Formulas for this lecture can be found in my paper formula sheets and online formula sheet.

Notation:

- F = Face Value of the bond. Also known as “Par value.” Typically, F=$1000 or more.

- c = coupon rate, as a percentage (c=6%, for example)

- Fc=F×c = your annual coupon payment.

- T=N = number of years until the bond “matures.” When that happens, you get F dollars, and the bond ceases to exist.

Pricing formula for regular coupon bonds:

PCouponBond=(1+i)1Fc+(1+i)2Fc+(1+i)3Fc+⋯+(1+i)TFc+(1+i)TF

Note that this only says that the price of a coupon bond is just the Present Discounted Value of the payments that you get from the bond. Each term of the form, (1+i)tFc refers to the coupon payment at time t. (1+i)TF refers to the lump sum payment of the Face value at the very end.

You can also write the formula out in text as follows:

- PCouponBond=(1+i)1Fc+(1+i)2Fc+(1+i)3Fc+⋯+(1+i)TFc+(1+i)TF

- 2 year coupon bond: PB=(1+i)1Fc+(1+i)2Fc+(1+i)2F

- 3 year coupon bond: PB=(1+i)1Fc+(1+i)2Fc+(1+i)3Fc+(1+i)3F

If c=0%, we have a “Zero Coupon Bond.” All of the terms in the above formula become zero, so

- PZCB=(1+i)TF

If T=∞, the bond never matures, we have “Consol.” We calculate the price of a consol using the perpetuity formula, PVPerpetuity=iCF, from the last lecture:

- PConsol =iFc

To quickly calculate price of a 4 year coupon bond with F=$1000, i=8%, and c=6%: (Note that Fc=$60)

