🔎 Why are i and c different?

The best way to answer this is to look at a little history.

The historical way to look at a bond: interest rate = coupon rate

Historically, the coupon rate of a bond acted like an interest rate.

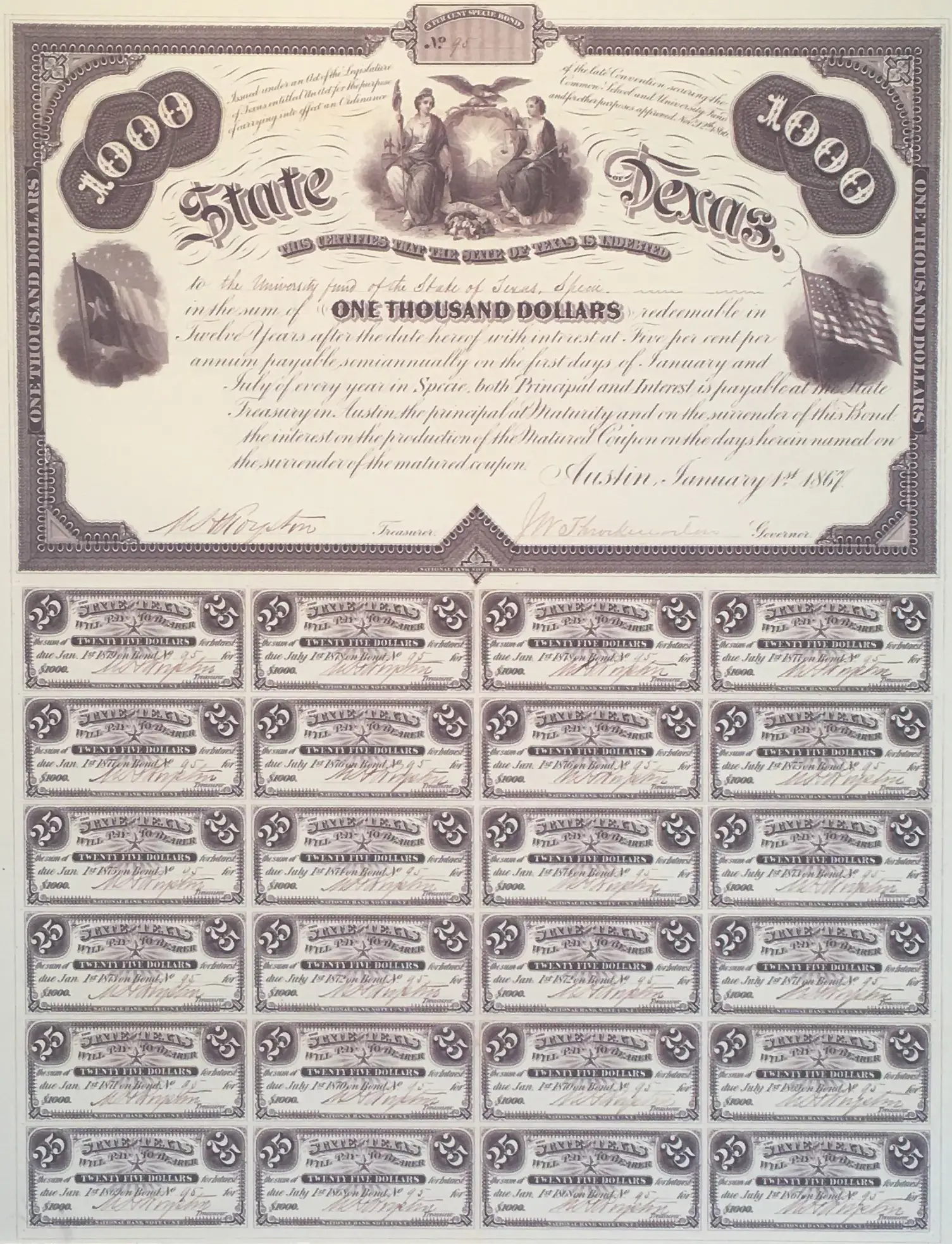

For example, you can read on the following bond that the borrower - the state of Texas - owes the investor and pays them a of that as an interest payment every year. (Specifically, it pays the investor twice a year.)

Text:

This certifies that the State of Texas is indebted to the University Fund of the State of Texas, Specie [specie=precious metal coinage] in the sum of ONE THOUSAND DOLLARS [] redeemable in twelve years [T=12] after the date hereof with interest at Five percent per annum [] payable semiannually on the first days of January and July of every year in Specie, both principal and interest is payable at the State Treasury in Austin. The principal at maturity and on the surrender of this bond. the interest on the production of the matured coupon on the days herein named on the surrender of the matured coupon.

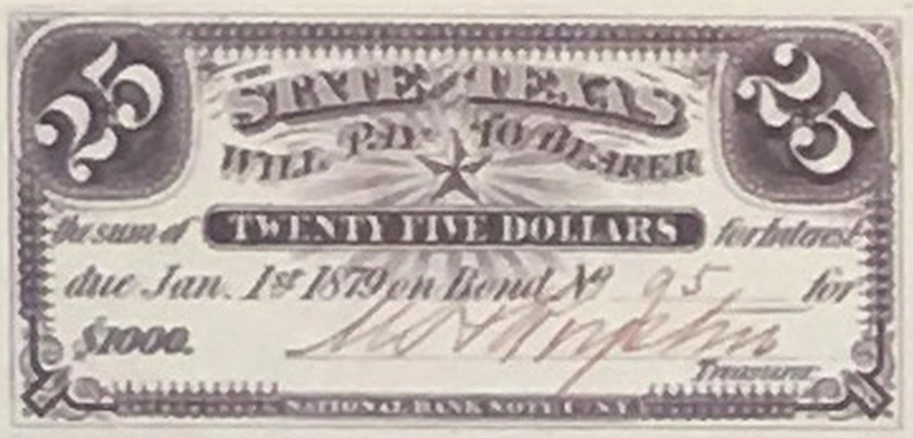

Here is a closeup of a coupon:

The text on the coupon is as follows:

The State of Texas will pay to the bearer the sum of TWENTY FIVE DOLLARS for interest due July 1st 1867 on bond no. 95 for .

The new way: interest rate = the actual rate of return you receive (IRR)

Fundamentally, a bond is a contract to deliver the “fixed income” payments described in the bond’s contract (aka the indenture). Thinking of the interest rate as being the coupon rate works until the bond begins being re-sold.

Clearly, if you purchase the above bond for instead of , then your return will be very very far from just .

Clearly, the actual price that you pay will determine the return that you earn on the bond.

This is the heart of why we pay attention to YTM as the return of a bond and why we largely ignore the coupon rate of the bond.

Many bonds are bought and sold in the secondary market every day. In fact, the secondary market for bonds is many times more active than the stock market.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.