👨🏫 Outline

Formulas for this lecture can be found in my paper formula sheets and online formula sheet.

Primary vs Secondary Markets

- Primary markets - where securities are first sold to the public, and where firms or governments receive the bulk of the revenue from those sales.

- Secondary markets - where individual and institutional investors trade securities among themselves. (Issuers of securities receive none of the proceeds from transactions in the secondary market.)

- Unpacking Primary vs Secondary - Initial Public Offerings (IPOs) are when securities are first sold to the public, so they are Primary Markets. Other than IPOs, 99% when you read about “stock prices,” these are from secondary markets, where investors are trading amongst themselves.

- Example - suppose ExampleCorp issues stock for $1 per share in the primary market. One year later the same shares trade for $10/share in the secondary markets. In this case, the company only received $1 per share in the primary markets. Investors make up to the remaining $9 by trading in the secondary market.

Functions of Money

- Medium of Exchange - “can pay for things with it”

- Store of Value - “can save it to buy things later (like when you retire)”

- Unit of Account - “measure prices and debts with it”

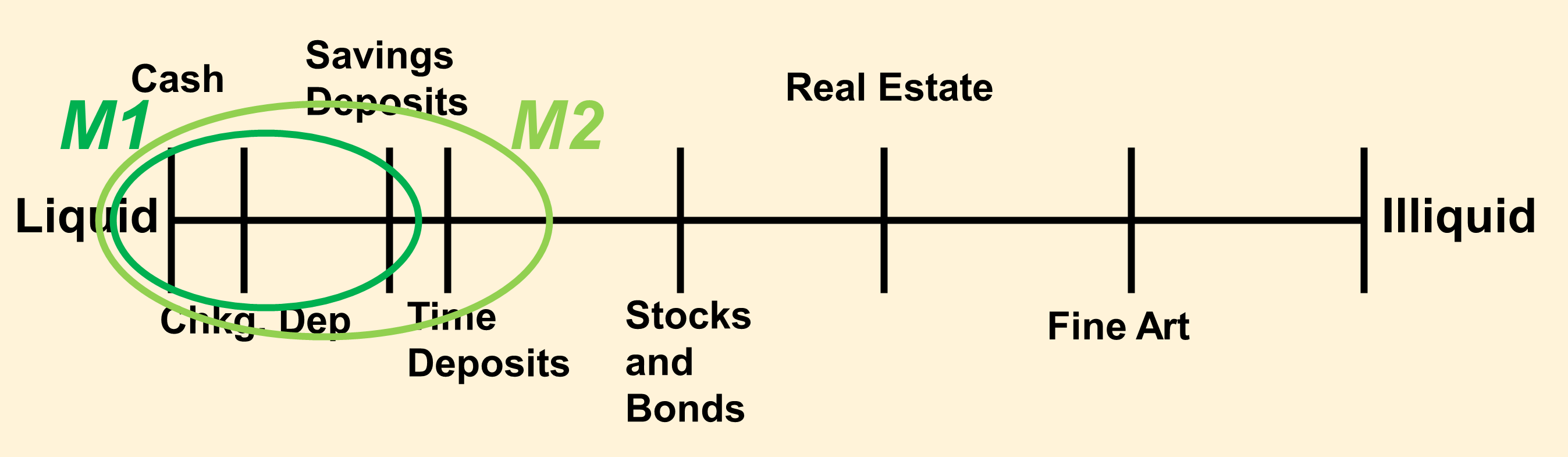

M1 Monetary Aggregate (Measures of the “Money Stock”)

- Currency and Traveler’s Checks - “Cash in the hands of the public” (does not include currency in bank vaults)

- Checking & Savings Deposits in banks.

Summary:

MoneySupply = M1 = Cash in Hands of Public + Deposits

- MS = CHP + Deposits

- Includes all of M1 and also

- Time deposits (you deposit money at a bank but there are penalties if you withdraw it early. For example: certificates of deposit)

- Money market mutual funds - you buy shares in a mutual fund that invests in short term bonds. Many people use this like a savings account. Note, however: it is not FDIC insured.

Liquidity means that you can convert something rapidly into money, at a good price.

What is not money?

- Checks - Checks are not money, but checking deposits are.

- Credit cards - Credit cards merely allow you to take a short-term, unsecured loan.

Reasons for Bank Merger Activity: (a 68% decrease in # banks)

- Summary: there were regulations in place that prevented large banks, but those regulations were rolled back in the late 20th century. Because of economies of scope, economies of scale, and loan diversification, banks want to merge, so when the regulations were rolled back, they merged. As a result of these mergers (and general business issues, of course) the number of banks decreased by 68%.

- Antiquated banking regulations in place until the early 1990s led to too many banks—overcapacity. For example, the McFadden Act (1927)—prohibited branching

- Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994—abolished all prohibitions on interstate banking

Terms (why bigger banks are more efficient):

- Economies of scale means that if a bank operates at a large scale in a single line of business, it can do so “better.” (better=lower costs or higher quality)

- If you have 1M checking account customers, your online portal will be better than if you only have 10K checking account customers. Checking account is a “single line of business.”

- Economies of scope (synergies) means that if a bank has multiple line of business, they can run those lines of business “better.”

- If your bank takes both checking and savings deposits (2 lines of business), it can do so more effectively than if it only did checking deposits (1 line of business).

