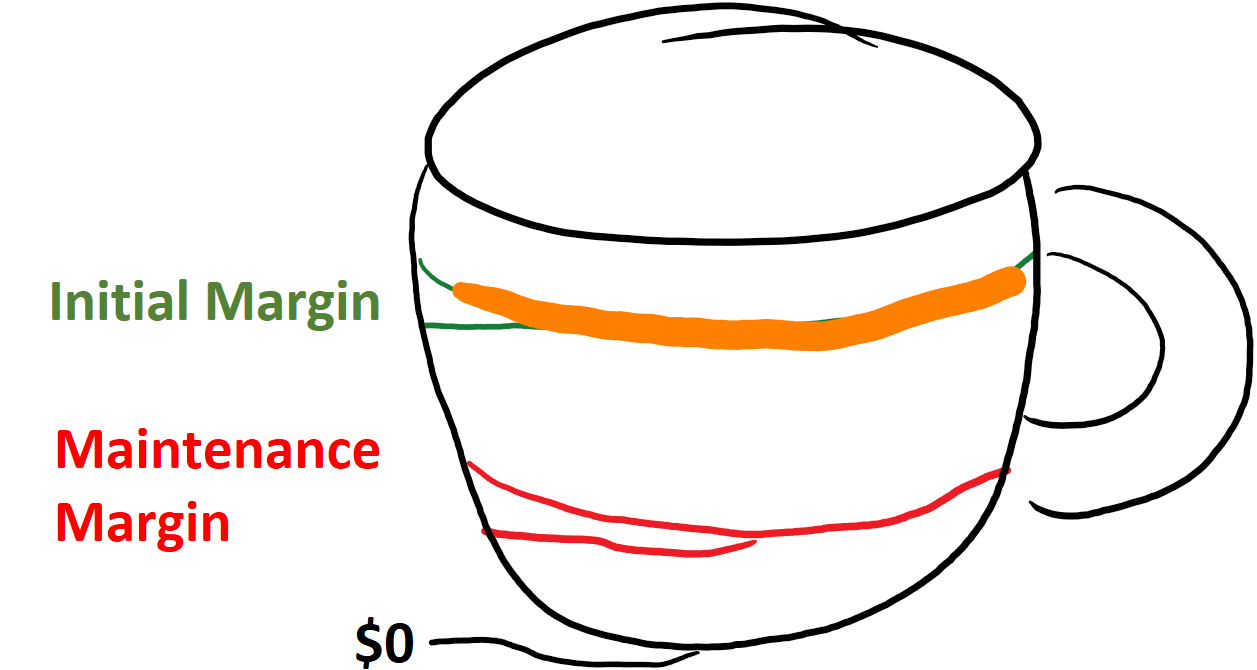

Suppose that you have gotten a margin call because you don’t have enough money in your margin account. Then you must send them money to refill the coffee cup up to the initial margin level.

✏️ Suppose you purchase a soybean futures contract at $12. The initial margin is $5000 and the maintenance margin is $3000. The contract size is 5000 bushels.

Suppose that the contract price drops from $12 to $11.90. What is your P/L both in terms of dollars and in terms of percentages? How much money is in your margin account? Will you get a margin call?

✔ per-contract P/L = (new price - old price) × contract size per-contract P/L = ($11.90 - $12.00) × 5000 bu = -$.10*5000= -$500

Our loss as a percentage is $500/$5000=10%.

To start the trade, you had to put $5000 into your margin account. Once this $500 loss is applied, you will only have $4500 in the account. Because you still have more money in your margin account than the maintenance margin, you won’t get a margin call. (ie $4500>$3000, so no margin call.)

✏️ Assume that you the price has already fallen to $11.90 and that you have $4500 in your margin account, as above. How low would the contract price have to fall for you to get a margin call? If it fell that far, how much money would you need to deposit?

✔ You get a margin call when the amount of money in your margin account falls to the maintenance margin. The maintenance margin $3000 and you have $4500 in your margin account. Therefore, if you lose another $1500, you will get a margin call.

We can calculate this using algebra: Plug and chug: (help)

Plug and chug: (help)

- Equation:

per-contract P/L = -ΔPrice × contract size

What sort of price change would cause a loss of $1500? - Plug:🔌

-$1500 = ΔPrice × 5000 - Solve: 🚂

ΔPrice = -$1500/$5000 = -$0.30 - Reflect: 🧠

In general, to figure out how much the price must drop, you just divide the amount of money you would lose by the size of the contract:

Δ Price = -$1500/5000bushels = -$0.30

If the futures price falls by and additional $.30 to $11.60, you will get a margin call. If this happens, you will need to deposit $2000 (=initial margin-maintenance margin) to “refill the coffee cup.”

🙋How are initial and maintenance margins calculated

✔ They are based on the specific contract. The exchange carefully examines the risk characteristics of the contract and balances the following two factors when setting margin requirements:

- It needs the margin requirements to be high enough that if the price of a contract suddenly changes, it needs to know that there will be enough money in the account that it can just take the traders losses out of the margin account. The exchange doesn’t want to have to hire lawyers to go after the trader if the trader refuses to pay. That would be expensive!

- Traders hate high margin accounts - no one wants to have to lock up the cash in a margin account. Therefore, it needs to set the margin requirements low enough to not alienate its customers, the traders.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.