👨🏫 Outline

Formulas for this lecture can be found in my paper formula sheets and online formula sheet.

Overview

- Introduction: Stocks vs. Bonds

- Long-run Returns vs. Short-run Volatility

- The Primary Market

- Finance Jargon: Shares Outstanding, Float, etc.

- Market Cap Categories

- The IPO Process

- The Secondary Market

- Types of Exchanges

Intro to Stocks

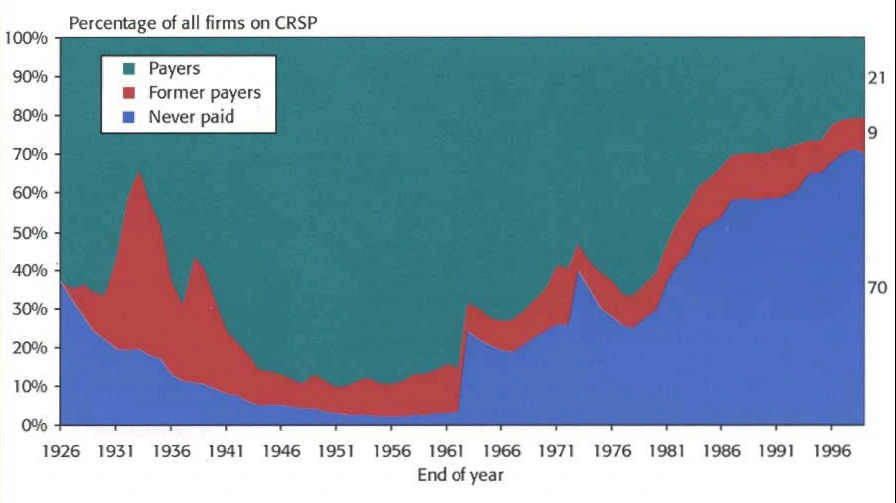

Are Dividends a Thing of the Past?

