🙋 Student Q&A (Lecture 9)

Click here to learn about timestamps and my process for answering questions. Section agendas can be found here. Email office hour questions to rob.mgmte2000@gmail.com . PS1Q2=“Question 2 of Problem Set 1”

📅 Questions covered Saturday, Apr 12

No Section today. For more information, see the announcement

📅 Questions covered Tuesday, Apr 15

🕣 7:43pm

❔ How do I start studying? I’ve already done most of the exercises in the website. I was able to get the harder questions on the midterm, but I made careless-style mistakes on some of the easier ones.

✔ In terms of pre-midterm content, I would go back and redo the problem sets. I would also go back and redo the midterm. Finally, I would go back and redo practice problems from my (Rob’s) website.

My hope is that the problem’s will become boring. That means that you have all of the key skills and you are confident with them. On the exam, there will be “standard” questions and “stretch” questions. It’s really encouraging that you did well on the harder problems - those were the stretch questions from the midterm.

To optimize for the stretch questions, you have to learn the material deeply. One way to do this is to pay attention to what I cover in section.

🕣 7:52

❔ I have a question about the following problem:

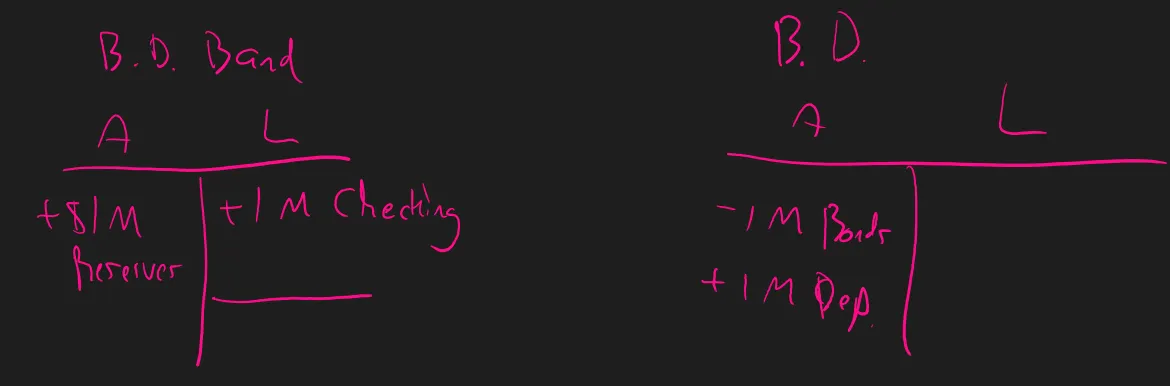

Suppose in the republic of Cantabridgia the public holds 10M of deposits. R=0% and E=20%. The Cantabridgia central bank (their Fed) buys $1M of bonds. What is the change in the money supply? What is the new money supply?

I was just wondering why you took 10M deposits?

✔

To pay for 1M of new reserves and transfers those reserve to the Bond Dealer’s Bank. It directs the bank to credit those reserves to the Bond Dealer’s checking account. Basically, it deposits those reserves into the Bond Dealer’s checking account.

ΔTotal Deposits = ΔReserves × (1/(R+E))

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.