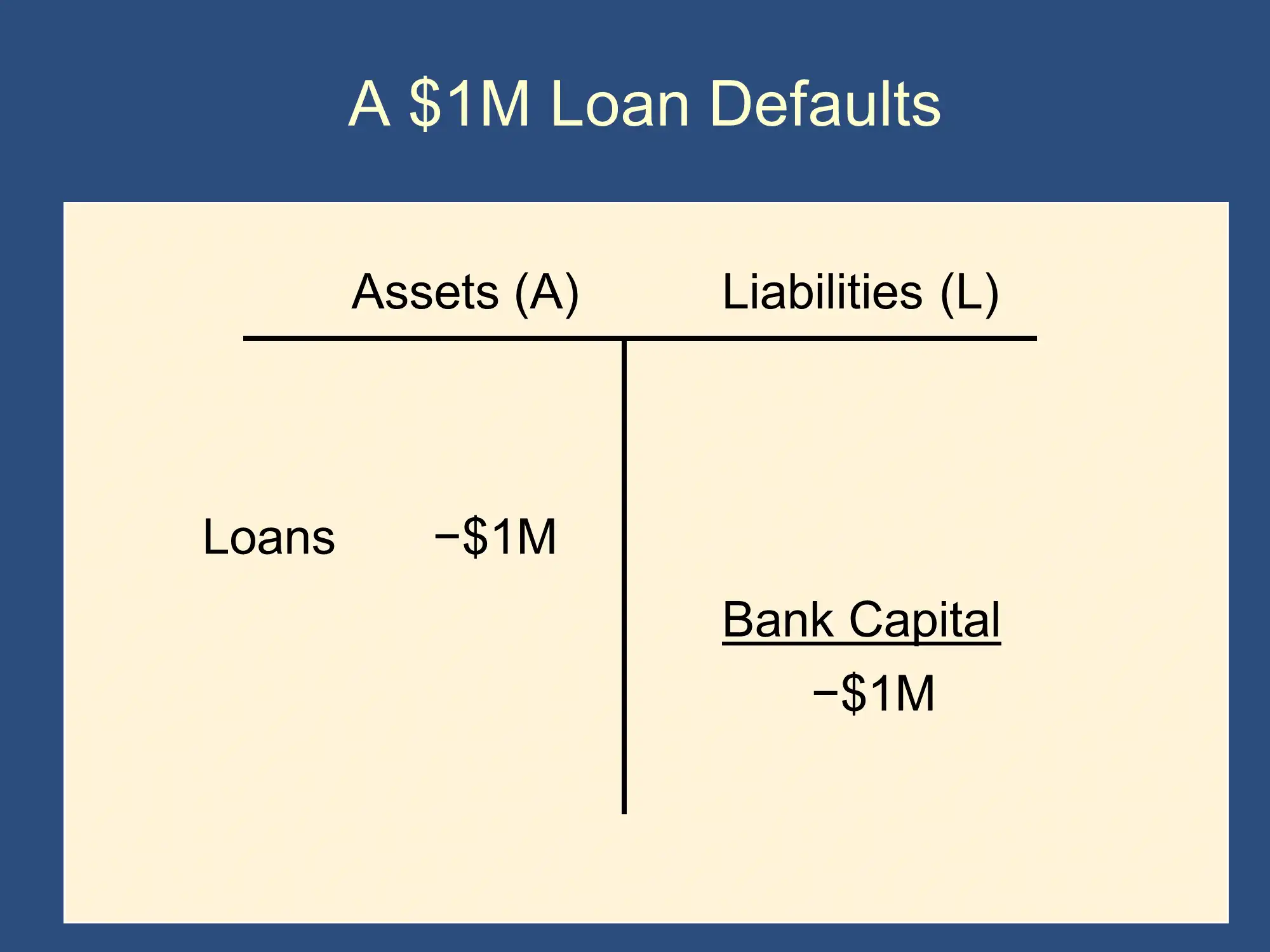

- Loan Diversification if you have different types of assets on your balance sheet, there is less risk

- DON’T PUT ALL YOUR EGGS IN ONE BASKET. It’s about managing investment risk.

- If your bank does both residential and commercial lending, your loan portfolio will be less risky.