Stocks vs. Bonds

| Bonds | Stocks |

|---|---|

| IOU | Ownership share |

| Coupon payment | Dividend |

| Position in event of liquidation | Residual claimant |

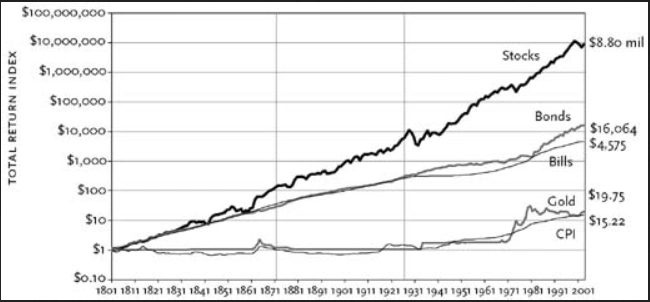

Long-term Returns on Stocks vs. Bonds

S&P 500 Index Over the Past Five Years

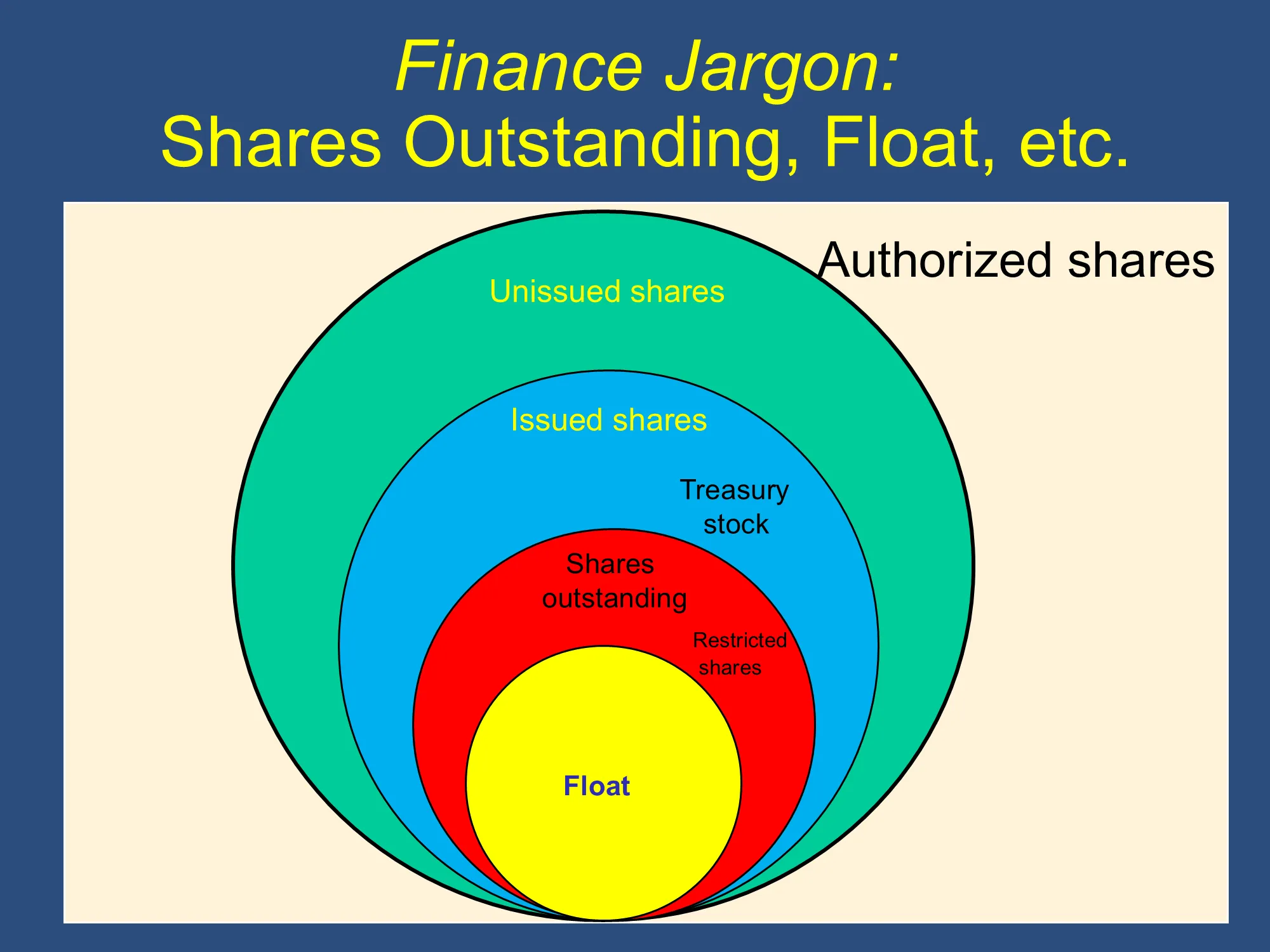

Share Types: Authorized, Outstanding, Float, etc.

- Authorized shares

Authorized shares = issued shares + unissued shares

Issued shares = shares outstanding + treasury stock

Share Types Example

Before Firm Buys Back 100 Million Shares

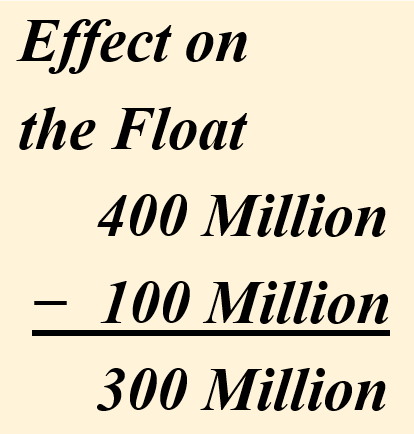

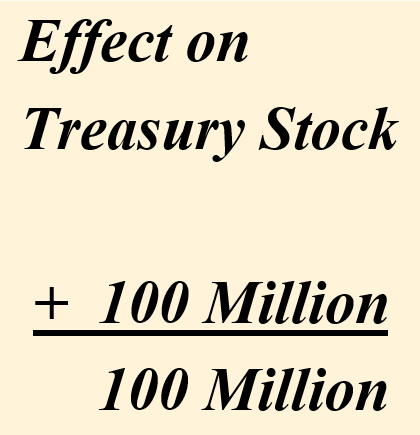

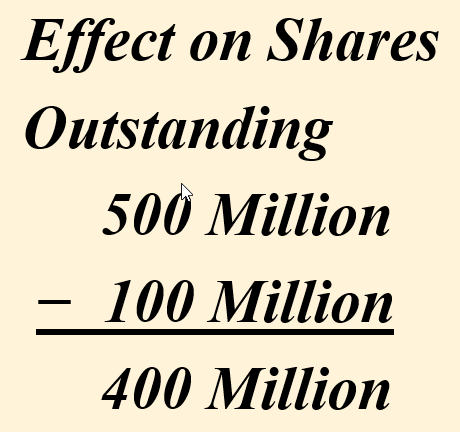

Effect of buying back shares

|  |  |

After Firm Buys Back 100 Million Shares

Market Capitalization

Example:

- 1 Billion shares outstanding

- Share price = $10

Meta (Facebook) Share Statistics

On 10/31/23

- 9.1 billion Class A and Class B shares authorized

- 2.69 billion shares outstanding

- 45 million restricted shares

- 2.24 billion share float

Market Cap Categories

| Mega Cap |

|

| Large Cap |

|

| Mid Cap |

|

| Small Cap |

|

| Micro Cap |

|

Initial Public Offerings (Primary Market)

Benefits vs. Costs of Going Public

-

Benefits

- Increased access to capital markets

- Founders can “cash in”

-

Costs

- Loss of control (Example: Jobs and Wozniak at Apple)

- Exposure of sensitive information (SOX)

- Investor relations efforts

The Initial Public Offering

- Initial Public Offering (IPO)

- First offering of stock to Public

- Underwriting

- Role of the syndicate

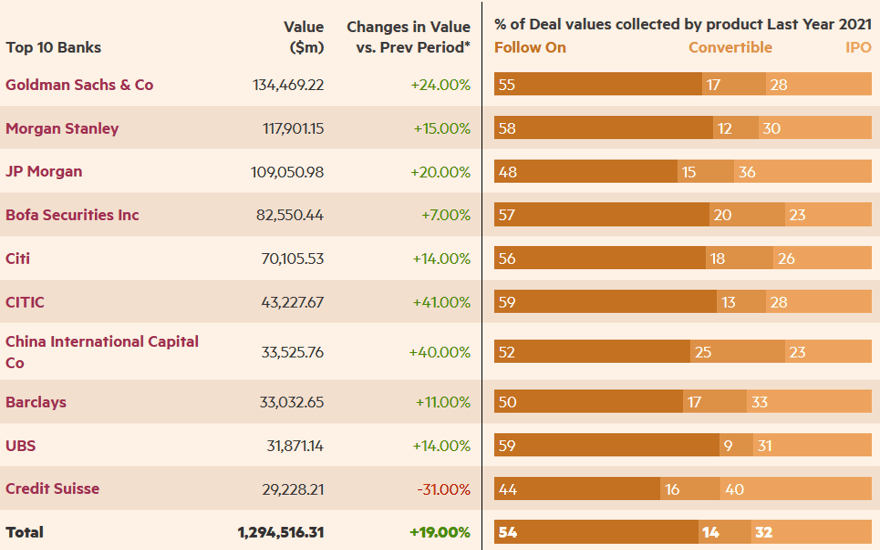

Top Underwriters, 2021 (by value of deals)

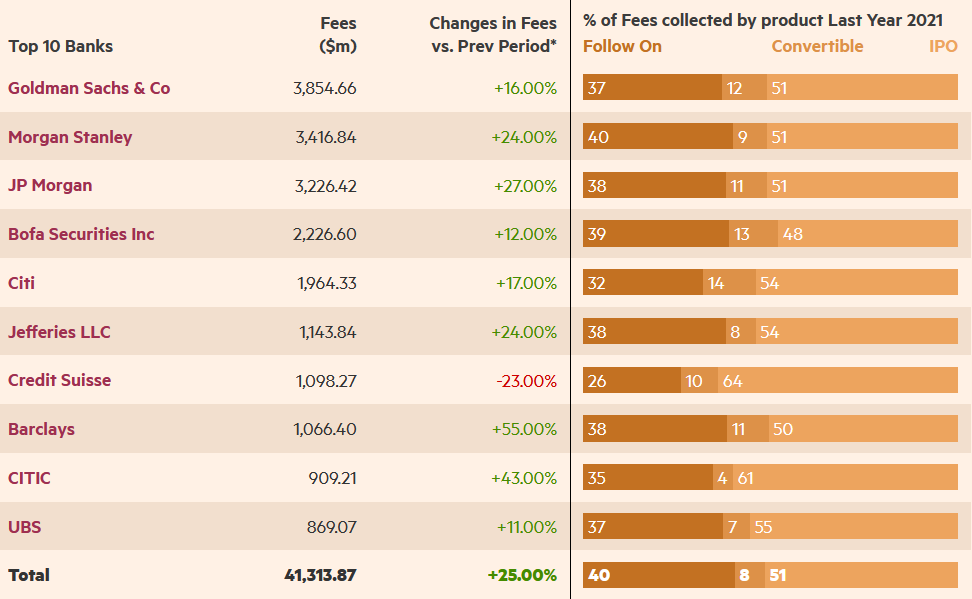

Top Underwriters, 2021 (by Fees Collected)