- PB=1.0860+1.08260+1.08360+1.0841060

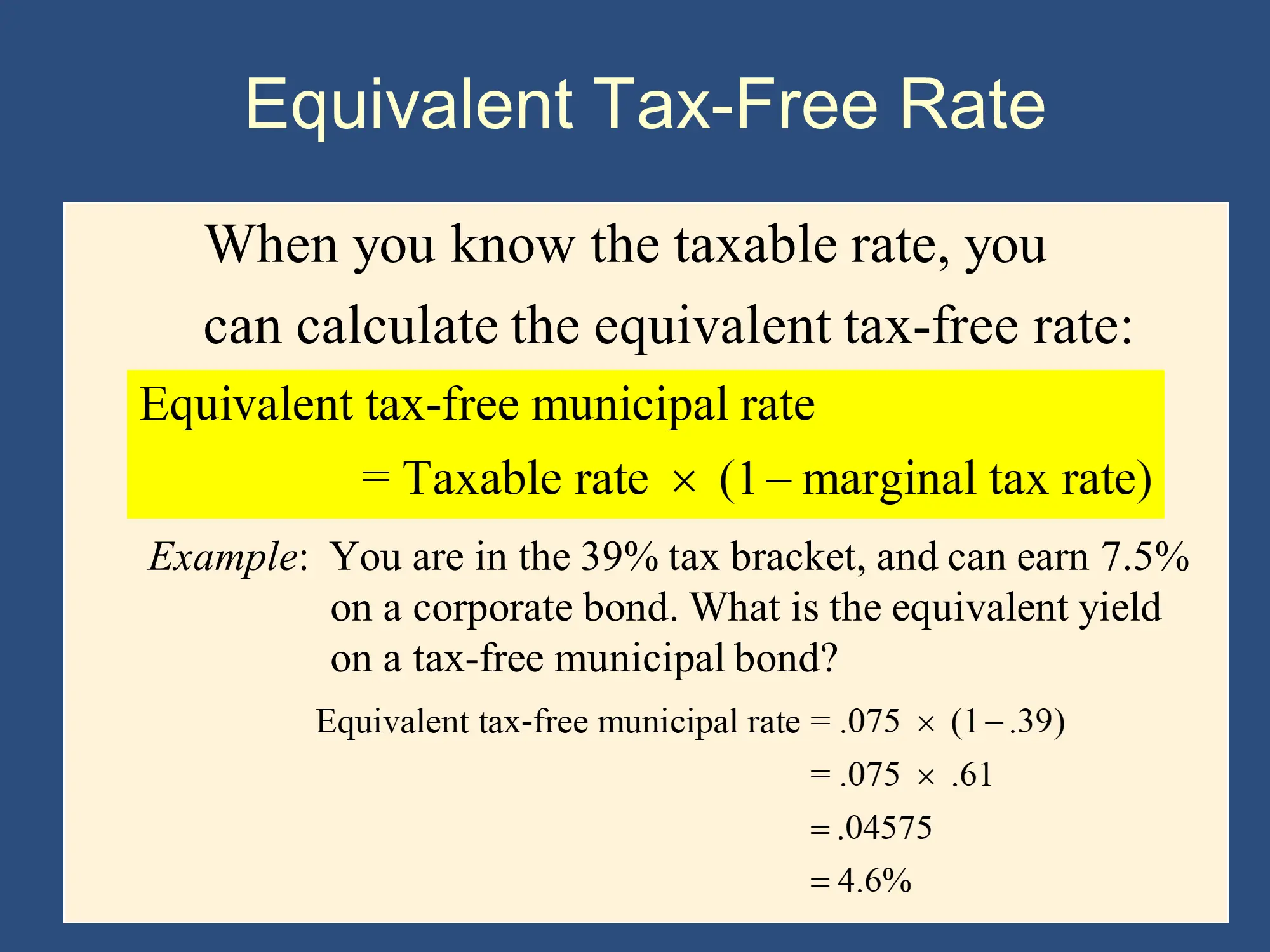

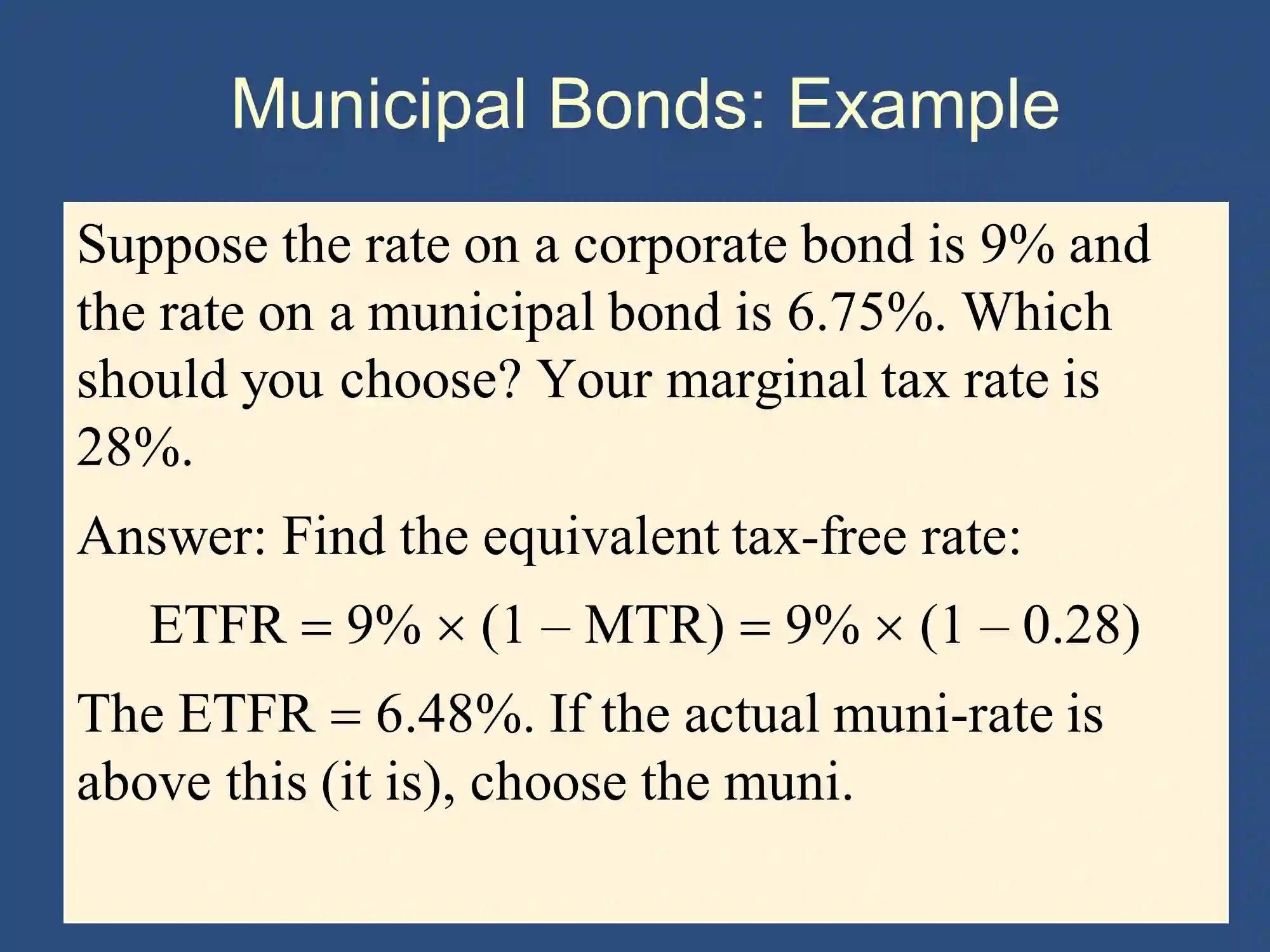

Equivalent Tax Free Rate =TaxableRate×(1−MarginalTaxRate)

The above formulas can also be found in more concise form in the formula sheet.

YTM

To solve a Yield To Maturity (YTM) problem write down the bond price formula and solve for i. This is equivalent to calculating the IRR of buying the bond and holding it until it matures.

Bonds and Taxes (Municipal Bonds)

Muni Effective Tax Free Rate example:

Municipal bonds are typically tax free. Therefore, to compare them to taxable bonds, you must compare the after-tax returns of each.

For a corporate bond:

- After Tax Rate=Actual Interest Rate×(1−Marginal Tax Rate)

For a Muni: (because there are no taxes)

- After Tax Rate=Actual Interest Rate

✏️ Suppose your marginal tax rate is MTR=30% and you are considering a 9% corporate bond and a 7% municipal bond. Which is better?

✔ Click here to view answer

Corporate, taxable bond:

After-Tax rate is = i(1−MTR)=9%×(1−30%)=6.3%

