Formulas for this lecture can be found in my paper formula sheets and online formula sheet.

The Fed decides how many dollars of reserves a bank is legally required to hold for every $100 of deposits:

DollarsofRequiredReserves$200M=R×CheckingDeposits=10%×$2B

Explanation: banks are legally required to hold reserves to help lessen bank runs and banking panics (like with SVB and the regional banks).

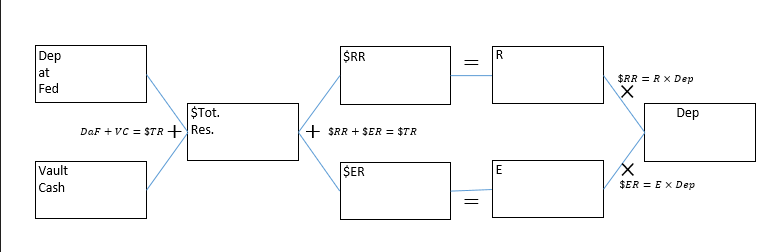

Both Vault Cash and Deposits at the Fed are readily available cash, so both count as legal reserves:

TotalReserves=VaultCash+DepositsattheFed

Explanation: The Federal Reserve is the Central Bank of the USA. Deposits at the Fed may also be called “Deposits at the Central Bank.”

If a bank holds more reserves than it is legally required to hold, these are called “Excess Reserves:“

ExcessReserves=TotalReserves−RequiredReserves

RequiredReserveRatio=R=CheckingDepositsDollarsofRequiredReserves

ExcessReserveRatio=E=CheckingDepositsDollarsofExcessReserves

TotalReserveRatio=R+E=CheckingDepositsDollarsofTotalReserves

Note: if Bruce simply provides “deposits,” he is probably giving you “checking deposits.” He’s not terribly interested in the distinction between checking and savings deposits.

Bank profitability and leverage

Profitability and Interest:

Profit=ΔContractPrice×ContractSize=($4.70−$4.50)×5000=$1000

NetInterestSpread=(interestrateearnedonassets)−(interestratepaidonliabilities)=7%−3%=4%

Netinterestincome=(totalinterestreceivedonassets)−(totalinterestpaymentsonliabilities)=$700M−$200M=$500M

Netinterestmargin=netinterestearningassetsNetinterestincome=$10B$500M=5%

Profitability Ratios:

Suppose Citizen’s bank has $200B of Assets, $180B of liabilities, $20B of Capital, and an annual profit after taxes of $2B:

ROA=AssetsProfitaftertaxes=$200B$2B=1%

Or, equivalently: Proftaftertaxes=Assets×ROA

ROE=CapitalProfitaftertaxes=$20B$2B=10%

Or, equivalently: Proftaftertaxes=Capital×ROE

Leverage=CapitalAssets=$20B$200B=10to1

DebtToEquity=CapitalLiabilities=$20B$180B=9to1

ROE=ROA×Leverage

Bankprofitorloss=ChangeinBankCapital

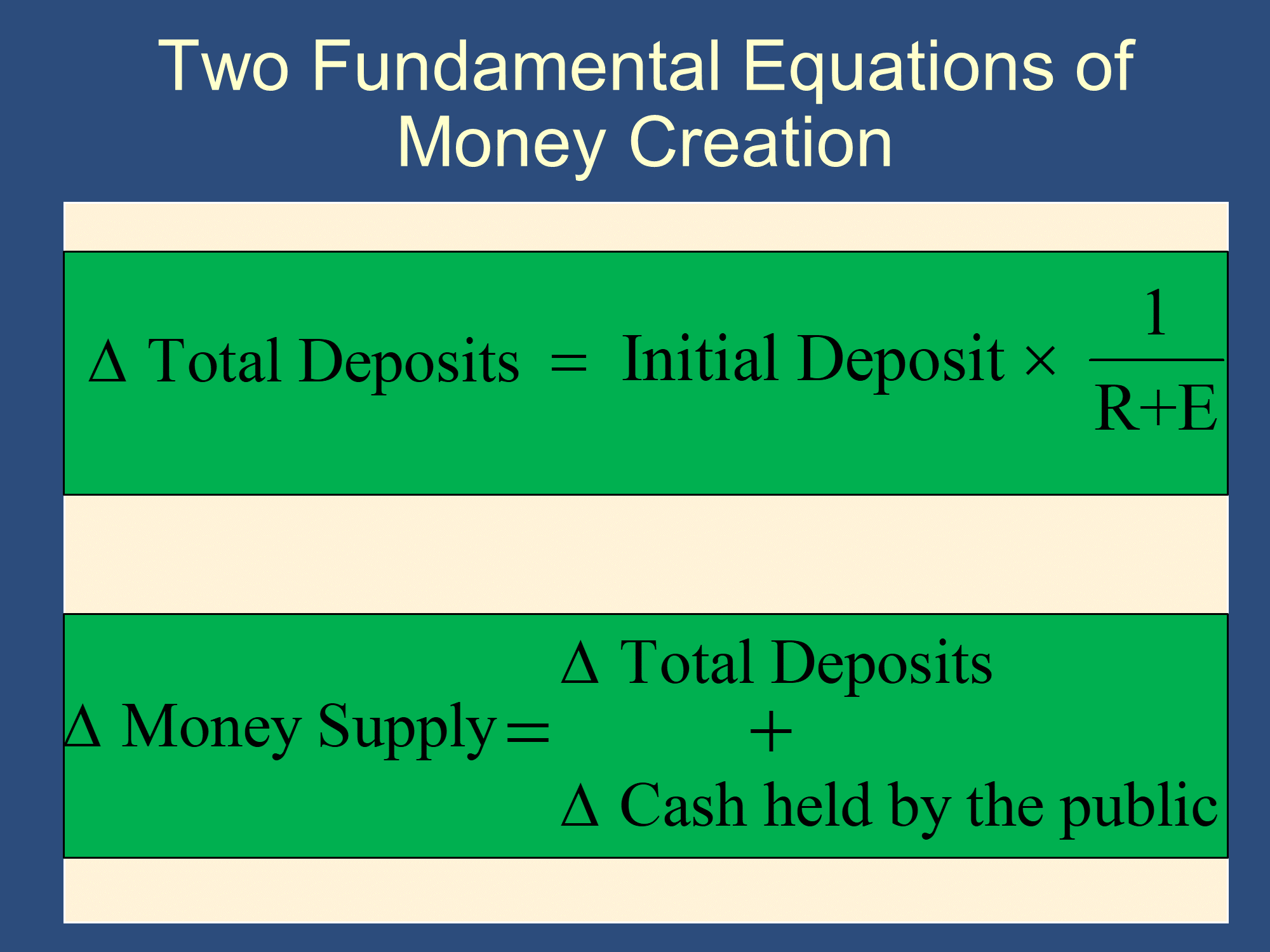

