🙋 Student Q&A (Lecture 6)

Click here to learn about timestamps and my process for answering questions. Section agendas can be found here. Email office hour questions to rob.mgmte2000@gmail.com . PS1Q2=“Question 2 of Problem Set 1”

📅 Questions covered Saturday, Mar 8

🕣 covered very near to end of recording

❔ prevailing interest rate in 4c?

✔ It just refers to the interest rate mentioned earlier in the problem.

🕣

❔ when would we need Excel to calculate i?

✔ covered during section

📅 Questions covered Sun, Mar 9

🕣 12:53

❔ If he asks for NPV, how do you solve it? How to use the formula?

✔

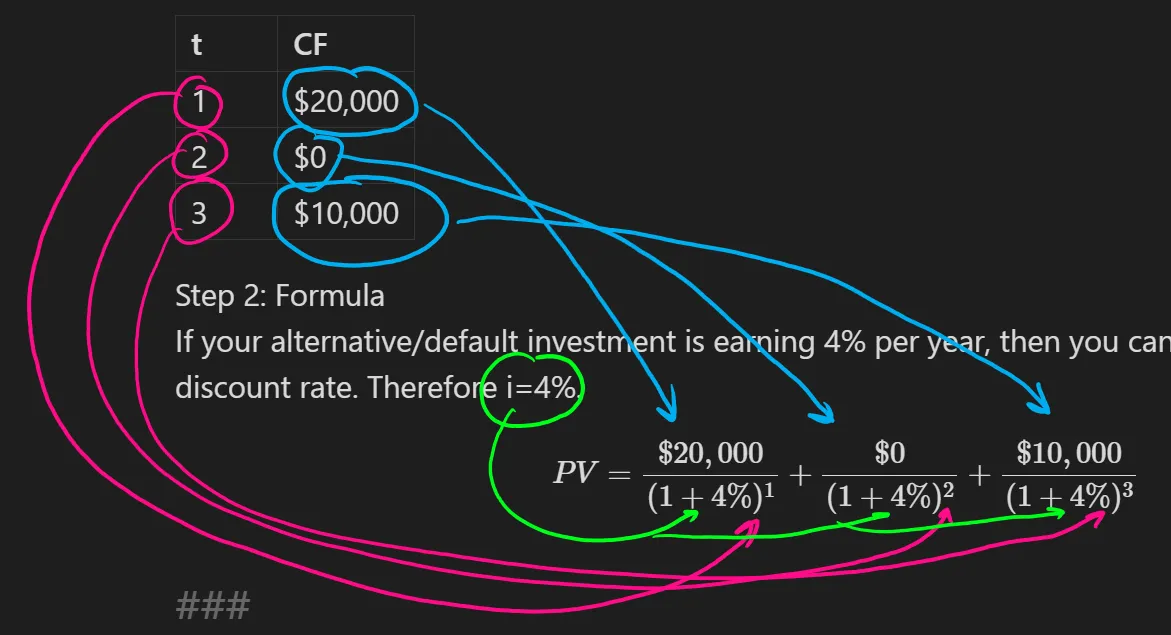

For a PV or NPV question, you always

- come up with a timeline of the cash flows and then

- drop the cash flows into the equation.

✏️ Suppose that your long lost aunt has gifted you some money. You will receive $20,000 in one year and $10,000 in 3 years. What is the PV of this gift? Assume that you keep most of your assets are in a money market mutual fund that earns 4% per year.

✔ Step 1: Timeline

| t | CF |

|---|---|

| 1 | $20,000 |

| 2 | $0 |

| 3 | $10,000 |

| Step 2: Formula | |

| If your alternative/default investment is earning 4% per year, then you can use 4% as your discount rate. Therefore i=4%. |

🕣

❔ Is “in one year” equivalent to “at the end of the current year?”

Is “at the beginning of this year” equivalent to “now?”

✔ Yes and yes.

🕣

❔ You are evaluating an investment that requires an upfront payment of 12,000 at the beginning of each year for the next 5 years. If the discount rate is 6%, what is the present value of this investment? Should you proceed with this investment? Show your calculations.

✔ We’re going to use the two steps from above. Step1: Timeline:

| T | Cash InFlow | Cash Outflows |

|---|---|---|

| 0 | 12,000 (1st year) | 50,000 |

| 1 | 12,000 (2nd year) | |

| 2 | 12,000 (3rd year) | |

| 3 | 12,000 (4th year) | |

| 4 | 12,000 (5th year) | |

| 5 |

Shortcut:

| T | Cash InFlow | Cash Outflows | Net Cashflows Inflows - Outflows |

|---|---|---|---|

| 0 | 12,000 (1st year) | 50,000 | -38,000 |

| 1 | 12,000 (2nd year) | 12,000 | |

| 2 | 12,000 (3rd year) | 12,000 | |

| 3 | 12,000 (4th year) | 12,000 | |

| 4 | 12,000 (5th year) | 12,000 | |

| 5 |

| =20000/(1+4%)^1 + 0/(1+4%)^2 +10000/(1+4%)^3 |

| =20000/(1+4%)1 +10000/(1+4%)3 |

| =-38+12/1.06 + 12/1.06^2 + 12/1.06^3 + 12/1.06^4 |

Questions covered Mon, Mar 10

🕣 7:44pm

❔ If we are trying to decide whether to take on a project or not, do we have to answer the question with both NPV and IRR or is it sufficient to answer it with just one or the other?

✔ Either the NPV or IRR rule is sufficient to answer a given question. They will typically have exactly the same answer. Note that there are subtle differences. See the slides that we coverd in the recording.

🕣 7:50pm

❔ Would studying mostly the problem sets be mostly sufficient or will it be very important to expand beyond that?

✔ Not quite. The problem sets aren’t comprehensive, but the slides are comprehensive. There are also additional practice problems on my website.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.