📰 Fundamental Analysis

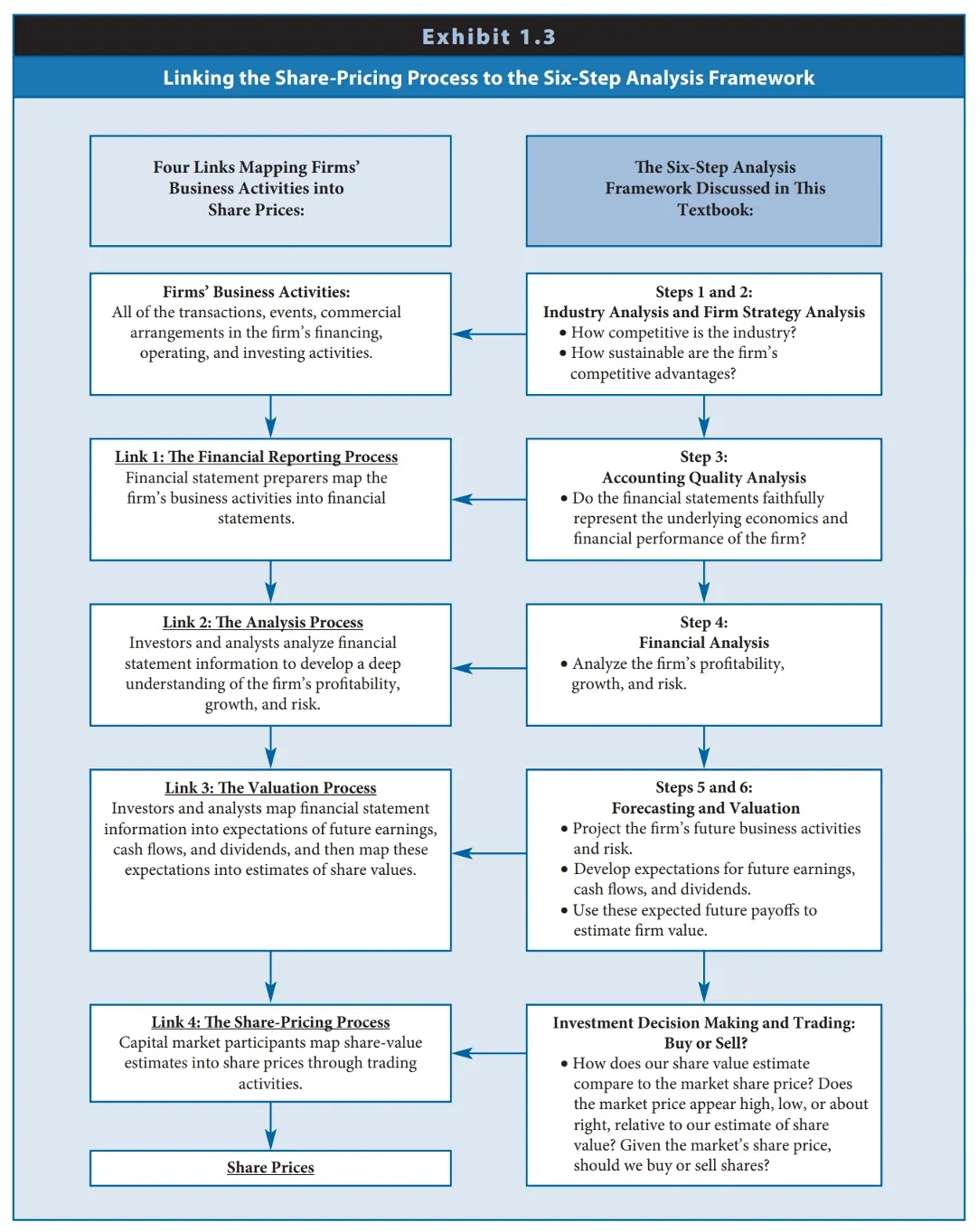

The following diagram illustrates an example process for fundamental analysis.

It can be summarized as follows:

- Understand and assess the industry.

- Understand and assess the firm’s strategy.

- Do you trust the firm’s accounting data?

- Understand and assess the firm’s profitability, growth prospects, and risk.

- Forecast future earnings and cash flow.

