❔ Ample Reserves FAQ

I want clarification on how the Fed charges interest on the banks for holding the reserves with them? Is it a one-time charge or an annual charge? And is this rate what we call the Discount Rate then?

IORB - an interest rate that the Fed pays on deposits at the Fed. It is the Interest rate that the fed pays On Reserve Balances. Reserve balances are just deposits that commercial banks make at the Fed. Remember, there are two types of reserves that banks can hold: Vault Cash and Deposits at the Fed. IORB is the interest rate that the fed pays on Deposits at the Fed.

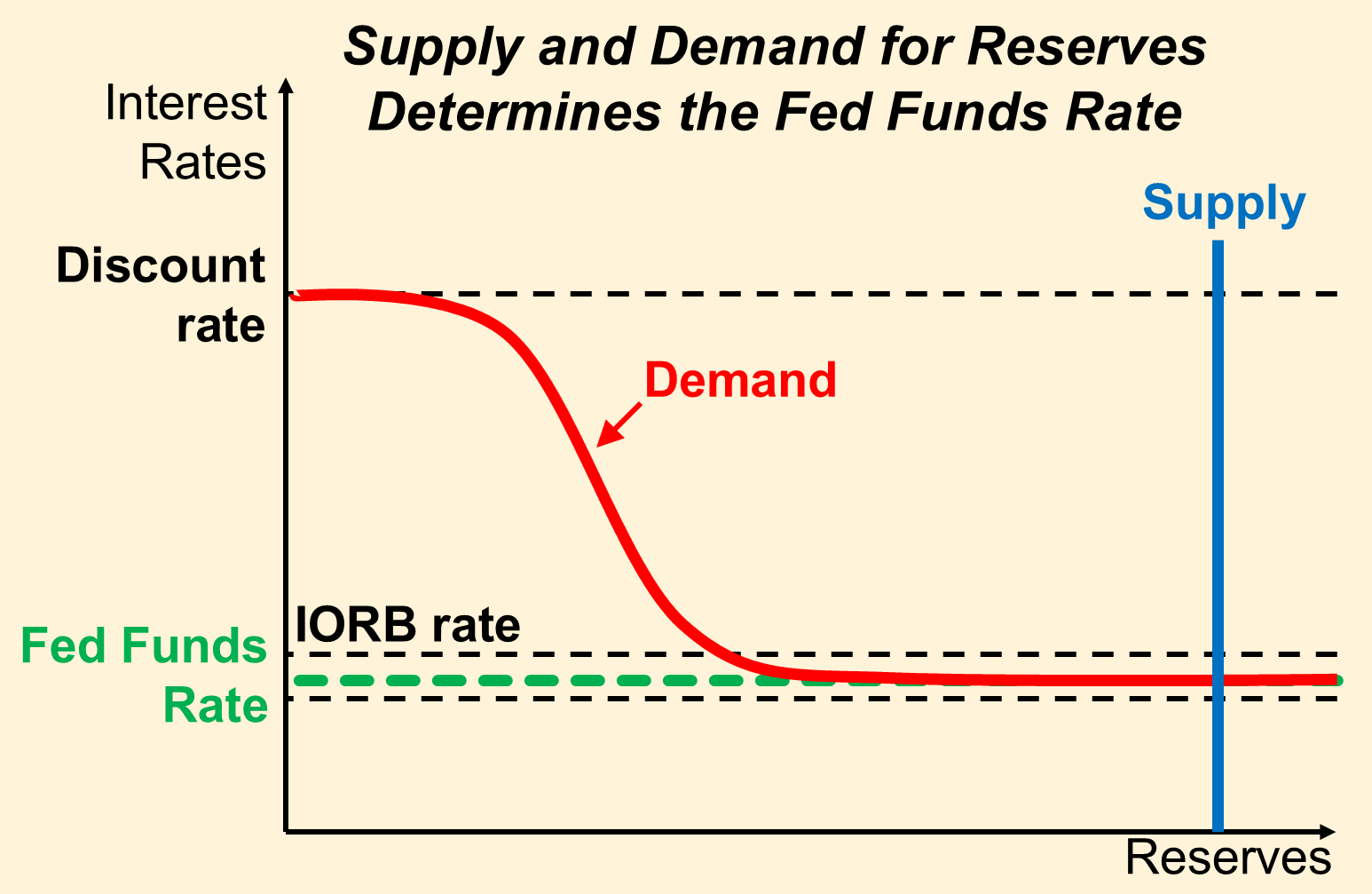

If a commercial bank has dollars, it can either lend those dollars out or deposit them at the Fed as “Reserve Balances.” If inflation is too high, the Fed needs to raise interest rates to slow the economy down. It raises interest rates by getting banks to deposit their dollars as reserve balances instead of lending that money out. If banks are lending less money out, then interest rates rise. There are a number of ways to understand how raising IORB raises interest rates. The above is an intuitive way of understanding it. The following diagram gives another way of understanding it:

Monetary policy professionals will prefer the diagram, but when you’re just starting out, think that when the Fed pays more IORB, the banks will deposit their dollars rather than lending them out. This will raise all interest rates, including the FFR.

To

It does this so that banks take the dollars out of circulation and deposit it at their federal reserve bank instead of lending them out.

Side note:

With IORB, the Fed is essentially a borrower of dollars. It is borrowing money from the commercial banks and is paying interest on those reserve balances that it is borrowing (ie IORB).

When the fed raises IORB, banks with excess reserves will lend their dollars to the fed rather than lending those dollars to businesses and consumers. As a result, businesses and consumers will have fewer dollars and will make fewer purchases. With fewer purchases, inflation will decline.

When the fed lowers IORB, banks with excess reserves will lend their dollars to businesses and consumers. …

Supply and demand for reserves in the Federal Funds market where banks lend money to each other

Normally, we expect demand curves to be downward sloping. Why are there two curves in the red line, below? Also, what is up with the bottom dotted line?

