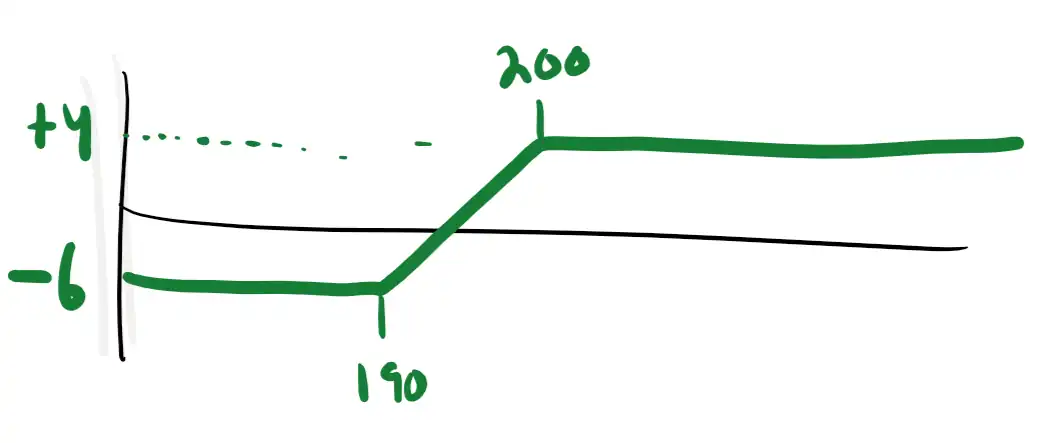

✏️ P/L for a Bull Spread

NOTE: there is much more helpful detail on the bear spread page: ✏️ Construct a table for a bear spread ✏️Suppose you have purchased a TSLA bull spread consisting of a long $190 call and a short $200 call. Calculate your profit or loss for each of the stock prices in the following table:

| S= | 150 | 170 | 190 | 210 | 230 |

|---|---|---|---|---|---|

| Profit/Loss for the Straddle |

Suppose that you have previously determined that the premium for the $190 call is $14 and the premium for the $200 call is $8.

✔ We know that a Bull Spread is made of a long call and a short call with different strike prices. The lower strike price is for the long call.

| S= | 150 | 170 | 190 | 210 | 230 |

|---|---|---|---|---|---|

| long $190 call @ $14 | |||||

| short $200 call @ $8 | |||||

| Profit/Loss for the Straddle |

At this point, we just fill in the P/Ls. Examples for how to do P/Ls are here:

| S= | 150 | 170 | 190 | 210 | 230 |

|---|---|---|---|---|---|

| long $190 call @ $14 | -$14 | -$14 | -$14 | $20-$14=$6 | $40-$14=$26 |

| short $200 call @ $8 | $8 | $8 | $8 | -$10+$8=-$2 | -$30+$8=-$22 |

| Profit/Loss for the Straddle | -$6 | -$6 | -$6 | $4 | $4 |

Example calculations for the P/Ls of the short call

Calculating P/Ls for short options can be particularly challenging, so here are several P/Ls for the short call:

When S=$150, P/L for the short call is $8

You have sold an option that obligates you to sell shares of stock worth S=$150 for K=$200 if requested.

You can think of yourself as being matched with a “counterparty” who purchased the option you wrote/sold. Just as you have a Short Call, they have a Long Call. They decide whether to exercise the Long Call they purchased. If they do, you must sell them 100 shares of the underlying stock for K=$200.

From your counterparty’s perspective, there is no way to make money by paying $200 for shares only worth $150. Therefore, we say this option is “Out of The Money (OTM)” and has no intrinsic value (IV=$0).

Given this, your counterparty won’t exercise the option. The only impact on your P/L is the $8 premium your counterparty paid you. P/L = $8 (per share).

When S=$210, P/L for the short call is -$2

You have sold an option that obligates you to sell shares of stock worth S=$210 for only K=$200 if requested.

You can think of yourself as being matched with a “counterparty” who purchased the option you wrote/sold. Just as you have a Short Call, they have a Long Call. They decide whether to exercise the Long Call they purchased. If they do, you must sell them 100 shares of the underlying stock for K=$200.

By purchasing your shares worth $210 for only $200 (a discount of $10), your counterparty can make $10 per share. Therefore, we say the option is “In The Money (ITM)” and has an Intrinsic Value of $10 for its owner.

We’ll assume your counterparty will exercise the option. They will “Call” for your shares to purchase them for K=$200. This will cause a loss for you of $10. For example, if you own the shares, you will have to sell them for $10 less than you could get on the open market. Alternatively, if you don’t have the shares, you’ll have to buy them for $210 and sell them for $10 less. Either way, you are $10 poorer than you would be if your counterparty hadn’t exercised the option. (Correspondingly, they are $10 richer. The IV of the option is both your loss and their gain.)

Offsetting the $10 loss from selling the shares, you also received a premium of $8. Your final per-share premium is .

(For comparison, your counterparty’s final P/L is $2. As always, one party’s gain is the other party’s loss.)

When S=$230, P/L for the short call is

You have sold an option that obligates you to sell shares of stock worth S=$230 for only K=$200 if requested.

You can think of yourself as being matched with a “counterparty” who purchased the option you wrote/sold. Just as you have a Short Call, they have a Long Call. They decide whether to exercise the Long Call they purchased. If they do, you must sell them 100 shares of the underlying stock for K=$200.

By purchasing your shares worth $230 for only $200 (a discount of $30), your counterparty can make $30 per share. Therefore, we say the option is “In The Money (ITM)” and has an Intrinsic Value of $30 for its owner.

We’ll assume your counterparty will exercise the option. They will “Call” for your shares to purchase them for K=$200. This will cause a loss for you of $30. For example, if you own the shares, you will have to sell them for $30 less than you could get on the open market. Alternatively, if you don’t have the shares, you’ll have to buy them for $230 and sell them for $30 less. Either way, you are $30 poorer than you would be if your counterparty hadn’t exercised the option. (Correspondingly, they are $30 richer. The IV of the option is both your loss and their gain.)

Offsetting the $30 loss from selling the shares, you also received a premium of $8. Your final per-share premium is .

(For comparison, your counterparty’s final P/L is $22. As always, one party’s gain is the other party’s loss.)

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.