- What is a fair share price for the firm?

a. If the firm is underpriced enough to compensate you for the risk, buy it.

b. If it is overpriced, consider taking a short position.

You are not responsible for anything on the page. It’s only here because valuation often seems like a mysterious black box and to illustrate how complex the process can be.

Fundamentally, the process of stock analysis is more art than science. It’s about making tough judgment calls and taking views on things that can’t be known with certainty.

Source: Financial Reporting, Financial Statement Analysis and Valuation, 10e. (944 pages)

Reminder: You are not responsible for anything on the page.

Description of the steps:

1. Identify the economic characteristics and competitive dynamics of the industry in which the firm participates. What dynamic forces drive competition in the industry? For example, does the industry include a large number of firms selling similar products, such as grocery stores, or only a small number of firms selling unique products, such as pharmaceutical companies? Does technological change play an important role in maintaining a competitive advantage, as in computer software? Understanding the competitive forces in the firm’s industry in the first step establishes the economic foundation and context for the remaining steps in the process.

2. Identify strategies the firm pursues to gain and sustain a competitive advantage. What business model is the firm executing to be different and successful in its industry? Does the firm have competitive advantages? If so, how sustainable are they? Are its products designed to meet the needs of specific market segments, such as ethnic or health foods, or are they intended for a broader consumer market, such as typical grocery stores and family restaurants? Has the firm integrated backward into producing raw materials for its products, such as a steel company that owns iron ore mines? Is the firm diversified across products, geographic markets, or industries? Understanding the firm’s strategy and the sustainability of its competitive advantages provides the necessary firm-specific context to evaluate the firm’s accounting information, assess profitability, growth, and risk, and project the firm’s future business activities.

3. Obtain all of the information available from a firm’s financial statements, and assess the quality of that information. If necessary, adjust the financial statements to enhance reliability and comparability. To be informative, the firm’s financial statements should provide a complete and faithful representation of the firm’s economic performance, financial position, and risk, in accordance with U.S. GAAP or IFRS. Do earnings include non- recurring gains or losses, such as a write-down of goodwill, which you should evaluate differently from recurring components of earnings? Has the firm structured transactions or commercial arrangements so as to avoid recognizing certain assets or liabilities on the balance sheet? Has the firm selected certain accounting methods simply to make the firm appear more profitable or less risky than economic conditions otherwise suggest? It is essential to understand the quality of the firm’s accounting information to effectively analyze the firm’s profitability, growth, and risk and to project its future balance sheets, income statements, and cash flows.

4. Analyze the current profitability, growth, and risk of the firm using information in the financial statements. Most financial analysts assess the profitability of a firm relative to the risks involved. What rate of return is the firm generating from the use of its assets? What rate of return is the firm generating for its common equity shareholders? Is the firm’s profit margin increasing or decreasing over time? Are revenues and profits growing faster or slower than those of its key competitors? Are rates of return and profit margins higher or lower than those of its key competitors? How risky is the firm because of leverage in its capital structure? Ratios that reflect relations among particular items in the financial statements are informative tools you can use to analyze profitability, growth, and risk. By understanding the firm’s current and past profitability, growth, and risk, you will establish important information you will use in projecting the firm’s future profitability, growth, and risk and in valuing its shares.

5. Prepare forecasted financial statements. What will be the firm’s future operating, investing, and financing activities? What will be the firm’s future resources, obligations, investments, cash flows, and earnings? What will be the likely future profitability, growth, and risk and, in turn, the likely future returns from investing in the company? Forecasted financial statements that project the firm’s future operating, investing, and financing activities provide the basis for projecting future profitability, growth, and risk, which provide the basis for financial decision making, including valuation.

6. Value the firm. What is the firm worth? Financial analysts use their estimates of share value to make recommendations for buying, selling, or holding the equity securities of firms when market price is too low, too high, or about right. Similarly, an investment bank that underwrites the initial public offering of a firm’s common stock must set the initial offer price. Also, an analyst in a corporation considering whether to acquire a company (or divest a subsidiary or division) must assess a reasonable range of values to bid to acquire the target (or to expect to receive).

Feedback? Email rob.mgmte2000@gmail.com 📧. Be sure to mention the page you are responding to.