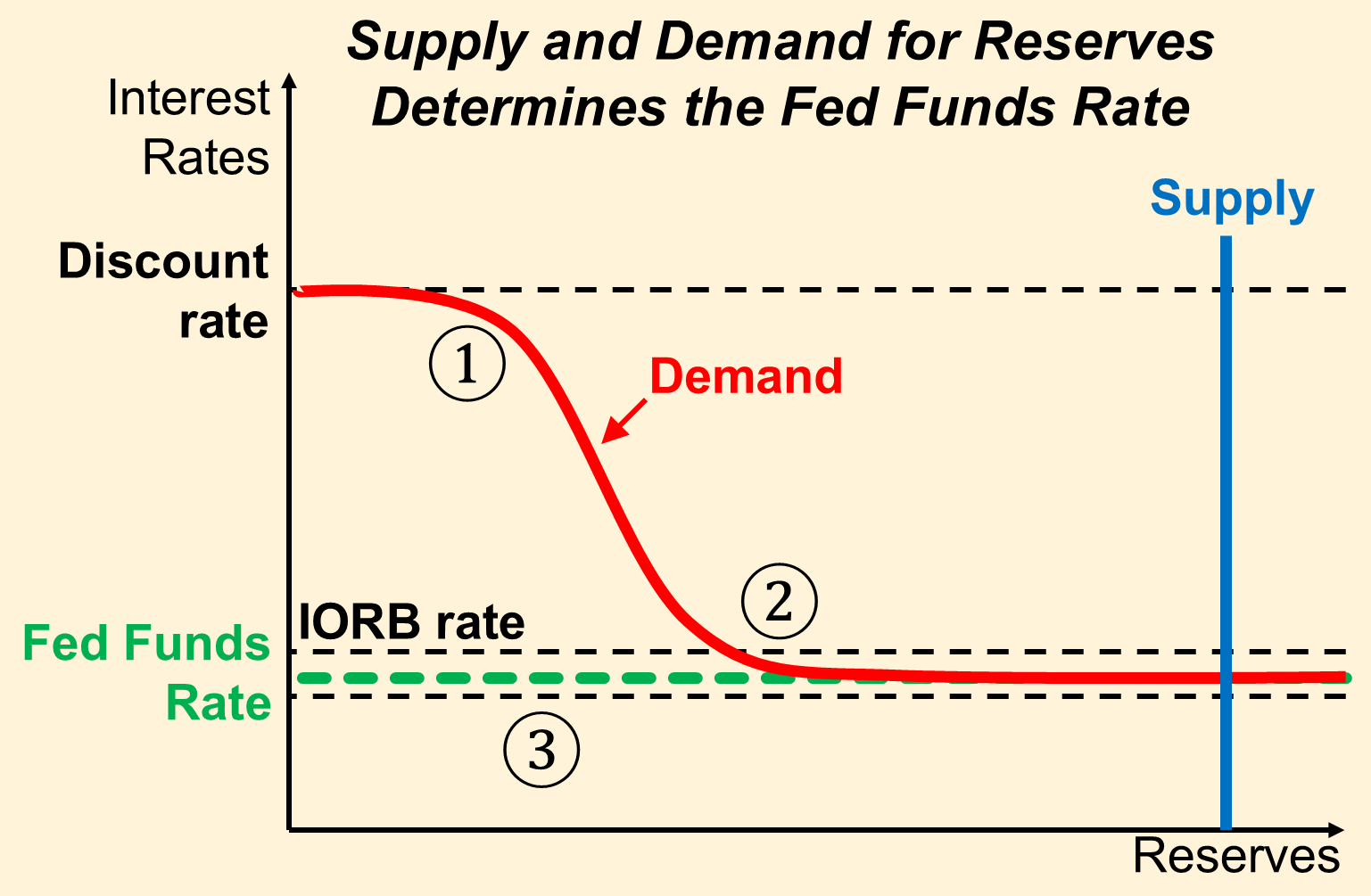

You’ve asked 3 questions. Each one is hard. We’ll cover the three questions in turn.

① Why does the demand for reserves flatten out at the discount rate?

The red line is the demand for reserves in the market for federal funds. It indicates how many reserves that banks will want to borrow from each other in the Federal Funds market.

First, we need to know what the Federal Funds market is. It is how banks lend money to each other short-term. If a bank has more Deposits at the Fed than it needs (ie more Reserve Balances than it needs) it can lend some of these out to other banks. The Fed Funds rate is the average rate that banks are lending these excess reserves to each other.