The muni’s after tax rate is 7%. The corporate looks like it has a higher yield, but after taxes, the muni is better. ⇨ The corporate bond is equivant to a 6.3% muni, because they both have the same after-tax return.

✏️ You are considering a 5% muni. What taxable yield (on a corporate bond) is this equivalent to? MTR=30%.

✔ Click here to view answer

You could simply use the above equation and Plug and chug: (help)

Plug and chug: (help)

- Equation:

After tax rate is = ic(1−MTR) - Plug:🔌

5%=ic(1−30%) - Solve: 🚂

ic=(1−.30).05=7.14% - Reflect: 🧠

The 5% muni has the same after-tax return as a corporate earning 7.14%.

In summary:

equivalent muni bondequivalent corporate bond=icorporate×(1−MTR)=(1−MTR)imuni

Suppose your marginal tax rate is 30%

And you are looking at two bonds:

| Taxable Rate | Tax Free Rate |

|---|

| Corporate | 9% | |

| Muni | | 6% |

Which do you invest in?

| Taxable Rate | After-Tax Rate |

|---|

| Corporate | 9% | ETFR=9%×(1−30%)=6.3% |

| Muni | | 6% |

The corporate bond may look like it is paying you 9%, but the government is taking a large chunk of that, so the equivalent tax-free rate is 6.3%.

After taxes, the Corporate Bond pays 6.3% and the Muni pays 6%, so the corporate bond is better.