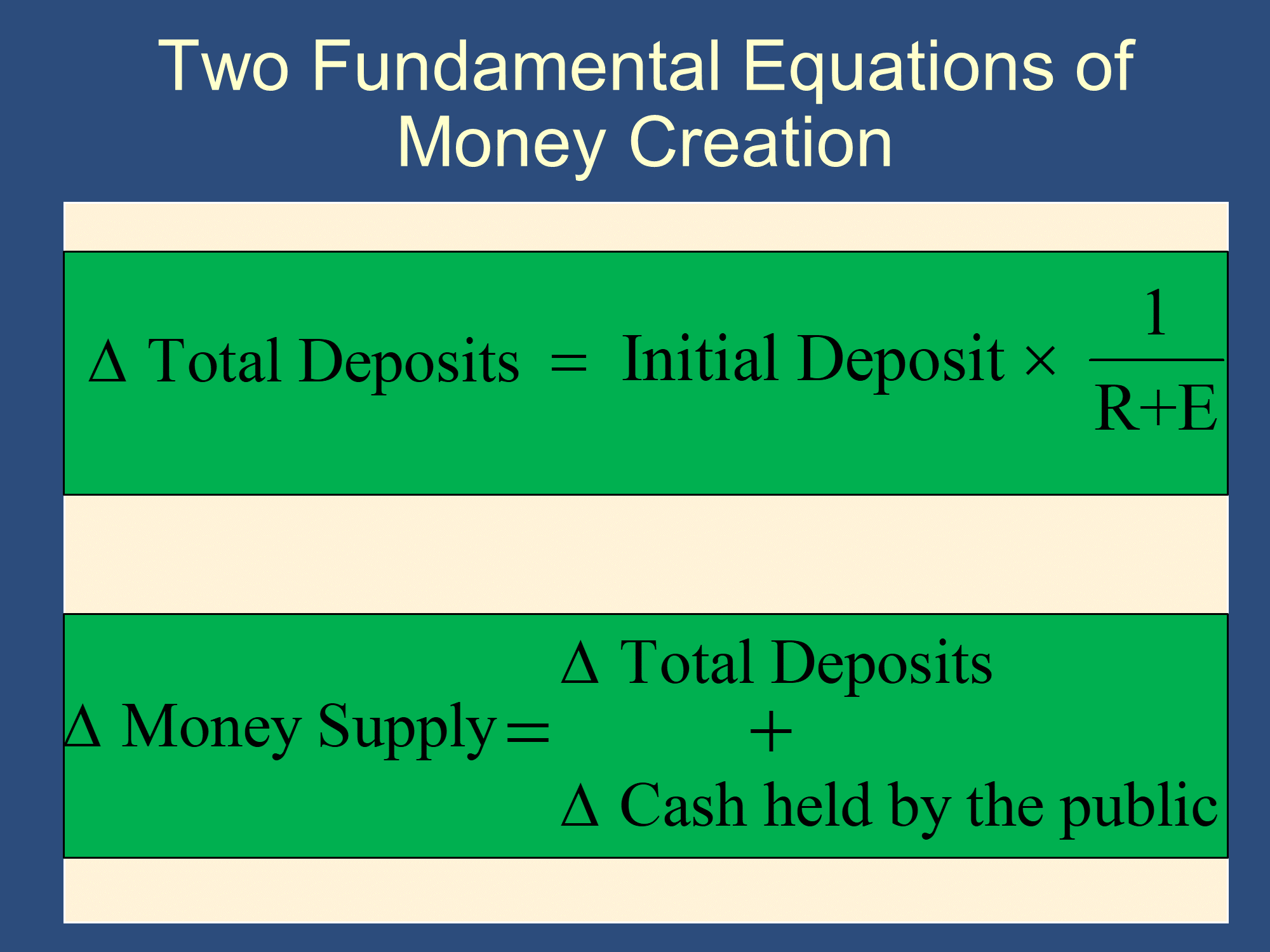

The Money Multiplier

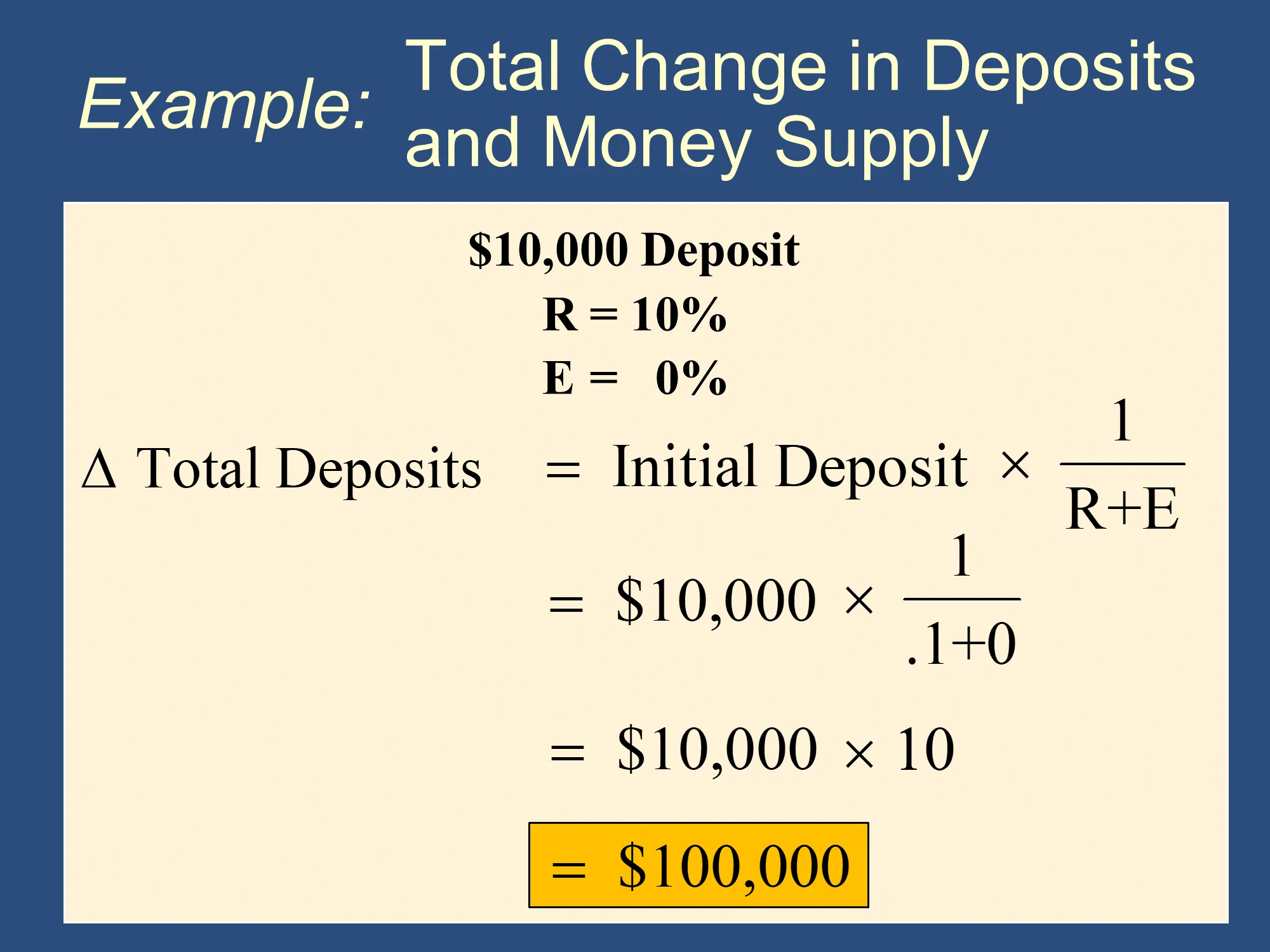

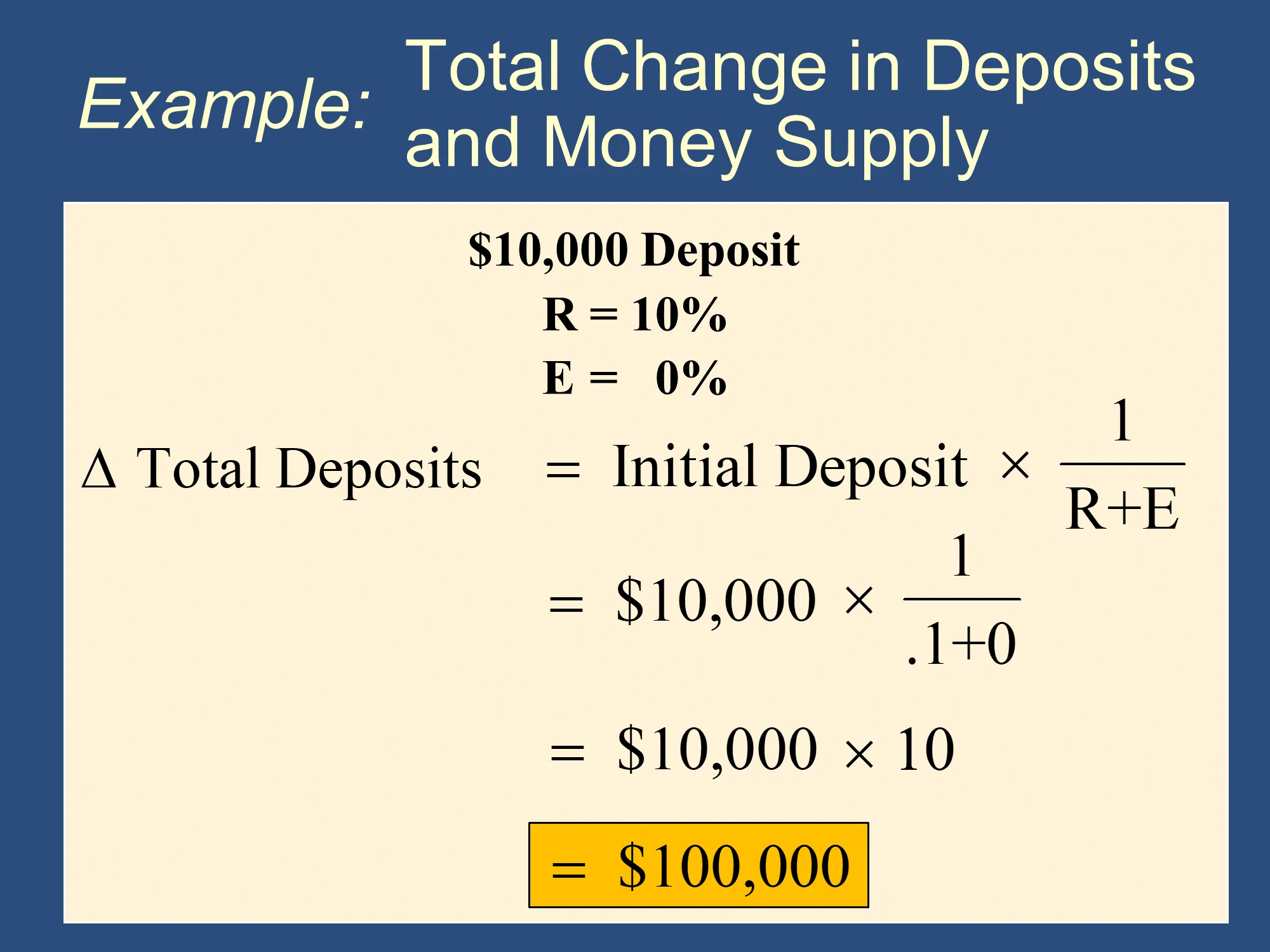

The first green equation says that you multiply reserves by the money multiplier to get total deposits.

- You can also use the first equation with Open Market Operations

- A variation to calculate the total deposits in the economy:

- TotalDepositsineconomy=Reservesineconomy×R+E1

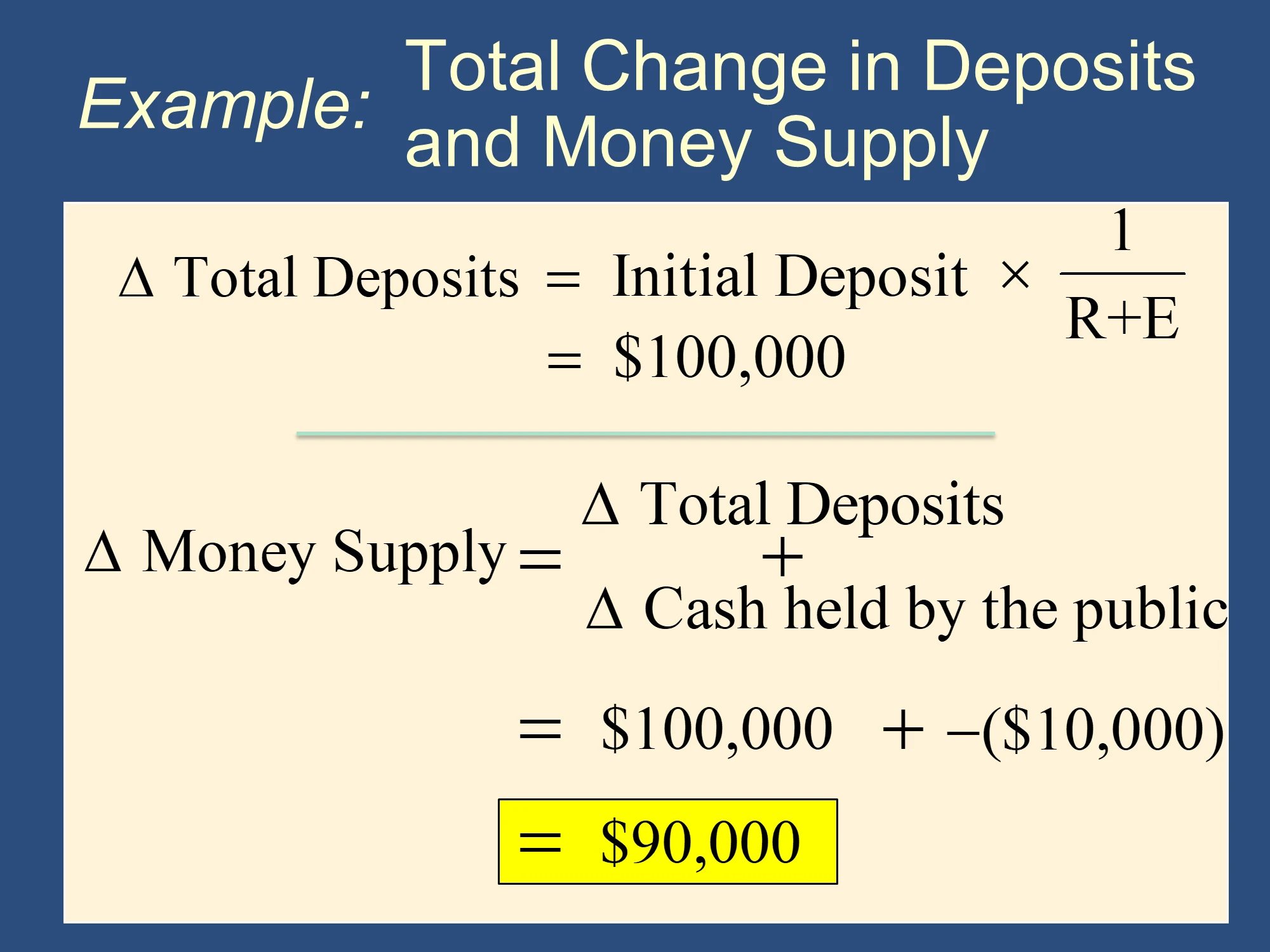

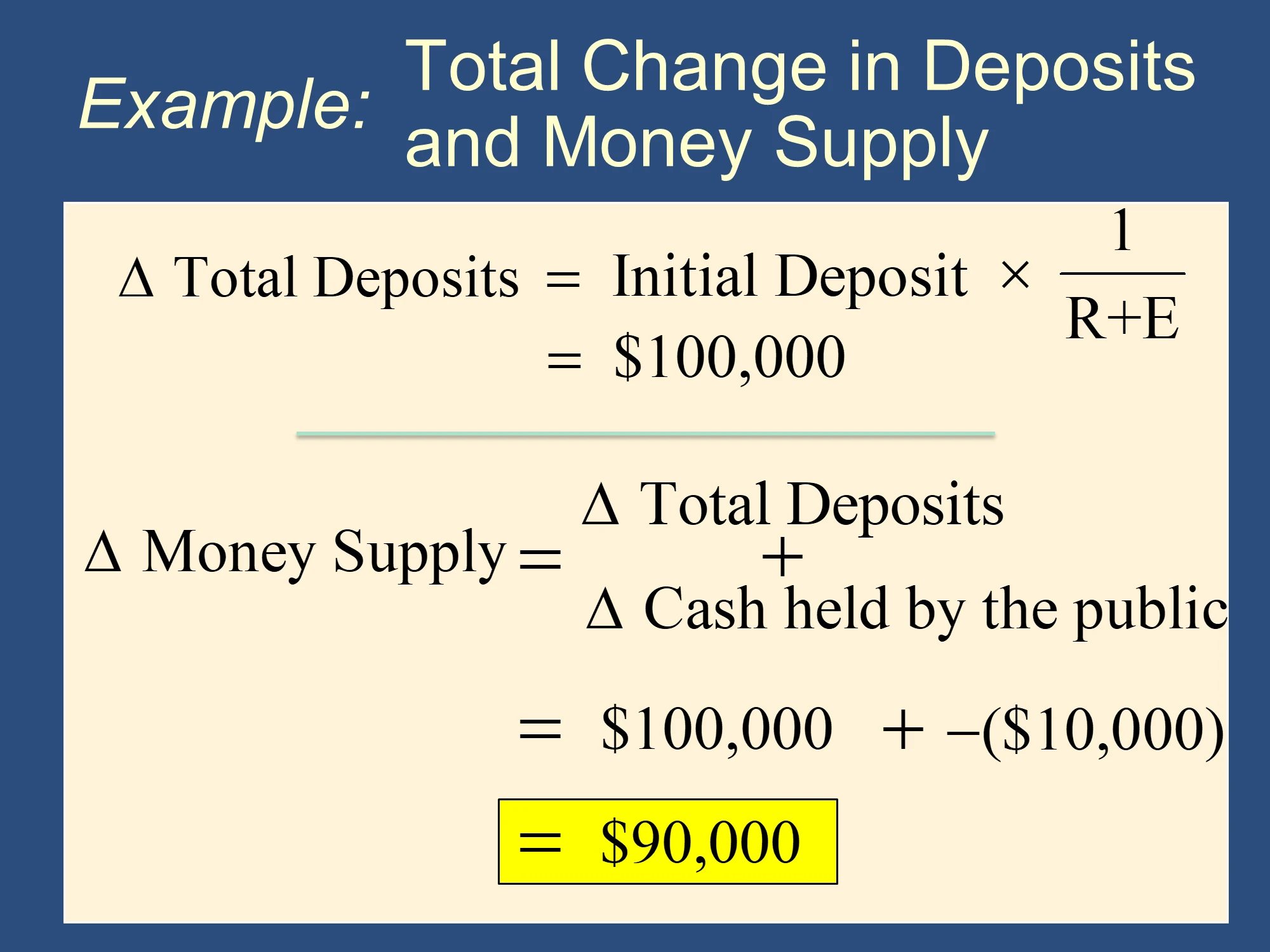

The second green equation follows from the definition of M1

Example: Suppose I walk in off of the street and deposit $10,000

⚡There are no balance sheet categories other than those listed:

100M Vault Cash

600M Deposits at Fed

5B Auto Loans

10B Mortgages | ? Checking Deposits

4B of Other Liabilities

1B Bank Capital |

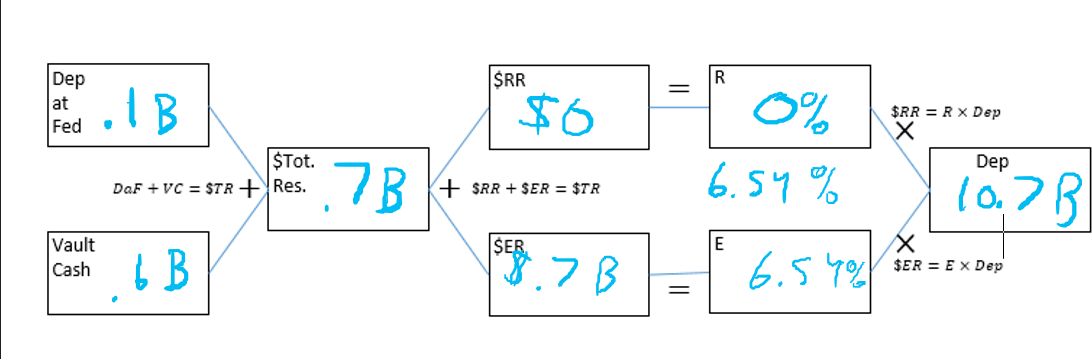

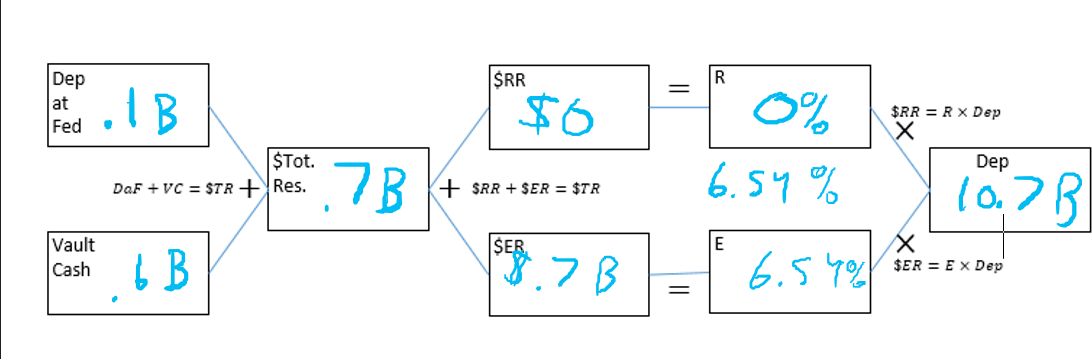

Suppose R=0%. What is E?

Assets=100+600+5000+10000=$15.7B

Liabilitiesmustbe$15.7B−$1B=$14.7B

$10.7BofCheckingdeposits.

100M VC

600M DaF

5B Auto Loans

10B Mortgages | 10.7B Deposits

4B of Other Liabilities

1B Bank Capital |

$Reserves=VC+DaF=$100M+$600M=$700M

R+ER+ER+E=$CheckingDeposits$TotalReserves=10.7.7=0.0654=6.54

R=0%, so E=6.54%

There are more questions like this here: ✏️ Balance Sheets Reserve Ratio Questions

⚡Revisit the above problem, assuming you don’t know R. What is the Money Multiplier?

Hint: we know that MM=R+E1, so we only need to find R+E to calculate the MM.

✔ TotalReserves=700M

Deposits=10,700M

R+E=Deposits$TotalReserves=6.54%

MM=R+E1=6.54%1=15.29

⚡Suppose R=10% and E=5%. Given the following balance sheet, what are the deposits at the Fed?

200M VC

? Deposits at the Fed

5B Auto Loans

? other assets | $10B Checking Deposits

$4B Other Liabilities

? Bank Capital |

✔ We can’t use Assets=Liabilities+BankCapital, because there are too many ’?‘s on in the balance sheet. However, we know R+E and Deposits, so we can figure out the number of reserves.

R=10% means that the government has required banks to hold 10% of their deposits as reserves.

$RequiredReserves=R×Deposits=10%×10B=$1Bofrequiredreserves.

We also know that E=5%. This means that the banks hold 5% of their deposits as “extra reserves,” beyond the required reserve. The total dollar amount of excess reserves is:

$ExcessReserves=E×Deposits=5%×$10B=$.5B

Here is another way to approach it:

TotalReserves=(R+E)×Deposits

R+E=15%

R+E=DepositsTotalReserves

Therefore, this bank has $1B+$.5B=$1.5B of reserves. If it has $200M of Vault Cash, how many deposits at the Fed does it have?

TotalReserves=VaultCash+DepositsatFed

(Interpretation: Both Vault Cash and cash deposited at the Fed count as legal reserves.)

$1.5B=$200M+DepositsattheFed

DepositsatFed=$1.3B

TotalReserves=(R+E)×Deposits