🔎 New Introduction to Bonds

In the previous lecture, we introduced two key concepts:

- Present Discounted Value tells you the price you should pay for any investment.

- IRR tells you the rate of return on any business or investment.

Now we are studying bonds…

❔ How should you calculate the price you are willing to pay for any bond?

- ✔ You calculate the present discounted value of the cash flows you get from that bond.

- 👉 This is what all of the bond pricing formulas are doing.

❔How do we calculate the return (or rate of interest) for any bond?

- ✔ You calculate the IRR of purchasing the bond.

- 👉 For bonds, the IRR is called the Yield or the “Yield to Maturity.”

These are clearly the most challenging topics in this lecture.

How much should you pay for a bond? (The three bond pricing formulas)

First, let’s explore the idea of purchasing a coupon bond. When you purchase a coupon bond, you pay its price at the start, and you get cash flows later, as follows:

| T | Cash Flows | Note |

|---|---|---|

| 1 | c is the Coupon rate and F is the Face value. is the coupon payment, . | |

| 2 | ||

| 3 | ||

| … | ||

| T | At the very end, you get a final coupon payment plus you are paid the par value. |

Ignoring everything he taught you in the bond lecture and just using what you know from the NPV/IRR lecture, what should you pay for this bond?

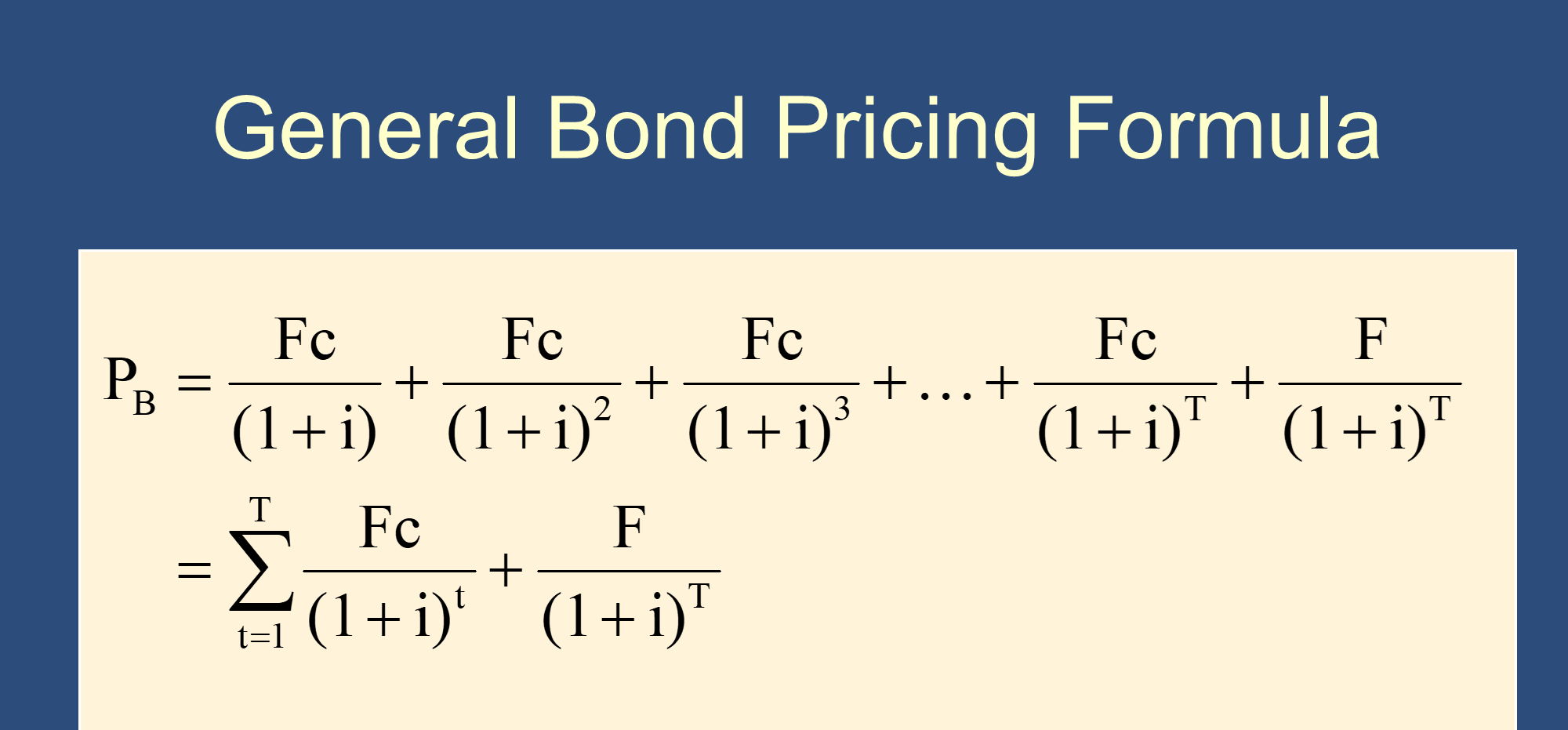

Writing as , you should pay:

This is exactly the formula from the slide:

It’s always much better to know where a formula comes from rather than just memorizing it. When you know where a formula comes from, you’ve mastered the formula.