How Do Firms Choose an Underwriter

- The contract

- The spread

- The Rep

Steps in an IPO: The Role of the Lead Underwriter

- Valuing the company

- Determining the offering price of shares

- “Building the book” via road shows

- Filing the necessary paperwork

- Filing the prospectus

Types of Underwriting Contracts

- Firm commitment contract: issuance to distribution and sale

- Safest but most expensive for the issuer

- Underwriter’s profit is the “spread”

- Best efforts contract

- All-or-none contract

Costs Involved in an IPO

- Legal and administrative costs

- Spread (or underwriting commission)

- Underpricing

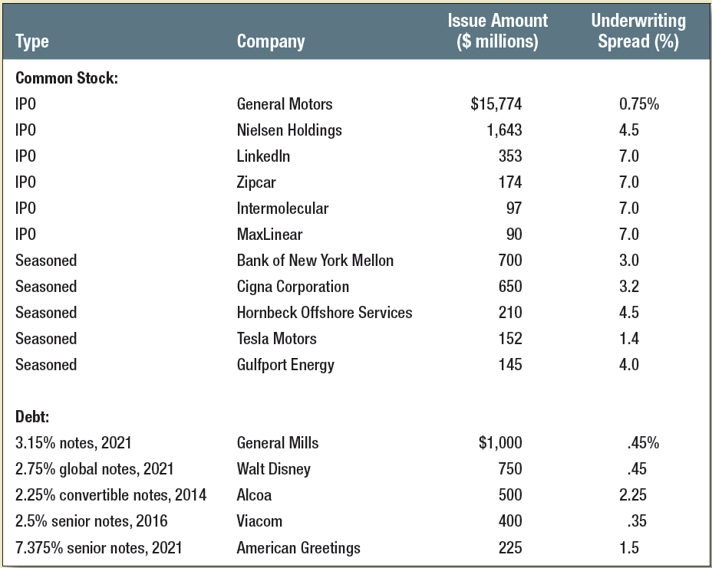

Spreads on Selected Issues

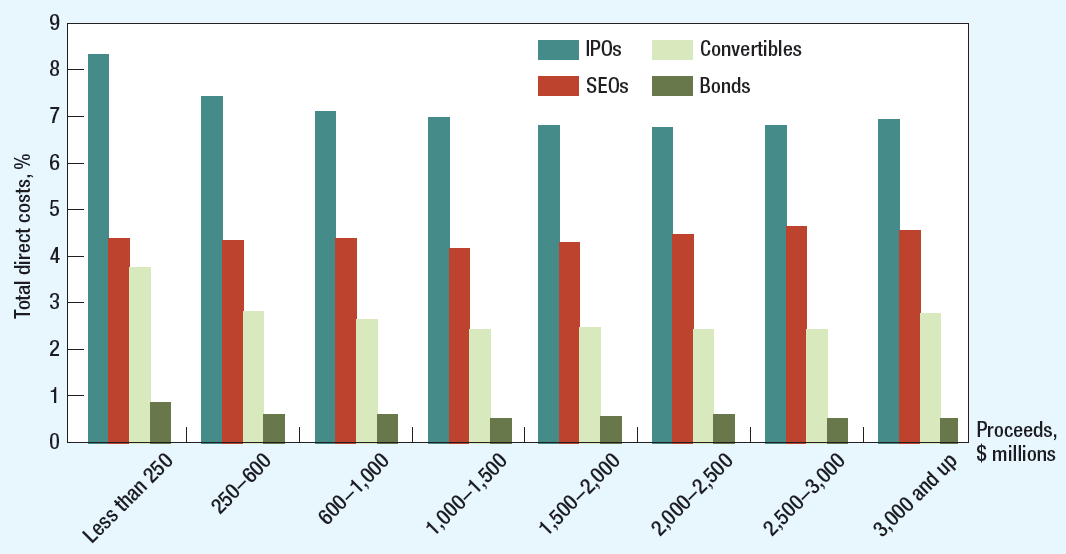

Costs of Raising Capital

Exchanges (Secondary Market)