Comparing i, c, Pb and F

Each column of this table is equivalent:

| When i>c, | then PB<F | Discount Bond |

|---|

| When i=c | then PB=F | Par Bond |

| When i<c | then PB>F | Premium Bond |

| NOTE: i represents the bond’s Yield to Maturity (YTM) | | |

For example, looking at the top row:

- if i>c, then it is a discount bond, so PB<F

- if PB<F, then it is a discount bond, so i>c

The last row of the table says that:

- if i<c, then it is a premium bond, so PB>F

- if PB>F, then it is a premium bond, so i<c

How you can use the above to check your work. Suppose PB=$1100 and F=$1000. c=6%. You calculate the YTM=7% and you want to know if you’ve made an error. Go back and check your math.

Just remember:

- If you are paying face value, then your YTM will be the coupon rate.

- If you are paying a lot (PB>F), then your YTM will be lower than the coupon rate (because you paid so much).

- If you are getting a good deal (PB<F), then your YTM will be higher than the coupon rate (because you the bond for cheap).

Bond Pricing Examples

✏️Bond 1: Coupon Cond

c=4%

T=4

F=$1000

i=5%

✔ Click here to view answer

A more concise way of solving it:

cF=4%×$1000=$40

PB=(1.05)140+(1.05)240+(1.05)340+(1.05)41040=$964.54

✏️Bond 2: Consol

c=8%

F=$10,000

T=∞ ← this means it is a consol.

i=9%

✔ Click here to view answer

Fc=$10,000×8%=$800

PC=9%$800=$8,888.89

✏️Bond 3: Zero Coupon Bond

c=0%

F=$5,000

T=6

i=7%

✔ Click here to view answer

PB=(1+7%)6$5000=$3331.71

Yield to Maturity (YTM) Examples

✏️Bond 1: Consol

c=5%

F=$1000

T=∞

PB=$1125

✔ Click here to view answer

Write down the bond pricing formula and solve for i

PC=icF

$1125=i5%×$1000

Switcheroo: i=$1125$50=4.444%

The yield to maturity is 4.444%.

✏️Bond 2: 1 year Coupon Bond

c=5%

F=$1000

T=1

PB=$1005

✔ Click here to view answer

Write down the bond pricing formula and solve for i

PB=(1+i)1cF+(1+i)1F

PB=1+icF+F ← must put it over a common denominator before you can switcheroo.

Plug in: $1005=1+i$1050

Switcheroo: 1+i=$1005$1050=1.0448%

i=4.48%, so the Yield to Maturity is 4.48%

✏️Bond 3: Zero Coupon Bond

c=0%

F=$1000

T=4

PB=$853

✔ Click here to view answer

Write down the bond pricing formula and solve for i

PZCB=(1+i)TF

Plug in: $853=(1+i)4$1000

(1+i)4=$853$1000=1.1723 ← Switcheroo

(1+i)4=1.1723 ← recopy

1+i=1.172341=1.0405 ← Take the 1/4th exponent of both sides. It cancels out the ^4. Don’t forget parentheses around the (41).

1+i=1.0405 ← recopy

i=4.05%, so this bond has a YTM of 4.05%

🧠 Note that Yield to Maturity is just calculating the IRR of purchasing the bond. This tells you the %-return of purchasing the bond. We can illustrate this by re-solving the above questions as if they were IRR problems instead of YTM problems. Note that we get the same answer!

Solving Bond #1 as an IRR problem rather than a YTM Problem:

✔ To calculate YTM as an IRR, you write, PDV Inflows=PDV Outflows:

PDV Inflows=icF=5%×i$1000

PDV Outflows=PC=$1125

$1125=i$50

i$50=$1125

i=$1125$50=4%

Solving Bond #2 as an IRR problem rather than a YTM Problem:

✔ The cash flows are:

| T | Cash Flows |

| 0 | -1005 (Cash Outflow of $1005) |

| 1 | 5%×$1000+$1000=$1050 |

PV of Cash Inflows=1+i$1050

PV of Cash Outflows=$1005

Setting PV Inflows=PV Outflows

1+i$1050=$1005

$1005$1050=1.0448=(1+i)

i=4.48%