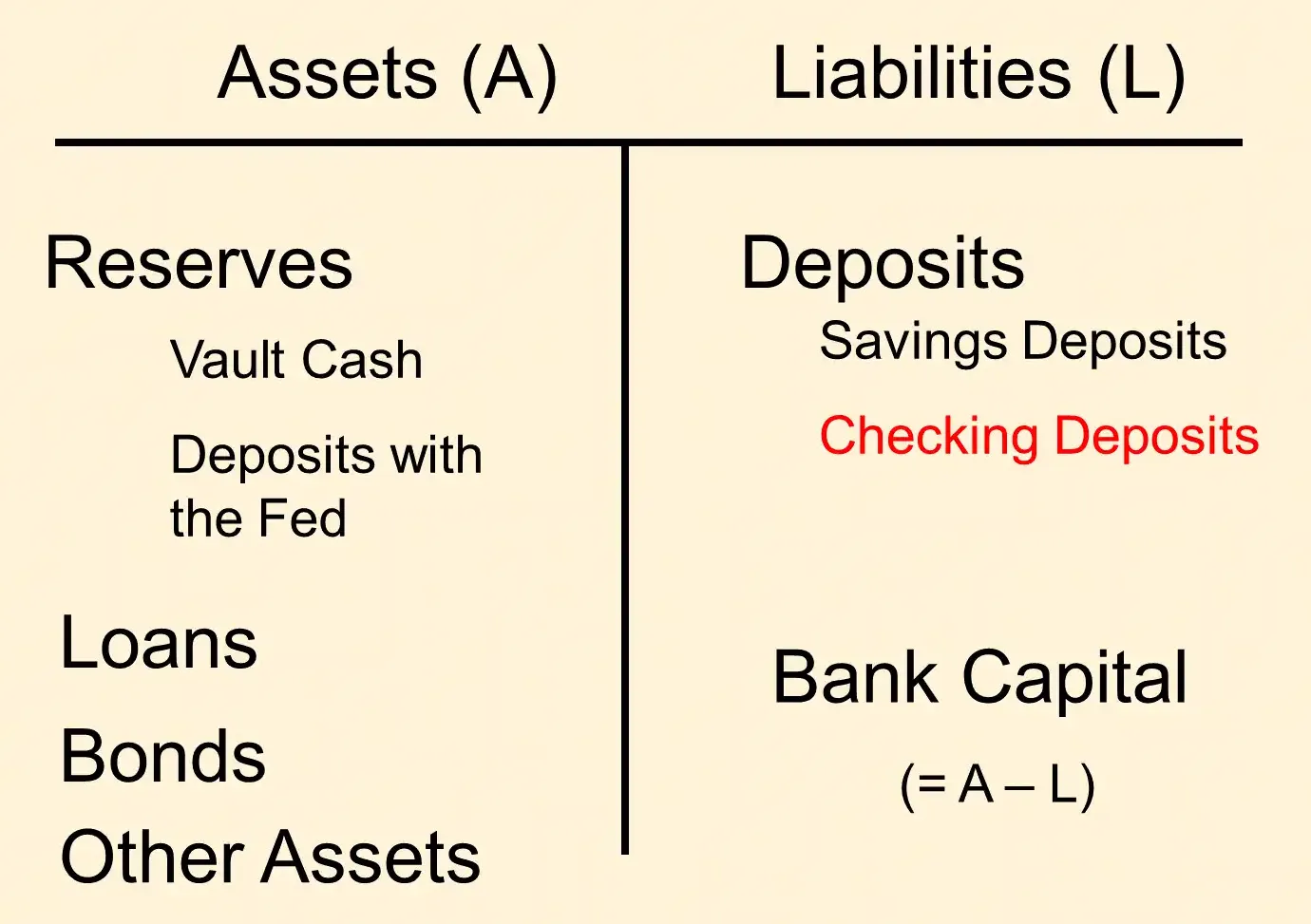

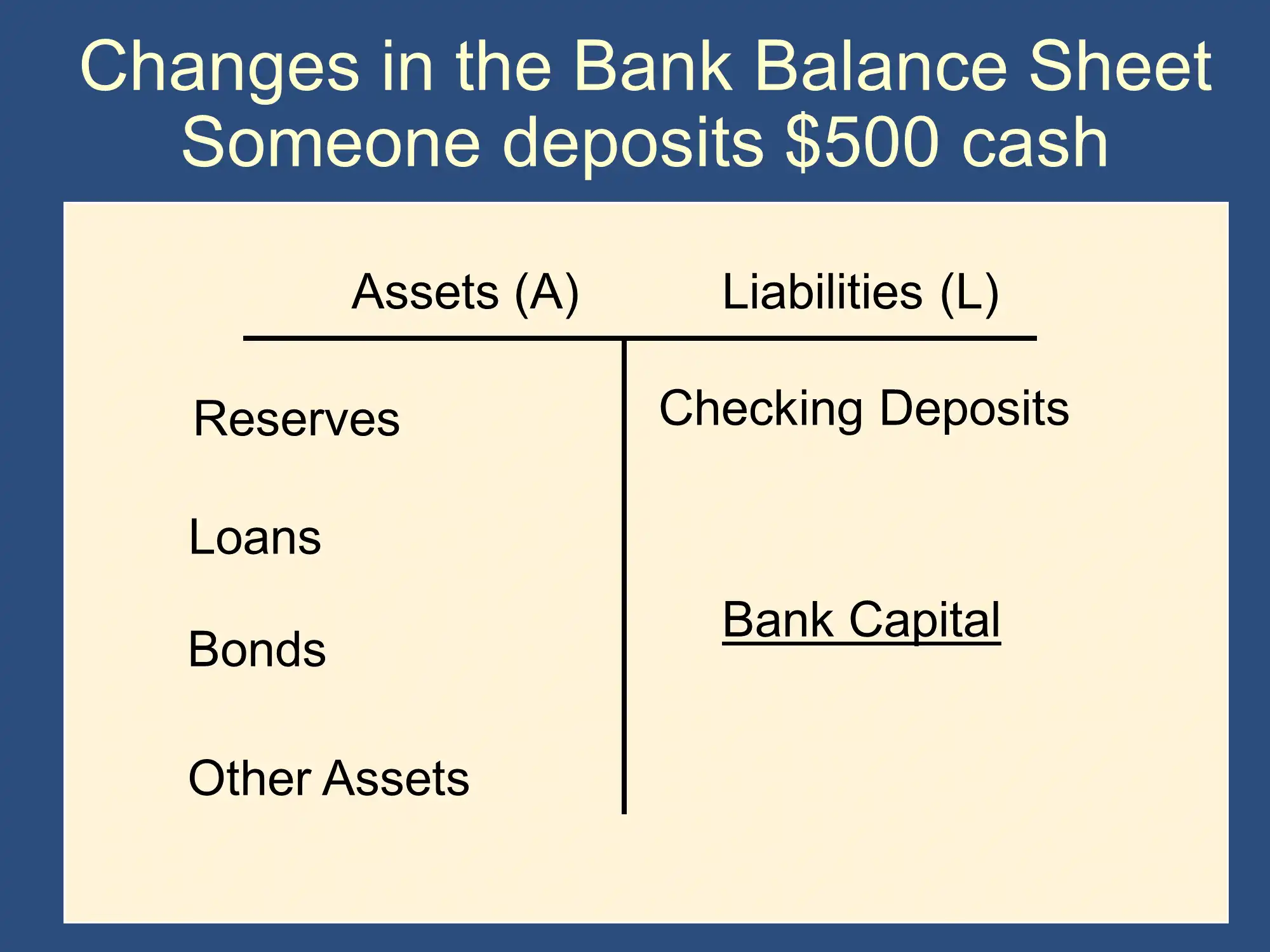

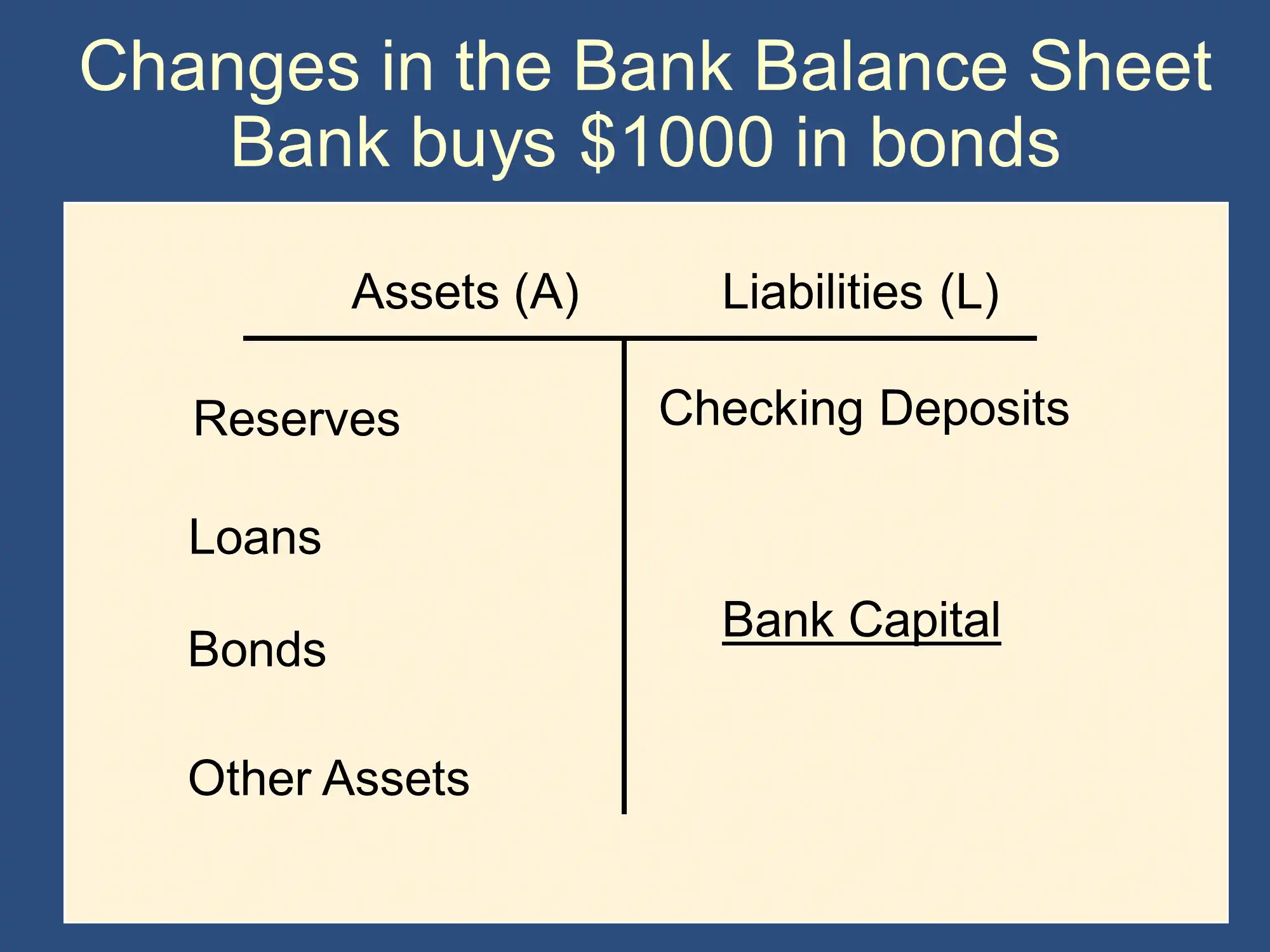

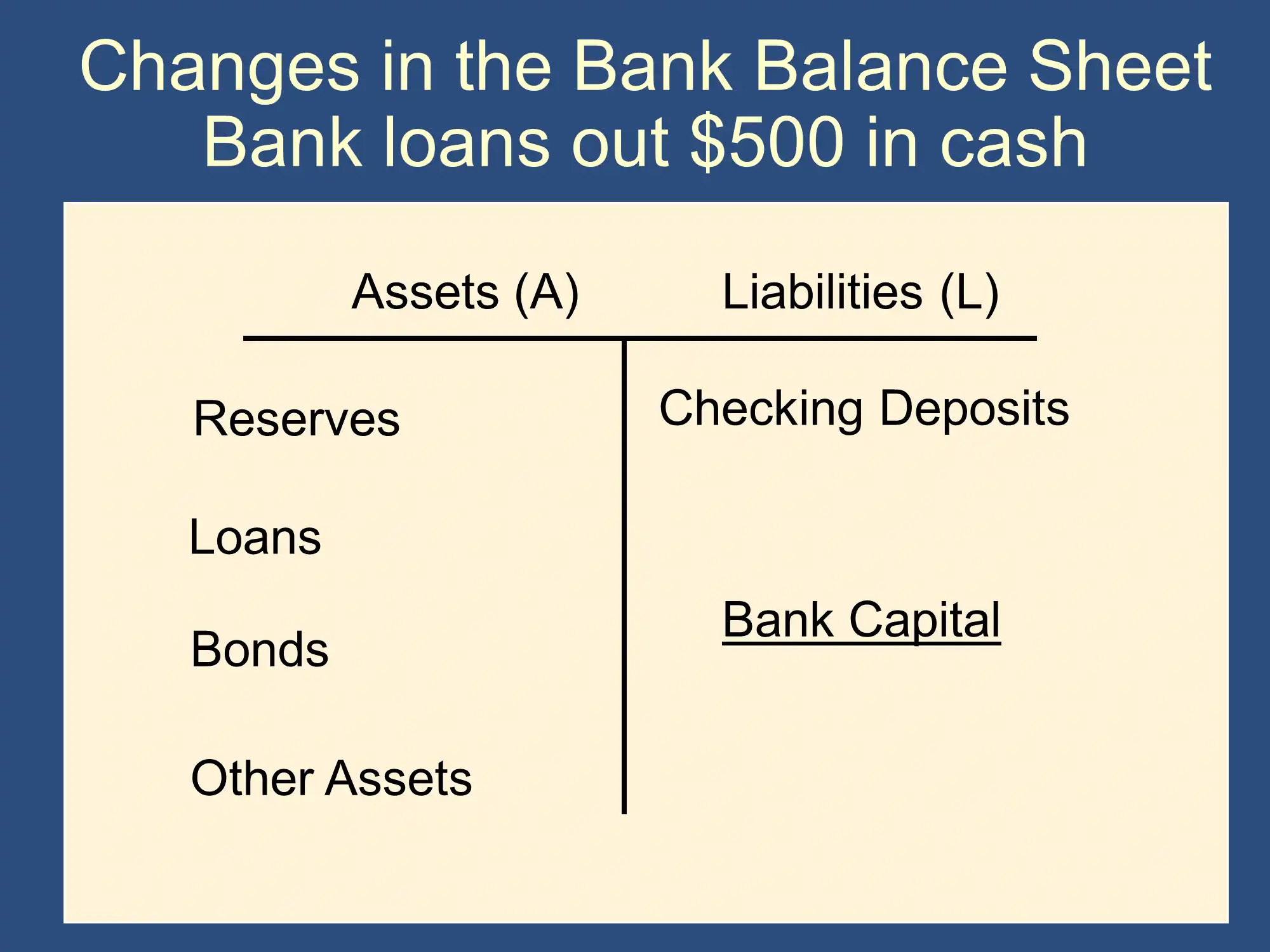

Bank Balance Sheets

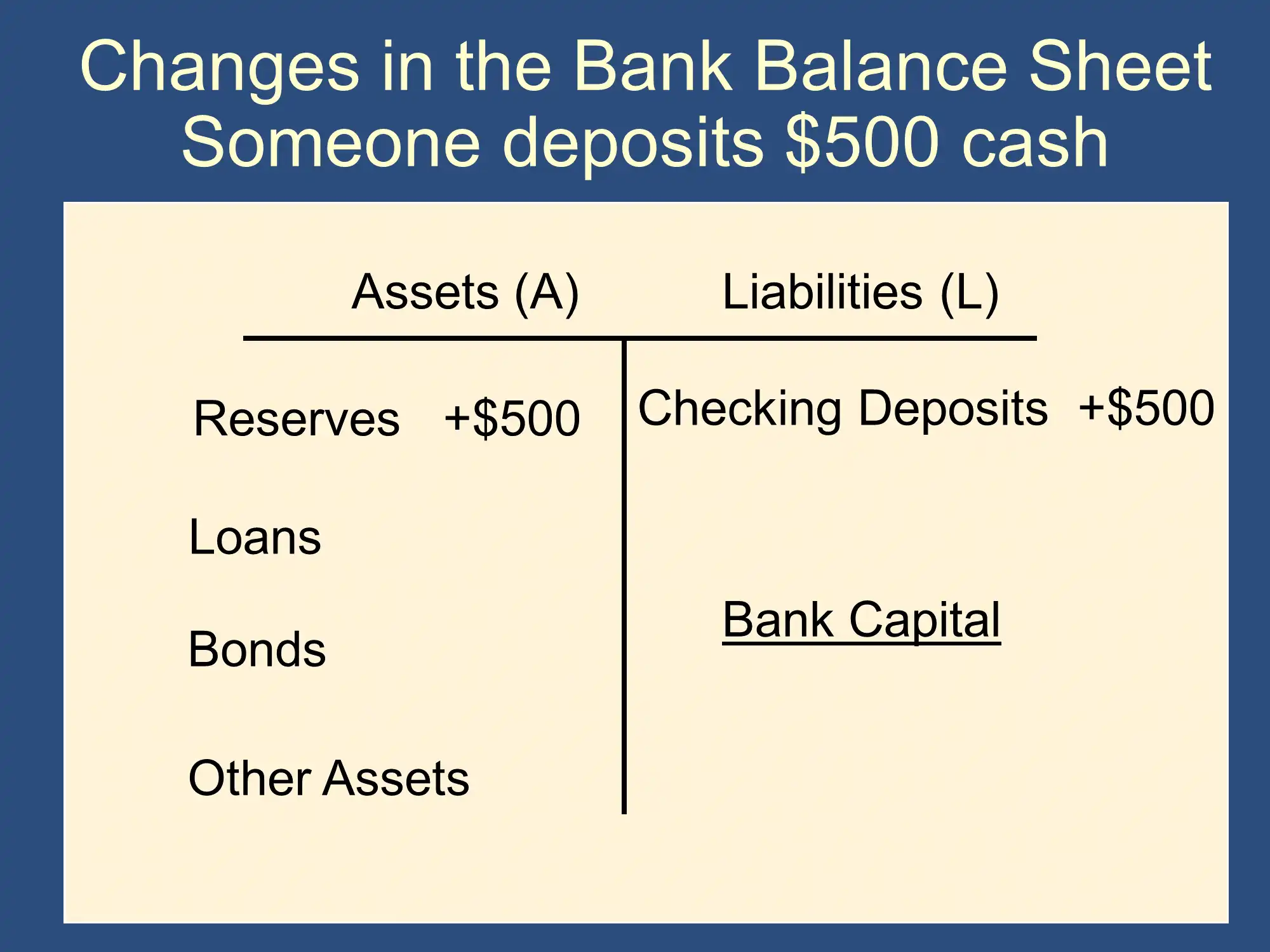

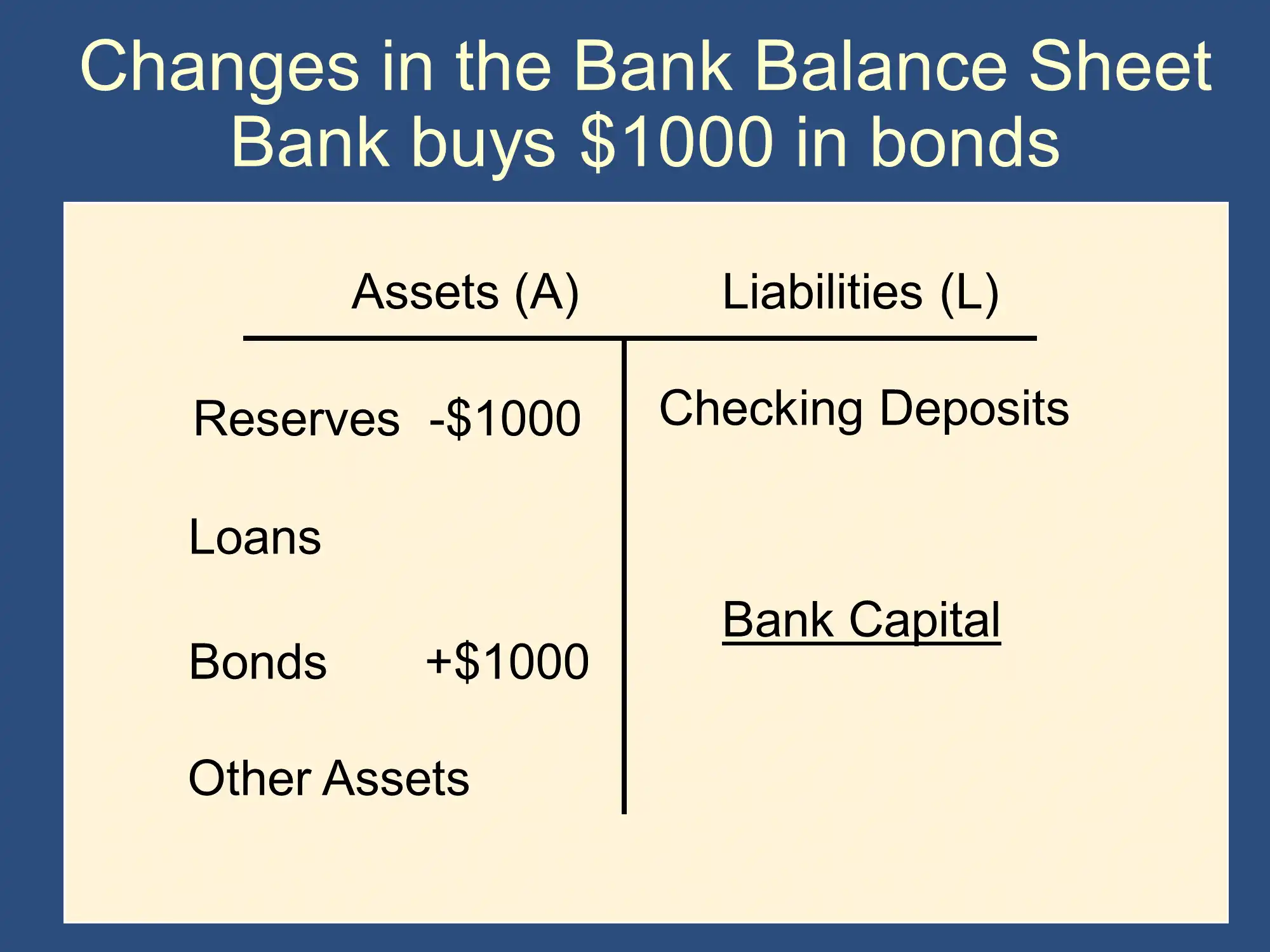

Reserves are cash that a bank has if it needs to make a payment. You can think of banks as using reserves the way that you use money. If a bank needs to make a payment, or send money, it uses reserves. There are two types of reserves: Vault Cash + Deposits at the Fed.

- Vault Cash is just currency (paper currency and coins) that the bank keeps on hand.

- Deposits at the Fed are currency that the bank has deposited at its local branch of the Federal Reserve bank. Just like you might deposit your extra cash in you bank, your bank will deposit its extra cash at its local Federal Reserve. Just like you can use your checking deposits to write checks, your bank can use its Deposits at the Fed to send cash to other banks. Deposits at the Fed are vital for the smooth operation of the financial system.

In summary: for a bank, TotalReserves = Vault Cash + Deposits at the Fed

For years, banks were required to hold reserves equal in value to 10% of the deposits at the bank. These were called “Required Reserves.” Now, the amount of required reserves is 0. Any additional reserves that a bank has (beyond this minimum) are called “Excess Reserves.”

In summary:

Balance Sheet

Definition of Bank Capital:

Rearranging this equation, it implies that the left and right of balance sheet are equal:

In other words, “the left and right sides of the balance sheet must balance” ⚖️

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.