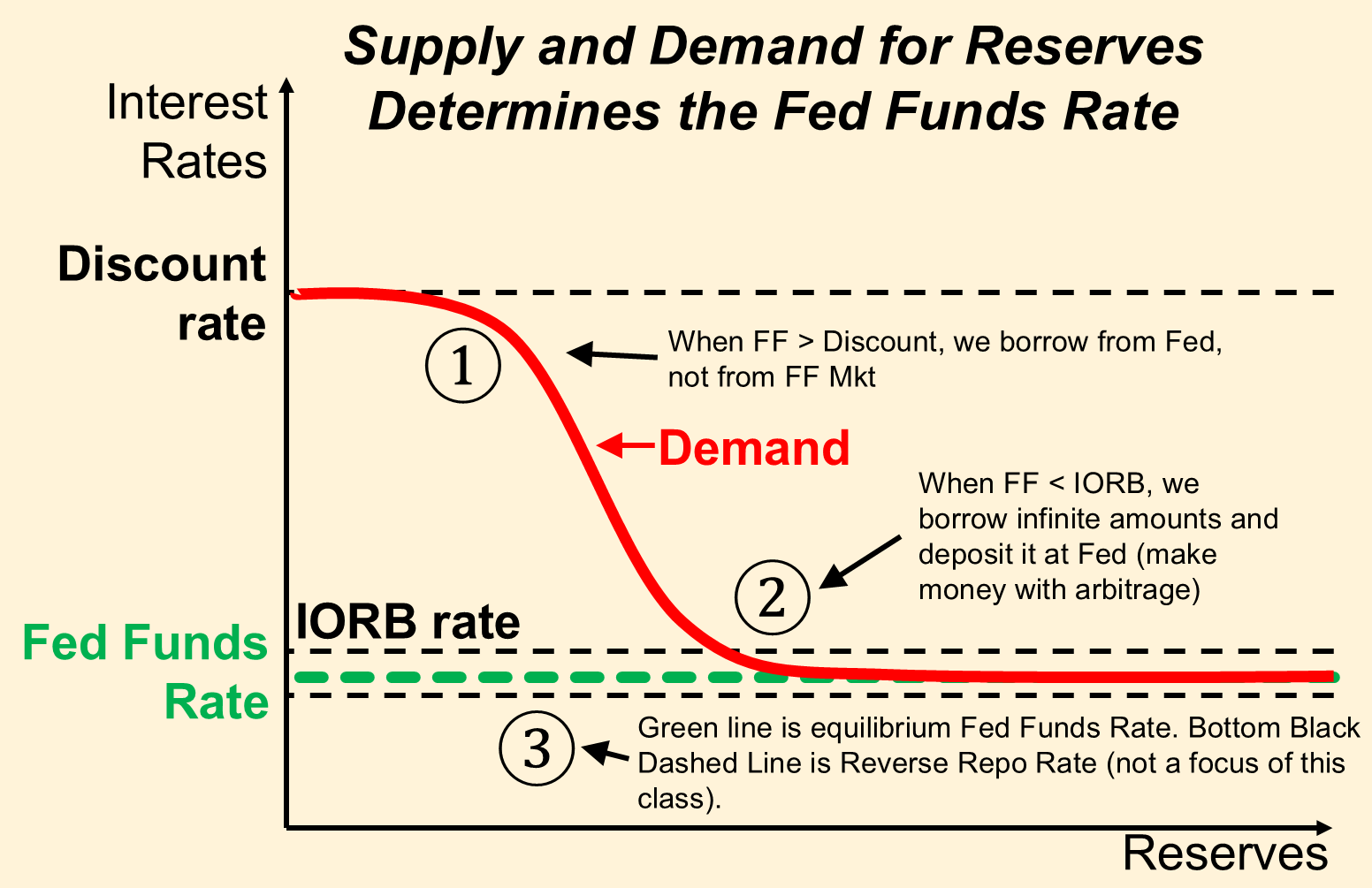

When the red line goes flat at ①, what that means is that banks will not borrow money from each other at an interest rate higher than the discount rate. The red line going flat means that banks will not demand any reserves from other banks if they have to pay more than the discount rate. Instead, they will just borrow those reserves from the Fed.

Suppose the discount rate is 6%. Suppose that the USAA needs more reserves. USAA calls up BoA and says, “I need some reserves for a week. How much will you charge?”

BoA says, we’ll charge 6.01%. What will USAA say? No thank you. I’ll go to the Fed. As a result, if the Fed Funds rate offered by BoA is 6.01%, than the reserves demanded by USAA will be $0. Banks won’t borrow funds from other banks when the interest rate for those funds is more than the Discount Rate. Everyone borrows money at the cheapest rate possible. This explains curve ①

The Fed Funds rate is always set by banks lending money to each other. They are free, independent capitalist economic entities. The Fed doesn’t have the power to set the Fed Funds rate - it is set by supply and demand. In fact, the following diagram just shows the supply and demand curves that we use to understand how the Fed Funds rate is set by supply and demand:

The fed wants banks to borrow from other banks because it doesn’t want to be the banking system for the entire economy. Economists don’t think government enterprises are run very well, so it wants the private sector to do the lending, not the Fed.

Therefore, the Fed sets the discount rate significantly above the target fed funds rate. That way, banks only use the discount window in emergencies. However, it is always available for emergencies.