🙋 We can abbreviate the formula as follows:

If the coupon rate is zero, then all of the Fc terms are zero, so we can ignore them. For a Zero Coupon Bond, our formula becomes:

Therefore,

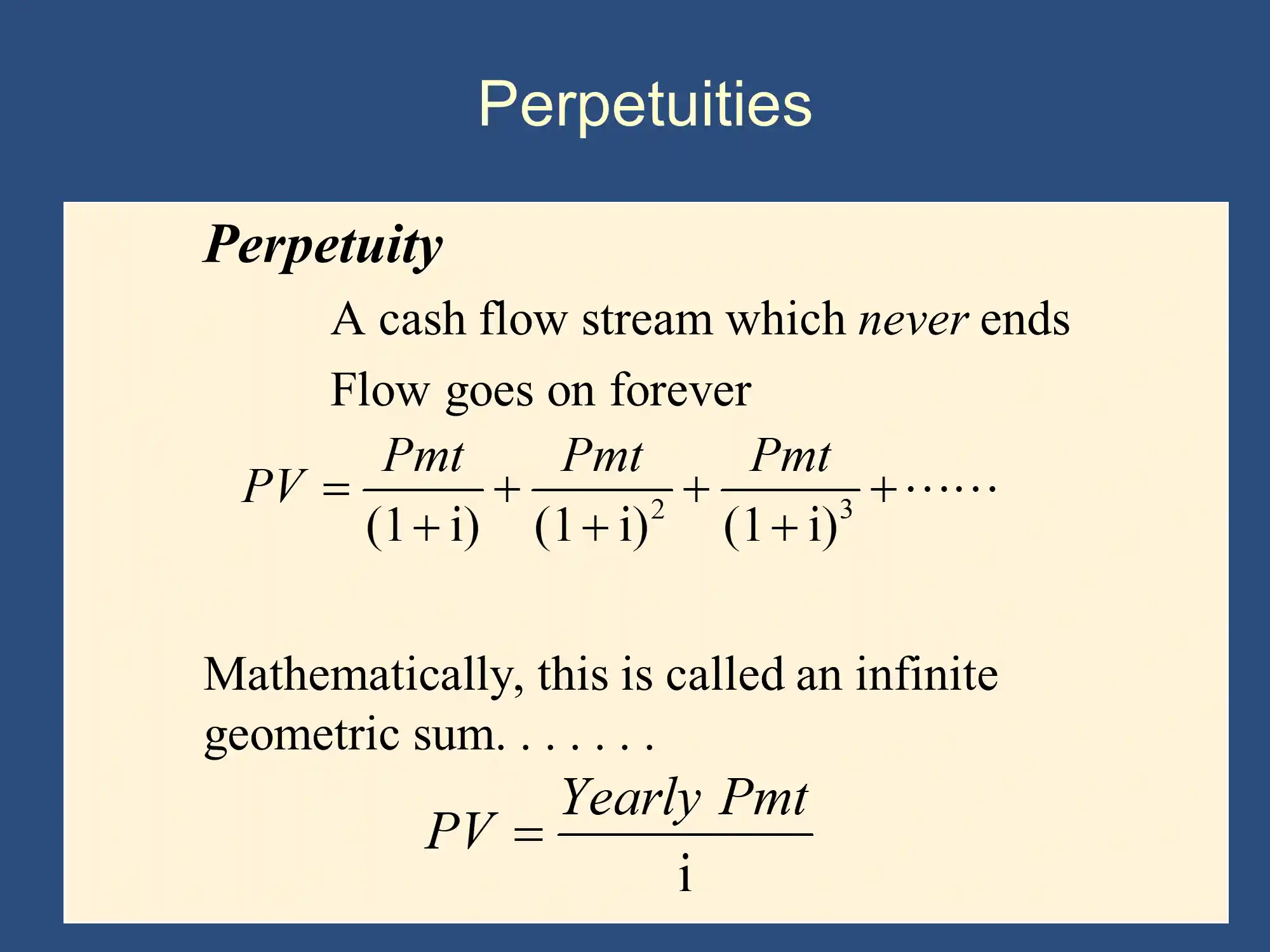

If, instead of getting a final payment of the face value, the coupon payments go on forever, then we use the Perpetuity formula:

This type of bond is called a consol:

Now we understand the most important formulas from the lecture:

The three bond pricing formulas:

Price of a coupon bond:

Price of a Zero Coupon Bond:

Price of a Consol:

What is the interest rate of a bond? (calculating Yield To Maturity/YTM)

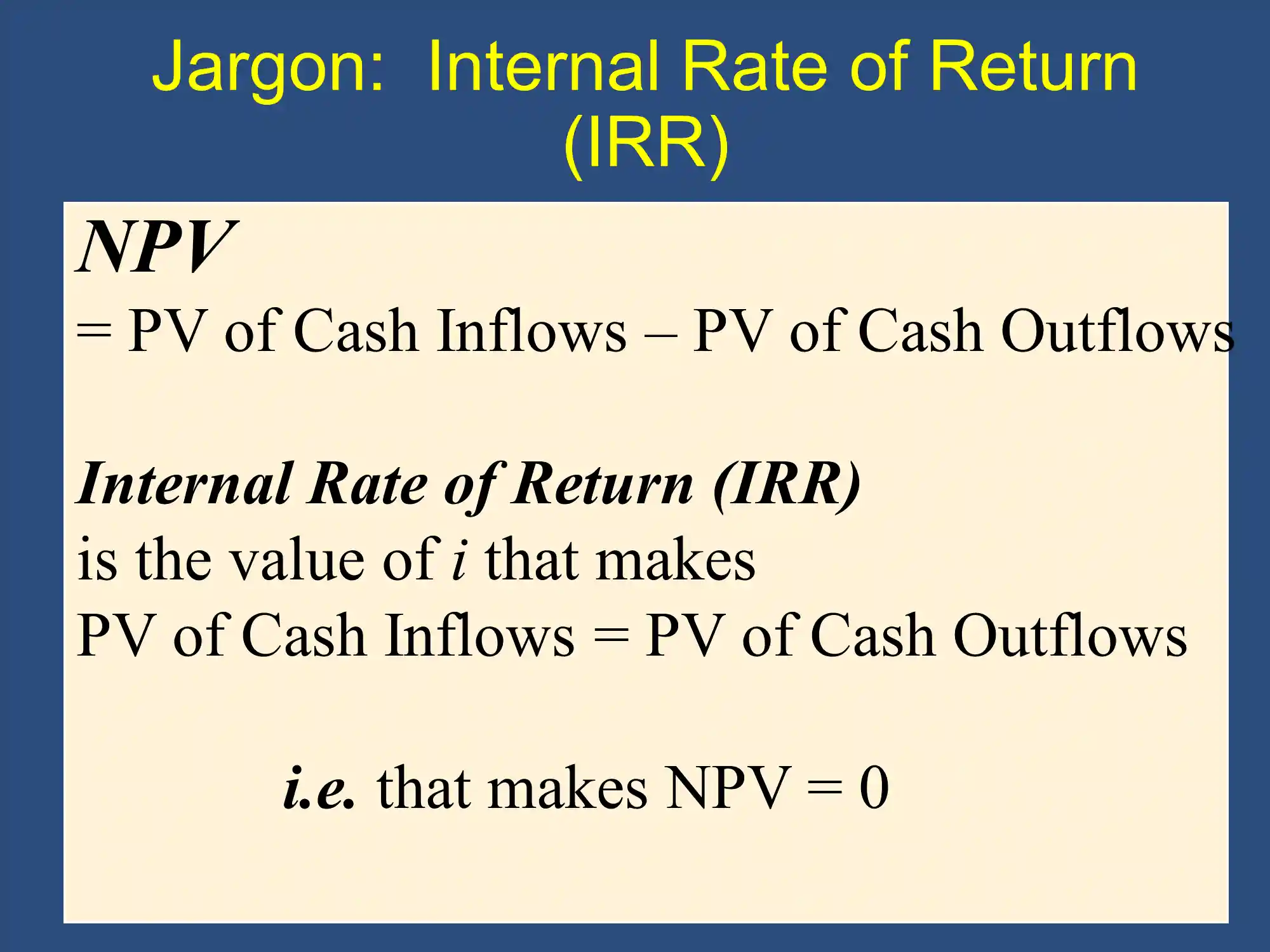

To calculate the Interest Rate of a bond, you just calculate the IRR of purchasing it. Because we are calculating the IRR of purchasing it, we must include the price we pay for it.

To calculate the IRR of anything, you just set the PDV of the Outflows = PDV of the Inflows.

When you purchase a bond, the only outflows are when you pay for the bond.

Therefore:

PDV of Outflows for a Coupon Bond

PDV of Outflows for a Zero Coupon Bond

PDV of Outflows for a Coupon Bond

When you purchase a coupon bond, the inflows are exactly the numbers that we analyzed above to calculate the fair bond price.

PDV of Outflows for a Coupon Bond

PDV of Outflows for a Zero Coupon Bond

PDV of Outflows for a Coupon Bond

In other words, we can reuse our calculations from the bond pricing formulas above.