Different Types of Markets

- Direct search

- Buyers and sellers seek each other

- Brokered markets

- Brokers search out buyers and sellers

- Dealer markets

- Dealers have inventories of assets from which they buy and sell

- Auction markets

- Traders converge at one place to trade

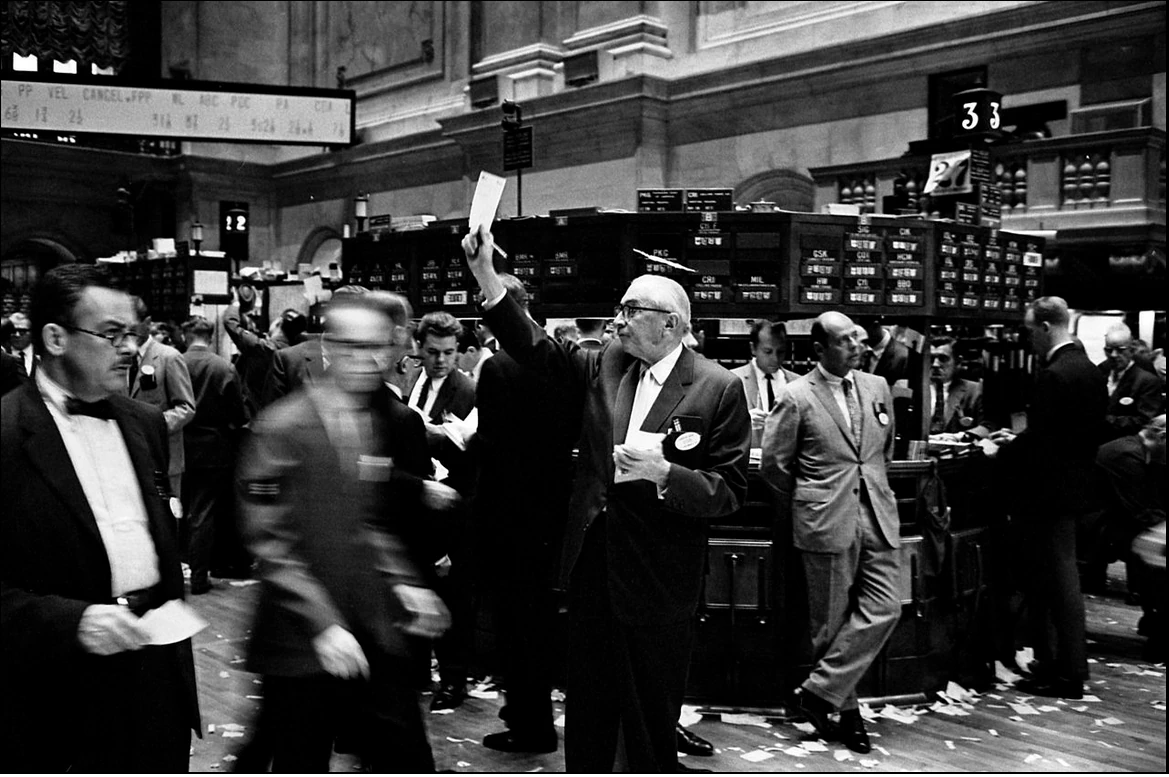

New York Stock Exchange (NYSE)

- Acquired by Intercontinental Exchange (ICE) in 2013

- Around 2,800 companies listed

- “Open outcry” auction market, which is quickly - evolving into an electronic market

- “Hybrid market”—orders can be handled electronically, - or by floor brokers (as of January 24, 2007) 80%+ of - trades now handled electronically

- Diminished role of specialists

- $24T in total market capitalization

- Avg. daily volume 3.2B shares

- Formerly: 1,366 “seats”, conferring the right to - trade on the exchange

- Now: NYSE sells 1-year licenses to trade on the - exchange

- Lists the largest, most established companies: - ExxonMobil, General Electric, Wal-Mart, Disney

- The largest U.S. stock exchange as measured by the value of the stocks listed on the exchange

- Automatic electronic trading runs side-by-side with traditional broker/specialist system

- SuperDot : Electronic order-routing system

- DirectPlus: Fully automated execution for small orders

- Specialists: Handle large orders and maintain orderly trading

NASDAQ

Founded in 1971

Electronic exchange

Has always been “screen-based”

3,300 companies listed

$19T in total market capitalization

Avg. daily volume around 2B shares

High tech and innovative firms: Microsoft, Intel, Cisco, JetBlue

- Originally, NASDAQ was primarily a dealer market with a price quotation system

- Today, NASDAQ’s Market Center offers a sophisticated electronic trading platform with automatic trade execution

- Large orders may still be negotiated through brokers and dealers

Types of Exchanges

- Physical “Floor” Exchanges

- NYSE

- AMEX

- Electronic Exchanges

- NASDAQ

- London Stock Exchange

- Electronic Communication Networks (ECNs)

- A more automated, efficient kind of electronic exchange

- No market makers

Open Outcry: The Platform for 200 Years

How Long Before It’s a Museum?

The New “Trading Floor”

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.