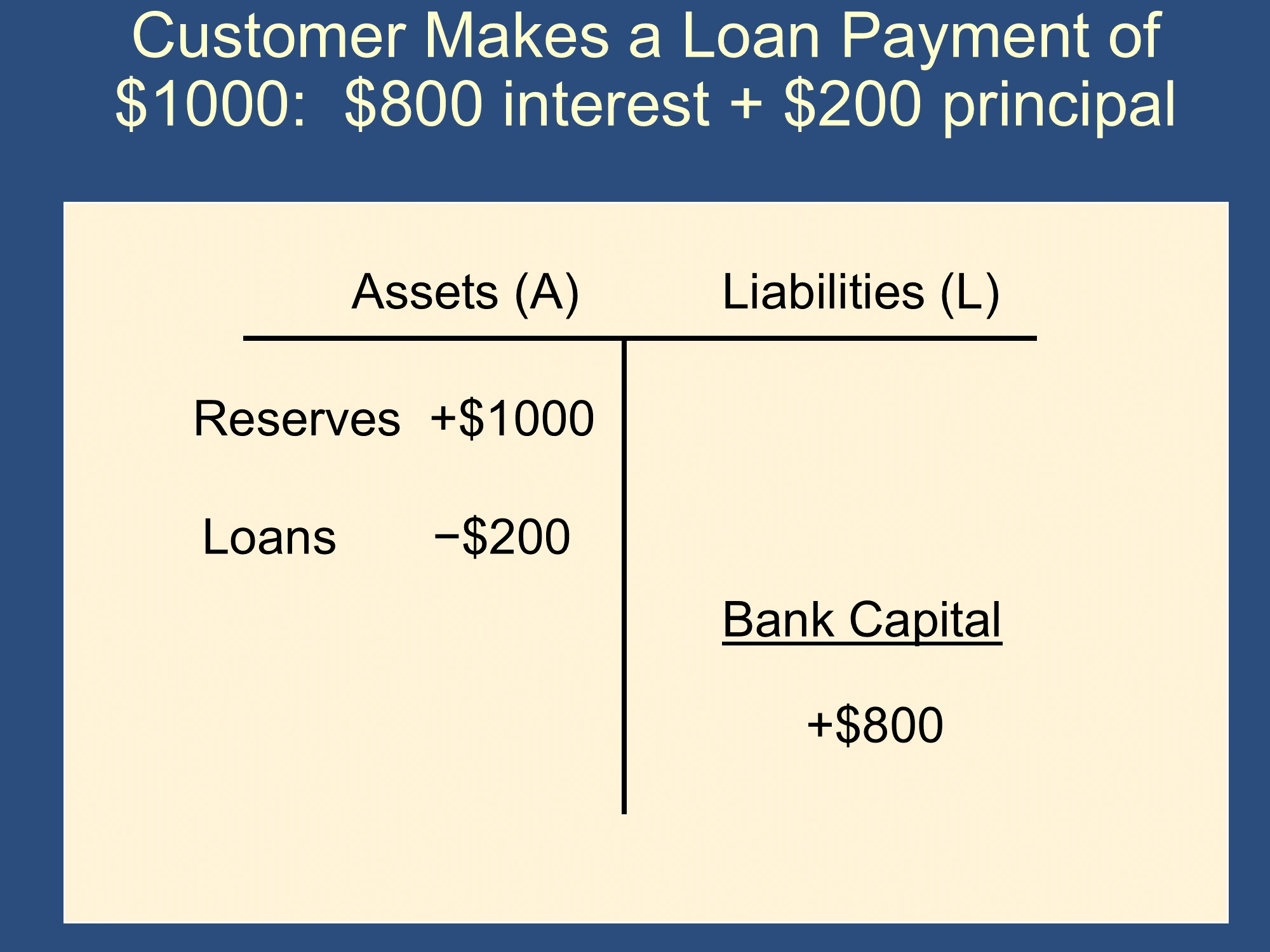

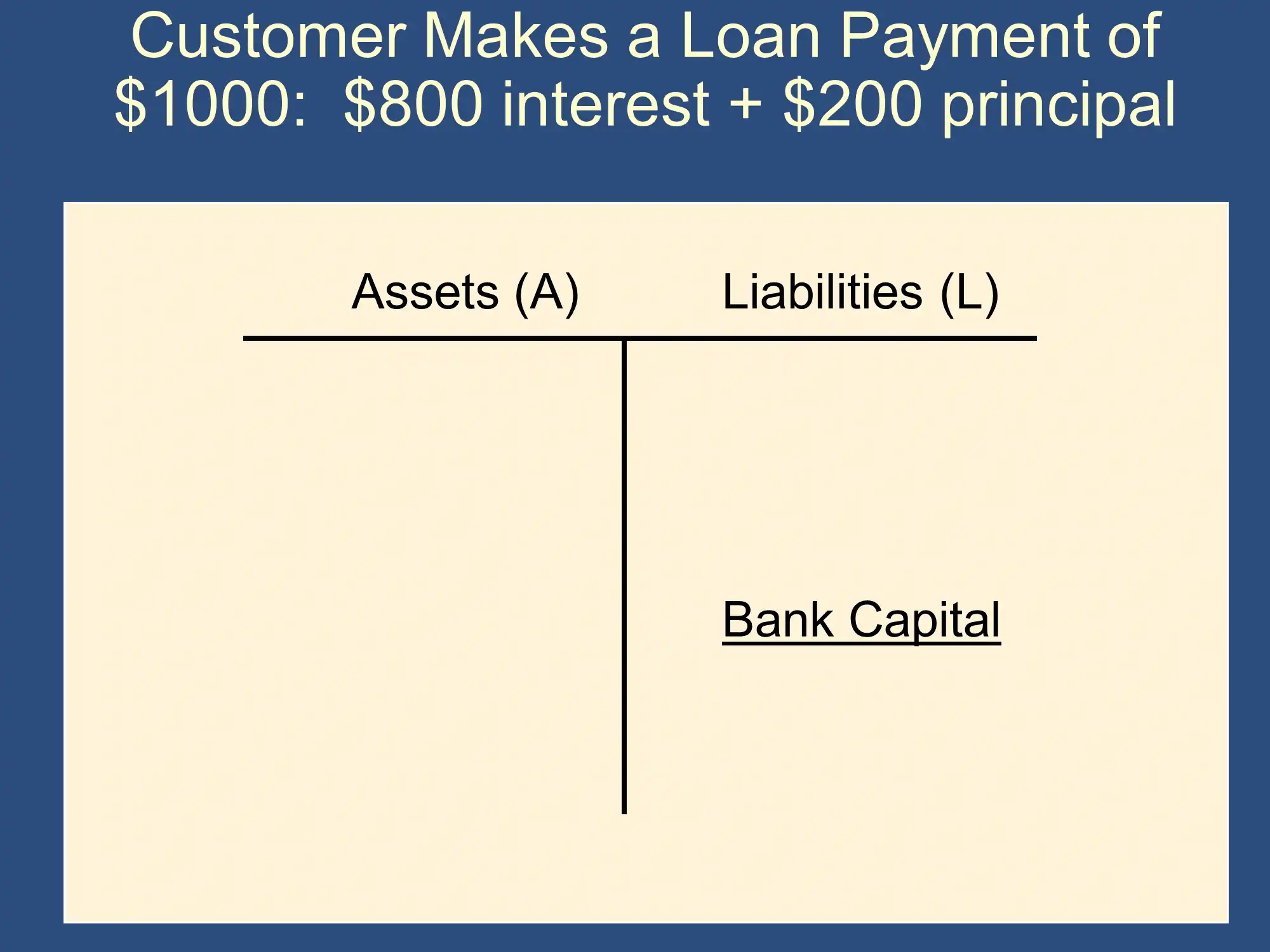

Hint: interest is “pure profit” and principle means paying down the loan.

Hint: interest is “pure profit” and principle means paying down the loan.

