🔎 Investment Companies (Big Picture)

In this portion of the lecture, we are talking about “investment companies.” If you know what mutual funds are, these investment companies are like different flavors of mutual fund.

In all cases, a mutual fund is a way for you to buy into a basket of stocks.

The different flavors have different attributes:

-

A classic mutual fund is technically known as an open-ended fund. With an open-ended fund, the number of shares can increase or decrease. To buy shares, you must buy them from the fund. To sell shares you sell them to the fund.

-

In the last 20 years, a new alternative to classic open-ended funds have become very popular. They are known as ETFs. An ETF is like a classic mutual fund, but instead of buying shares from the fund itself, you buy shares from other investors on an exchange, exactly like you would buy a share in a company.

In addition to these two major types, there are two other types to be aware of:

-

With a close-ended fund, the number of shares is fixed. You buy or sell shares by transacting with other investors.

-

A Unit Investment Trust is an older way of making a mutual fund. A lawyer would tell you that it is structured as a trust rather than a corporation, but you probably don’t care very much. But there are some limitations on UITs which make them less popular these days.

Finally, above, we have been talking about investment companies that the public can invest in. There are special very risky investment companies that only “sophisticated/accredited investors” can invest in. These are hedge funds, private equity, and venture capital funds.

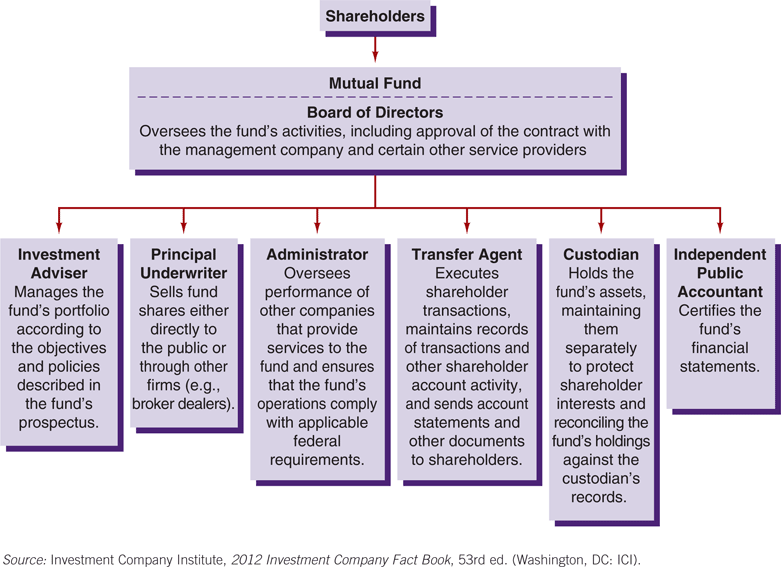

Note that any of these Investment Companies is a company. When you invest in the fund, you are actually purchasing stock in that company. The structure of the company will look something like this:

If you buy a share in the mutual fund, you own one share of a company and that company owns a massive collection of investments.

For example, the SPDR S&P 500 ETF Trust is essentially a company that has a balance sheet like the following:

| Assets | Liabilities |

|---|---|

| $421.05 B of stocks | .05B of debt |

| 900 million ownership shares |

Of all of the things listed above, the most important, by far, is the investment advisor:

If you know someone who is making a lot of money working in mutual funds or hedge funds, etc., they are likely working at the investment advisor.

For example, Fidelity is an Investment Advisor. It has a famous mutual fund known as Magellan (famously led by Peter Lynch). The point is that Magellan is a company (a corporation). When you buy the Magellan mutual fund, you become a shareholder in the Magellan company. Magellan is an open ended mutual fund, so when you want to buy a share in Magellan, you (or eTrade, if you are buying the share through eTrade) approach Fidelity and say, ‘we want to purchase a share.’ The underwriter (an investment bank like Morgan Stanley) will create new shares for you and sell you newly created shares in the Magellan corporation. The Transfer agent will keep track of the fact that you are now a shareholder of Magellan (possibly via eTrade).

So what does Fidelity and Peter Lynch do? They provide consulting services to the corporation. They are the “Investment Advisor.” Remember that Magellan, like SPY is a company that has been created to do nothing other than purchase securities (stocks and bonds). Someone has to tell Magellan which stocks and bonds to buy and get paid well to do so. That’s what the Investment Advisor (Peter Lynch/Fidelity) does. They get “advisor fees” for doing this.

Caveat - I’m simplifying things a bit. As usual, refer to the slides/lecture for the level of detail you want to know.

An ETF, like SPY, is like a closed-ended fund, with a couple of differences…

- when you buy and sell shares with other investors, you can do so on a stock exchange. ETFs are typically listed on a stock exchange like Arca. This makes them exceptionally easy to buy and sell. I could buy shares right now and sell them in one minute. That’s why I could demonstrate buying them in my trading software. This is why they are called “Exchange Traded Funds” (ETFs)

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.