To calculate the IRR, we just set the PDV of Outflows = PDV of Inflows, as we learned in the previous lecture:

(We could set PV of Cash Inflows = PV of Cash Outflows or NPV=0, but setting PV of Outflows = PV of Inflows is the easiest. We’re just doing what’s on the slide.)

When we PDV of Outflows = PDV of Inflows, we get exactly the same formulas that we got above.

Price of a coupon bond:

Price of a Zero Coupon Bond:

Price of a Consol:

To calculate the IRR for purchasing these bonds, we just plug F, c, T, and into one of the formulas above, leaving i as a variable. We then solve for i.

This IRR is called the Yield to Maturity.

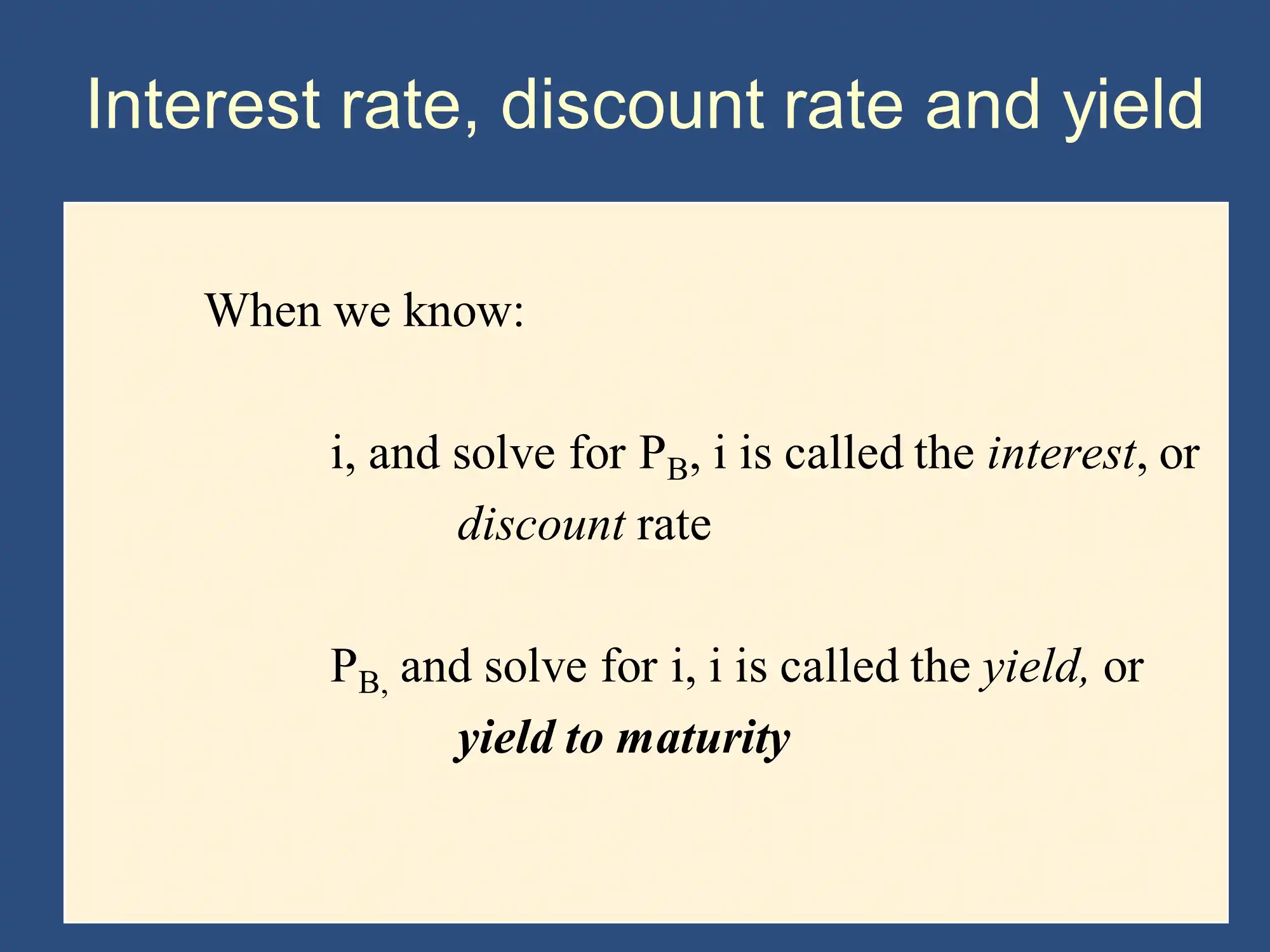

This explains what Bruce meant by the following slide:

Bottom line: you will typically be plugging numbers into the three bond pricing formulas and either solving for or i.

But remember - all you are really doing is calculating PDVs and IRRs.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.