🙋That’s true! I’m reading a econ textbook written by Ben Bernanke and he craps on legislators and gov administrators 😂

The FOMC decides how all of the administered rates are set.

② Why does the demand for reserves flatten out at the discount rate?

✏️ Suppose that BoA calls up USAA and says, “Hey, we’ve got too many reserves. We can lend you some reserves for 4.99%. How much do you want?” Assume that the IORB rate is 5%. What will USAA do?

✔ Click here to view answer

USAA will borrow all of the reserve balances it can from BoA at 4.99%. It will keep those reserve balances in its account at the fed and earn 5% on those balances. It has an interest rate spread of 5%-4.99%=0.01% = 1 basis point. If it borrows $1B, then it make $1,000,000,000*.01% = $100,000

Therefore, USAA’s demand for reserves will be infinite when the Fed Funds rate is less than the IORB. This is exactly what the bottom curve illustrates.

When USAA borrows money at 4.99% and lends it at 5%, it can make a risk-free profit. Whenever there is an opportunity to make a risk-free profit, we use the French word, “arbitrage.” The fact that banks like USAA will do arbitrage trades like the one described immediately above is why the red line can’t get too far below the IORB.

🙋③ What is the dotted line at the bottom of the diagram?

Some entities don’t have deposit accounts at the Fed. Therefore, if they have excess reserves, they can’t take advantage of the IORB rate. Instead, they must lend their money to a bank that has a deposit account at the Fed. Alternatively, they can also use a different program called “Reverse Repo.”

So if IORB rate is the rate of interest that Federal Reserve pays on behalf of a eligible institution for maintaining the balances at their reserve…then does that mean banks pay to borrow money from Fed (discount rate) and in return Fed pays banks to maintain that balance at Fed (IORB rate)? Can you please clarify this concept 🙂

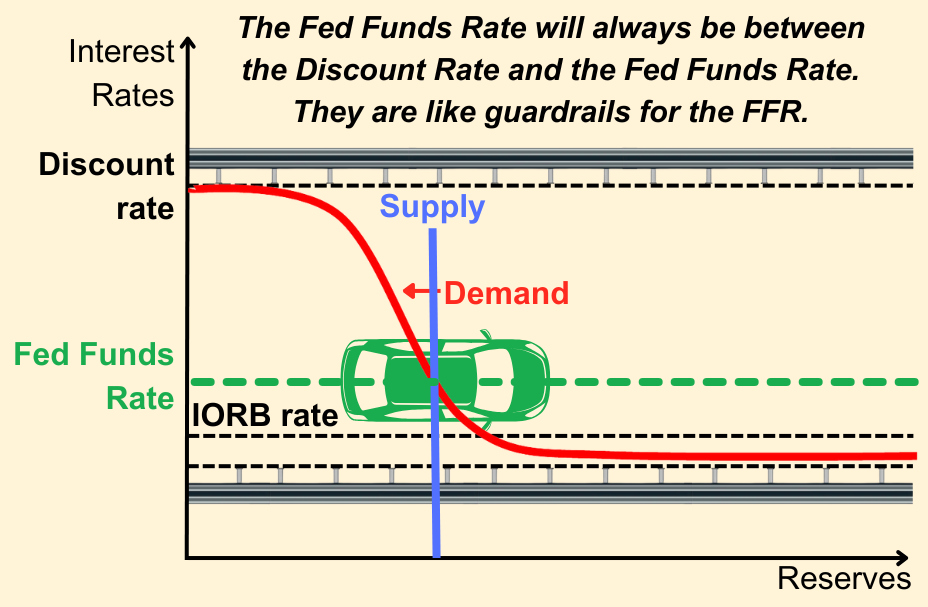

I would encourage you to think of the discount rate and IORB as railings on a road that keep interest rates in reasonable levels:

These are just guardrails that keep the system functioning smoothly.

What if a bank borrows at the discount window and then lends those same dollars back to the fed at the IORB rate?

Then the bank would lose money and essentially be giving money to the Fed. You never want to borrow at a high rate and lend at a low rate.

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.