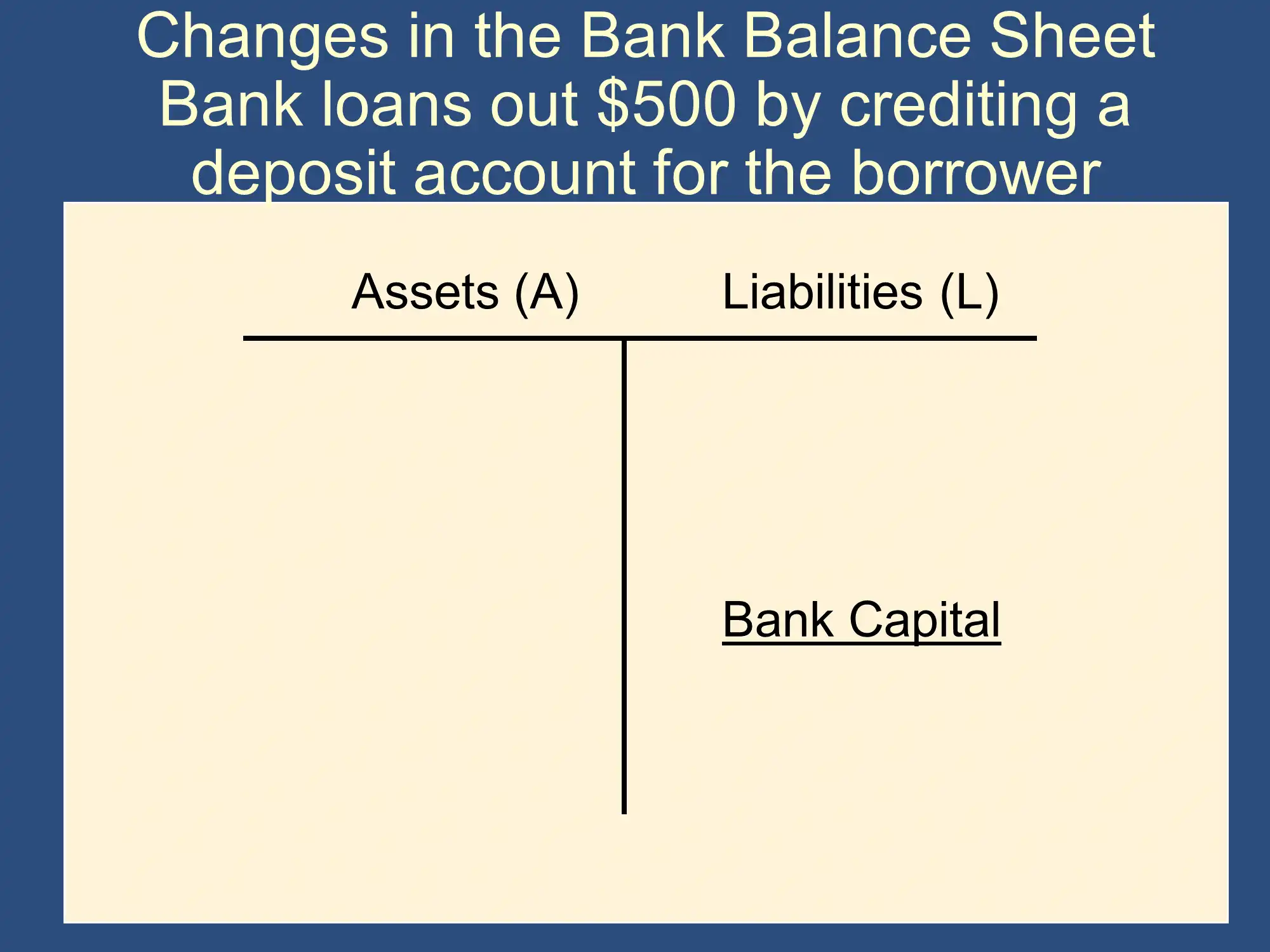

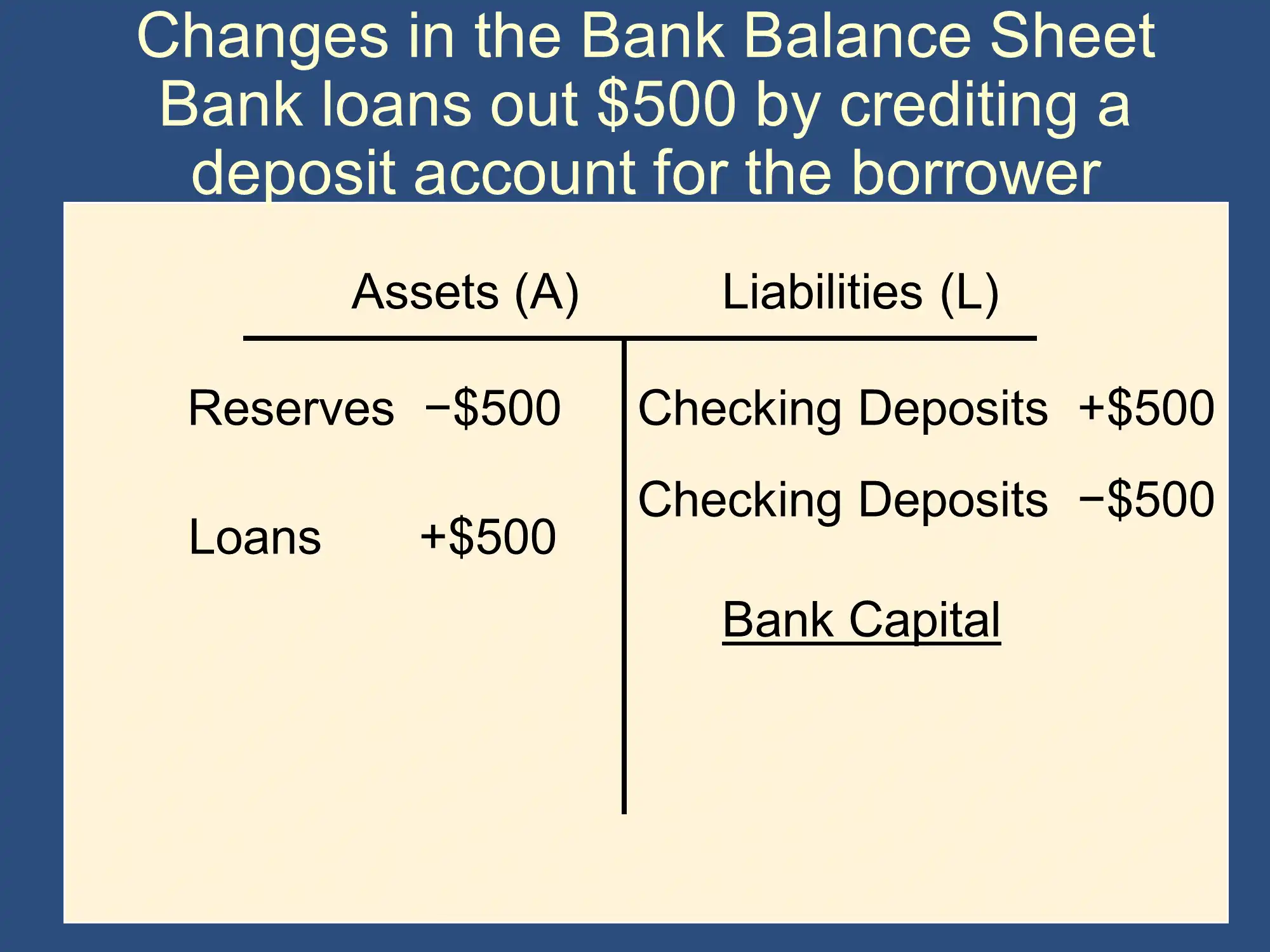

At first, a new deposit is created, so deposits and loans both increase. Later, the money is withdrawn, so deposits and reserves both decrease.

At first, a new deposit is created, so deposits and loans both increase. Later, the money is withdrawn, so deposits and reserves both decrease.